NEW YORK CITY — Charney Cos. and Tavros have unveiled plans to build 175 Third Street, a 1 million-square-foot apartment tower in Brooklyn’s Gowanus area. The 27-story building will feature more than 1,000 units, approximately 250 of which will be designated as affordable housing. The development cost, including the land purchase, is estimated at roughly $1 billion, according to the New York Post. The project marks the fifth building on four different sites in the new Gowanus Wharf development by Charney and Tavros. Catalyzed by the major Gowanus rezoning in 2021, the new development will feature a public park along the Gowanus Canal. According to a release, the project will contribute to the rehabilitation of the canal while supporting the continued evolution of the industrial Brooklyn neighborhood. Bjarke Ingels Group (BIG) designed the new tower along with dencityworks | architecture. BIG previously completed a design for the same site in 2023 for a different owner. Charney and Tavros purchased the site in May for $160 million. “Our design for 175 Third Street in Gowanus is conceived as a three-dimensional neighborhood of building blocks stacked to frame a central park cascading down toward the canal waterfront,” says Bjarke Ingels, founder and …

Top Stories

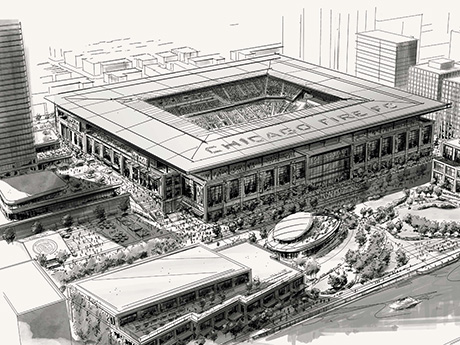

Chicago Fire FC Unveils Plans for New $650M Riverfront Soccer Stadium, Opening Set for 2028

by John Nelson

CHICAGO — The Chicago Fire FC, a Major League Soccer (MLS) franchise, has unveiled plans for a new, privately funded soccer stadium in downtown Chicago. The Wall Street Journal reports the project would cost roughly $650 million to execute. The club and its owner and chairman, Joe Mansueto, plan to debut the new stadium in spring 2028, along with a surrounding entertainment district. “Soccer is the world’s game, and a world-class city like ours deserves a world-class club — with a world-class home to match,” says Mansueto, who purchased the club in 2018. “This new home will serve as a catalyst for job creation, economic development and vibrant community life.” The Chicago Fire did not release financial terms of the development, but Mansueto says that no public funds will be used in the development of the venue, which is designed to seat approximately 22,000 fans for matches. The stadium’s seating capacity can also be expanded for concerts or other community events, according to the project’s website, DearChicago.com. The venue will be situated along the Chicago River just south of Roosevelt Road. The stadium will serve as an anchor of The 78 as it is anticipated to be Chicago’s 78th neighborhood. The …

CHESTERFIELD, MO. — Locally based developer The Staenberg Group has begun Phase I of a 4.5 million-square-foot mall redevelopment project in Chesterfield, a western suburb of St. Louis. According to local news sources, including The St. Louis Business Journal, the mixed-use project is valued at roughly $2 billion. Known as Downtown Chesterfield, the project is a re-imagining of the former site of the Chesterfield Mall, demolition of which is now complete save for the department store buildings of former anchors Macy’s and Dillard’s. The first phase of new development will involve grading the site and installing infrastructure, creating a 3.3-acre central park and building utilities and streets. At full build-out, Downtown Chesterfield will feature up to 2,363 residential units, including 1,000 to be developed as part of Phase I. Residential buildings will include retail and restaurant space, and the Macy’s building will be repurposed to support retail and office uses. The Dillard’s store will be modernized and upgraded and could re-open in advance of the 2026 holiday shopping season. “This is more than just tearing down a mall — it’s laying the foundation for the future of Chesterfield,” said Michael Staenberg, president of The Staenberg Group. “You’ll drive in off Clarkson …

Range Light Investment Acquires Mall at Westlake in Suburban Birmingham, Plans Industrial Redevelopment

by Abby Cox

BESSEMER, ALA. — Range Light Investment Partners has acquired the former Mall at Westlake, a 323,000-square-foot shopping and dining destination located southwest of Birmingham in Bessemer, Ala. The Ohio-based investment firm plans to redevelop the property into an industrial flex complex that will be known as Marvel City Business Park. The former mall, which originally opened in 1969, permanently closed 40 years later in 2009 after retail activity migrated elsewhere, according to Range Light, leaving the property available for alternative purposes. “Shopping malls built from the 1960s through the 1990s were the distribution centers of that era,” says Pat Foran, founder of Range Light Investment Partners. “All of the features that made them great malls years ago are the same features light industrial and flex tenants are looking for today.” “There are many more tenants looking for 30,000 to 50,000 square feet than 300,000 to 500,000 square feet in the Birmingham area, and there are virtually no options for them,” adds Foran. “Marvel City Business Park will cater to those smaller bay-sized tenants that don’t need 36-foot-high ceilings and want more affordable rent than what the newer big box developments demand.” Situated on a 40-acre site at the intersection of interstates …

HOUSTON — Hines Global Investment Trust (HGIT), a real estate investment trust (REIT) sponsored by Houston-based global asset manager Hines, has acquired three industrial assets located on the East Coast for a total $309 million. The acquired properties include two distribution facilities situated within the Georgia International Trade Center (GITC) in the Savannah market and two warehouse/distribution facilities located in Upton Crossing, a warehouse campus in Wilmington, Mass. The Davis Cos., a real estate investment and development firm based in Boston, sold both assets, which total 2.5 million square feet. Additionally, HGIT acquired I-85 Logistics Center, an industrial property in the Greenville-Spartanburg metro in South Carolina’s Upstate region. The seller of I-85 Logistics Center was not disclosed. The properties in Savannah total 2.2 million square feet and were fully leased at the time of sale. A joint venture between Davis and Atlanta-based Stonemont Financial Group developed GITC, which comprises a total 7.7 million square feet of manufacturing and warehouse space across 10 buildings. The site is located roughly 10 miles from the Port of Savannah. Totaling 215,000 square feet, the properties at Upton Crossing in Wilmington were 81 percent leased at the time of acquisition. Davis acquired Upton Crossing in …

MIAMI — South Florida-based developer 13th Floor Investments, in partnership with Barings, has received a $125 million construction loan for the second phase of Link at Douglas, a transit-oriented multifamily development in Miami. A syndicate of Santander Bank and TD Bank provided the loan. Known as Cadence, the project marks the third multifamily building at Link at Douglas, a 7-acre development located at the confluence of Miami’s Coral Gables and Coconut Grove neighborhoods. Now under construction, the 35-story tower will include 432 market-rate apartments, 12.5 percent of which will be set aside as workforce housing units. The project is adjacent to Miami-Dade County’s Douglas Road Metrorail Station. Construction is estimated to take 33 months to complete. “Securing this construction financing marks a major milestone in bringing the next phase of Link at Douglas to life,” says Daryl Shevin, CFO of 13th Floor. “It reflects strong confidence in our vision and the demand for well-located, high-quality transit-oriented housing in South Florida.” The first phase of Link at Douglas, which was completed in 2023, encompasses two fully leased multifamily towers with a total of 733 apartments. More than 30,000 square feet of retail space anchored by a Milam’s Market accompanies the 312-unit …

MIAMI — Los Angeles-based investment firm CIM Group and its development partners have officially opened Miami Worldcenter, a $6 billion mixed-use development in downtown Miami. CIM Group partnered on the project with Miami Worldcenter Associates, a development entity founded by Art Falcone and Nitin Motwani. The development spans 27 acres across 10 city blocks in the city’s Park West neighborhood and has generated nearly 9,000 jobs over the course of its construction and operation. The site formerly housed blighted properties and surface parking lots. The Miami Worldcenter master plan includes approximately $100 million in completed infrastructure; 100,000 square feet of new public space; 300,000 square feet of retail, restaurant and entertainment space; and 16 high-rise towers for residential and hospitality uses, many of which are completed or underway. The development will bring approximately 11,000 residences and more than 1,000 hotel rooms to downtown Miami. “Miami Worldcenter is a game-changing development that has revitalized a dormant and distressed area of downtown Miami and repositioned it as a vital contributor to the community and the local economy,” says Shaul Kuba, co-founder and principal of CIM Group. “We joined partners Art Falcone and Nitin Motwani as the master developers in 2011 and have proudly …

Creation, Crescent Break Ground on Heritage Park Mixed-Use Development in Downtown Gilbert, Arizona

by John Nelson

GILBERT, ARIZ. — A partnership between two developers, Creation and Crescent Communities, has broken ground on the first phase of Heritage Park, a mixed-use development that will occupy a full city block in downtown Gilbert. The project will function as the northern gateway of Heritage District, which at full build-out will revitalize 10 acres in the East Valley of the metropolitan Phoenix area. Phase I of Heritage Park will feature 47,000 square feet of shops and restaurants, the 288-unit NOVEL Heritage Park apartments, a public square with water features and more than 300 surface parking spaces. The Arizona Republic reported that the first phase represents a $200 million capital investment, with the entire mixed-use development carrying a price tag of $500 million. Future phases of Heritage Park will include a 125-room hotel, offices and additional parking. “Bringing Heritage Park from vision to reality is a collaborative effort, driven by our exceptional development and construction teams, supportive town leadership and visionary tenants,” says David Sellers, co-founder of Creation, which has offices in Phoenix and Dallas. “Together, we are committed to creating an iconic gateway into Gilbert’s Heritage District — one that enhances quality of life, celebrates local culture and offers an exceptional …

NEW YORK CITY — Innovo Property Group (IPG) has topped out Review Avenue Complex, a 736,000-square-foot industrial project in Queens. IPG is developing the facility in partnership with the Urban Investment Group (UIG) at Goldman Sachs Alternatives. Located in New York City’s Borden Innovation District, Review Avenue Complex is situated off of the Long Island Expressway. Completion is scheduled for the fall. Totaling six stories, the development will feature flexible floor plates, with suites starting at 31,000 square feet. Each floor is designed to accommodate up to two tenants, with truck access at each level via a 35-foot-wide ramp. The facility will offer clear heights up to 32 feet, four freight elevators, heavy power and is photovoltaic and electric vehicle ready. Each level will also feature loading docks and parking. In total, the development will accommodate 116 cars and 118 oversized vehicles. In June 2023, IPG received $354 million in financing for the project, including construction financing from Axos Bank and Cerberus Capital Management and equity from Goldman Sachs Asset Management. New York City-based IPG acquires and manages assets in metro New York City. The company recently completed the Borden Complex, a 1 million-square-foot industrial development also located in New …

NEW YORK CITY — Universal Music Group (UMG) has leased 88,000 square feet at Penn 2, a recently completed office tower in the Penn District campus within Midtown Manhattan. Vornado Realty Trust (NYSE: VNO) owns the property. The building will serve as the headquarters of iconic labels Def Jam Recordings, Island Records, Mercury Records and Republic Records, as well as Bravado, UMG’s merchandise company, and Verve Label Group. The property will also serve as the East Coast offices for Universal Music Publishing Group and several UMG corporate functions. UMG’s New York offices have been located at 1755 Broadway since the early 2000s, according to Variety. The global company’s corporate headquarters are in Hilversum, Netherlands. As part of a 22-year lease, UMG will occupy the entire fourth through seventh floors of Penn 2. UMG is also taking a ground-floor space along Seventh Avenue with future plans to debut a retail experience for music fans, as well as a private lobby on 33rd Street that will feature a visitor center and direct elevator access to its floors. UMG will be able to showcase its artists on large-scale LED signage within the Penn District. The new headquarters will be located within The Bustle, …