NEW YORK CITY — JLL’s Capital Markets group has arranged the $1.1 billion refinancing of 3 Bryant Park, a 42-story office tower located at 1095 Avenue of the Americas in New York City. The 1.2 million-square-foot trophy building is situated within the Bryant Park neighborhood of Midtown Manhattan. Christopher Peck, Drew Isaacson, Lauren Kaufman, Jennifer Zelko and Christopher Pratt of JLL arranged the refinancing on behalf of the owner, Ivanhoé Cambridge, and the property manager, Houston-based Hines. Ivanhoé Cambridge purchased 3 Bryant Park in 2015 for $2.2 billion. Wells Fargo, Bank of America and Bank of Montreal were the lead lenders for the refinancing. Further details of the financing were not released. Located adjacent to Manhattan’s Bryant Park and the 42nd Street Subway station, 3 Bryant Park was 97.2 percent leased at the time of financing to tenants including Salesforce, which has signage atop the tower. Other tenants include Stifel, Dechert LLP, US Bank, Lloyds Bank and Standard Chartered. The tower also includes retail space leased to tenants including Whole Foods Market, Equinox, Valbella, Shake Shack and Rosetta Bakery. Other offerings at 3 Bryant Park include a new conference center, sky lobby with a coffee bar and more than 16,000 …

Top Stories

Simon Unveils Plans for Multimillion-Dollar Transformation of Smith Haven Mall on Long Island

by John Nelson

LAKE GROVE, N.Y. — Mall giant Simon Property Group (NYSE: SPG) has unveiled plans for a multimillion-dollar transformation of Smith Haven Mall in the Long Island village of Lake Grove. The redevelopment project will feature improvements to both the interior and exterior of the mall, with the addition of new retailers, restaurants, a new outdoor plaza and amenities throughout the property. The redevelopment process will begin this summer and is scheduled for completion in 2026. “At Simon, we are committed to making significant investments across our portfolio to ensure that our centers continue to deliver exceptional customer experiences for today’s shoppers,” says Mark Silvestri, president of development at Simon. Smith Haven Mall’s exterior will be repainted and will include new signage, updated entryways, landscaping and seating accommodations. The mall’s interior will receive new flooring and fixtures, as well as enhancements to Center Court and a transformation of the food court with newly installed seating. New tenants at the mall include fashion retailer Zara, which will open its first location in Eastern Long Island near Smith Haven’s Center Court next year. The square footage of the new Zara was not disclosed, but the space will be “massive,” according to Simon. Additionally, Golf …

COSTA MESA, CALIF. — Liberated Brands, a licensed operator of several sport, outdoor and lifestyle apparel brands, has initiated Chapter 11 bankruptcy proceedings, according to court documents filed in Delaware. Liberated Brands’ portfolio of retailers includes Volcom, Billabong, Quiksilver, ROXY, Honolua Surf, RVCA, Beachworks, Becker Surfboards, ZJ Boarding House, Spyder and Boardriders. According to Gordon Brothers, which is providing real estate advisory services to the retailer, Liberated Brands plans to close its 122 stores throughout the country. Gordon Brothers — which earlier this year entered into a sales transaction with Big Lots upon the latter’s Chapter 11 bankruptcy filing — has initiated closing sales at each of the 122 retail locations. In a statement, Liberated Brands CEO Todd Hymel cited “a series of major headwinds and challenges,” including the rise in interest rates, inflation, supply chain delays, declining consumer demand, shifting customer preferences and substantial fixed costs. Additionally, in December 2024, the company’s North American license rights for its wholesale operations under the Volcom, RVCA and Billabong brands were terminated due to a default. Founded in 2019 by Hymel, Costa Mesa-based Liberated Brands briefly enjoyed a sharp increase in product demand during the COVID-19 pandemic, with revenue increasing from $350 million in …

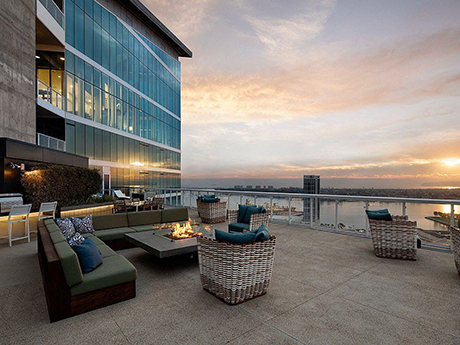

SAN DIEGO — MG Properties has acquired Park 12 Apartments, a 35-story multifamily tower located in downtown San Diego, for $309 million. The transaction is the largest multifamily acquisition in San Diego since 2020 and the third-largest multifamily acquisition in the city’s history, according to the locally based buyer. Built in 2018, the community is located adjacent to Petco Park, home of the San Diego Padres Major League Baseball team, and within the Ballpark Village master-planned community. The property offers a mix of studio, one-, two- and three-bedroom units, including penthouse apartments with exclusive access to a lounge on the 32nd floor. Shared amenities include saltwater and heated pools with poolside event space, a 24-hour fitness center, golf simulator and putting green, sun deck and spa, dog park, coffee and herbal tea bar, clubroom, sports lounge, game room and courtyards with outdoor seating, grilling areas and fire pits. Joseph Smolen and Geoff Boler of Eastdil Secured represented the seller, Charleston, S.C.-based Greystar, in the transaction. Greg Stampley and Lee Redmond, also with Eastdil Secured, originated a Fannie Mae acquisition loan of an undisclosed amount on behalf of MG Properties. San Diego-based MG Properties is a privately owned real estate firm specializing …

ALEXANDRIA, VA. — Carr Properties has formed an equity joint venture with Barings for the development of 425 Montgomery Street, a $131 million project to transform a former office building into multifamily units in Alexandria, roughly seven miles south of Washington, D.C. The partnership subsequently received an $84 million construction loan from real estate investment firm Kennedy Wilson. Cushman & Wakefield served as advisor for both the equity and debt financings. The development site, located adjacent to Montgomery Park in the city’s Old Town Alexandria neighborhood, formerly housed a vacant office building. The eight-story, 250,000-square-foot project will feature 237 apartment units in studio, one-, two- and three-bedroom layouts. Amenities will include an outdoor pool and a resident lounge/amenity center, as well as a performing arts venue leased to CityDance. About one-third of the units will offer views of the Potomac River. Carr acquired the project site (formerly 901 N. Pitt St.) in spring 2024. Construction has commenced, and a groundbreaking ceremony is scheduled for next month. The project is slated for completion by late 2026. “We look forward to partnering with Carr Properties on this exciting residential investment that we believe will benefit from several tailwinds, including the region’s strong …

Cypress Equities, Lauricella Break Ground on 123,941 SF Office Building for Shell in New Orleans

by John Nelson

NEW ORLEANS — A partnership between Cypress Equities, a real estate development and management firm based in Dallas, and locally based firm Lauricella Land Co. has broken ground on a new eight-story office building in New Orleans. Situated on the banks of the Mississippi River, the 123,941-square-foot property, named Shell Plaza, will house the headquarters of the Gulf of Mexico operations for oil-and-gas giant Shell (NYSE: SHEL). Shell executed the office lease with Cypress Equities and Lauricella Land Co. last year. The new property represents the first Class A office building to break ground in New Orleans since 1989 and the first office property within the River District, a 39-acre mixed-use neighborhood on the riverfront, according to the development team. “This project will boost the local economy while setting a new standard for sustainable, modern office space in New Orleans,” says Chris Maguire, CEO of Cypress Equities. Shell Plaza will be located on a 1.6-acre site at 1600 Convention Center Blvd. at the corner of Henderson and Euterpe streets and adjacent to the New Orleans Ernest N. Morial Convention Center. River District Neighborhood Investors LLC, working on behalf of the convention center, is overseeing the development of the River District …

MIAMI — A partnership locally based firm Mint Developers, hospitality owner-operator Sonesta International Hotels Corp. and property manager AD1 has unveiled plans for an $850 million hotel and residential project in downtown Miami. The James Hotel & Residences in Downtown Miami will comprise 336 fully furnished, for-sale residences and roughly 200 hotel rooms. At 82 stories, the project will be the tallest skyscraper in Miami upon completion, according to the developers. Construction is scheduled to begin in the first quarter of 2026 and to be complete by early 2028, with residential sales expected to launch in the second quarter of this year. Residents and hotel guests will have access to amenities such as a spa, private cabanas with plunge pools, snow and rain rooms and onsite dining. One of the property’s restaurants will include the highest elevation luxury bar in the Americas. The project will also feature a four-story private club where members will have access to the James Hotel. Financing details were not disclosed, but Daniel Berman, president and CEO of AD1, stated that the first round of funding has been secured and that Sonesta is directly contributing to the financing of the project. Berman also said that the project …

MINNEAPOLIS — Onward Investors has acquired Ameriprise Financial Center, a 31-story office tower located at 707 2nd Ave. S in downtown Minneapolis. The 960,000-square-foot building has served as the corporate headquarters of Ameriprise Financial since its construction in 2000. Ameriprise Financial announced in 2022 that the company would be vacating the property in order to consolidate its headquarters at another building in downtown Minneapolis. Ameriprise Financial Center is soon to be vacant, according to Onward Investors. A sales price was not disclosed. However, locally based newspaper The Minnesota Star Tribune reported that the property sold for $6.3 million, a steep discount from the last time the building traded hands. Most recently in September 2016, a joint venture between Axar Capital Management and Morning Calm Management acquired the building for $200 million. Ameriprise Financial Center is located within the Minneapolis skyway system, a network of enclosed pedestrian bridges that provide direct access to buildings including the Minneapolis Club, Capella Tower, SPS Tower and Baker Center. The property also includes a four-story parking ramp that offers below-grade parking for roughly 300 vehicles. Onward Investors stated that it is exploring variety of options for the property, including converting portions of the building to uses other than …

TOLEDO, OHIO AND HOUSTON — An affiliate of Welltower Inc. (NYSE: WELL) has entered into an agreement to acquire NorthStar Healthcare Income Inc., a non-listed REIT that owns a diversified portfolio of seniors housing properties throughout the United States, for roughly $900 million. Toledo-based Welltower will take ownership of NorthStar Healthcare’s portfolio of 40 seniors housing communities in the acquisition. Founded in 2010, Houston-based NorthStar Healthcare’s portfolio includes independent living, assisted living and memory care properties. “We expect that this portfolio will serve to further enhance our regional densification strategy through our existing geographic footprint and network of exceptional seniors housing operators,” says Nikhil Chaudhri, co-president and chief investment officer of Welltower, calling the agreement a “win-win outcome for shareholders of both companies.” NorthStar Healthcare stockholders will receive $3.03 per share according to the agreement, exceeding the net asset value per share of $2.96 as decided by NorthStar Healthcare’s board of directors in June 2024. Under terms of the agreement, the NorthStar board of directors and advisors may initiate, solicit and consider alternative acquisition proposals during a 40-day “go shop” period beginning from the date of the merger agreement. The all-cash transaction is scheduled to close within the first half …

THOMPSON’S STATION, TENN. — Mall owner Simon Property Group (NYSE: SPG) has entered into an agreement to purchase a development site in metro Nashville with plans to build a luxury shopping and lifestyle destination known as Nashville Premium Outlets. The 325,000-square-foot project will be situated at the intersection of I-65 and I-840 in the southern suburb of Thompson’s Station. “This project represents a significant investment in our town and has the potential to enhance local amenities, create jobs and strengthen our economy,” says Thompson’s Station Mayor Brian Stover. Simon is collaborating with Nashville-based Adventurous Journeys Capital Partners (AJ Capital), a company known for its work in hospitality and real estate development. Construction is expected to begin in 2026, but a timeline for completion was not provided. Preliminary plans call for 75 retailers, restaurants and a hotel, with the potential to add residential options and big box retailers. “We are excited to bring another premier shopping and lifestyle destination to Nashville, one of our country’s most dynamic and fastest growing markets,” says Gary Duncan, Simon’s president of Premium Outlets and The Mills brands. Nashville Premium Outlets will join Simon’s existing properties in the metro area, including Opry Mills and The Mall …