DALLAS — JLL has arranged a $596 million CMBS loan for the refinancing of a portion of The Crescent, a 1.3 million-square-foot mixed-use development located in Uptown Dallas. Goldman Sachs and J.P. Morgan provided the debt to the owner, Crescent Real Estate, and the three-year, floating-rate loan will refinance the property’s three office towers and the retail atrium building. Crescent Real Estate has owned, sold and reacquired its namesake mixed-use development multiple times since the 1990s. Completed in 1986 on roughly 11 acres, The Crescent consists of three office towers with ground-floor retail space totaling 1.2 million square feet; a three-story, 167,510-square-foot atrium building; the Hotel Crescent Court; The Spa at The Crescent; 11 restaurants and various high-end retail shops. After several renovations over the past five years, The Crescent also features a mix of updated amenities such as a full-service fitness center, two salons, an art gallery and a multi-level parking garage. Tenants at the property — which is 90 percent leased — include Jeffries, BankUnited, BMO Harris Bank, Wells Fargo, PNC Bank, Raymond James and UBS. Weil, Gotshal & Manges LLP, along with Westwood Management, have also both recently signed office lease renewals at the development. The debt advisory team …

Top Stories

SAN DIEGO — Golden Columbia, a real estate investment platform sponsored by locally based GANMI Corp., has completed the acquisition of two Class A office properties in downtown San Diego. Together, the buildings total 707,623 square feet. The sales price was not disclosed, but The San Diego Union-Tribune reports the properties traded for $103.5 million. The newspaper also reports that the seller, Regent Properties, purchased the two buildings for a combined $223.5 million in June 2021. The properties include One Columbia Place, a 27-story office tower located at 401 W. A St., and Two Columbia Place, a 12-story office building located at 1230 Columbia St. One Columbia Place comprises 556,943 square feet, and Two Columbia Place spans 150,680 square feet. According to a statement issued by GANMI Corp., long-term plans for One and Two Columbia Place include repositioning the properties into an “experience-driven workplace destination designed to support tenants, employees and the broader downtown ecosystem.” Enhancements at the buildings will be implemented in phases. “People don’t come back to the office for desks alone — they come back for energy, community and convenience,” says Casey Gan, CFO of GANMI Corp. “Our mission at Columbia Place is to build a complete workplace experience by …

Selig Submits Rezoning Request for Second Phase of The Works Mixed-Use Village in Atlanta

by John Nelson

ATLANTA — Selig Enterprises has submitted a rezoning request for the second phase of The Works, an 80-acre mixed-use village located in Atlanta’s Upper Westside neighborhood. According to The Atlanta Journal-Constitution, Phase II could span 2.2 million square feet upon completion. Phase I of The Works included adaptive reuse offices housing firms including Google Fiber and City of Atlanta; Westbound at The Works, a 306-unit apartment community; Chattahoochee Food Works, a food hall with 31 stalls serving dishes including pho, barbecue, donuts, subs, Mexican food and more; Dr. Scofflaw’s at The Works, a research-and-development brewery concept from Atlanta-based Scofflaw Brewing; retail space, including boutique stores, salons, Stellar Bodies and a standalone Ballard Designs store; and outdoor gathering areas, including Fetch Park (off-leash dog park) and The Camp (outdoor playground and live music space). Selig is proposing a mix of multifamily, office and retail components along Logan Circle and Chattahoochee Avenue. Phase II, which will span the remaining 53 acres of the site, is currently in early planning stages, with no immediate construction timeline established at this time. Selig is working closely with the Upper Westside CID and local neighborhood groups to gain insight and feedback throughout the process. Founded in …

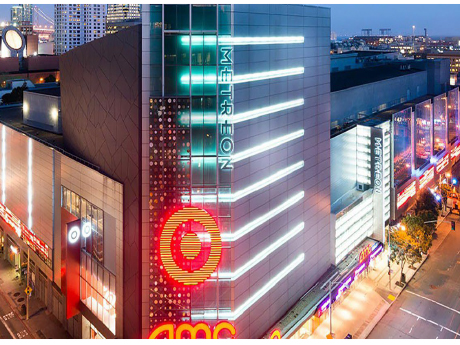

TMG, Bridges Capital Acquire 320,000 SF Metreon Shopping Center in Downtown San Francisco

by John Nelson

SAN FRANCISCO —TMG Partners and equity partner Bridges Capital LLC have acquired Metreon, a 320,000-square-foot, vertically oriented shopping center in downtown San Francisco. Built in 1999, the retail and entertainment destination is anchored by Target and a 16-screen AMC Theatres that features the tallest IMAX screen in North America. Locally based TMG and Bridges Capital purchased the four-story property from Acore Capital in a deed-in-lieu transaction. The sales price was not disclosed. The City and County of San Francisco will continue to retain ownership of Metreon’s ground lease through at least 2082, according to the San Francisco Business Times. The news outlet also reported Acore Capital was the mortgage lender for Metreon on behalf of the previous owner, Starwood Capital Group. “This investment in Metreon is a powerful vote of confidence in our downtown recovery,” says San Francisco Mayor Daniel Lurie. “We’re grateful for [TMG’s] partnership as we work to accelerate San Francisco’s comeback.” Metreon is located at 135 4th St. at Mission in the city’s Yerba Buena neighborhood. The property includes City View at Metreon, a 31,000-square-foot events venue with floor-to-ceiling windows offering views of the San Franisco skyline. TMG will rebrand the venue and partner with Skylight, a …

ATLANTA — Charlotte-based developer Crescent Communities has unveiled plans for 3600 Peachtree, a new mixed-use project in Atlanta’s Buckhead district. A construction timeline for the project was not announced. The 2.5-acre site is located at the corner of Peachtree and Wieuca roads, adjacent to Simon’s Phipps Plaza mall. Crescent made the announcement alongside its project partner, the Church of Wieuca, which currently occupies part of the site. Plans currently call for a 21-story, 375,000-square-foot office building and a 300-unit apartment community that will be operated under the developer’s NOVEL by Crescent Communities brand. The development will also feature street-level retail and restaurant space. Crescent also plans to introduce a comprehensive, hospitality-driven amenity program via approximately 10,000 square feet of shared indoor amenities and direct access to an elevated 19,000-square-foot landscaped outdoor terrace. Specific amenities will include conferencing and training spaces that can accommodate more than 200 attendees, as well as multiple alternative work environments and spa-like wellness and fitness facilities with locker rooms, indoor and outdoor lounges. Project partners for 3600 Peachtree include HSR Development Services (residential development), Partners Real Estate (office leasing), Pickard Chilton (architecture) and Kimley-Horn (civil engineering). “Our focus is on creating a workplace that feels elevated …

NEW YORK CITY — Gencom, a Miami-based investment firm, has acquired The Ritz-Carlton New York, Central Park, a 253-room hotel located in Midtown Manhattan. Banco Inbursa provided financing for the acquisition. Although the sales price was not disclosed, media outlets reported a bidding price of $400 million for the property in March 2024. “Gencom continues to see compelling long-term opportunities in New York City, particularly for luxury assets with enduring global appeal,” says Karim Alibhai, founder and principal of Gencom. Situated within the Plaza District at the corner of Central Park South and Sixth Avenue, the Ritz-Carlton New York comprises 253 guest rooms, including 47 suites that are located on the lower 22 floors of the 33-story building. The upper floors consist of roughly a dozen private residential condominiums, which were not included in the sale. Guest rooms offer a more standard hotel room layout, with separate seating areas, marble bathrooms and walk-in showers. Meanwhile, the residential condos average more than 1,000 square feet in size and include distinct living spaces, kitchens and dining areas. The Ritz-Carlton hotel also features various amenities for its guests, including Contour, the all-day gastro lounge; the Ritz-Carlton Club Lounge; the La Prairie Spa; and a …

FORT WORTH, TEXAS — The City of Fort Worth has announced plans for Phase II of the Fort Worth Convention Center overhaul. Totaling $606 million in costs, the project will deliver a new, flexible convention center. The convention building will replace an arena dated back to 1968 and modernize an existing building that has not been significantly renovated since a 2003 expansion. In December of last year, the city cut the ribbon on the $95 million Phase I of the Fort Worth Convention Center. Plans for Phase II were presented to the city council on Tuesday, Feb. 3. Upon completion, Phase II will comprise a four-story structure with a central tower, a plaza with native prairie green space connected to General Worth Square and terraces for outdoor events. The facility will total 257,268 square feet of exhibit hall space; 60,917 square feet of meeting room space; and 74,033 square feet of ballroom space, as well as 16 loading docks. Construction will begin in early 2027, with the demolition of the existing arena. Completion of the project is scheduled for early 2030. The center will remain operational during construction. Atlanta-based firm TVS, in collaboration with Fort Worth-based Bennett Partners, designed the …

INDIANAPOLIS — Indianapolis-based mall owner Simon Property Group (NYSE: SPG) has unveiled plans to invest more than $250 million for the redevelopment of The Mall at Green Hills in Nashville, Cherry Creek Shopping Center in Denver and International Plaza in Tampa. Simon acquired the three properties in November 2025 as part of its purchase of the remaining 12 percent interest in The Taubman Realty Group LP that it did not already own. The $250 million investment reflects Simon’s focus on mall redevelopments to create modern environments that cater to today’s shopper, according to Eli Simon, the company’s chief operating officer. He says the redevelopment projects will mimic the recently completed transformation of Southdale Center in Minneapolis. The Mall at Green Hills will undergo a complete transformation and exterior revitalization featuring two-story flagship entrances, jewel-box spaces for luxury boutiques, new landscaping and “elevated arrival moments.” The interior will receive upscale finishes and architectural enhancements. The 1 million-square-foot mall opened in 1955 under the moniker Green Hills Village. Cherry Creek Shopping Center will receive modernized flagship spaces, refined architectural updates and upgraded storefronts. The enclosed mall, which officially opened in 1990, dates back to the 1950s when it was an open-air mall. …

NEW YORK CITY AND EL SEGUNDO, CALIF. — Brookfield Asset Management (NYSE: BAM) has entered into a definitive agreement in which one of the firm’s private real estate funds will acquire the outstanding shares of Peakstone Realty Trust (NYSE: PKST), an industrial REIT that has a strategic focus on the industrial outdoor storage (IOS) sector. The El Segundo-based company, which sold off its final office assets in December, currently owns 76 industrial properties, including 60 IOS assets. At a proposed price of $21 per share, the all-cash transaction represents an implied enterprise value of approximately $1.2 billion. The price represents a 34 percent premium relative to Peakstone’s share price on Jan. 30, the last full trading day prior to the announcement. “This transaction recognizes the value of our industrial portfolio and the progress we have made expanding our IOS platform,” says Michael Escalante, CEO of Peakstone. At the conclusion of the acquisition, Peakstone will be a privately held company and will be delisted from the New York Stock Exchange. Founded in 2009 as Griffin Realty Trust, the company was rebranded as Griffin Capital Essential Asset REIT in January 2023 and then as Peakstone Realty Trust in 2021. For Brookfield, the …

UPPER MACUNGIE, PA. — Pharmaceutical giant Eli Lilly & Co. (NYSE: LLY) will open a $3.5 billion manufacturing facility in the Lehigh Valley community of Upper Macungie. The development will span about 925,000 square feet across multiple buildings and is expected to bring about 850 new jobs to the region. A construction timeline was not announced. Lilly is acquiring the property at 9802 Main St. in Upper Macungie from Jaindl Land Development for the project. According to local news outlet WFMZ, this property is known as Fogelsville Corporate Center and is undeveloped agricultural land. In addition to the 850 permanent jobs, development of the new facility is expected to create about 2,000 construction jobs. According to Pennsylvania Gov. Josh Shapiro, the state committed more than $100 million in incentives to land the project, including $50 million in tax credits. Lehigh Carbon Community College will receive additional state funding and feed Lilly’s talent pipeline by creating and expanding academic and workforce training programs in life sciences. “Lilly’s commitment to the Lehigh Valley and to Pennsylvania will bring billions of dollars of investment and hundreds of good-paying jobs, solidifying our position as a leader in the growing life sciences industry,” Shapiro said …