ATLANTA — Hilton Worldwide Holdings (NYSE: HLT) has opened Signia by Hilton Atlanta in the city’s downtown district. At 976 rooms and 1.3 million square feet, the project represents the largest hotel development in the city in at least 40 years, according to Hilton. The property is also the first new-build hotel for the company’s Signia brand, as well as the first Signia property in Georgia. The Georgia World Congress Center Authority (GWCCA), which owns and operates the adjacent Georgia World Congress Center, is the owner of the Signia hotel. Development costs were not disclosed, but the Atlanta Business Chronicle reports that the project cost roughly $450 million to develop. Built on the grounds of the former Georgia Dome, a sports and concert arena that was demolished in November 2017, the 42-story hotel is the lodging component of the GWCCA’s “Championship Campus,” which is self-described as “North America’s largest combined convention, sports and entertainment destination.” The campus also includes Georgia World Congress Center, Centennial Olympic Park and Mercedes-Benz Stadium, which is the home arena of the NFL’s Atlanta Falcons and MLS’s Atlanta United. The hotel is also adjacent to State Farm Arena, home of the NBA’s Atlanta Hawks, and Centennial …

Top Stories

KeyBank Arranges $571.7M Financing Package for Affordable Seniors Housing Property in Rochester, New York

by Katie Sloan

ROCHESTER, N.Y. — KeyBank has arranged a $571.7 million financing package for Andrews Terrace, a 526-unit affordable seniors housing property located along the Genesee River in Rochester. A partnership between Conifer Realty and Community Preservation Partners owns the property and has announced renovation plans. Located at 125 St. Paul St., Andrews Terrace was built in 1975 and consists of two residential buildings, one rising 19 stories and the other 22 stories. The towers offer studio, one- and two-bedroom apartments for seniors and disabled residents. The buildings are connected on the first floor with elevated walkways throughout. Under an existing Housing Assistance Payment contract, 496 of the community’s apartments are reserved for residents earning up to 50 percent of the area median income (AMI), with 30 apartments set aside for those earning 60 percent or less of AMI. Renovations for the 557,602-square-foot community will include kitchen upgrades and bathroom refurbishment in each unit, and renovations to common areas including the lobby, community room, management office, maintenance shop and parking garage. The project will also include the addition of a community garden, seating and grilling area, bocce ball courts, fitness room, game room, reading nook, two community rooms, new mailboxes and a …

Breakthrough Properties Acquires Majority Stake in $236M Callan Ridge Life Sciences Campus in San Diego

by Jeff Shaw

SAN DIEGO — Breakthrough Properties Inc. has acquired a 65 percent stake in Callan Ridge, a 185,000-square-foot research campus in San Diego’s Torrey Pines scientific research area. Healthpeak Properties (NYSE: PEAK), the project’s developer, retains a 35 percent stake in the asset. The formation of the joint venture values Callan Ridge at $236 million. Healthpeak began construction of the Callan Ridge campus in 2021. The two-building asset is fully leased to Turning Point Therapeutics Inc., a subsidiary of Bristol-Myers Squibb Co., through April 2035. The lease on 105,000 square feet commenced in July 2023. The lease on the remaining 80,000 square feet will commence in July of this year. The three-story, two-building complex augments part of Healthpeak’s 20-acre Torrey Pines Science Park. Callan Ridge features numerous sustainable features, including a canopy with integrated solar panels; electrochromic windows that change color to control sunlight and heat throughout the day; recycled steel and concrete; and drought-tolerant landscaping. The joint venture plans to pursue LEED Gold certification for the campus. The property also offers amenities such as a fitness center, restaurant, roof deck and patio space, as well as 506 parking stalls. Ferguson Pape Baldwin Architects designed the development. According to Healthpeak, Callan …

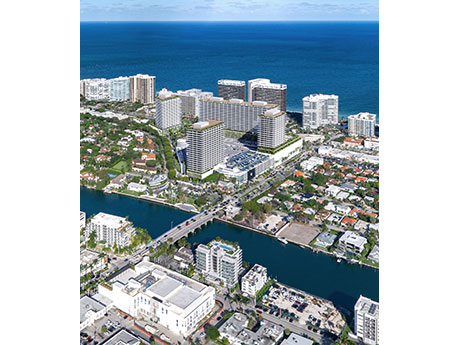

MIAMI — Whitman Family Development has submitted plans for a mixed-use project at its Bal Harbour Shops in Miami’s Bal Harbour village. Plans call for 600 apartment units, 40 percent of which are earmarked for workforce housing and 60 percent of which will be luxury housing. There will also be a 70-room, 20-story hotel and an additional 45,700 square feet of retail space. Bal Harbour Shops comprises more than 100 shops, restaurants and entertainment options. The open-air, luxury retail center, which is home to brands such as Chanel, Gucci, Tiffany & Co. and Valentino, is currently undergoing a $550 million retail expansion that will add about 250,000 square feet, nearly doubling the center’s current retail space. The expansion will accommodate the addition of 35 new upscale stores and restaurants. The new housing development is made possible by Florida’s Live Local Act, a bipartisan bill passed by the Florida legislature last year in response to the critical need for affordable and attainable housing statewide. The legislation enables developers to build at higher density and building heights, so long as they commit to including attainable housing units. The law requires that local municipalities approve mixed-use residential projects in any area zoned commercial …

MIAMI — Terra and Grass River Property, two Miami-based development firms, have completed construction of Grove Central, a transit-oriented, mixed-use development in Miami’s Coconut Grove neighborhood. The property comprises a 23-story apartment tower, 1,250-space public parking garage and 170,000 square feet of retail space leased to tenants including Target and Sprouts Farmers Market. Grove Central is a public-private partnership between the co-developers and Miami-Dade County, which owns the land. The development is located at the intersection of US Highway 1 and SW 27th Avenue and connects to the adjacent Coconut Grove Metrorail Station. The project interfaces directly with The Underline, a 10-mile linear park that stretches from the Dadeland South Metrorail Station to the Miami River in downtown’s Brickell district, as well as Miami-Dade County’s bus system and the City of Miami’s trolley network. According to Terra and Grass River Property, Grove Central generated more than 1,600 construction jobs during its development and nearly 500 permanent full-time and part-time positions. The project has also spurred tens of millions of dollars in lease revenue to Miami-Dade County, which can collect property tax revenues for the first time in the site’s history. “Grove Central is an exciting milestone and a shining example …

NEW YORK CITY — Vornado Realty Trust (NYSE: VNO) is nearing completion of a $750 million repositioning of PENN 2, a 1.8 million-square-foot office building that sits atop the Penn Station transit hub in Midtown Manhattan. PENN 2 will sport architectural features such as a modern glass curtain wall, a triple-height lobby that opens onto a new plaza on 33rd Street and a six-story podium comprised of 105,000 square feet of column-free, double-height space. Above the 33rd Street plaza is a 280-person town hall space with a flexible seating system that can support large-scale keynote talks, private media screenings, banquets, conferences, workshops and open-floor exhibitions. PENN 2 also offers 72,000 square feet of outdoor green space, including an outdoor terrace atop the podium and a landscaped 17,000 square-foot rooftop park that is available to all tenants. The building sits across the street from Madison Square Garden, which houses its global headquarters within the office space. The larger PENN District campus is home to major tenants such as Meta, Morgan Stanley, Amazon, The Hartford, Cisco Systems and Samsung. “The reimagined PENN 2 appeals directly to innovation-oriented companies seeking an ultra-premium, hospitality-infused office environment that offers a one-seat ride for workers throughout the …

Flint Development Nears Completion of First Building at $390M Flint Commerce Center in De Soto, Kansas

by Jeff Shaw

DE SOTO, KAN. — Flint Development is nearing completion of the first building at Flint Commerce Center, a $390 million industrial park in the western Kansas City suburb of De Soto. At full build-out, the multi-phased project will include up to six buildings on a 370-acre site. Development of the first building, a 1 million-square-foot distribution center, is slated for completion this summer. Located at 10200 Edgerton Road, the cross-dock distribution center is being constructed with tilt-up concrete panels and 40-foot clear heights. The first facility — which is called Building C — will offer 98 dock doors and four drive-through doors, with the capacity to expand to 168 dock doors. The parking lot can accommodate 515 cars and 251 trailers. In August 2023, Panasonic Energy announced plans to lease half of the facility to support a nearby lithium ion battery manufacturing facility, which is currently under construction. “There is a lot of excitement surrounding the Panasonic factory and we are happy to see the amount of prospect activity for Flint Commerce Center,” says Mark Long, CEO of Newmark Zimmer. Newmark Zimmer is representing Flint Development in lease negotiations for Flint Commerce Center. “Together, this lease and the additional land …

UCLA Acquires Former Westside Pavilion Mall in Los Angeles for $700M, Unveils Plans for Research Park

by Katie Sloan

LOS ANGELES — The University of California, Los Angeles (UCLA) has acquired One Westside and Westside Two, located two miles from its Westwood campus in Los Angeles. A joint venture between Hudson Pacific Properties (NYSE: HPP) and Macerich (NYSE: MAC) sold the assets for $700 million. The 700,000-square-foot property — located at 10800, 10830 and 10850 W. Pico Blvd.— was formerly occupied by Westside Pavilion mall, a city landmark that served as the backdrop for a number of movies and television shows since its opening in 1985. Hudson Pacific and Macerich began redevelopment efforts at the property in March 2018, converting the mall into a Class A office campus. Google inked a lease in January 2019 to occupy the entire campus under a 14-year term, which was to commence upon completion of the project in 2022. Details of the termination of Google’s lease at the property were not disclosed. The university plans to convert the property into UCLA Research Park, which will house the California Institute for Immunology and Immunotherapy at UCLA and the UCLA Center for Quantum Science and Engineering. The acquisition was made possible by a $500 million investment from the state of California, $200 million of which …

FORT LAUDERDALE, FLA. — Bank OZK has provided a $220 million construction loan for Phase I of FAT Village, an 835,000-square-foot mixed-use development in Fort Lauderdale’s Flagler Village neighborhood. Plans for Phase I include 601 multifamily units, 180,000 square feet of creative office space and more than 70,000 square feet of retail space, including food-and-beverage offerings, shopping, entertainment, and art studios and galleries. FAT stands for Food Art Technology. FAT Village is located two blocks from the Brightline’s Fort Lauderdale high-speed commuter rail station, which connects Fort Lauderdale to Miami, West Palm Beach and Orlando. The developers say that this four-block creative enclave will serve as the reimagined epicenter of the city’s art-centric district. Hines and local partner Urban Street Development are developing the 5.6-acre project. “At a time when financing and construction starts have materially slowed, it’s gratifying to be in a position to move forward on FAT Village, which we believe will be a transformational development for Flagler Village and Fort Lauderdale,” says Alan Kennedy, managing director at Hines. “We look forward to creating a dynamic and engaging destination that honors and advances the neighborhood’s legacy while providing new living, working and recreational options to help the city …

Carolwood Equities Purchases 62-Story Office Tower in Downtown Los Angeles for $153.3M

by John Nelson

LOS ANGELES — Carolwood Equities LP, a real estate private equity firm based in Beverly Hills, Calif., has purchased Aon Center, a 62-story office tower in downtown Los Angeles. The 1.1 million-square-foot skyscraper is located at 707 Wilshire Blvd. in the city’s Financial District. The $153.3 million sale of Aon Center represents the largest office sale in fourth-quarter 2023 in the Western United States, according to Newmark. The deal is also the largest purchase in downtown Los Angeles last year but sold for 45 percent less than its last purchase price, according to the Los Angeles Business Journal. The media outlet reports that the seller, San Francisco-based Shorenstein Properties, had previously purchased the tower in 2014 for $269 million. Private investors Daniel Abrams and Adam Tischer are part of the new ownership group alongside Carolwood Equities. Tischer, vice president of Colliers’ Los Angeles office, was also part of the brokerage team for the buyer that also included Sean Fulp, vice chair of Colliers. “The ownership group’s acquisition of the iconic Aon Center exemplifies the flow of private capital into Los Angeles, seizing the opportunity created by market dislocation,” says Fulp. “With a new low basis and a well-capitalized owner, Aon Center …