By John D. Hutchinson, vice chairman, global head of origination, Trez Capital The COVID-19 pandemic brought mass migration to the Sun Belt states, and by far, the most sought-after location of the pandemic migration boom was Texas. Multifamily investment demand remains strong due a higher quality of living, affordability and job growth. People are leaving high-tax, high-regulation states and moving to states like Texas with lower taxes and more favorable business climates. Austin, specifically, has outshone the top cities in the “Texas Triangle” with its large influx of both people and jobs. Austin’s exponential population growth, attractive cultural qualities and high-income jobs have created demand for and premium prices on real estate. Although the U.S. economy has seen changes in the last couple of months, such as inflation and interest rate hikes, the city still affords a great opportunity for multifamily investors. According to data from CoStar Group, Austin has doubled its construction starts over the past year and is expected to add 15,827 new units in 2022. In fact, there was a record 25 percent rent growth and strong occupancy at the end of 2021. A Growing Market In 2021, the Austin area’s net population growth was about 16 …

Texas

HUMBLE, TEXAS — JLL has negotiated the sale of Humblewood Shopping Center, a 183,897-square-foot retail property located on the northern outskirts of Houston. Tenants at the center include Conn’s HomePlus, Petco, Michaels, DSW, Five Below, Texas State Optical, Sketchers, GameStop, Honey Baked Ham, Jason’s Deli, Smoothie King, IHOP, Humble Nails, Gadget MD and Ace Cash Express. Chris Gerard and Ryan West and Erin Lazarus of JLL represented the seller, Forge Capital Partners, in the transaction. South Florida-based JBL Asset Management acquired the asset for an undisclosed price.

CARROLLTON, TEXAS — Canadian investment firm Western Wealth Capital has purchased Embry Apartment Homes, a 151-unit multifamily property located in the northern Dallas suburb of Carrollton. The property was built in 1985 and expanded in 1995. According to Apartments.com, the one- and two-bedroom units range in size from 713 to 1,200 square feet, and amenities include a pool, fitness center, clubhouse, outdoor grilling stations, business center and a pet play area. The new ownership plans to implement a value-add program.

IRVING, TEXAS — Dallas-based brokerage firm The Multifamily Group (TMG) has negotiated the sale of a portfolio of five multifamily properties totaling 129 units in Irving. The properties — Nursery Apartments, Irvington Place, Arbor Vista, Sunnylane and Oakland — were all built between 1950 and 1961 and had a collective occupancy rate of 98 percent at the time of sale. Yonnic Land of TMG represented the seller in the transaction, and Greg Miller of TMG represented the buyer. Both parties requested anonymity.

SAN MARCOS, TEXAS — New York City-based Lument has provided a bridge loan of an undisclosed amount for the acquisition of The Nest, a 104-unit apartment complex in San Marcos. Built on five acres in 1975, the community consists of 23 buildings with 10 one-bedroom units, 92 two-bedroom residences, one three-bedroom apartment and one four-bedroom unit. Amenities include a pool, basketball court, turf soccer field and a dog park. John Sloot and Colin Cross of Lument originated the three-year, floating-rate loan on behalf of the undisclosed borrower, which plans to renovate the property. John Brickson of McKinney Realty Capital arranged the debt.

BONHAM, TEXAS — Marcus & Millichap has brokered the sale of X Extreme Storage, a 57-unit self-storage facility in Bonham, about 75 miles northeast of Dallas. The facility spans 61,560 net rentable square feet, and individual units measure 25 by 45 feet. Danny Cunningham and Brandon Karr of Marcus & Millichap represented the seller and procured the Texas-based buyer in the transaction. Both parties were private investors that requested anonymity.

Developers have seen permitting and entitlement timelines lengthen exponentially over the past few years. What is causing increased timelines and how do developers overcome challenges and avoid unnecessary delays? If expanded timelines are inevitable in some cases, how can developers ensure that slowdowns do not spread to other aspects of development? Many municipalities have been overwhelmed by an explosion in projects and applications in the development queue, and the issues are compounded by employee turnover within these organizations. Municipal slowdowns in upgrading utility capacities have further stalled the process of development. Additionally, the process for obtaining permits and entitlements has grown increasingly complex in certain regions, regardless of property type. REBusiness Online spoke with experts at Bohler, a land development design and consulting firm, to learn the best practices for keeping delays and budgets under control in the face of growing timeline uncertainties. To avoid problems before they begin, these experts recommend early due diligence and local expertise, as well as an approach that incorporates the community, local agencies and the authority having jurisdiction at crucial points. Bohler’s team also emphasizes the importance of working through waiting periods and working on different elements of a project concurrently, so that if …

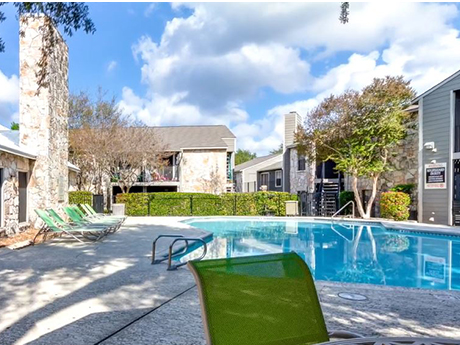

SAN ANTONIO — Walker & Dunlop has arranged a loan of an undisclosed amount for the refinancing of The Place at Castle Hills, a 680-unit apartment community located on the north side of San Antonio. Built in 1984, the garden-style property comprises 52 buildings that house one- and two-bedroom units with walk-in closets and private balconies/patios. Amenities include four pools, a fitness center, outdoor picnic areas and a Wi-Fi lounge. Alex Inman, Jon Hyduke, René Jaubert, Harrison Hoskins and Hannah Coen of Walker & Dunlop arranged the loan on behalf of the borrower, Arizona-based investment firm MC Cos.

HOUSTON — JLL has brokered the sale of Market Square at Eldridge, a 262,556-square-foot retail power center located near the Energy Corridor area in West Houston. At the time of sale, the property was 98 percent leased to tenants such as Burlington, Michaels, Party City, PetSmart, Dollar Tree, HomeGoods, Bath & Body Works, Ulta Beauty, Cato, Old Navy and Office Depot. Chris Gerard, Ryan West, Erin Lazarus and Megan Babovec of JLL represented the seller, Walton Street Capital, in the transaction. Locally based investment firm Wu Properties purchased the center for an undisclosed price.

EULESS, TEXAS — Locally based investment firm Fort Capital has acquired a portfolio of 10 Class B industrial buildings totaling 226,663 square feet in Euless, located in the central part of the Dallas-Fort Worth metroplex. At the time of sale, the portfolio was 98 percent leased to a roster of 36 tenants in industries such as logistics, furniture and fabrication. All of the buildings were constructed between 1964 and 1985, with most construction dates trending toward the latter end of that range. The seller and sales price were not disclosed.