HUMBLE, TEXAS — A partnership between New York-based Sunsail Capital and Dallas-based ZaneCRE has acquired Sarah at Lake Houston, a 350-unit multifamily property located in the northern Houston suburb of Humble. Built in 2020, the property features one-, two- and three-bedroom units and amenities such as a pool, fitness center, multi-sport simulator, business and conference center, dog park and a biergarten. Zack Springer of Newmark brokered the transaction. Purvesh Gosalia, also with Newmark, arranged acquisition financing on behalf of the joint venture.

Texas

TOMBALL, TEXAS — Berkadia has negotiated the sale of Bridgewater Apartments, a 206-unit workforce housing community in the northern Houston suburb of Tomball. Built in phases between 1979 and 1982, Bridgewater Apartments contains one- and two-bedroom units ranging in size from 670 to 944 square feet. The amenity package comprises a resident kitchen, clubroom, business center, pool, picnic areas with grilling stations, an enclosed pet park and open green spaces. Joey Rippel, Chris Young, Kyle Whitney, Jeffrey Skipworth, Chris Curry and Todd Marix of Berkadia represented the seller, Houston-based Sentinel Capital, in the transaction. Cutt Ableson, also with Berkadia, arranged acquisition financing on behalf of the buyer, a partnership between Tranquility Capital, Abundance Equity Partners and Rubio Investors.

PORTLAND, TEXAS — Northmarq has arranged the sale of Sun Valley Apartments, a 120-unit multifamily complex in Portland, located outside of Corpus Christi in South Texas. The property was originally built in 1968 and offers a pool and onsite laundry facilities. Zar Haro and Phil Grafe of Northmarq represented the seller, McGuire Family Properties, in the transaction. The undisclosed buyer plans to implement a value-add program.

ARLINGTON, TEXAS — California-based automotive parts manufacturer Prestige Autotech has signed a 49,280-square-foot industrial lease at 2001-2023 Exchange Drive in Arlington. According to LoopNet Inc. the property was built in 1972 and spans 187,840 square feet. Reed Parker and Mark Graybill of Lee & Associates represented the landlord, Link Logistics Real Estate, in the lease negotiations. Greg Nelson and Jimmy Holcomb of Paladin Partners represented the tenant.

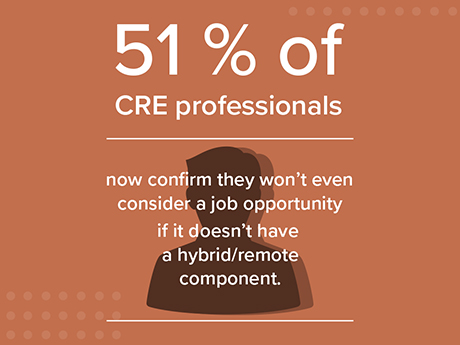

By Kent Elliott, principal, and Chase Fryhover, director, RETS Associates By now, we’re all familiar with the Great Resignation — workers’ mass exodus from their jobs during the pandemic. The phenomenon hit just about every office-using industry, including commercial real estate. In fact, our firm recently conducted a survey of 200 individuals in the industry on job sentiment, which revealed that more than 75 percent of respondents intend to or would consider leaving their current company this year. The trend has affected Texas in a very profound way. According to the Bureau of Labor Statistics, more Texans quit their jobs in September and October 2021 than did workers in any other state. So, what can commercial real estate companies — particularly in the Texas markets — do to maintain a productive and happy workforce and remain competitive in the field? Here are a few recommendations for companies looking to attract and retain talent in the current work environment based on our 20 years of experience as a national recruiting firm for the industry. Be Willing to Bend These days, flexibility is an essential quality at companies where people want to work. This largely began with the pandemic. The business community’s recognition …

Content PartnerFeaturesIndustrialLeasing ActivityLee & AssociatesLife SciencesMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates’ Second-Quarter 2022 Economic Rundown by Sector

Rising interest rates, inflation and general economic uncertainty altered the patterns and outlooks for the industrial, office, retail and multifamily sectors across the United States. As Lee & Associates’ recent Q2 2022 North America Market Report reveals, certain sectors like industrial and multifamily, that were white hot last year, have begun to cool slightly. Meanwhile, retail is making historic gains in the face of decreasing interest in ecommerce. The full Lee & Associates report is available (with further breakdowns of factors like vacancy rates, market rents, inventory square footage and cap rates by city) here. The analysis below provides an overview of four major commercial real estate sectors alongside economic factors impacting each. Industrial Overview: Record Low Supply, Rent Growth Demand for industrial space eased slightly from its record-setting growth of last year but remained strong through for the first half of 2022 as annualized rent growth moved into double digits and the overall vacancy rate fell to 3.9 percent, a record low. Net absorption through June totaled 192.2 million square feet. It was the second highest two-quarter total on record and more than the 170 million square feet of tenant growth for all of 2019. It was exceeded only by 297.8 …

HOUSTON — Northmarq has arranged an undisclosed amount of acquisition financing for a portfolio of three multifamily assets totaling 1,134 units that are located throughout the metro Houston area. Sedona Square is a 250-unit property that was built in phases in the early 1980s and offers one-, two and three-bedroom apartments. Verano was constructed in 1980 and totals 312 units in one- and two-bedroom formats. Rock Creek at Hollow Tree, also constructed in 1980, comprises 572 residences in one-, two- and three-bedroom floor plans. James Currell, Joel Heikenfel and Emily Balazi of Northmarq arranged the debt through an undisclosed bridge/mezzanine lender on behalf of the borrower, Dallas-based WindMass Capital.

EL PASO, TEXAS — Dallas-based Provident Realty Advisors will develop a 308,270-square-foot speculative industrial project in El Paso. The facility will be situated on an 18.4-acre site near the intersection of Windermere Avenue and Loop 375 and will have both warehouse and distribution space. Building features will include 32-foot clear heights and 190-foot truck court depths. Construction is set to begin toward the end of the year. CBRE represented the seller of the land, River Oaks Properties, and will market the facility for lease upon completion.

SAN ANTONIO — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has negotiated the sale of Vantage at O’Connor, a 288-unit apartment community in northeast San Antonio. The property was built in 2020. According to Apartments.com, Vantage at O’Connor offers one-, two- and three-bedroom units ranging in size from 605 to 1,150 square feet and amenities such as a pool, fitness center, media lounge, two pet parks and package concierge services. Will Balthrope and Drew Garza of IPA represented the seller, Vantage Communities, and procured the undisclosed buyer in the transaction.

CARROLLTON, TEXAS — HLC Equity has sold Toscana Apartments, a 192-unit multifamily property in the northern Dallas suburb of Carrollton. The complex was originally built in 1986 and offers a pool, clubhouse, fitness center, pet play area and outdoor grilling and dining stations. HLC Equity acquired the property in 2017 for $13.2 million and implemented a value-add program that upgraded unit interiors and common areas. California-based Archway Equities purchased the asset for an undisclosed price. David Austin and Rob Key of JLL brokered the deal. Toscana Apartments was 99 percent occupied at the time of sale.