FAYETTEVILLE, GA. — The U.S. Soccer Federation has selected a site in Fayetteville, 22 miles south of downtown Atlanta, to develop its new National Training Center. The facility will be located within the master-planned community of Trilith and will span more than 200 acres. The development is expected to create 440 new jobs and costs $228 million to develop, according to the State of Georgia. The National Training Center will serve as the headquarters for U.S. Soccer, which is currently based in Chicago. Plans for the facility include a dozen soccer fields; more than 100,000 square feet of indoor courts for all 27 of the U.S. Soccer national teams; and 200,000 square feet of facilities, locker rooms, meeting rooms and headquarters space for U.S. Soccer employees. The federation plans to break ground on the project in the spring of 2024. Arthur Bank, co-founder of The Home Depot and owner of Major League Soccer team Atlanta United and the NFL’s Atlanta Falcons, contributed $50 million to the development. According to U.S. Soccer, the site was chosen due to its proximity to the Hartsfield-Jackson Atlanta International Airport and Atlanta’s downtown area, optimal climate for year-round programming, the ability to impact the local …

Top Stories

McDonald’s to Test Small-Format, Beverage-Led CosMc’s Concept with First Location in Metro Chicago

by Katie Sloan

BOLINGBROOK, ILL. — McDonald’s (NYSE: MCD) has announced plans to test CosMc’s, a new smaller format concept featuring a beverage-led menu with new food and drink items. The first location will open this month in the Chicago suburb of Bolingbrook, where the first McDonald’s franchise location opened in 1955. By the end of 2024, the company plans to open 10 pilot locations for the concept, with target markets set to include the Dallas-Fort Worth and San Antonio metropolitan areas. CosMc’s will offer digital and drive-thru ordering formats only, with dynamic menu boards, cashless payment devices and pick-up windows. The concept’s menu will be beverage-focused, including specialty lemonades and teas, blended beverages and cold brew coffees. Drink offerings — which will include churro- and s’mores-flavored coffees, sour cherry energy drinks and lemonades — will be customizable, to include the addition of boba, energy and Vitamin C shots. CosMc’s locations will also feature a small lineup of food items, including new offerings like a spicy queso sandwich and pretzel and hash brown bites, alongside traditional menu standbys like Egg McMuffin sandwiches and McFlurrys. The new concept is named after CosMc, a mascot that McDonald’s launched in the late 1980s. Chicago-based McDonald’s is …

CHICAGO — Salesforce Tower Chicago, a 60-story office building featuring software provider Salesforce Inc. as the anchor tenant, has opened in the Windy City. The 1.2 million-square-foot tower is situated along the Chicago River and is part of Wolf Point, a three-phase development designed by Pelli Clarke Pelli. Hines developed Wolf Point in partnership with the longtime landowner, the Joseph P. Kennedy Family. As a result of the rise of remote work during the pandemic, Salesforce has reduced its footprint in the building from 500,000 square feet to 360,000 square feet, according to Crain’s Chicago Business. The remaining 140,000 square feet of space is empty and available for sublease. Salesforce consolidated its local employees into the building from four offices downtown and one in suburban Naperville, according to Crain’s. The company’s lease runs through May 2040. Salesforce Tower Chicago features focus spaces like libraries and focus pods, as well as areas for team collaboration and connection such as event spaces and communal kitchens. Throughout the workspaces are a mix of mindfulness rooms, pods of height-adjustable desks, and meeting and training rooms. Salesforce doubled the size of the social lounges on its employee floors and added more conference rooms equipped with …

TITUSVILLE, FLA. — A partnership between Houston-based Hines and locally based Key Group has announced plans to develop Space Coast Innovation Park, a 3 million-square-foot industrial development in the Space Coast city of Titusville. Located in Brevard County, the three-phase development will be situated on 450 acres near Space Coast Regional Airport’s Exploration Spaceport and within a few miles of NASA’s Kennedy Space Center. Nearby space exploration and aerospace defense firms include SpaceX, Blue Origin, Boeing, Northrop Grumman and Lockheed Martin. This past summer, Amazon announced it is developing a $120 million satellite processing facility in nearby Cape Canaveral, Fla. Additionally, the U.S. Air Force recently selected Patrick Space Force Base as its preferred headquarters location for the U.S. Space Force’s Space Training and Readiness Command operations. “As the rapid commercialization and privatization of the aerospace industry continues, with the space economy expected to generate more than $1 trillion in annual sales by 2040, we believe now is the perfect time to create a best-in-class logistics hub for aerospace companies requiring more direct access to Kennedy Space Center and Cape Canaveral than properties located further south can offer,” says Ryan Wood, managing director at Hines. “We look forward to partnering …

JERSEY CITY, N.J. — New York City-based developer Tishman Speyer has received a $300 million construction loan from Otera Capital for a 58-story multifamily tower in Jersey City. With financing in place, Tishman Speyer plans to begin construction later this month and deliver the building in early 2027. The property will be located at 55 Hudson St. along the Hudson River in the Paulus Hook neighborhood, less than a block from the Paulus Hook Pier, which offers ferry service to various New York City metro locations. Plans call for 1,017 units in one-, two- and three-bedroom floor plans. The building will also feature 75,000 square feet of indoor and outdoor amenities and 60,000 square feet of retail and restaurant space. The development of 55 Hudson will be followed by 50 Hudson, a 48-story apartment tower that will include comparable indoor and outdoor amenities. When completed, the two-building development will boast nearly 2,000 new apartments, over 70,000 square feet of retail space and a 32,000-square-foot waterfront plaza. The plaza, which will provide a direct connection to Jersey City’s esplanade, will be available for community events. The design team for the project includes Handel Architects, Marchetto Higgins Stieve Architects, landscape architects Hollander Design …

BOCA RATON, FLA. — Basis Industrial, a privately held real estate owner and operator headquartered in Boca Raton, has acquired four commercial properties in Florida and Texas for a total of approximately $160 million. Bank United, Banesco and Thorofare provided roughly $110 million in financing for the transaction. Beach Point Capital Management provided a preferred equity/mezzanine loan of roughly $70 million, with the borrowers, Basis and NexPoint, providing the remaining funds. In addition to the acquisitions, the loans and equity will fund a $60 million refinancing for two of the borrowers’ existing commercial properties in Florida. The six properties, including those being refinanced, total over 1.3 million square feet. The four acquired properties include: The properties that Basis refinanced were Crystal Pointe and Gateway & Commercial Point. Crystal Pointe is a 96,888-square-foot property located at 4500-4870 North Powerline Road in Deerfield Beach, Florida. Crystal Pointe is currently 100 percent leased. Gateway & Commercial Point is a 253,701-square-foot asset located at 7550-7800 Southland Blvd. in Orlando. The property is currently 97.6 percent leased. “This is a huge step for Basis’ growth and my vision,” says Daniel Weinstein, founder and CEO of Basis Industrial. “We expect to add millions of square feet over the next few years in targeted …

Dai Nippon Printing to Develop $233M Battery Pouch Manufacturing Facility in Linwood, North Carolina

by Katie Sloan

LINWOOD, N.C. — Tokyo-based Dai Nippon Printing Co. (DNP) has announced plans to develop a $233 million manufacturing facility in Linwood, approximately midway between Charlotte and Greensboro. The development will produce battery pouches that encase and protect lithium-ion batteries for electric vehicles. While further details on the building itself were not disclosed, DNP plans to complete the project by 2026. The factory will be the company’s first advanced manufacturing facility in the U.S. DNP hopes to expand the facility in the coming years to also manufacture jumbo rolls, which are another type of casing for lithium-ion batteries. The project is facilitated in part by a recently approved Job Development Investment Grant (JDIG) from North Carolina’s Economic Investment Committee, the state’s department of commerce leads. The department estimates the project will grow North Carolina’s economy by $691 million over the course of the grant’s 12-year term. Through the agreement, DNP can potentially be reimbursed $2.7 million by the state over the grant’s term, dependent upon tax revenues generated by new jobs created by the development. “From the east to the west, North Carolina’s electric vehicle industry is growing exponentially,” said North Carolina Commerce Secretary Machelle Baker Sanders. “Our natural resources and …

ANN ARBOR, MICH. — American Campus Communities (ACC) is underway on the development of a $631 million student housing project at the University of Michigan in Ann Arbor. Plans call for a new residential community with five residence halls totaling 2,300 beds and a 900-seat dining facility, the largest of its kind among academic institutions, according to ACC. The university engaged ACC in a public-private partnership to lead the development of the project, which is situated on Central Campus between East Hoover Avenue and Hill Street. RAMSA is serving as the architect of record and Elkus Manfredi Architects is the interior architect. According to ACC, the development signifies the first Central Campus residence halls built specifically for first-year students since 1963 and will significantly alleviate a decades-long shortage of on-campus housing. “This important new student residential community allows all first-year students who want to live on the University of Michigan Central Campus to do so,” says Graham Wyatt, partner at RAMSA. “It will provide affordable and uniquely appropriate residential communities and amenities for the first- and second-year students who live there, and it will create a crucial link between Central Campus and the Athletic Campus.” To make way for the …

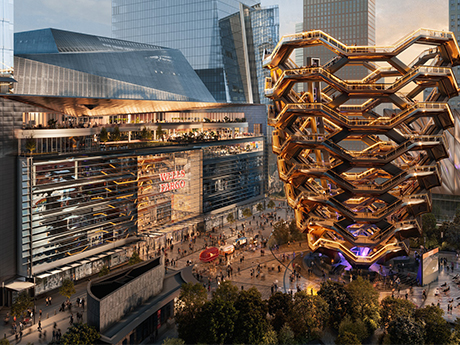

Wells Fargo Plans 400,000 SF Adaptive Reuse Office Project at Hudson Yards in Manhattan

by John Nelson

NEW YORK CITY — Wells Fargo & Co. (NYSE: WFC) has announced formal plans to expand its office footprint within Hudson Yards, a mixed-use district on Manhattan’s west side. The San Francisco-based banking giant, which already occupies space within the $25 billion Hudson Yards campus, has purchased additional space from Related Cos., the master developer behind Hudson Yards along with Oxford Properties Group. Multiple media outlets have reported that Wells Fargo purchased the space at 20 Hudson Yards, which formally housed a Neiman Marcus store, for $550 million. The bank plans to convert the 400,000 square feet of space to offices in synergy with its current 500,000-square-foot footprint at 30 Hudson Yards, according to Bloomberg News. Forbes reported that the Neiman Marcus location closed in summer 2020. Wells Fargo plans to begin moving employees from its existing office space at 150 E. 42nd St. to the new Hudson Yards office beginning in late 2026. The property is expected to house 2,300 Wells Fargo employees at full operation. The 11-story building will also include a dedicated entrance on 10th Avenue and naming rights to Wells Fargo for signage on the exterior of the property. “This investment further solidifies our longstanding commitment …

CHICAGO — CBRE has arranged the sale of a two-building, 1.1 million-square-foot industrial campus located at 4700-4800 Proviso Drive and 5000 Proviso Drive in Chicago. The properties are located in the Melrose Park neighborhood on the west side of the city. The site is located roughly 10 miles from O’Hare International Airport and is also near the Union Pacific Intermodal railway and the interchange of interstates 290 and 294. According to data from CBRE, the O’Hare submarket had an industrial vacancy rate of 2.4 percent as of the third quarter. Houston-based Hines purchased the campus for an undisclosed price. Zach Graham, Michael Caprile and Joe Horrigan of CBRE represented the unnamed seller in the transaction. The campus was fully leased at the time of sale, with a single logistics user that has been in place for approximately 20 years occupying each of the three spaces. Building features include 32- and 35-foot clear heights, one dock per 5,000 square feet of space, 159 trailer parking stalls and the capacity for dual rail loading. Hines plans to implement a value-add program to make improvements at the property. “This transaction represented a compelling opportunity given its strategic infill location in the densely populated …