HOUSTON — Axiom Space, a developer of infrastructure for space exploration, will open a new, 106,000-square-foot headquarters facility at the Houston Spaceport, a center for aerospace research and development that is located on the city’s southwest side. Developer Griffin Partners recently broke ground on the campus, which will house offices, astronaut training areas, engineering development/testing labs and a high bay production facility to house Axiom’s space station modules. Project partners include Jacobs Engineering and general contractor Turner Construction Co. Axiom Space currently employs more than 400 people, the majority of which work at its current Houston facilities. The company has plans to grow the number to 600 by the end of the year and 1,000 by 2025.

Texas

ARLINGTON, TEXAS — Global Real Estate Advisors (GREA) has arranged the portfolio sale of three multifamily properties totaling 217 units in Arlington that were all built in the 1960s. The properties include Avalon (75 units), Tuscany Square (70 units) and Regency (72 units). Mark Allen of GREA represented the buyer and seller, both of which requested anonymity, in the transaction. The new ownership plans to implement a value-add program.

IRVING, TEXAS — Marcus & Millichap has brokered the sale of The Vanderbilt, a 152-unit multifamily complex in Irving. The property offers studio, one- and two-bedroom floor plans and amenities such as a pool, dog park, outdoor grilling and dining areas and onsite laundry facilities. David Fersing, Nick Fluellen, Bard Hoover and Wesley Racht of Marcus & Millichap represented the buyer, private investor Tony Lin, in the transaction.

Content PartnerFeaturesHealthcareIndustrialLoansMidwestMultifamilyNAINortheastOfficeSoutheastTexasWestern

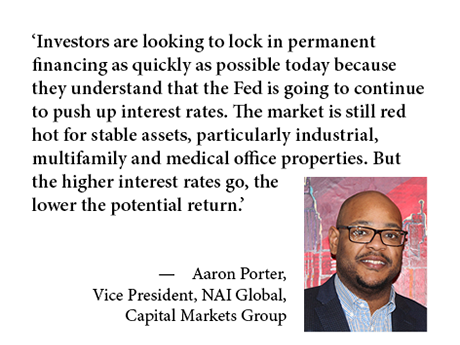

Rising Interest Rates and Inflation to Fuel Change in Property Markets

Beginning in the fourth quarter of 2020, commercial real estate buyers and sellers moved off the sidelines and began fueling an impressive investment sales rebound as many pandemic-related lockdowns and restrictions eased or ended. The rush to purchase hard assets hit its apex a year later when commercial property sales surged to a record $362 billion in the fourth quarter of 2021 alone, according to Real Capital Analytics, a part of MSCI Real Assets that tracks property transactions of $2.5 million or more. The strong market is continuing this year: Deals of $170.8 billion closed in the first quarter, a year-over-year increase of 56 percent, Real Capital reports. Buyers in the first quarter also pushed up prices 17.4 percent over the prior year, according to Real Capital’s Commercial Property Price Indices (CPPI). But given rising interest rates and other recent headwinds, will investors continue to drive robust investment activity and bid up prices? The 10-Year Treasury yield has spiked some 150 basis points to around 3 percent since the beginning of 2022, and fixed 10-year mortgage rates of between 3 percent and 4 percent are up about 100 basis points. For short-term variable loans, the benchmark secured overnight financing rate …

HOUSTON — New York City-based investment firm Gaia Real Estate has sold The Copperfield Portfolio, a collection of five multifamily properties in northwest Houston totaling 1,376 units. Gaia acquired the properties in 2015 and implemented a value-add program. Renovations included upgrades of amenity spaces such as pools, clubhouses, fitness centers, children’s play areas and laundry centers, as well as new flooring, cabinets, appliances and countertops to the interiors of select units. The buyer and sales price were not disclosed. Gaia has now sold 50 multifamily properties in Sun Belt markets for more than $1.5 billion.

HOUSTON — North Texas-based Jackson-Shaw will develop Post Oak Logistics Park, a 536,992-square-foot industrial project that will be located in southwest Houston. Post Oak Logistics Park will comprise a 168,893-square-foot front-load building and a 368,099-square-foot cross-dock building. The typical bay is 56 feet by 50 feet, with 130- to 185-foot truck courts and ample trailer storage. An affiliate of Greystar is Jackson-Shaw’s equity partner on the project. Rosenberger Construction is the general contractor, with Powers Brown serving as the architect and WGA as the civil engineering firm. BancFirst provided construction financing. Cushman & Wakefield is the leasing agent. Completion is slated for the second quarter of 2023.

EL PASO, TEXAS — CBRE has preleased a 169,011-square-foot industrial building located in El Paso’s Far East submarket to an undisclosed logistics user. Mississippi-based EastGroup Properties is developing the speculative property, which sits on 12.6 acres, with completion slated for July. Building features include 32-foot clear heights, 135-foot truck court depths and parking for 163 cars and 50 trailers. Bill Caparis and Andre Rocha of CBRE represented EastGroup Properties in the lease negotiations.

ARLINGTON, TEXAS — Lument has provided a $22.6 million bridge loan for the acquisition of The Junction, a 252-unit apartment community in Arlington. The garden-style property was built in 1970 and comprises 28 buildings, a leasing office and a laundry facility. Amenities include a pool, outdoor grilling areas, dog park and a playground. The sponsor, American Ventures, plans to use a portion of the proceeds to fund capital improvements. Ted Nasca led the transaction for Lument.

HUMBLE, TEXAS — Colliers has brokered the sale of a 48,000-square-foot industrial facility in northeastern Houston suburb of Humble. The property comprises four buildings on a 3.3-acre site. Tom Condon Jr. of Colliers represented the seller, R.B. Machine Works, in the transaction. Patrick Swint of Knightsbridge Ventures represented the buyer, an entity doing business as 2407 Wilson LLC.

HOUSTON — JLL has negotiated the sale of One Park 10 Plaza, a 162,919-square-foot office building in Houston’s Energy Corridor area. The eight-story building is located within the 550-acre Park 10 master-planned development and was 76 percent leased at the time of sale. The property includes a 560-space parking garage. Marty Hogan and Kevin McConn of JLL represented the seller, Florida-based investment firm Accesso Partners, in the transaction. Houston-based private equity firm Interra Capital Group purchased the building, which has received more than $ 1 million in capital improvements over the last decade, for an undisclosed price.