FRISCO, TEXAS — The Teachers Insurance and Annuity Association (TIAA) will open a corporate center in Frisco, a move that is expected to create about 2,000 new jobs and constitute a capital investment of approximately $58 million. The site will be located within The Star, the Dallas Cowboys’ 91-acre headquarters and training campus. Founded in 1918, TIAA provides insurance and financial services to employees in the academic, research, medical and governmental fields. The organization, which did not provide a timeline for the move, cited the workforce demographics of North Texas, as well as the amenities at The Star, as major factors behind its specific site selection.

Texas

DALLAS — Global investment firm KKR has acquired TCC Altamoore, an approximately 616,000-square-foot industrial park in Dallas, from Trammell Crow Co. for an undisclosed price. Built in 2021, TCC Altamoore consists of a 298,168-square-foot building and a 206,917-square-foot building that are fully leased to undisclosed, publicly traded companies. The third building spans 110,960 square feet and is currently being marketed for lease. Randy Baird, Jonathan Bryan, Ryan Thornton and Eliza Bachhuber of CBRE brokered the deal on behalf of Trammell Crow Co.

SAN ANTONIO — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has negotiated the sale of Timberhill Commons, a 340-unit apartment community in northwest San Antonio. Built in 2020 on a 21.5-acre site on the city’s northwest side, the garden-style property offers studio, one-, two- and three-bedroom units with an average size of 820 square feet. Residences include full-size washers and dryers and private patios/balconies. The amenity package comprises a pool, fitness center, dog park, business center, game room, social lounge, coffee bar and outdoor grilling and dining areas. Will Balthrope and Drew Garza of IPA represented the seller, a partnership between San Antonio-based White-Conlee Builders and Palatine Capital Partners, in the transaction. The duo also procured the buyer, Atlanta-based Dreamstone Investments.

SAN ANTONIO — Lument has provided a $16 million bridge loan for the acquisition of Palazzo, a 92-unit apartment complex in San Antonio. The property was built as a 100-unit condo development in 2008, but with only eight units sold upon completion, ownership converted the residences to rentals. Today, Palazzo consists of 10 buildings on a 4.3-acre site that house 20 one-bedroom, 48 two-bedroom and 24 three-bedroom units. Amenities include a fitness center, business center and a dog park. Phil Frasca of Lument originated the financing, which was structured with a floating interest rate, three-year term and two 12-month extension options. The borrower was not disclosed.

LEWISVILLE, TEXAS — U.S. Foam Corp., a provider of foam rubber products, has sold a 43,904-square-foot industrial building located at 720 E. State Highway 121 in Lewisville, a northern suburb of Dallas. The property was built in 1960 and expanded in 1972. Nathan Denton and Jeremy Mojica of Lee & Associates represented U.S. Foam Corp., which has occupied the property since 1991, in the transaction. Rich Young Jr. with Rich Young Co. represented the undisclosed buyer.

Affordable HousingArbor Realty TrustContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSoutheastTexasWestern

As Affordability Crisis Deepens, Policies and Market Shift to Assist the Underserved

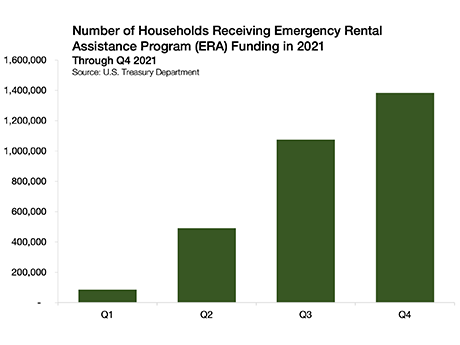

By Omar Eltorai, Arbor Realty Trust To understand the affordable housing market in spring 2022, one needs to first assess how this sector weathered the pandemic and then assess the current state of housing affordability across the country. In-depth findings on these trends are included in the Arbor Realty Trust-Chandan Economics Affordable Housing Trends Report, from which this article is excerpted. Weathering the Pandemic When it comes to the pandemic response, federal policymakers proved effective at defusing a large-scale increase in homelessness from financially insecure households. The Center for Disease Control and Prevention’s (CDC) eviction moratorium, while unpopular among industry advocates, prevented an estimated 1.6 million evictions, according to an analysis by Eviction Lab. After the Supreme Court struck down the federal moratorium in August 2021[1], the wave of evictions that many were forecasting did not immediately materialize. Nationally, tracked eviction filings ticked up but remained well below their pre-pandemic averages, according to Eviction Lab. A key reason why many at-risk renters have remained in their homes is the deployment of funds allocated in the Emergency Rental Assistance Program (ERA) — a funding pool designed to assist households that are unable to pay rent or utilities. The ERA Program was …

SCHERTZ, TEXAS — Atlanta-based Core5 Industrial Partners has acquired 164 acres in Schertz, a northeastern suburb of San Antonio, for the development of a 1.8 million-square-foot project. Construction of Phase I, which will comprise two buildings totaling roughly 1 million square feet, is set to begin later this year. Carlos Marquez and Brett Lum of NAI Partners represented Core5 Industrial in its acquisition of the land and have also been retained to lease the development. Corbin Barker of Endura Advisory Group represented the land seller, an entity doing business as Boeck Farm Co. Ltd.

AUSTIN, TEXAS — Newmark has brokered the sale of 823 Congress, a 190,254-square-foot office building in downtown Austin. The recently renovated building was 71 percent leased at the time of sale. Chris Murphy, Robert Hill, Gary Carr and Chase Tagen of Newmark represented the seller, a fund backed by New York-based DRA Advisors, in the transaction. David Milestone, Brett Green and Josh Francis of Newmark arranged an undisclosed amount of acquisition financing on behalf of the buyer, Dallas-based Pillar Commercial. The sale included a six-story parking garage located at 900 Brazos St. The building was recently renovated to the tune of $15 million.

BEAUMONT, TEXAS — Marcus & Millichap has arranged the sale of Storage Depot, a 507-unit self-storage facility in Beaumont. The property spans 59,120 net rentable square feet. Dave Knobler, Brandon Karr and Danny Cunningham of Marcus & Millichap represented the undisclosed, Texas-based seller in the transaction. The trio also procured the buyer, El Paso-based Riverbend Development. The sales price was not disclosed.

HOUSTON —Dallas-based private equity firm Trive Capital, in partnership with Dallas-based Aspen Oak Capital Partners, has acquired Alta Med Main, a 338-unit apartment community located near Texas Medical Center in Houston. Built in 2020 by Wood Partners, the property features one- and two-bedroom units and amenities such as a pool, fitness center and coworking space and outdoor grilling areas.