NEW ALBANY, OHIO — Santa Clara, Calif.-based Intel has unveiled plans to invest more than $20 billion to build two new computer chip factories. The campus will be located in New Albany, approximately 18 miles northeast of Columbus. Construction is scheduled to begin at the end of 2022 for the start of production in 2025. The two semiconductor fabrication plants, or “fabs,” will be situated on nearly 1,000 acres in Licking County. The project site can accommodate a total of eight chip factories. At full buildout, the total investment in the site could increase to as much as $100 billion over the next 10 years. The project is the largest single private-sector investment in Ohio’s history, according to Intel. Ohio will be home to Intel’s first new manufacturing site location in 40 years. Additionally, Air Products, Applied Materials, LAM Research and Ultra Clean Technology have announced plans to establish a physical presence in the region to support the buildout of the site, with more companies expected to join the project in the future. “Building this semiconductor mega-site is akin to building a small city, which brings forth a vibrant community of supporting services and suppliers,” says Keyvan Esfarjani, Intel senior …

Top Stories

NEW FAIRVIEW, TEXAS — Rockhill Capital and Investments has acquired Shoop Ranch, a 1,807-acre plot of land in New Fairview. The tiny city of fewer than 2,000 residents is located approximately 30 miles northwest of downtown Fort Worth. Rockhill plans to build a massive mixed-use project on the site, which will include 4,150 single-family homes, 900 multifamily residences, shops, restaurants, offices, public spaces and government buildings such as schools, a town hall, public pool and fire station. “The [city] council and staff are focusing on maintaining our current rural feel, natural elements and open space, while creating a development and city center where people can live, work and play,” says Ben Nibarger, New Fairview’s city administrator. He notes that the city and Rockhill have been planning the development for about a year. “New Fairview is in a position for growth, and we are working with the city to thoughtfully plan a thriving community that will satisfy the needs for a city hub and additional housing, while also celebrating the area’s natural beauty,” says Jennifer Alexander, project manager at Rockhill Capital and Investments. The Shoop Ranch property features more than 1.5 miles of Oliver Creek, which offers fishing locations for bass …

HOUSTON — CyrusOne Inc. (NASDAQ: CONE) has entered into a definitive agreement to sell four of its data centers in Houston for approximately $670 million. Under the terms of the agreement, DataBank Holdings Ltd. will acquire Houston West I, II and III, as well as Houston Galleria. The four facilities total more than 300,000 square feet. Additionally, CyrusOne will lease back the Houston West III shell to support a lease signed with a customer in the fourth quarter of 2021. The transaction is expected to close by the end of this quarter. Proceeds from the sale will be utilized to fund future development projects. “We are excited to execute on our capital recycling initiative to fund our continued growth,” says David Ferdman, interim president and CEO of Dallas-based CyrusOne. “This divestiture further optimizes our portfolio as we redeploy capital into accretive developments across core markets with diverse hyperscale and enterprise demand in the U.S. and Europe.” The transaction marks DataBank’s entry into the Houston market. “With our deep roots in Texas, [Houston] was a logical metro for us to expand into and allows us to bring our digital infrastructure and interconnection solutions to the fourth-largest metro in the U.S.,” says …

JBG Smith Begins Construction on Two Apartment Towers in Metro DC’s National Landing District

by John Nelson

ARLINGTON, VA. — JBG Smith (NYSE: JBGS), an owner and developer of mixed-use properties in the greater Washington, D.C. market, has begun construction on a pair of multifamily towers at 2000 and 2001 South Bell Street in Arlington. The development is expected to bring 775 apartments and nearly 27,000 square feet of retail space to National Landing, a neighborhood anchored by Amazon’s HQ2 campus and the Virginia Tech Innovation Campus, both of which JBG Smith is developing. “The start of construction at 2000 and 2001 South Bell Street is a major milestone in National Landing’s ongoing transformation and delivers on our pledge to build new housing in lockstep with Amazon and Virginia Tech’s growth in the neighborhood,” says Bryan Moll, executive vice president of development at JBG Smith. KPF designed 2000 South Bell Street to be a modern, 25-story glass tower with 355 multifamily units situated above approximately 15,000 square feet of street-level retail space. The adjacent 2001 South Bell Street was designed by Studios to be a 420-unit, 19-story tower with a green-glazed brick façade and approximately 10,000 square feet of street-level retail space. SK+I will serve as the architect of record for both towers, which are designed to …

WASHINGTON, D.C. AND PENSACOLA, FLA. — A joint venture between Washington, D.C.-based National Real Estate Advisors (NREA) and Florida-based Catalyst Healthcare Real Estate has acquired two national healthcare portfolios totaling approximately 1.2 million square feet Together, the portfolios comprise 40 properties across 13 states, the majority of which are located in Sun Belt markets. At the time of sale, the portfolios had a combined occupancy rate of 92 percent. Of that 1.1 million square feet of occupied space, about 88 percent is leased to regional healthcare systems and physician groups. The acquisition and recapitalization represent a total investment of approximately $420 million. The sellers were also not disclosed. “These transactions underscore our commitment to investing in highly competitive, diverse markets that seek to generate long-term, healthy returns for our clients,” says Jeffrey Kanne, president and CEO of NREA. “This acquisition not only significantly scales our medical office portfolio but furthers our geographic diversification.” “Our joint venture strives to positively impact healthcare delivery by investing strategic capital with a partnership-like mentality,” adds Chad Henderson, founder and CEO of Catalyst. “The closing of the portfolios was a significant first step for our joint venture and paves the way for the future of …

PHOENIX, ARIZ. — Chicago-based Clayco has broken ground on PALMtower, a 28-story residential tower development in downtown Phoenix. The project is slated for completion by early 2024. Development costs were not disclosed. PALMtower will feature 352 apartment units with unit features including quartz countertops, luxury vinyl tile, custom finish light fixtures and views of downtown Phoenix. The property will also offer parking onsite, including six floors of above-ground parking with 370 spaces and 120 spots for bike parking. The property will also include a 17,500-square-foot seventh-floor amenity level with an indoor-outdoor common space. The outdoor amenities will include a pool, spa, outdoor kitchen, native gardens and 360-degree city views. Indoor amenities will feature a resident’s club, media room, lounge areas and fitness and yoga centers. The project is landlocked on all sides in one of downtown Phoenix’s most constrained sites, according to Clayco. The 481,980-square-foot building’s exterior cladding will include glass and metal paneling. Located at 440 East Van Buren St., PALMtower is located less than a half mile from the Arizona State University Downtown Phoenix campus and across the street from the University of Arizona College of Medicine campus. The property will be located near retailers and restaurants, including …

AREP, Harrison Street to Develop Six Properties in Virginia’s Data Center Alley for $1B

by Katie Sloan

ASHBURN AND ARCOLA, VA. — A joint venture between American Real Estate Partners (AREP) and Harrison Street has announced plans to develop six powered shell data centers in Virginia’s Data Center Alley for $1 billion. The campuses will span 2.1 million square feet across two sites in Ashburn and Arcola. The first project will include a portion of the former AOL headquarters on Pacific Boulevard in Ashburn. The development will feature four built-to-suit data centers delivering 300 megawatts (MW) of electrical power capacity. The second development will be located on Arcola Boulevard, directly across the street from a new development by Google and near Dulles International Airport in Arcola. The campus will include two built-to-suit data centers offering approximately 100 to 125 MW of electrical power capacity. The new buildings will range from 265,000 to 440,000 square feet in size. A timeline for the developments was not announced. The joint venture has also broken ground on ABX-1 at Beaumeade, a 265,000-square-foot, two-story, powered shell data center located on Loudoun County Parkway along the Ashburn Fiber Ring in Ashburn. The partnership acquired the site in January 2021 and has not announced a timeline for the project. A number of large-scale data …

CAMBRIDGE, MASS. — Newmark has arranged the $815 million sale of Charles Park, a two-building office complex and parking garage in Cambridge. The Davis Cos. and Principal Real Estate Investors sold the asset to an affiliate of Alexandria Real Estate Equities Inc. (NYSE: ARE). Charles Park spans 408,259 square feet and consists of two Class A office buildings, One Rogers Street and One Charles Park. The property also includes a 656-space, seven-level parking garage. Alexandria plans to redevelop the two buildings into life sciences space, but further details of that project were not provided. Situated near Charles Park is the nearly 1 million-square-foot CambridgeSide complex, which is undergoing a residential and retail development. Charles Park is also located near two Massachusetts Bay Transportation Authority (MBTA) subway stations, the campus of Massachusetts Institute of Technology (MIT), the new Cambridge Crossing mixed-use development and Massachusetts General Hospital. “Charles Park is well positioned along Kendall Square’s rapidly expanding First Street corridor with immediately recognizable architecture highlighted by its distinctive horseshoe-shaped façade,” says Edward Maher, vice chairman with Newmark. “The asset is further surrounded by an unmatched laboratory and technology mecca in the life sciences epicenter of the world.” Maher, along with Robert Griffin, …

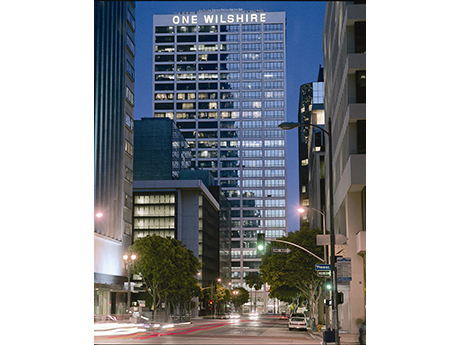

LOS ANGELES — JLL has arranged the $389.2 million refinancing of One Wilshire, a multi-tenant data center located at 624 S. Grand Ave. in downtown Los Angeles. The borrower is GI Partners, an alternative investment firm based in San Francisco. The 30-story, 661,553-square-foot data center features five separate utility power risers and 13 onsite generators with fuel storage for 24 hours of operation, along with separate and redundant data risers. The property also features office space, a multi-tower antenna array and fiber connectivity to the rooftop. Kevin MacKenzie, Brian Torp, Jake Wagner, Samuel Godfrey and Darren Eades of JLL arranged the 10-year, fixed-rate, non-recourse, interest-only loan through Goldman Sachs. “As one of the largest internet exchanges in the world, One Wilshire is truly a best-in-class asset recognized as the premier telecommunications hub of the Western United States,” says MacKenzie. “GI Partners has done an excellent job managing the asset to maximize utilization and creating significant value.” The demand for fast, secure and reliable data storage and delivery is at an all-time high and will continue to escalate for the foreseeable future thanks to the widespread appeal of content streaming services, social media and virtual connectivity. As a data center market, …

QUINCY, MASS. — CBRE has arranged the $114 million sale of Neponset Landing, a 280-unit apartment community located at 2 Hancock St. in the South Shore Boston suburb of Quincy. The sales price equates to approximately $407,000 per unit. Built in 2007, the 12-story building offers a mix of one-, two- and three-bedroom units with stainless steel appliances, granite countertops and individual washers and dryers. Amenities include a lounge with an entertainment kitchen, fitness center, billiards room, leasing office, private media room and concierge services. In addition, residents have access to shuttle service to the North Quincy MBTA station. Neponset Landing is also near Interstate 93, which provides direct access to downtown Boston. Simon Butler, Biria St. John and John McLaughlin of CBRE represented the seller, an entity doing business as Neponset Landing LLC, in the transaction. The seller is an affiliate of Oregon-based Green Cities Co. that secured LEED Certification status for the property in 2018. The CBRE team also procured the buyer, a joint venture between Boston-based Synergy Investments and an undisclosed foreign investment partner. The new ownership plans to implement a capital improvement program, specific details of which were not released. “This transaction marked the successful conclusion …