DALLAS — Cushman & Wakefield has arranged the sale of a national portfolio of seven industrial buildings totaling 1.6 million square feet. The buildings are located across Texas, California, Utah and Tennessee. An unnamed institutional owner purchased the portfolio. The seller and sales price were not also not disclosed. Properties in the recently acquired industrial portfolio include Valwood A (201,354 square feet), Valwood C (134,266 square feet) and Valwood D (127,620 square feet) in Carrollton, Texas (part of the Dallas MSA); Chino Distribution Center (409,930 square feet) in Chino, Calif.; Salt Lake Distribution Center I (190,000 square feet) and Salt Lake Distribution Center II (190,000 square feet) in Salt Lake City; and Elam Farms Distribution Center II (363,500 square feet) in Murfreesboro, Tenn. The buildings were constructed in the mid-2000s and were collectively 97 percent leased at the time of sale to a mix of national and regional tenants. The properties feature ESFR fire sprinkler systems, average clear heights of 30 feet, expansive truck courts, concrete tilt-up construction and ample parking. The national industrial advisory group at Cushman & Wakefield that arranged the sale consisted of Jim Carpenter, Adam Pastor, Robby Rieke, Emily Brandt, Jeff Chiate and Casey Masters. “This transaction …

Top Stories

ATLANTA — Commercial real estate firm CP Group has announced plans to reopen the 1.2 million-square-foot former CNN Center in downtown Atlanta this year. CP Group has repositioned the property as The Center (CTR), which is projected to open in May. The firm acquired the building from AT&T in 2021 and first announced the rebranding in 2024. CNN began moving back to its Turner Techwood campus in Midtown Atlanta in 2023. Changes at the development include a new, 12-concept dining space, dubbed CTR Food Works. Situated in the central atrium, the 24,000-square-foot CTR Food Works will be operated under Gansevoort Cos. and led by Robert Montwaid, who created Chattahoochee Food Works in Atlanta and Gansevoort Market in New York. Confirmed food-and-beverage concepts include La Tropical, Fuzzy’s, Patty & Frank’s, Mimi Taqueria, Flora D’Italia, Dessert Box and a full-service CTR bar. The restaurants and bar are expected to open in time for the FIFA World Cup, of which Atlanta is a host city. Restaurant anchor Mastro’s Ocean Club has also signed a lease at the property and will occupy an 8,200-square-foot, ground-floor space. Hines is representing CP Group in all retail leasing transactions and is advising on redevelopment strategy at the …

DAVIE, FLA. — El-Ad National Properties has topped off construction of The District in Davie, a $1 billion mixed-use project located about 24 miles north of Miami. The topping off marks the structural completion of Phase I, including the entry promenade and service access roadways, of the 2.8 million-square-foot development. Phase I is anticipated for completion in early 2027. When fully built out across three phases, The District in Davie will feature five residential towers ranging from 21 to 24 stories with 1,292 rental units, 36,000 square feet of restaurant and retail space and 1.1 million square feet of access-controlled parking with 2,650 spaces. Each tower will offer studio, one-, two- and three-bedroom units that will range in size from 589 to 1,460 square feet. Residences will feature high-speed internet, smart thermostats and keyless entry, as well as private terraces on each floor. Amenities will include rooftop pools, coworking spaces, pet parks, children’s play suites, 24-hour fitness and spa treatment rooms, outdoor kitchens, game lounges and a reservable sky lounge for indoor and outdoor entertaining. Atlanta-based architecture firm Cooper Carry is designing the project. Promethean Builders LLC is serving as general contractor. Situated in central Broward County, Davie is one …

Merus Acquires RiverGate Mall in Metro Nashville, Plans $450M Mixed-Use Redevelopment

by John Nelson

GOODLETTSVILLE, TENN. — Merus, a design-build firm that was formerly known as Al. Neyer, has purchased RiverGate Mall, an enclosed shopping mall located at 1000 Rivergate Parkway in Goodlettsville that opened in 1971. The Cincinnati-based firm is planning to transform the 57-acre site on the northern outskirts of Nashville into a $450 million mixed-use district. Merus plans to demolish the mall this spring. In its place, the firm will develop 700 multifamily units, 100 townhomes, 80 independent seniors housing units, more than 130,000 square feet of retail and dining space and a center green and plaza for community programming. “Stepping into a site like this comes with a responsibility — not just to redevelop it, but to do it right,” says Patrick Poole, senior vice president and Nashville market leader for Merus. “Our focus is taking a property designed for a different era and reimagining it as a walkable, active district where people can live, work, gather and spend time.” Merus purchased the 514,000-square-foot mall, which is situated next to Dollar General’s global headquarters, for $33 million. Bryan Belk and John Tennant of Franklin Street represented the seller, Hendon Properties, in the transaction. Hartman Simons & Wood LLP executed legal work …

MORRISTOWN, N.J. — JLL has provided $296 million in Freddie Mac financing for a portfolio of 13 multifamily properties totaling 1,880 units in New Jersey. The portfolio consists of garden-style properties that are scattered across five Central and Northern New Jersey counties: Middlesex, Somerset, Union, Monmouth and Morris. The vintage of the properties ranges from 1959 to 1999. Michael Klein, Thomas Didio Jr., Michael Mataras and Joseph Gruber of JLL originated the 10-year, fixed-rate loan, which was structured with interest-only payments for a portion of the term. The borrower was not disclosed. “The borrower’s exceptional management capabilities and dedication to maintaining a well-kept, high-performing portfolio ensure these vital communities continue to deliver quality, affordable homes for residents,” says Didio. — Taylor Williams

DALLAS — JLL has arranged a $596 million CMBS loan for the refinancing of a portion of The Crescent, a 1.3 million-square-foot mixed-use development located in Uptown Dallas. Goldman Sachs and J.P. Morgan provided the debt to the owner, Crescent Real Estate, and the three-year, floating-rate loan will refinance the property’s three office towers and the retail atrium building. Crescent Real Estate has owned, sold and reacquired its namesake mixed-use development multiple times since the 1990s. Completed in 1986 on roughly 11 acres, The Crescent consists of three office towers with ground-floor retail space totaling 1.2 million square feet; a three-story, 167,510-square-foot atrium building; the Hotel Crescent Court; The Spa at The Crescent; 11 restaurants and various high-end retail shops. After several renovations over the past five years, The Crescent also features a mix of updated amenities such as a full-service fitness center, two salons, an art gallery and a multi-level parking garage. Tenants at the property — which is 90 percent leased — include Jeffries, BankUnited, BMO Harris Bank, Wells Fargo, PNC Bank, Raymond James and UBS. Weil, Gotshal & Manges LLP, along with Westwood Management, have also both recently signed office lease renewals at the development. The debt advisory team …

SAN DIEGO — Golden Columbia, a real estate investment platform sponsored by locally based GANMI Corp., has completed the acquisition of two Class A office properties in downtown San Diego. Together, the buildings total 707,623 square feet. The sales price was not disclosed, but The San Diego Union-Tribune reports the properties traded for $103.5 million. The newspaper also reports that the seller, Regent Properties, purchased the two buildings for a combined $223.5 million in June 2021. The properties include One Columbia Place, a 27-story office tower located at 401 W. A St., and Two Columbia Place, a 12-story office building located at 1230 Columbia St. One Columbia Place comprises 556,943 square feet, and Two Columbia Place spans 150,680 square feet. According to a statement issued by GANMI Corp., long-term plans for One and Two Columbia Place include repositioning the properties into an “experience-driven workplace destination designed to support tenants, employees and the broader downtown ecosystem.” Enhancements at the buildings will be implemented in phases. “People don’t come back to the office for desks alone — they come back for energy, community and convenience,” says Casey Gan, CFO of GANMI Corp. “Our mission at Columbia Place is to build a complete workplace experience by …

Selig Submits Rezoning Request for Second Phase of The Works Mixed-Use Village in Atlanta

by John Nelson

ATLANTA — Selig Enterprises has submitted a rezoning request for the second phase of The Works, an 80-acre mixed-use village located in Atlanta’s Upper Westside neighborhood. According to The Atlanta Journal-Constitution, Phase II could span 2.2 million square feet upon completion. Phase I of The Works included adaptive reuse offices housing firms including Google Fiber and City of Atlanta; Westbound at The Works, a 306-unit apartment community; Chattahoochee Food Works, a food hall with 31 stalls serving dishes including pho, barbecue, donuts, subs, Mexican food and more; Dr. Scofflaw’s at The Works, a research-and-development brewery concept from Atlanta-based Scofflaw Brewing; retail space, including boutique stores, salons, Stellar Bodies and a standalone Ballard Designs store; and outdoor gathering areas, including Fetch Park (off-leash dog park) and The Camp (outdoor playground and live music space). Selig is proposing a mix of multifamily, office and retail components along Logan Circle and Chattahoochee Avenue. Phase II, which will span the remaining 53 acres of the site, is currently in early planning stages, with no immediate construction timeline established at this time. Selig is working closely with the Upper Westside CID and local neighborhood groups to gain insight and feedback throughout the process. Founded in …

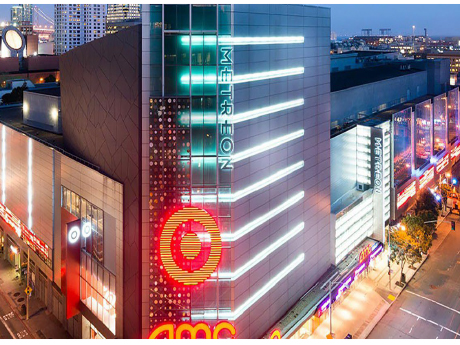

TMG, Bridges Capital Acquire 320,000 SF Metreon Shopping Center in Downtown San Francisco

by John Nelson

SAN FRANCISCO —TMG Partners and equity partner Bridges Capital LLC have acquired Metreon, a 320,000-square-foot, vertically oriented shopping center in downtown San Francisco. Built in 1999, the retail and entertainment destination is anchored by Target and a 16-screen AMC Theatres that features the tallest IMAX screen in North America. Locally based TMG and Bridges Capital purchased the four-story property from Acore Capital in a deed-in-lieu transaction. The sales price was not disclosed. The City and County of San Francisco will continue to retain ownership of Metreon’s ground lease through at least 2082, according to the San Francisco Business Times. The news outlet also reported Acore Capital was the mortgage lender for Metreon on behalf of the previous owner, Starwood Capital Group. “This investment in Metreon is a powerful vote of confidence in our downtown recovery,” says San Francisco Mayor Daniel Lurie. “We’re grateful for [TMG’s] partnership as we work to accelerate San Francisco’s comeback.” Metreon is located at 135 4th St. at Mission in the city’s Yerba Buena neighborhood. The property includes City View at Metreon, a 31,000-square-foot events venue with floor-to-ceiling windows offering views of the San Franisco skyline. TMG will rebrand the venue and partner with Skylight, a …

ATLANTA — Charlotte-based developer Crescent Communities has unveiled plans for 3600 Peachtree, a new mixed-use project in Atlanta’s Buckhead district. A construction timeline for the project was not announced. The 2.5-acre site is located at the corner of Peachtree and Wieuca roads, adjacent to Simon’s Phipps Plaza mall. Crescent made the announcement alongside its project partner, the Church of Wieuca, which currently occupies part of the site. Plans currently call for a 21-story, 375,000-square-foot office building and a 300-unit apartment community that will be operated under the developer’s NOVEL by Crescent Communities brand. The development will also feature street-level retail and restaurant space. Crescent also plans to introduce a comprehensive, hospitality-driven amenity program via approximately 10,000 square feet of shared indoor amenities and direct access to an elevated 19,000-square-foot landscaped outdoor terrace. Specific amenities will include conferencing and training spaces that can accommodate more than 200 attendees, as well as multiple alternative work environments and spa-like wellness and fitness facilities with locker rooms, indoor and outdoor lounges. Project partners for 3600 Peachtree include HSR Development Services (residential development), Partners Real Estate (office leasing), Pickard Chilton (architecture) and Kimley-Horn (civil engineering). “Our focus is on creating a workplace that feels elevated …

Newer Posts