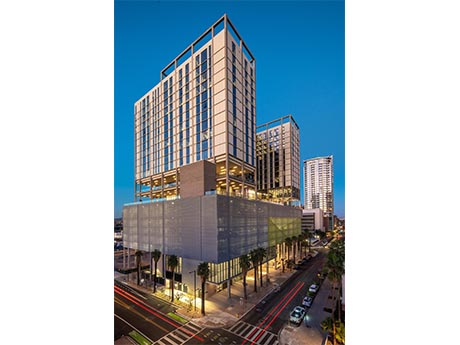

FORT LAUDERDALE, FLA. — A partnership between locally based office owner-operator CP Group and New York City-based investment manager Related Fund Management has acquired Las Olas Square, an office and retail complex in Fort Lauderdale. The sales price was $144.5 million, according to The South Florida Business Journal. The local news outlet also reports that the seller was a partnership between Steelbridge Capital, Square2 Capital and Apollo Global Management. Las Olas Square consists of a 17-story office building and a three-story office and retail building. Combined, the two buildings total 267,000 square feet. The larger office building features structured parking, meeting and conference facilities, and newly created outdoor amenity spaces. The previous owner recently completed a multimillion-dollar renovation of the lobby, common areas and restrooms. Suites are equipped with motion-activated lighting systems and floor-to-ceiling windows. Retail tenants at Las Olas Square include restaurant Del Frisco’s Grille, Truist Bank and Spaces, a coworking concept. Part of the appeal of Las Olas Square is the strong pipeline of multifamily developments that are underway in the area, as well as the location at a “main and main” intersection within the city’s urban core, according to Brett Reese, senior vice president at CP Group. …

Top Stories

MIAMI — Affiliates of Harbor Group International (HGI) have acquired ParkLine Miami, an 816-unit luxury apartment community in downtown Miami. The purchase price was not disclosed, but news outlets reported last fall that the asking price was $500 million. The seller, Florida East Coast Industries (FECI), completed construction of the property in 2020. The development is perched directly above MiamiCentral, a transportation hub spanning six city blocks that connects to four major transit lines. “The ParkLine Miami investment represents a unique opportunity to acquire a world-class asset in a desirable, high-growth location with accessibility to major employment drivers and direct elevator access to all major regional and local transportation modes,” says Richard Litton, president of HGI. ParkLine Miami consists of two apartment towers rising 44 and 47 stories. Connecting the two towers is a two-acre amenity deck set 150 feet above street level. Offerings include pools, outdoor and indoor fitness centers, pet parks, a quarter-mile running track and a business center with coworking spaces. HGI, a privately owned international real estate investment and management firm based in Norfolk, Va., now owns 1,105 units across five properties in Miami-Dade County. Cammeby’s International Group partnered with HGI on the transaction. Cammeby’s, which …

Blackstone Acquires Minority Stake in One Manhattan West Office Tower in New York for $1.4B

by John Nelson

NEW YORK CITY — Blackstone (NYSE: BX) has purchased a 49 percent stake in One Manhattan West, a 67-story office tower in Manhattan totaling 2.1 million square feet. Brookfield (NYSE: BAM) and Qatar Investment Authority sold the minority interest to Blackstone and will retain a 51 percent ownership stake in the skyscraper. The purchase price wasn’t disclosed, but Brookfield says that the deal “values the office building at $2.85 billion,” which translates to Blackstone’s stake totaling just below $1.4 billion. Ben Brown, managing partner of Brookfield, says the competition for the acquisition was intense despite the uneven recovery of New York City’s office market due to COVID-19. “The partial sale of One Manhattan West and the interest we received as soon as we put it on the market are clear validations that the highest quality office properties are seeing enormous demand coming out of the pandemic,” says Brown. “One Manhattan West is home to some of the world’s leading companies, and their continued desire to work from and grow in the building is a promising sign for Manhattan West and prime, well-located office assets broadly.” Located on the corner of Ninth Avenue and 33rd Street, One Manhattan West is leased …

Lovett Industrial, Clarion Partners Break Ground on 3.1 MSF Development in Metro Houston

by Jeff Shaw

TOMBALL, TEXAS — A partnership between Houston-based developer Lovett Industrial and New York City-based investment manager Clarion Partners has broken ground on Interchange 249, a 3.1 million-square-foot development in the northern Houston suburb of Tomball. Interchange 249 will consist of 10 buildings on a 240-acre site at the intersection of State Highway 249 and Rocky Road that will be developed across three phases. Macy’s has already committed to leasing 48 percent of Phase I, which will consist of four buildings totaling 1.9 million square feet. These buildings will feature 32- to 40-foot clear heights and combined parking for 577 trailers. Completion of Phase I is slated for the first quarter of 2023. The development features approximately one mile of frontage along Grand Parkway. The site has direct access to both Grand Parkway and Highway 249, allowing for efficient regional and local distribution. Additional advantages include proximity to Houston’s labor force and a central location within an area that is experiencing unprecedented residential and commercial growth, according to the developers. Powers Brown Architecture is designing Interchange 249, and Kimley-Horn is the civil engineer. Harvey Builders is serving as the general contractor, and Cushman & Wakefield has been tapped as the leasing …

PHOENIX — Chicago-based developer The X Co. has completed X Phoenix, a 20-story multifamily high-rise project located at 200 W. Monroe St. in the state capital’s downtown area. The 731,321-square-foot building houses 330 residential units and represents Phase I of a larger development. Phase II of X Phoenix will feature a 26-story multifamily tower that will be developed on an adjacent parcel. Construction of Phase II is scheduled to begin this spring. Phase I of X Phoenix included a parking garage with 612 stalls, plus an indoor mezzanine storage space with 159 bike parking spots and a wash station. The eighth floor of the building houses two pools with a poolside bar and restaurant that is scheduled to open in April. In addition, the ninth floor of the building features a 9,000-square-foot fitness center with locker rooms and a yoga studio. Lastly, the building contains 50,000 square feet of commercial space that will be built out to support restaurant and coworking uses. Chicago-based Fitzgerald & Associates designed X Phoenix, with Workshop/APD handling interior design. Clayco, a design-build firm with five offices across the county, provided construction management services. Kimley-Horn and Peterson Associates provided engineering services. The X Co. has built …

Regent Properties Acquires 1.2 MSF Trammell Crow Center Skyscraper in Dallas for Over $600M

by Katie Sloan

DALLAS — Regent Properties has acquired Trammell Crow Center, a 50-story, 1.2 million-square-foot office tower located at 2001 Ross Ave. in downtown Dallas. The property is among the tallest buildings in the city. Regent purchased the skyscraper from a group of institutional investors advised by J.P. Morgan Global Alternatives. While terms of the transaction were not released, The Dallas Morning News reports that the Class A tower, along with a retail building and parking garage across the street, sold for more than $600 million. The property recently underwent $180 million in renovations, which included the development of a 2,000-space parking garage, 10,000-square-foot athletic club, 10,000-square-foot conference center, tenant lounge, outdoor gathering areas and 32,000 square feet of retail space. The acquisition also includes the adjacent full city block situated at 2000 Ross Ave., which can accommodate a new residential or office tower. The site is also home to a JW Marriott slated to open in 2023, which was not included in the sale. “Last year we set an objective to invest more than $2 billion in high-quality office real estate across Texas and the Sun Belt regions,” says Eric Fleiss, CEO of Regent Properties. “The purchase of this iconic asset during a …

SEATTLE — The RMR Group Inc. (NASDAQ: RMR) has begun the redevelopment of 351, 401 and 501 Elliott Avenue West in Seattle into a project dubbed Unison Elliott Bay. The existing three office buildings will be transformed into Class A office and life sciences space totaling more than 300,000 square feet. Amenities will include an outdoor lounge, conference and training rooms, fitness facility, new lab mechanical infrastructure and two backup generators for labs. Tenants will also have access to covered and surface parking, bike storage and electric vehicle charging stations. Customizable floor plates will range from 21,000 to 27,500 square feet. The buildings are located near the new Climate Pledge Arena, home of the Seattle Kraken National Hockey League team, as well as 15 acres of trails, beaches and open space. Tenants will also have access to onsite food options in addition to the dining and retail amenities of Seattle’s Lower Queen Anne neighborhood. “Unison’s customizable floor plates, distinctive spaces and common areas that prioritize wellness, with views of the natural beauty of the Puget Sound and Olympic Mountains, will be in demand from an array of tenants,” says Chris Bilotto, senior vice president of RMR. “We anticipate delivery in …

MarketSpace Capital, Park Harbor Capital Complete Purchase of Tri-County Mall Near Cincinnati, Plan $1B Redevelopment

by John Nelson

SPRINGDALE, OHIO — MarketSpace Capital and Park Harbor Capital, two private real estate investment and development firms based in Texas, have officially closed on their purchase of Tri-County Mall, an enclosed, 1.3 million-square-foot regional shopping center in the Cincinnati suburb of Springdale. The co-developers plan to transform the mostly vacant mall into a $1 billion redevelopment project housing residences, offices, restaurants, shops, a school, entertainment venues and green space. The redevelopment received unanimous approval from the Springdale City Council about 10 weeks ago. MarketSpace and Park Harbor are set to begin construction later this year on Phase I, which will include 450 apartments, 40,000 square feet of retail space and restaurants and 110,000 square feet of recreational space, including a 38,000-square-foot fitness center. Several health and wellness amenities will also feature in the initial phase, including walking and cycling trails and a park. Several local companies are involved in this project, including THP as the structural engineer and The Kleingers Group as the civil and traffic engineer. BHDP, whose founders designed the original mall in the late 1950s, will serve as the prime architect, with Human Nature serving as the landscape architect. BSB Group International will lead branding and marketing …

Welltower Acquires 33-Property Seniors Housing Portfolio for $548M, Plans Two Developments in Silicon Valley

by Jeff Shaw

TOLEDO, OHIO — Welltower Inc. (NYSE: WELL), a Toledo-based healthcare REIT, has agreed to acquire 33 seniors housing communities totaling 2,787 units in Michigan, Ohio and Tennessee. The purchase price is $548 million. The communities will be acquired as three separate portfolios from undisclosed sellers. The communities were available for purchase because the lease-up process was heavily damaged by the onset of the COVID-19 pandemic. With occupancy at only 63 percent, Welltower expects the communities will greatly improve their performance in 2023 and beyond. Welltower will install Michigan-based senior living operator StoryPoint to manage the communities under a RIDEA agreement. The acquisition is expected to be funded through the issuance of partnership units, assumed debt and cash on-hand. Simultaneously with the acquisition announcement, Welltower unveiled a development partnership with a joint venture between Related Cos. and Atria Senior Living to develop two seniors housing communities in Silicon Valley. One will be located in Santa Clara and the other in Cupertino. Welltower suggests these developments are just the first projects of many for the partnership. The Santa Clara development will consist of 191 units next to a fully entitled, 9.2 million-square-foot urban development that Related began building in 2015. The larger project, …

NEW YORK CITY — Rabina has received $540 million in construction financing for 520 Fifth Avenue, an approximately 1,000-foot-tall high-rise development in Manhattan. With site work already underway, the 450,000-square-foot mixed-use tower will be the second tallest building on Fifth Avenue after the Empire State Building. The construction timeline was not disclosed. The project will include residential components, boutique commercial office space, recreational facilities and ground-floor retail. The first three levels will consist of restaurants and then floors four through 28 will be office space. Floors 31 through 68 will feature residential units, according to New York Yimby. The news outlet also said the residential amenities will include a pool, spa, fitness center and sports court. Located on Fifth Avenue and 43rd Street in Manhattan’s Midtown neighborhood, the property is situated near notable buildings including the New York Public Library, Grand Central Station, Rockefeller Center and the Chrysler Building. Christopher Peck, Geoff Goldstein, Evan Pariser, Marko Kazanjian, Alex Staikos and Madison Warwick of JLL Capital Markets represented Rabina in arranging the financing. Bank OZK will provide a $410 million senior mortgage loan while Carlyle’s global credit business will provide $130 million in mezzanine financing. The loan terms were not disclosed. …