IRVING, TEXAS — Partners Real Estate has brokered the sale of Embassy Apartments, a 111-unit multifamily complex in Irving. According to Apartments.com, the property offers one-, two- and three-bedroom units, as well as onsite laundry facilities. Preston Browne and Scott Lunine of Partners brokered the deal, which traded at a per-unit price of roughly $125,000. The seller and buyer were not disclosed.

Texas

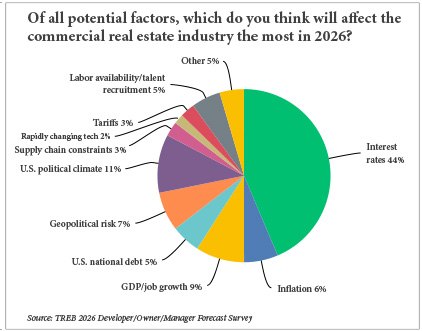

By Taylor Williams The results of Texas Real Estate Business’ annual reader forecast survey are in, and they paint a somewhat surprising picture of an optimistic business outlook for the new year. Why surprising? Well, geopolitically speaking, 2026 has already picked up right where 2025 left off. The Trump administration’s capture of Venezuelan president Nicolas Maduro and his wife in early January touched off a fresh source of geopolitical angst. The administration then subsequently ratcheted up its preexisting talk about Greenland becoming part of the United States, including issuing a threat to impose more tariffs on European countries that opposed that plan. Editor’s note: In mid-November, Texas Real Estate Business sent email invitations to participate in the annual online survey to three separate groups — brokers; developers, owners and managers; and lenders and financial intermediaries. The survey was held open through mid-December. Invitations to participate were also included in the Texas Real Estate Business e-newsletter, as well as through ReBusinessOnline.com. The tariff threat has since been walked back, but it’s hardly an understatement to say that the first month of 2026 has been rocky in terms of geopolitics. And when that happens, it’s anyone’s guess as to just how rattled markets …

AUSTIN, TEXAS — Locally based general contractor OHT Partners has broken ground on The Martin, a 375-unit multifamily project in East Austin. The Martin will offer one- and two-bedroom units that will range in size from 550 to 1,400 square feet, with 37 residences to be set aside as affordable housing for households earning up to 50 percent of the area median income. Amenities will include two pools, a jumbotron, fitness center, golf simulator, a karaoke and multimedia room, podcast rooms, dog park, coworking spaces and a dedicated rideshare lounge. Completion is slated for fall 2028. Project partners include architect Omniplan, civil engineer 360 Professional Services, structural engineer Urban Structure, MEP consultant Basharkhah Engineering, interior designer Ink + Oro and landscape architect KW Landscape Architects.

ROWLETT, TEXAS — SRS Real Estate Partners has arranged the $13.7 million sale of a 40,000-square-foot retail building in Rowlett, a northeastern suburb of Dallas, that is leased to Crunch Fitness. The gym opened at the building at 3601 Lakeview Parkway last fall under a 15-year, corporate-guaranteed lease. Matthew Mousavi and Patrick Luther of SRS represented both the seller, a multi-state developer, and the buyer, a publicly traded REIT, in the transaction. Both parties requested anonymity.

TEMPLE, TEXAS — Extended Stay America has opened a 116-room hotel in the Central Texas city of Temple. Developed by Provident Hospitality, the Extended Stay America Premier Suites – Temple is a four-story building with rooms that feature fully equipped kitchens with refrigerators, stovetops and microwaves, as well as dedicated dining and work areas. Amenities include fitness and business centers, as well as onsite laundry facilities.

DALLAS — Westwood Management has signed a 30,000-square-foot office lease renewal in Uptown Dallas. The boutique asset management firm will remain a tenant at The Crescent, where it has occupied space since 1990, through 2036. Paul Whitman, Brad Selner and Blake Waltrip of JLL represented the tenant in the lease negotiations. Tony Click and Jordyn Allen represented the landlord, Crescent Real Estate, on an internal basis.

LANCASTER, TEXAS — Developer IAC Properties has broken ground on a 727,080-square-foot industrial project in Lancaster, a southern suburb of Dallas. Known as IAC Pleasant Run, the 52.8-acre development will consist of two buildings that will span 457,646 and 269,434 square feet. The buildings will be situated on a total of 47 acres, and the remaining acreage will be devoted to a detention pond. Combined, the buildings will offer 7,941 square feet of office space, 127 dock doors, four drive-in doors and parking for 532 cars and 201 trailers. Ware Malcomb is the project architect, and Krusinski Construction Co. is the general contractor. Kimley-Horn is the civil engineer and landscape architect. Construction is expected to be complete early next year.

HOUSTON — Brazos Presbyterian Homes Holding Inc., a nonprofit owner-operator, will develop a 21-story seniors housing building in the Uptown area of Houston. Known as Uptown Oaks at The Hallmark, the project represents an expansion of The Hallmark, a senior living community that first opened in 1972. The new building will feature 120 independent living units that will range in size from 1,250 to 3,000 square feet. Amenities will include a wellness center with a yoga studio and massage area, dining venues, an art and hobby studio, café, movie theater and a pool. PRDG Architecture designed the building. Construction is expected to begin in 2027, with occupancy starting in 2030.

ENNIS, TEXAS — Marcus & Millichap has brokered the sale of The Willows, an 84-unit apartment building in Ennis, about 40 miles south of Dallas. The Willows was built on a 3.8-acre site in 1985 and offers studio, one- and two-bedroom units. Matt Aslan and Bard Hoover of Marcus & Millichap represented the seller in the transaction. The duo also collaborated with Marcus & Millichap’s Nick Fluellen to procure the buyer. Both parties requested anonymity.

DALLAS — Weil, Gotshal & Manges LLP has signed a 69,000-square-foot office lease renewal in Uptown Dallas. The global law firm will remain a tenant at The Crescent, where it has occupied space since 1993, through 2036. Randy Cooper, Craig Wilson and Dan Harris of Stream Realty Partners represented the tenant in the lease negotiations. Tony Click and Jordyn Allen represented the landlord, Crescent Real Estate, on an internal basis.