CLEMSON, S.C. — Core Spaces and Kayne Anderson Real Estate have broken ground on Hub Clemson, a 1,303-bed student housing community located steps from Clemson University in South Carolina. The seven-story development will feature 394 units across 821,000 square feet, offering a mix of studio to five-bedroom layouts and a series of three-story townhomes. Hub Clemson will include 20,000 square feet of amenities, such as a rooftop pool and lounge with views of Lake Hartwell, a fitness center, coffee shop and communal green spaces. Located at the corner of Tiger Boulevard and College Avenue, the project site connects directly to the Keowee Trail, a 1.3-mile hiking trail. The new development will offer outdoor dining areas, entertainment spaces and pedestrian-friendly pathways for residents, students and the broader community. Plans call for 8,700 square feet of retail space and approximately 830 parking spaces. The project more than doubles the amount of active parkland area for the community at Abernathy Park along the shoreline of Lake Hartwell, according to Joe Gatto, senior managing director of acquisitions and investments at Core Spaces. Hub Clemson is slated for completion in early summer 2027, ahead of the 2027-2028 academic year. Juneau Construction Co. is the general …

Top Stories

Extell Development Secures $600M Construction Loan for Four Seasons Resort and Residences in Park City, Utah

by John Nelson

PARK CITY, UTAH — Extell Development Co., a national real estate development firm based in New York City, has secured a $600 million construction loan for Four Seasons Resort and Residences Deer Valley, a new hospitality and condominium development currently underway in Park City, Utah’s premier ski town. New York-based JVP Management provided the financing. Extell broke ground on the development earlier this spring and plans to deliver the property in 2028. Designed by ODA Architecture, Four Seasons Resort and Residences Deer Valley will feature one- to seven-bedroom hotel suites ranging in size from 1,200 to 7,000 square feet, all with direct ski-in/ski-out access. Amenities at the property will include wellness and fitness facilities with saunas, steam rooms, whirlpools and spa services, as well as four dining venues and a ski-in/ski-out lounge with an outdoor terrace and fireplace. Additional amenities will include access to 50 miles of hiking and biking trails, an ice rink, indoor sports court and indoor and outdoor pools with panoramic views and private cabanas. The property will also feature a grand ballroom, three meeting rooms and an outdoor event terrace. Upon completion, the development will include a building with 68 private one- to five-bedroom residences as …

JERSEY CITY, N.J. — A partnership between New York-based developer The Albanese Organization, BXP (NYSE: BXP) and Boston-based investment manager CrossHarbor Capital Partners has broken ground on 290 Coles Street, a $400 million multifamily development in Jersey City. Completion is slated for spring 2028. In addition to its namesake thoroughfare, the 1.7-acre site in the West SoHo neighborhood, which spans a full city block, is bounded by Jersey Avenue and 16th and 17th streets. Plans call for 670 apartments, 60,000 square feet of indoor and outdoor amenity space and 13,000 square feet of retail space. More specifically, 290 Coles will consist of two buildings that will rise 14 and 21 stories that will be constructed above a six-level podium. Floor plans were not disclosed. Amenities will include coworking areas, a fitness center, rooftop sky lounge and sundeck, outdoor pool, golf simulator, chef’s kitchen, children’s playroom and a pet spa. MHS Architecture designed the development, with Brooklyn-based Meshberg Group handling interior design. K L Masters Construction Co. is serving as the general contractor and construction manager. Additional project partners include ICOR Consulting Engineers, DeSimone Consulting Engineering and Dresdner Robin. “With its continued population growth, Jersey City is an attractive market for …

JRK Property Holdings Acquires Two Apartment Communities in Los Angeles, Washington, D.C. for $315M

by Abby Cox

LOS ANGELES AND WASHINGTON, D.C. — Los Angeles-based JRK Property Holdings has acquired two apartment communities totaling 684 units, Chase Knolls in Los Angeles and WestEnd25 in Washington, D.C., in two separate transactions for a combined total of $315 million. Located on 14 acres in the Los Angeles neighborhood of Sherman Oaks, Chase Knolls is a 401-unit garden-style community that encompasses nearly two city blocks. The property was originally built in 1949 to include 260 Art Deco-inspired apartment homes across 19 one- and two-story residential buildings. In 2021, a new clubhouse and resort-style swimming pool were integrated into the community, along with 141 new units that were constructed to occupy six additional residential buildings. JRK also plans to make further enhancements to the complex to improve the community amenities and common areas. According to Cushman & Wakefield, which marketed the property for sale on behalf of the undisclosed seller, Chase Knolls is one of only 12 apartment communities exceeding 100 units built in Sherman Oaks over the past 75 years, a testament to the significant development hurdles in the area, such as limited land and high barriers to entry. The second property, WestEnd25, is a 283-unit high-rise apartment community that …

SAN DIEGO — Locally based health system Scripps Health has completed the development of a new hospital located in the La Jolla neighborhood of San Diego. Construction costs totaled $664 million. Dubbed Scripps Memorial Hospital La Jolla North Tower, the building totals 420,000 square feet across eight floors. The property is situated on the Scripps Memorial Hospital La Jolla campus, about 15 miles north of downtown San Diego. Designed by HGA Architects, the hospital building features 188 inpatient beds, a rooftop helistop, nine operating rooms, three interventional radiology suites, expanded imaging capabilities, a NICU (neonatal intensive care unit), labor and delivery section and postpartum services. McCarthy Building Cos. served as the general contractor for the tower, which is directly connected to the Prebys Cardiovascular Institute, also constructed by McCarthy. According to Scripps Health, the tower was planned and constructed over eight years. Financing for the project included a $2.5 million gift from philanthropist Barbara Smith. Scripps Health, a $5 billion not-for-profit health system, operates four hospitals on five campuses. — Hayden Spiess

RALEIGH, N.C. — The Macerich Co. (NYSE: MAC) has acquired Crabtree Valley Mall, a Class A retail property totaling approximately 1.3 million square feet in Raleigh, for $290 million. The seller was an entity doing business as CVM Holdings LLC, according to local news outlet WRAL. The largest mall in North Carolina’s Research Triangle area, Crabtree opened in 1972 and is home to more than 200 stores and restaurants. Anchor tenants at the property include Belk and Macy’s. Additional retailers include Apple, Banana Republic, Brahmin, Brooks Brothers, Build-A-Bear Workshop, Chubbies, Coach, H&M, The LEGO Store, Michael Kors, TAG Heuer and Tommy Bahama. Kanki Japanese House of Steaks & Sushi, P.F. Chang’s China Bistro, The Cheesecake Factory, Seasons 52, Brio Italian Grill and Fleming’s Prime Steakhouse & Wine Bar are some of the mall’s restaurant tenants. According to Macerich, Crabtree generates $429 million in annual sales, $951 in sales per square foot and over 8.7 million annual visitors. “Crabtree checks all the boxes for pursuing opportunistic external growth,” says Jack Hsieh, president and CEO of Macerich. Over the course of 2025 through 2028, Macerich plans to invest roughly $60 million of redevelopment and leasing capital to maximize the center’s performance. Enhancements …

BELMONT, MASS. — The Hamilton Co., a privately held real estate investment and management firm based in Boston, has acquired Hill Estates, a 396-unit apartment community in Belmont. The original developer, the DiGiovanni family, sold the market-rate community for $175 million. Built by the DiGiovanni brothers — Silvio, Rocco, Joseph and Charles — in the 1960s, Hill Estates had been owned and managed by the family since its inception and hit the market for the first time as part of this transaction. Simon Butler, Biria St. John, John McLaughlin and Brian Bowler of CBRE represented the DiGiovanni family and procured The Hamilton Co. in the transaction. KeyBank Real Estate Capital provided an undisclosed amount of acquisition financing. “For over 50 years, the DiGiovanni family had been great stewards of this legacy asset in one of the most desirable towns in the Boston metro,” says St. John. “While the DiGiovanni family has taken great care and pride in this asset, we anticipate that The Hamilton Co. will make substantial investments in the asset to modernize and amenitize the community.” Hill Estates is situated on a 14.7-acre site off Brighton Street in Belmont, which is located on the western border of Cambridge, …

KEENE, N.H. AND GRAND RAPIDS, MICH. — C&S Wholesale Grocers, a New Hampshire-based food supplier whose brands include Piggly Wiggly and Grand Union, has agreed to acquire Michigan-based SpartanNash (NASDAQ: SPTN), owner of brands such as Our Family and Full Circle Market, in a merger valued at nearly $1.8 billion. The figure represents a purchase price of $26.90 per share of SpartanNash common stock in cash and includes the assumption of SpartanNash’s existing debt. The price marks a 52.5 percent premium over the company’s closing price of $17.64 per share on June 20 and a premium of 42 percent over the company’s 30-day volume-weighted average stock price as of that date. The merger, which has been unanimously approved by both companies’ boards of directors, is expected to close before the end of the year. Upon closing, the new company will operate more than 200 corporate-run grocery stores and almost 60 complementary distribution centers throughout the country. The distribution centers will supply more than 10,000 independent retail locations. “For our customers, this transaction creates the necessary scale, efficiency and purchasing power needed to enable independent retailers to compete more effectively with larger big box chains,” says Tony Sarsam, president and CEO …

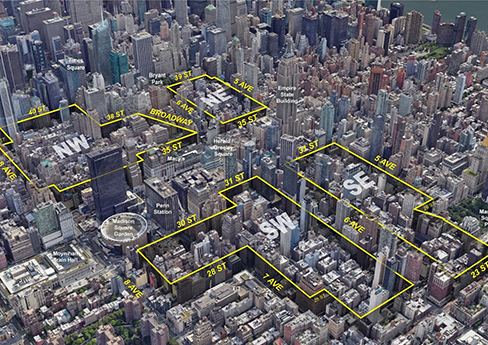

NYC Planning Commission Approves Midtown Manhattan Rezoning Proposal to Add Thousands of New Residences

by Abby Cox

NEW YORK CITY — The New York City Planning Commission has approved the Midtown South Mixed-Use Plan (MSMX), a rezoning initiative that could ultimately facilitate the creation of as many as 9,700 new residences across a 42-block section of Midtown Manhattan. The MSMX plan covers four areas centered around Herald and Greeley Square, located between West 23rd and West 40th streets, as well as Fifth and Eighth avenues. The area today is largely defined by commercial and industrial uses, with current land-use rules restricting new housing development. Midtown South is currently home to more than 7,000 businesses, 135,000 jobs and various public transportation hubs, but the neighborhood has struggled to rebound in the aftermath of the COVID-19 pandemic as hybrid work schedules have become more entrenched. In addition to these commercial vacancies, the submarket is subject to restrictive zoning rules that limit opportunities for New Yorkers to live near their jobs. “For far too long, outdated zoning policies have limited the potential of this well-resourced area to help address New York City’s urgent housing needs,” says Rachel Fee, executive director of the New York Housing Conference, nonprofit affordable housing policy and advocacy organization. “In the midst of a dire housing crisis, …

WASHINGTON, D.C. — Walker & Dunlop has arranged $106.3 million loan for the refinancing of Agora, an apartment community located in Washington, D.C. The borrower is locally based owner-operator WC Smith. Completed in 2018, Agora totals 334 units across 11 stories. The community marks the second phase of the larger development known as The Collective, which totals 1,138 apartments in the Capitol Riverfront neighborhood. The Collective also includes Park Chelsea, a 429-unit community, and The Garrett, which features 373 apartments and 5,000 square feet of coworking space. Amenities at The Collective include a Whole Foods Market, fitness center, spa rooms and an indoor golf simulator. The development is located within walking distance of Nationals Park, Audi Field and the Navy Yard. “Agora is a standout asset within their exceptional portfolio, and the swift rate lock, secured within 24 hours of the signed application, demonstrates our dedication to providing timely, customized solutions that ensure the best possible outcomes for our clients, says Connor Locke, managing director of multifamily finance at Walker & Dunlop. Walker & Dunlop also arranged financing for the other two phases of The Collective. In 2024, the firm originated more than $30 billion in debt financing. — Hayden Spiess