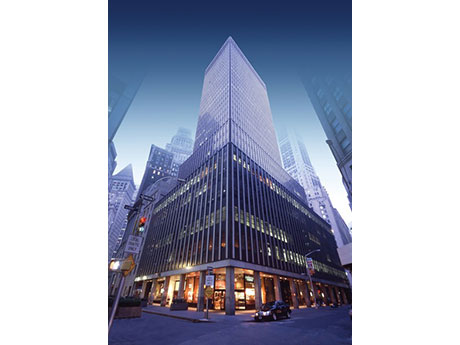

NEW YORK CITY — JLL Capital Markets has arranged $220 million in financing for the conversion of 55 Broad Street in New York City’s Financial District into 571 luxury apartment units. Conversion of the 30-story office tower will occur in phases. JLL arranged the four-year, floating-rate loan through Mexico City-based Banco Inbursa on behalf of the borrower, a partnership between Metro Loft Developers LLC and Silverstein Properties. JLL also advised on the procurement and structuring of equity for the deal. The Rudin Family sold the building to the developers for about $173 million, according to Crain’s New York Business. Upon completion, 55 Broad Street will feature studios, one-, two- and three-bedroom units along with roughly 17,000 square feet of amenity space. Amenities will include a rooftop pool, fitness center, coworking facilities and sports simulators. The project will be one of the first fully electric residential buildings in Manhattan, leveraging self-contained heating and cooling systems. Mechanical renovations will bring the building to 100 percent carbon neutral and will enable the creation of additional amenities and rentable floor area. Located less than two blocks from the Bowling Green subway station, 55 Broad Street offers connectivity to destinations across the city and the …

Top Stories

SAN DIEGO — Kilroy Realty Corp. (NYSE: KRC), an office, mixed-use and life sciences REIT based in Los Angeles, has obtained a $375 million loan for a portion of One Paseo, a mixed-use campus in San Diego. New York Life Insurance Co. provided the 11-year, non-recourse loan, which features a fixed 5.9 percent interest rate. The loan matures in August 2034. The 36-acre property is situated between the city’s Carmel Valley neighborhood and Del Mar, as well as near I-5 and State Route 56. One Paseo is home to tenants including lululemon athletica, Sephora, drybar, BodyRok, Harland Brewing, Shake Shack, Cava and Blue Bottle Coffee, among others. The loan was secured by a 23-acre portion of Kilroy Realty’s One Paseo campus that comprises two office buildings, 608 apartment units and more than 95,000 square feet of retail space. This portion was developed in phases between 2019 and 2021, according to Kilroy Realty. “Against a challenging capital markets backdrop, we are very pleased with this loan execution, which further fortifies our already strong balance sheet and liquidity position while establishing a new partnership with a world-class life insurance company,” says John Kilroy, CEO of Kilroy Realty. JLL and Allen Matkins advised …

NEW YORK CITY — Wegmans Food Market has announced plans to open an 87,500-square-foot store at 770 Broadway in Manhattan’s East Village neighborhood. The market, dubbed Wegmans Astor Place, will be located at the base of an office building that Vornado Realty Trust owns. Meta, formerly known as Facebook, occupies the office portion of the property. The store, which is set to open on Oct. 18, will offer made-to-order and packaged foods; ready-to-eat and ready-to-heat options, including a selection of entrees and sides for individuals and families; and a ‘restaurant foods’ section with fresh sushi, salads, sandwiches, soups, pizza and wings. The location will also include an onsite dining room with sushi and oyster bars, which are set to open in early 2024. This store will be Wegman’s second in New York City, following the opening of Wegmans Brooklyn in 2019. “We know our customers can’t wait to come see what we have in store and our employees have been training, in some cases, for over a year to get ready for this day,” says Matt Dailor, the new store’s manager. “Wegmans is a celebration of food and people, and we can’t wait to open the doors on October 18 …

Arctaris Impact Investors Opens $152M Northeast Heights Opportunity Zone Office Project in Washington, D.C.

by Jeff Shaw

WASHINGTON, D.C. — Arctaris Impact Investors LLC has completed Phase I of Northeast Heights, a six-story, 281,000-square-foot office building in Ward 7 of Washington, D.C. The office building is located in a Qualified Opportunity Zone, which is an economically distressed area where new investments may be eligible for preferential tax treatment. The office building is the first phase of a three-phase, $600 million effort to revitalize Ward 7, according to Arctaris’ website. Future phases of Northeast Heights are expected to include a grocery store redevelopment, approximately 1,300 residential units and community spaces. According to Arctaris, the project was catalyzed by D.C. Mayor Muriel Bowser’s mandate for city agencies to use the leasing power of the D.C. government to encourage economic development in historically underserved communities. Northeast Heights was pre-leased to the city’s Department of General Services and will serve as the new headquarters for the agency, which employs approximately 700 people. The Department of General Services was the first city agency to sign a contract for office space east of the Anacostia River under this initiative. “Arctaris is proud to be part of the coalition led by Mayor Bowser, combining forces with like-minded, community-oriented investors to help bring new vitality …

MINNEAPOLIS — CBRE has arranged the $225 million sale of the office component of RBC Gateway Tower, a newly constructed mixed-use development located at 250 Nicollet Mall in Minneapolis. The portion acquired by San Francisco-based Spear Street Capital includes 525,000 square feet of office space, a ground-floor office lobby and 296 below-grade parking spaces. Ryan Watts, Tom Holtz, Brandon McMenomy, Steven Ward, Greg Greene and Harrison Wagenseil of CBRE represented the seller, United Properties, in the transaction. The office portion of the property was 99 percent leased at the time of sale to six tenants including RBC Capital Markets, United Properties and Pohlad Cos. The 1.2 million-square-foot tower also includes the 222-room Four Seasons Hotel Minneapolis — Minnesota’s first five-star hotel, according to CBRE — and 34 luxury Four Seasons Private Residences on the uppermost floors. Three restaurants are also on-site, including a full-service restaurant and bar, Mara, and Socca Café. “RBC Gateway Tower is a crown jewel in the Gateway District, with unmatched location and amenities,” says Watts of CBRE. “Premier properties like this offer exceptional workspaces that cater to the needs of modern employees, making them highly desirable as companies adapt to new workplace trends.” Minneapolis-based United Properties …

NEW YORK CITY — Canyon Partners Real Estate LLC and J.P. Morgan have provided a $193 million senior construction loan to East End Studios for the ground-up development of Sunnyside Campus, a media and content production studio in Queens. Construction is underway, and completion is slated for the first quarter of 2025. Sunnyside Campus will total 275,000 square feet and feature three full-service, ground-floor sound stages spanning 75,000 square feet. The stages will feature clear heights of 37 feet and may be subdivided. Plans additionally call for a 15,000-square-foot rooftop flex stage with views of the Queens, Brooklyn and Manhattan skylines along with ample outdoor gathering space. The stages will be supported by 125,000 square feet of production, office and mill spaces, 225 below-grade parking spaces, and eight enclosed loading bays for full-size trucks. Mill space can be utilized for set construction, welding, props, special effects and more. Like all East End Studios projects, the Sunnyside facility will be fully integrated with extended reality and virtual reality infrastructure. Positioned on a full city block between Queens Boulevard and the Long Island Expressway, the Sunnyside campus offers cast and crew members convenient public transportation options. The New York City Industrial Development …

Balfour Beatty Plans $240M Student Housing Project at William & Mary in Williamsburg, Virginia

by John Nelson

WILLIAMSBURG, VA. — Balfour Beatty Campus Solutions, a developer and operator of college and university real estate and infrastructure projects, has released plans for on-campus student housing options at William & Mary, a public research university in Williamsburg. The developer formed a public-private partnership with the school to bring the $240 million project to fruition. The new student housing accommodations will exceed 1,200 new beds. The general contractors, which includes Balfour Beatty’s buildings division and Richmond-based Kjellstrom+Lee, plan to break ground this month and open for student occupation in 2025. The first phase will deliver 935 beds at West Woods on the west side of William & Mary that will feature modern living units and community spaces, as well as a 50,000-square-foot dining hall. The second phase will feature 269 beds in a new facility adjacent to the school’s Lemon and Hardy Halls along Jamestown Road. The residence halls will be heated using geothermal heating and air conditioning in support of the school’s Climate Action Roadmap, which aims for a carbon-neutral campus by 2030. Lemon and Hardy Halls will also be transitioned to geothermal heating and cooling as part of the project. The design-build team includes VDMO Architects and CMTA. …

GLENDALE, CALIF. AND NEW YORK CITY — Self-storage REIT Public Storage (NYSE: PSA) has agreed to acquire Simply Self Storage from New York City-based Blackstone Real Estate Income Trust Inc. (BREIT) for $2.2 billion. The deal is scheduled to close during the third quarter. Simply Self Storage is an owner-operator that was founded in Orlando in 2003. The company owns 127 facilities and operates 25 more on a third-party basis for a total of more than 11 million net rentable square feet across 18 states. Roughly 65 percent of Simply Self Storage’s portfolio, which has a collective occupancy rate of 91 percent, is concentrated in Sun Belt markets. “This acquisition reflects the continued execution of our multi-factor external growth platform, which includes acquisitions, development, redevelopment, expansion and third-party management,” says Joe Russell, CEO of Public Storage. “We are pleased to complete this transaction with Blackstone, which has done a tremendous job of growing and improving the quality and operations of the Simply portfolio over the past few years.” “Where you invest matters, and this transaction demonstrates the strong investor demand for the high-quality assets and platforms we have assembled within BREIT,” adds Nadeem Meghji, head of Blackstone Real Estate Americas. …

Unibail-Rodamco-Westfield Sells 1.1 MSF Westfield Mission Valley Shopping Center in San Diego for $290M

by Jeff Shaw

SAN DIEGO — French investor Unibail-Rodamco-Westfield (URW) has sold Westfield Mission Valley, a 1.1-million-square-foot retail center in San Diego, for $290 million. Spread across two separate parcels, URW sold the eastern portion to Lowe and Real Capital Solutions, while Sunbelt Investment Holdings Inc. bought the smaller western portion. The Westfield Mission Valley shopping mall, the eastern part of the property, was originally built in 1960 on a 41-acre site. The center currently offers 73 shops, including Target, Nordstrom Rack, Macy’s Home, Michael’s, Bloomingdale’s Outlet and a 24-Hour Fitness, as well as restaurants such as Yard House, Outback and Buffalo Wild Wings. The center also includes the AMC Mission Valley 20 movie theater. The western portion of the asset features a Trader Joe’s, Marshalls and variety of smaller restaurants and retailers. The property is located opposite the San Diego Trolley’s Mission Valley Center Station. The mall is also accessible to thoroughfares such as I-8, I-805 and Highway 163. Lowe and Real Capital Solutions plan to redevelop their portion of the property into a walkable, transit-oriented, mixed-use village. Lowe will lead the redevelopment project. The team plans to refresh the existing retail and add complementary uses such as multifamily residential to the …

Dynamic Star to Break Ground on Phase I of Fordham Landing Mixed-Use Project in The Bronx

by Katie Sloan

NEW YORK CITY — Dynamic Star has released details for One Fordham Landing, a 350,000-square-foot office building located in the University Heights neighborhood of The Bronx in New York City. The building will be the first of a larger mixed-use development, Fordham Landing, which is valued at $3.5 billion, according to Crain’s New York Business. Located on West Fordham Road along the Harlem River, Fordham Landing will be developed in phases beginning with the segment Fordham Landing South. Alongside the recently announced office building, this initial phase will include 505 units of affordable and market-rate housing. The multifamily and office portions of the project will share a 20,000-square-foot amenity space featuring community gardening areas, a pickleball court, lap pool, basketball court and fitness center. Plans for Phase I also include a landscaped public waterfront esplanade overlooking the Harlem River. One Fordham Landing, which is scheduled for completion in 2025, will target medical and educational tenants. The building’s base will feature 28,000-square-foot floor plates with 18-foot ceiling heights, and the upper floors of the project will feature 10,000-square-foot floor plates. The development is also set to include a new entrance and pedestrian bridge to the adjacent North University Heights Metro station. …