SEATTLE — Newmark has arranged a $435 million loan for the refinancing of Starbucks Center, the coffee giant’s nearly 1.5 million-square-foot headquarters campus located at 2401 Utah Ave. S in Seattle. Deutsche Bank provided the loan to the owner, a partnership between two local real estate companies, Nitze-Stagen & Co. Inc. and Daniels Real Estate. According to the property’s Wikipedia page, the main building was originally constructed in 1915 as a retail store for Sears, Roebuck & Co. Starbucks (NASDAQ: SBUX) first took occupancy of the property in 1993. At that time, the property was known as SoDo Center after its namesake neighborhood, which is one of Seattle’s main industrial districts, per Wikipedia. Since then, the campus has undergone more than 60 expansions over the past three decades to accommodate the company’s growth, according to Newmark, which also notes that Starbucks has invested more than $300 million of its own capital in the Seattle campus to date. In addition, Starbucks recently signed a lease extension through 2038. Jonathan Firestone, Jordan Roeschlaub, Blake Thompson and Kevin Shannon led the transaction for Newmark. “The closing of this refinancing positions Starbucks Center for continued excellence as one of the city’s premier office assets,” …

Top Stories

CHATTANOOGA, TENN. — Chattanooga-based CBL Properties (NYSE: CBL) has acquired four enclosed regional malls from Washington Prime Group for $178.9 million. The properties include Ashland Town Center in Ashland, Ky.; Mesa Mall in Grand Junction, Colo.; Paddock Mall in Ocala, Fla.; and Southgate Mall in Missoula, Mont. CBL says it is focused on owning and managing successful enclosed malls in dynamic and growing middle markets. The deal suggests mall recovery extends beyond luxury properties, driven by limited retail construction since 2008, according to The Wall Street Journal. Ashland Town Center is a single-level mall that opened in 1989. Totaling more than 420,000 square feet, the property features more than 70 retailers and restaurants, including anchors JCPenney, Belk, T.J. Maxx, Ulta Beauty and Five Below. The center has undergone several renovations over the years, including a major redevelopment in the late 2000s that added a new JCPenney prototype store and updated amenities. The largest indoor shopping center in western Colorado, Mesa Mall spans roughly 733,000 square feet and is home to more than 120 stores and services. Anchor tenants include Cabela’s, Dillard’s, JCPenney, Target, HomeGoods and Dick’s Sporting Goods. Originally developed in 1980, the property has undergone several redevelopments to modernize …

Verizon Selects PENN 2 in Manhattan for New Corporate Headquarters, to Occupy Nearly 200,000 SF

by John Nelson

NEW YORK CITY — Telecommunications giant Verizon (NYSE: VZ) has selected the PENN 2 office tower in Midtown Manhattan for its new corporate headquarters. The company will staff approximately 1,000 employees at its new office. Verizon signed a 19-year lease with the landlord, Vornado Realty Trust (NYSE: VNO), to occupy approximately 200,000 square feet of space on floors eight through 10. The timeline for Verizon’s occupancy at PENN 2 was not released. Josh Kuriloff, Peyton Horn, Heather Thomas and Kyle Ernest of Cushman & Wakefield represented Verizon in the lease negotiations. Glen Weiss, Josh Glick, Jared Silverman and Anthony Cugini represented Vornado on an internal basis. Located directly above the Penn Station public transit hub, PENN 2 offers direct access to 15 subway lines, the Long Island Railroad, New Jersey Transit, PATH, Amtrak and the upcoming Metro-North Railroad, which is scheduled to debut in 2027. Other tenants at PENN 2 include Major League Soccer, MSG Entertainment Corp. (operator of nearby Madison Square Garden) and Universal Music Group, which recently signed an 88,000-square-foot lease at the tower. As part of the lease agreement, Verizon employees at PENN 2 will have exclusive access to more than 25,000 square feet of outdoor space at …

NEW YORK CITY — JLL has brokered the $243.5 million sale of Riverbank, a 44-story apartment tower located at 560 W. 43rd St. in Midtown Manhattan. Barings sold the freshly renovated property to an undisclosed institutional investment firm, with JLL representing both parties in the transaction. JLL also arranged $128.3 million in acquisition financing for the deal. The direct lender and specific loan terms were not disclosed. Originally developed in the late 1980s as a condominium project, Riverbank currently houses 418 rental units comprising 43 studios, 270 one-bedroom units, 62 two-bedroom apartments and 43 three-bedroom residences. The high-rise also features nearly 18,000 square feet of retail space that is fully leased to a nail salon, liquor store and coffee shop. Most of Riverbank’s units have private balconies with city and Hudson River views, and residents have access to a 5,000-square-foot lounge called the Harbor Club that offers poker and billiards tables, a media room and coworking space. Additional amenities include an Olympic-size pool, fitness center, outdoor terrace and grilling stations. Jeffrey Julien, Rob Hinckley, Andrew Scandalios, Steven Rutman and Devon Warren led the JLL Capital Markets team that handled the sale of Riverbank. Kelly Gaines, Geoff Goldstein and Michael Shmuely …

ARLINGTON, VA. — Penzance, a locally based commercial real estate development and management firm, has received approval from Arlington County for a proposed three-tower, luxury mixed-use development in Arlington’s Rosslyn district. Dubbed One Rosslyn, the new development will deliver more than 970,000 square feet of rental apartments, for-sale residential condominiums and retail space along Gateway Park, which will replace the current Rosslyn Gateway office buildings. Upon completion, One Rosslyn will deliver a total of 845 residential units. Penzance is developing the project in partnership with Boston-based investment manager The Baupost Group. STUDIOS Architecture and Hickok Cole collaborated to design the three-tower composition. One Rosslyn’s south tower will stand the tallest at 300 feet, while delivering 461 residences across 434,000 square feet. The northwest apartment tower, which is the second tallest building, will span 356,000 square feet and include 311 rental units. Lastly, the project’s northeast tower will offer 73 for-sale condominiums across 195,000 square feet. Residents will also have access to a private, 30,000-square-foot landscaped terrace overlooking Gateway Park. Additionally, the ground level will provide more than 14,000 square feet of curated retail space along all four blocks of the property. Designed to enhance walkability and encourage multimodal transportation, public spaces …

DALLAS AND VANCOUVER — City Office REIT (NYSE: CIO), a Canadian company focused on the acquisition, ownership and operation of office properties in Sun Belt markets in the United States, has entered into a merger agreement valued at $1.1 billion. Under the terms of the agreement, MCME Carell Holdings LP and MCME Carell Holdings LLC — collectively a joint venture between South Florida-based firms Elliott Investment Management LP and Morning Calm Management LLC — will acquire all issued and outstanding shares of City Office REIT common stock for $7 per share in cash. The company’s stock price closed on Tuesday, July 23 at $5.56 per share, roughly the same as a year ago. City Office REIT’s current portfolio comprises 54 office buildings totaling roughly 5.4 million square feet of net rentable space in the Dallas, Denver, Orlando, Phoenix, Portland, Raleigh, San Diego, Seattle and Tampa markets. The company’s U.S. headquarters is located in Dallas. Terms of the merger agreement include the sale of City Office’s Phoenix portfolio. Upon close, City Office will become a private company and its shares will no longer trade on the New York Stock Exchange. “After conducting an extensive process to explore potential strategic alternatives, we …

CLARKSVILLE, TENN. — Hamilton Development has broken ground on NorthPark Logistics, a 2.1 million-square-foot industrial park in Clarksville, a city in northern Tennessee. The project marks the first Class A speculative industrial park in Clarksville, according to the Nashville-based developer. The 200-acre site at 4175 Guthrie Highway will feature 14 buildings at full build-out. Located within 50 miles of Nashville, the NorthPark Logistics site is directly served by R.J. Corman rail, offers immediate access to I-24, is within an hour’s drive from both Clarksville Regional Airport and Nashville International Airport and is adjacent to the $3.2 billion LG Chem plant. In addition to LG Electronics, Clarksville is home to industrial tenants such as Hankook Tire, Google, Bridgestone and Amazon. “As industrial employers continue to invest billions of dollars in the area, we believe there will be increasing demand for institutional-quality industrial space,” says Whitfield Hamilton, CEO of Hamilton Development. NorthPark Logistics will feature opportunities for flexible build-to-suit or speculative space, with the ability to accommodate tenants ranging from 18,200 to 1.2 million square feet. Hamilton Development has begun construction on the first phase of the development, which encompasses four buildings totaling nearly 550,000 square feet. Building 1, a 206,752-square-foot property, …

SINGAPORE AND CONSHOHOCKEN, PA. — Mapletree Investments Pte Ltd., a global real estate investment and management firm based in Singapore, has agreed to sell a portfolio of 10 bulk warehouse facilities that are located across various Sun Belt markets. Metro Philadelphia-based industrial development firm EQT Real Estate is purchasing the portfolio, which features properties in Georgia, Florida and Texas, for $241.2 million. Specific properties were not released, but a source familiar with the transaction says the assets are situated in suburban Atlanta, Dallas, Houston, Orlando and South Florida. Mapletree owns the warehouse facilities under Mapletree US & EU Logistics Private Trust, a closed-end private fund that was launched in 2019. Mapletree recently sold another portfolio within the $4.3 billion fund — a 1.8 million-square-foot portfolio that Faropoint purchased for $328 million. Clayton Skistimas, Christina Buhl, Marc Alfert, Mark Chu and Steve Silk of Eastdil Secured represented Mapletree in the transaction with EQT. The deal is expected to close by late 2025. “This divestment represents a strong outcome for our investors and affirms the value we’ve created across our U.S. industrial portfolio,” says Richard Prokup, CEO of Mapletree’s U.S. division. “As we look ahead, we remain focused on reinvesting in premier …

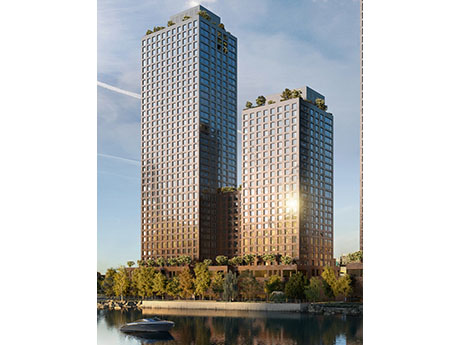

NEW YORK CITY — SCALE Lending, the debt financing arm of New York City-based Slate Property Group, has provided a $305 million construction loan for a new multifamily project in the Mott Haven area of The Bronx. The borrower is locally based development and investment firm The Beitel Group. The unnamed project will comprise two interconnected buildings that will rise 40 and 26 floors and house 755 studio, one- and two-bedroom apartments. Amenities will include an outdoor pool, large outdoor terrace, gym with sauna and steam room, pickleball court, golf simulator, coworking area, party room and children’s play room, as well as 11,500 square feet of retail space. Beitel Group bought the land at 355 Exterior St., which is situated along the Harlem River, last fall and subsequently demolished all existing structures. Prestige Construction NY is serving as the general contractor for the project, which has been vested into the city’s 421a program for inclusion of an affordable housing component. Landstone Capital Group arranged the construction loan, which carries an 18-month term with two six-month extension options, through SCALE Lending on behalf of Beitel Group. Construction is slated for a June 2026 completion. “The Mott Haven submarket of New York …

ATLANTA — Electric vehicle (EV) manufacturer Rivian has selected Atlanta for its new East Coast headquarters. Rivian will occupy the top floor and lobby of Portman Holdings’ Junction Krog Street office building, which is located at 667 Auburn Ave. NE along the Atlanta BeltLine’s Eastside Trail. The office, which will span approximately 45,000 square feet, is expected to open in late 2025 and will house roughly 500 employees upon full build-out. Portman delivered Junction Krog Street in fall 2023. Situated near the popular Krog Street Market food hall in the city’s Inman Park neighborhood, the mixed-use building features 135,000 square feet of creative office space, a rooftop deck, outdoor balconies on every level and ground-level retail space housing eateries Yuji, Brash Coffee and YEPPA&co. The headquarters will operate within a short drive to Rivian’s new $5 billion EV production facility situated within the 1,600-acre master-planned community of Stanton Springs North near Social Circle, Ga. Construction of the 7,500-person manufacturing plant is expected to begin in 2026. Rivian received financing from the U.S. Department of Energy’s Advanced Technology Vehicle Manufacturing Loan Program for the manufacturing facility, which will build the R2, a midsize SUV, and the R3, a midsize crossover. The …