WACO, HOUSTON AND FORT WORTH, TEXAS — Blueprint Healthcare Real Estate Advisors has negotiated the sale of four skilled nursing facilities totaling 704 licensed beds in Waco, Houston and Fort Worth. A national owner acquired the properties for $28 million and plans to lease the facilities out to multiple operators. Blueprint marketed the properties, which were all built in the 1960s, on behalf of a court-appointed receiver.

Texas

COPPELL, TEXAS — McLaren Automotive has opened a 31,000-square-foot office and showroom at 1405 S. Belt Line Road in the central metroplex city of Coppell. The space will house the North American operations of McLaren’s sports car division, which the British luxury auto manufacturer has relocated from New York. Dallas-based Merriman Anderson Architects designed the space, which also features a training center and workshop.

SAN ANTONIO — Northmarq has brokered the sale of Judson Meadows, a 28-unit apartment complex in San Antonio. The property was built in 2007 and offers a playground, dog park and outdoor picnic areas. Zar Haro, Moses Siller, Bryan VanCura and Phil Grafe of Northmarq represented the undisclosed seller in the transaction. The buyer and sales price were also undisclosed.

Content PartnerFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

How to Maintain Multifamily Investment Momentum in the Face of Rising Interest Rates

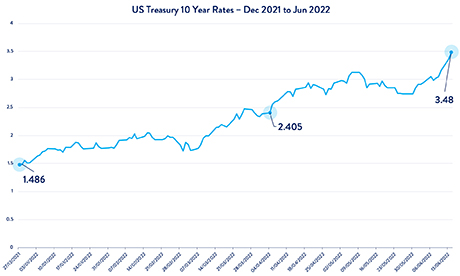

By Melissa Jahnke, associate director of operations, Walker & Dunlop The Federal Reserve raised interest rates by 75 basis points in June and then another 75 basis points in July, sending shockwaves across the commercial real estate industry. Fortunately, there are opportunities and solutions to bypass these potential roadblocks. Specifically, investors in a segment of multifamily housing known as small balance lending (SBL), encompassing five- to 150-unit properties, have several options to realize their aspirations for financing multifamily portfolios. View a higher resolution version of the timeline above here. During a recent webcast “Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans,” Walker & Dunlop’s market experts spoke about navigating today’s financing landscape. The expert panel included Allison Williams, senior vice president and chief production officer; Allison Herrera, senior director of SBL; and Tim Cotter, director of capital markets. These experienced professionals have found ways to make deals happen in a wide variety of financing environments and have shared their perspectives and guidance. If you are an owner of five- to 150-unit properties that require loans between $1 million to $15 million, the following will help you navigate today’s financial environment and build your momentum. Step 1: Consider the …

PLANO, TEXAS — Chicago-based investment firm Waterton has acquired Mission Gate, a 434-unit apartment community in Plano. Built on 24 acres in 1999, Mission Gate features one-, two- and three-bedroom units with an average size of 965 square feet across 13 buildings. Amenities include a pool, outdoor grilling stations, a playground and a dog park. Waterton plans to invest in capital improvements to unit interiors and common areas. The seller and sales price were not disclosed.

AUSTIN, TEXAS — Northmarq has arranged three bridge loans totaling $43.7 million for the acquisition of five multifamily properties in Austin. The properties include Mueller I and II, which feature a combined 110 units and are located in the Windsor Park area; Villas at Mueller, a 124-unit community; the 40-unit Spanish Trails Apartments; and the 51-unit Miller Square Apartments. Chase Johnson and Brian Fisher of Northmarq originated the financing on behalf of the borrower, Zion Capital. The direct lenders were not disclosed.

NORMAN, OKLA. — Hospitality development and management firm Lambert is nearing completion of the NOUN Hotel, a 92-room boutique hotel located near the University of Oklahoma’s campus in Norman. The grand opening is scheduled for Thursday, Sept. 22. The four-story hotel, which will include two suites, will offer multiple food and beverage establishments and 3,900 square feet of meeting and event space.

ARLINGTON, TEXAS — Bassett Furniture, a Virginia-based manufacturer and retailer, has signed a 38,582-square-foot industrial lease at 1019 Enterprise Place in Arlington. Mark Graybill of Lee & Associates represented the landlord, High Street Logistics Properties, in the lease negotiations. Reed Parker, also with Lee & Associates, represented the tenant.

LUBBOCK, TEXAS — Texas-based brokerage firm Independence Commercial Advisors has negotiated the sale of Poka Lambro Shopping Center, a 37,500-square-foot retail property in Lubbock. Built on 4.9 acres in 1983, the property includes outparcels that house a Wells Fargo ATM and a recently renovated Burger King. Richard Mireles of Independence Commercial Advisors represented the undisclosed seller and procured the buyer, Texas-based NetCo Investments Inc., in the transaction.

SAN MARCOS, TEXAS — California-based developer Highpointe Communities has broken ground on Sendero at Trace, a $73 million multifamily project in the Central Texas city of San Marcos. The community will feature 399 one-, two- and three-bedroom units ranging in size from 775 to 1,300 square feet. The amenity package will comprise a pool, fitness center, clubhouse, outdoor gathering spaces and lifestyle programming services. The first units are expected to be available for occupancy by the end of 2023.