ASCENSION PARISH, LA. AND SEOUL — Hyundai Steel Co., a South Korean steel manufacturer and part of automotive giant Hyundai Motor Group, has announced plans to develop a $5.8 billion steel manufacturing facility in southeast Louisiana’s Ascension Parish. The new steel plant is part of Hyundai’s announcement for $21 billion in U.S. investments between 2025 and 2028. Construction on the plant, which will be capable of producing 2.7 million metric tons of steel annually, is scheduled to begin in the third quarter of 2026 in Ascension Parish. Hyundai Steel is targeting commercial production of automotive steel plates to begin at the mill in 2029. According to a statement issued by Louisiana Gov. Jeff Landry, the new facility is expected to create 1,400 new direct jobs with an average salary of $95,000. Louisiana Economic Development (LED) also estimates that the project will result in 4,100 indirect new jobs. A large portion of the steel manufactured at the mill will be transported to Hyundai vehicle manufacturing plants throughout the country. Hyundai Steel also plans to open up sales of its automotive steel plates to other auto manufacturers in the United States, Europe and Latin America, according to Seo Gang-Hyun, president and CEO …

Top Stories

Johnson & Johnson Breaks Ground on $2B Pharmaceutical Manufacturing Facility in Wilson, North Carolina, As Part of $55B Investment

by John Nelson

WILSON, N.C. AND NEW BRUNSWICK, N.J. — Johnson & Johnson (NYSE: JNJ), has broken ground on a $2 billion pharmaceutical manufacturing facility in Wilson, about 50 miles east of Raleigh. The project is part of a larger, $55 billion investment in U.S. manufacturing, research-and-development (R&D) and technology initiatives that the global pharmaceutical, medical devices and consumer health products provider is planning over the next four years. “Today’s announcements accelerate our nearly 140-year legacy as an American innovation engine tackling the world’s toughest healthcare challenges,” says Joaquin Duato, chairman and CEO of Johnson & Johnson. “Our increased U.S. investment begins with the ground-breaking of a high-tech facility in North Carolina that will not only add U.S.-based jobs but manufacture cutting-edge medicines to treat patients in America and around the world.” The new manufacturing facility will span approximately 500,000 square feet and will create 5,000 construction jobs, as well as 500 specialized positions for employees and contractors, including process technicians, laboratory analysts, engineers and microbiologists. Upon completion, Johnson & Johnson plans to produce medicines for people with cancer, immune-mediated and neurological diseases at the Wilson plant. The company estimates that the facility will have an economic impact of $3 billion in North …

NEW ORLEANS — Gencom, a Miami-based investment firm, has acquired a portfolio of two connected hotels located in the historic French Quarter of New Orleans. The 758-room hospitality portfolio includes The Ritz-Carlton, New Orleans and the Courtyard by Marriott New Orleans French Quarter/Iberville. Situated along the city’s historic Canal Street, The Ritz-Carlton New Orleans comprises 528 hotel rooms and suites. The hotel features about 48,000 square feet of event space, a fitness center, indoor pool and a 25,000-square-foot spa. The Ritz-Carlton also offers Davenport Lounge, a jazz bar and lounge, and the M Bistro eatery. The property opened in 2000. The adjacent Courtyard by Marriott French Quarter/Iberville offers 230 rooms, as well as a coffee shop. The building was originally constructed in 1878 as a department store and was converted into a hotel in 2012. The property is located within walking distance of Bourbon Street, the Caesars Superdome and the New Orleans Ernest N. Morial Convention Center. Both hotels have recently undergone multi-year renovation programs. The Ritz-Carlton was refurbished with updates to guest rooms and public areas, including a $15 million upgrade to its Maison Orleans Club Level. Additionally, all guest accommodations and public spaces at The Courtyard by Marriott …

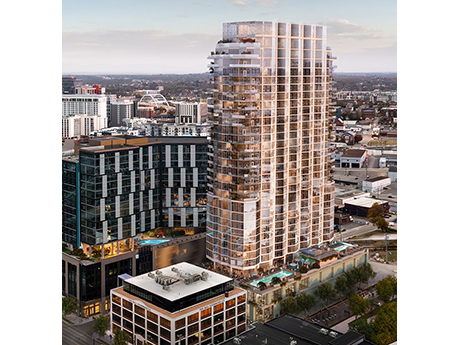

Walker & Dunlop Arranges $253M Construction Loan for Pendry Nashville Hotel and Condominium Tower

by John Nelson

NASHVILLE, TENN. — Walker & Dunlop (NYSE: WD) has arranged a $253 million construction loan for the development of the Pendry Nashville and Pendry Residences Nashville, a luxury 30-story hotel and condominium tower located in the city’s Gulch district. Pendry Hotels & Resorts, in partnership with investment and development firms SomeraRoad and Trestle Studios, plan to immediately break ground on the project. Upon completion, Pendry Nashville will include 180 guestrooms and suites, while 146 for-sale residences will be offered at Pendry Residences. The Pendry Nashville Hotel & Residences development is part of Phase III of the Paseo South Gulch master-planned micro-neighborhood, a 1 million-square-foot mixed-use district developed by SomeraRoad. Aaron Appel, Keith Kurland, Jonathan Schwartz, Adam Schwartz, Michael Diaz, Sean Bastian and Jackson Irwin of the Walker & Dunlop New York Capital Markets team arranged the loan. Bank OZK and InterVest Capital Partners provided the financing package on behalf of SomeraRoad and Trestle Studio. Jay Morrow and Carter Gradwell of the Walker & Dunlop Hospitality team represented SomeraRoad throughout the financing process, working in collaboration with the firm’s New York Capital Markets team. “Having worked with SomeraRoad to capitalize prior phases of their Paseo South Gulch master-planned development, we are …

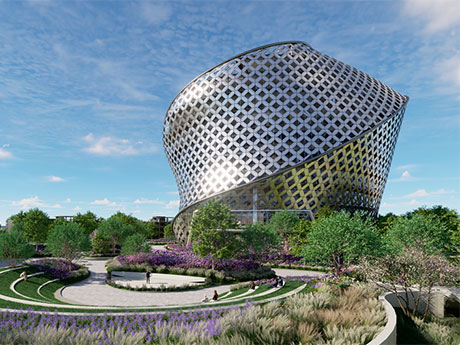

Port San Antonio Board of Directors Approves Next Step in Development of 300,000 SF Innovation Tower

SAN ANTONIO — The Port San Antonio Board of Directors has unanimously approved the next step in the development of Innovation Tower, an office project on the 1,900-acre Tech Port campus, located just southwest of downtown San Antonio. Port San Antonio is a public entity created to redevelop land formerly occupied by Kelly Air Force Base. Yesterday, the board approved $7.5 million to move the tower from its preliminary phase to the finalization of architectural plans, budget and schedule. The design phase is expected to last about one year, with groundbreaking slated for 2026 and completion by 2028. Project costs are estimated at roughly $275 million, according to the San Antonio Business Journal. The multi-story Innovation Tower, which will be located at the main entrance of the campus, will support growing demand by adding nearly 300,000 square feet of high-end office space. The tower will also include 27,000 square feet of amenity spaces such as a health and wellness center, sauna, locker rooms and a large conference room. Pelli Clarke & Partners designed the tower, with architect Bill Butler leading the project. The tower is a component of a broad innovation campus development strategy the organization unveiled in fall 2024. …

Subtext, Larson Capital Management to Develop 1,738-Bed Student Housing Project Near Texas A&M University

by John Nelson

COLLEGE STATION, TEXAS — Subtext, a student housing and multifamily owner-operator based in St. Louis, has partnered with Larson Capital Management for a two-phase student housing development near Texas A&M University in College Station. The project will include EVER College Station (176 units, 545 beds) and VERVE College Station (382 units, 1,193 beds), which will be situated across the street from one another in the city’s Northgate Entertainment District, less than two blocks from campus. EVER will rise seven stories at 401 Stasney St. and include 420 parking spaces, while VERVE will rise 21 stories at 311 Stasney St. and feature 882 parking spaces. The properties will feature layouts ranging from studios to five-bedroom apartments, as well as a combined 55,000 square feet of amenity space (29,000 square feet of indoor and 26,000 square feet of outdoor). The specific amenity offerings will include open lounges, study rooms, a coffee bar, mini market, fitness center, sauna, meditation rooms, outdoor fitness spaces, multi-sport simulator, indoor/outdoor bar and kitchen. Other amenities will include a resort-style pool with poolside cabanas, a jumbotron TV and a sky lounge with a spa, as well as outdoor grilling stations, fire pits, a dog run and a game …

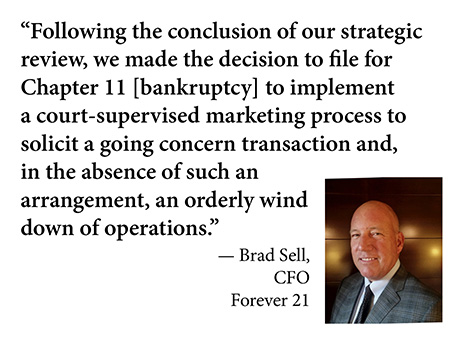

LOS ANGELES — Forever 21 has filed for Chapter 11 bankruptcy and will begin the process of closing all its U.S. stores. According to Reuters, the U.S. store count is about 350. The Los Angeles-based apparel retailer filed over the weekend in the U.S. Bankruptcy Court for the District of Delaware. Forever 21 has entered into a plan support agreement with its lenders to begin the voluntary closure process while continuing to look for sales opportunities of existing U.S. assets. Forever 21 was founded in 1984 and had a footprint of more than 800 stores worldwide at the height of its operation. The company also filed for Chapter 11 bankruptcy protection in 2019, which led to the company closing 350 stores across the United States and other countries. International stores are not impacted by the 2025 filing. As a relative staple within American mall tenancy, Forever 21 faced new challenges in its post-2019 bankruptcy filing stemming from the COVID-19 pandemic and elevated competition from e-commerce brands and platforms. According to CNBC, the company has been hit especially hard by competition from Chinese platforms Shein and Temu. The company’s ownership structure underwent a series of changes between 2021 and 2023, and …

NEW YORK CITY — Walker & Dunlop has arranged the recapitalization of Hub, a 55-story multifamily tower located at 333 Schermerhorn St. in downtown Brooklyn. The borrower, Steiner NYC, bought out a majority stake in the high-rise from its equity partner, J.P. Morgan Asset Management (JPMAM), giving the company full ownership. The sales price was not released, but Walker & Dunlop disclosed the transaction was done at a valuation of $420 million for the tower. Developed by locally based Steiner, the building totals 750 units, with studio, one- and two-bedroom floor plans. Upon its completion in 2018, Hub was the tallest building in Brooklyn. Walker & Dunlop advised Steiner on the recapitalization and secured $62.5 million in preferred equity from Meadow Partners to facilitate the purchase. Aaron Appel, Jonathan Schwartz, Keith Kurland, Adam Schwartz, Michael Ianno and Christopher de Raet of Walker & Dunlop represented Steiner NYC in the financing. “This deal stands apart from traditional financings due to its complex structure, which involved an equity buyout and the sourcing of preferred equity to help capitalize the transaction,” says Appel. Walker & Dunlop previously arranged construction financing, JPAMM’s equity investment and institutional permanent financing for Hub back in 2019 for …

SpaceX to Invest $280M for Expansion of Starlink Semiconductor R&D Facility in Bastrop, Texas

by John Nelson

BASTROP, TEXAS — Space Exploration Technologies Corp. (SpaceX) plans to invest $280 million for the expansion of its semiconductor research-and-development (R&D) and advanced packaging facility in Bastrop, about 33 miles southeast of Austin. The company received its fifth Texas Semiconductor Innovation Fund grant, totaling $17.3 million, from the State of Texas to help fund the expansion. Over the next three years, SpaceX plans to expand the square footage of its Bastrop facility by 1 million square feet to produce Starlink kits and their adjacent parts, as well as advanced silicon products. The facility expansion will focus on developing printed circuit boards (PCBs), a semiconductor failure analysis lab and advanced packaging for panel level packaging (PLP). Starlink is an international satellite internet provider owned and operated by SpaceX. Upon completion of the project, the Bastrop facility will be the largest PCB and PLP facility in North America. “This grant will help continue to expand Bastrop’s manufacturing for Starlink to help connect even more people across the state and around the world with high-speed, low-latency internet,” says Gwynne Shotwell, president and chief operating officer of SpaceX. Texas’ Semiconductor Innovation Fund was assembled in 2023 through the Texas CHIPS Act, which developed a …

NEW YORK CITY — Life Time (NYSE: LTH) has announced an agreement with Silverstein Properties to open an athletic country club at Brooklyn Tower, a 74-story residential skyscraper located at 9 Dekalb Ave. in downtown Brooklyn. The health and wellness experience will mark Life Time’s largest location in Brooklyn at approximately 80,000 square feet. Life Time Brooklyn Tower will span seven floors throughout the 1,066-foot-tall building. Life Time’s programming will include studio classes, personal training, strength and fitness offerings and amenities. Highlights of the new club will include: Life Time Brooklyn Tower is expected to open in the second half of 2026. Additional information will be provided as the project progresses, and a waitlist for members has been established. Brooklyn Tower integrates the historic Dime Savings Bank of Brooklyn into its design and features 143 luxury condominiums and 398 rental units. Silverstein gained full control of the project in a $672 million deal last year and is expected to relaunch condo sales in April, according to the Brooklyn Daily Eagle, which reports that only 20 of the tower’s condos have sold since its 2022 launch. “As the new owner of Brooklyn Tower, Silverstein Properties is committed to a successful completion …