JACKSONVILLE, FLA. — The NFL’s Jacksonville Jaguars have opened the Miller Electric Center, a $120 million practice facility in downtown Jacksonville. The 125,000-square-foot facility comprises an indoor practice field, offices, locker rooms, a draft room, shaded viewing area, concessions, team retail store and medical facilities. The Miller Electric Center is a public-private partnership between the Jaguars and the City of Jacksonville. The city also owns TIAA Bank Field, the Jaguars’ home stadium that is in the planning stages for a roughly $1 billion overhaul. The city and Jaguars owner Shad Khan would share the expense if they can reach an agreement on the stadium and accompanying extension of the team’s lease, according to The Florida Times-Union. The Jaguars organization plans to begin its training camp at the new practice facility Wednesday, July 26. The team hosted a ribbon-cutting ceremony for Miller Electric Center yesterday that featured Khan, along with newly inaugurated Jacksonville Mayor Donna Deegan, Jaguars president Mark Lamping and Jaguars head coach Doug Pederson, among others. Stadium of the Future In June, the Jaguars unveiled conceptual designs for its “Stadium of the Future,” a design project nearly three years in the making intended to spark a transformation of the city’s …

Top Stories

PMG, Greybrook Receive $226M Construction Loan for High-Rise Apartment Development in Fort Lauderdale

by John Nelson

FORT LAUDERDALE, FLA. — A partnership between PMG, a development and investment firm with offices in New York City and Miami, and Toronto-based private equity firm Greybrook has received a $226 million construction loan for a high-rise apartment tower in downtown Fort Lauderdale. Related Fund Management and Lubert-Adler provided the financing to the developers. Located at 140 S.W. 2nd St., the 42-story building represents Phase II of Society Las Olas, the first phase of which opened in May 2020 and sold in 2021. Phase I’s retail component, which spans 17,000 square feet, was sold separately to PMG and Greybrook in early 2022 for $17 million. Phase II of Society Las Olas will add 563 new luxury apartments to the local supply, as well as 1,652 square feet of ground-floor retail space. Units will comprise apartments with traditional rental arrangements as well as co-living/rent-by-bedroom options. Amenities will include a coworking lab with private meeting rooms, pool deck, yoga lawn and a modern fitness center. Residents will have access to a proprietary mobile app that will enable keyless entry and allow residents to manage guest lists, adjust smart thermostats, send notifications about packages, manage payments, request maintenance and register for community events. …

NEW YORK CITY — Locally based firm Extell Development Co. is underway on construction of a 435,000-square-foot medical office project at 1520 First Ave. on Manhattan’s Upper East Side. Designed by Perkins Eastman Architects, the 30-story building will occupy a full city block between East 79th and East 80th streets and house ambulatory care and surgical facilities. Foundation completion and vertical construction are scheduled to occur during the third quarter of this year, and full completion is slated for the second quarter of 2025. According to the development team, the facility will be the first privately built medical office tower to be developed on the Upper East Side. Additional building features will include multiple outdoor terraces and mechanical systems to enhance comfort and energy efficiency, as well as ground-floor retail space. The Hospital for Special Surgery (HSS) has preleased eight floors totaling 195,580 square feet to serve as the facility’s anchor tenant. Newmark has been tapped to lease the remainder of the space. HSS will house orthopedic and rheumatology physician’s offices, as well as ancillary services for treatment of musculoskeletal conditions. The space will complement the expansion of HSS’ main campus, which will house the newly announced Lauder Family Spine …

DEKALB, ILL. — The Kraft Heinz Co. plans to invest more than $400 million in an automated consumer packaged goods (CPG) distribution center in DeKalb, approximately 60 miles west of Chicago. The facility, which will be located along I-88 with national railway access, will total 775,000 square feet, making it one of the largest automatic distribution centers in North America, according to the company. The facility’s design includes a 24/7 automated storage and retrieval system, which will distribute more than 60 percent of Kraft Heinz’s foodservice products and approximately 30 percent of all dry goods. Kraft Heinz also expects the facility to contribute to the company’s broader environmental, social and governance (ESG) goals. More specifically, the company plans to implement sustainable technology to reduce the waste produced at the facility and minimize its overall environmental impact. Kraft Heinz says the plant will generate more than 150 jobs in the region. “As we continue on our journey to lead the future of food, our talented North America teams and collaborative external partners are innovating at a rapid pace to expand our supply chain capabilities,” says Carlos Abrams-Rivera, executive vice president and president of North America at Kraft Heinz. “The DeKalb distribution center …

Fisher Brothers Breaks Ground on 308-Unit Multifamily Project in Miami’s Wynwood Neighborhood

by Katie Sloan

MIAMI — Fisher Brothers has broken ground on Wynhouse Miami, a 308-unit multifamily community located at 2200 NW First Ave. in the Wynwood neighborhood of Miami. JP Morgan Chase and affiliates of Canyon Partners provided $117.5 million in financing for the development, which Suffolk Construction is building. The eight-story community is scheduled for completion in early 2025. Wynhouse Miami will offer units in studio, one- and two-bedroom configurations, alongside a selection of penthouse units. Shared amenities will include a fitness center, second-floor lawn area, co-working and entertainment lounges, an expo kitchen, and a rooftop swimming pool and outdoor entertainment space with views of the downtown Miami skyline. The property will also feature 26,000 square feet of ground-floor retail space and public artwork on the exterior of the community, with passageways to encourage pedestrians to engage with the building and community spaces. The development team for the project includes Rockwell Group, Nichols Architects and ID & Design International. “The project pays homage to the industrial, craft-oriented nature of the historic neighborhood,” says Andrew James, principal of Nichols Architects. “At the same time, the contemporary identity of Wynwood is being reinforced by the paseos, which will enhance the pedestrian realm, and the application …

PHILADELPHIA — Walker & Dunlop Inc. has arranged $40 million in limited partner equity and $135 million in construction financing for 5000 Richmond Street, a 750,000-square-foot, last-mile distribution facility in Philadelphia. The project will include two Class A buildings each with clear heights of 40 feet, a total of 112 loading dock doors, 206 trailer parking stalls and 759 car parking stalls. The site is within a Qualified Opportunity Zone and benefits from a long-term tax abatement from the city. The development will be situated six miles from Center City and offer immediate access to I-95, I-276 and I-476, which connect to New York City and Washington, D.C. Vacancy in the metro Philadelphia industrial market ticked up slightly in the first quarter to 4.4 percent, according to CBRE. But the market remains undersupplied, leading rents to gain upward momentum, states the brokerage. Aaron Appel, Jonathan Schwartz, Adam Schwartz, Keith Kurland, Mo Beler, Michael Diaz and Michael Ianno of Walker & Dunlop represented the borrower, DH Property Holdings LLC (DHPH). Barings provided the construction financing. “This multi-year effort began with our team sourcing limited partner capital to help DHPH acquire the land in the depths of COVID, and culminated in a …

Empire Group Obtains $88.5M Construction Financing for Build-to-Rent Residential Community in Phoenix

by John Nelson

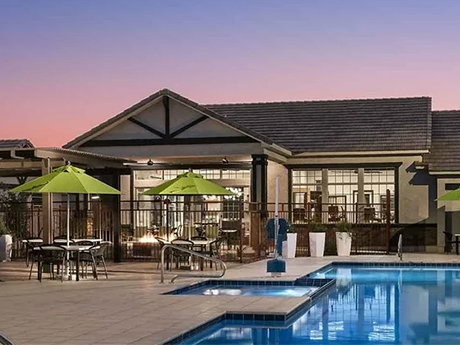

PHOENIX — Empire Group, a multifamily and commercial real estate development firm based in Scottsdale, Ariz., has obtained an $88.5 million construction loan for the development of Village at Bronco Trail. The 354-unit build-to-rent (BTR) community will be situated on a 30-acre site at 29th Avenue and Sonoran Desert Drive on the city’s north side. Empire Group expects to deliver the first swath of single-family homes at Village at Bronco Trail in 2024. Homes will average 920 square feet and amenities will include detached garages, a dog park, grilling area, resort-style pool, clubhouse and common area open spaces. Each home will have a private yard; kitchen with quartz countertops, stainless steel appliances and backsplashes; full-size washers and dryers; and upgraded smart-home features and technology. The property will be situated within two miles of the chip manufacturing plant for Taiwan Semiconductor Manufacturing Co., which is a $40 billion facility and a major economic demand driver for the North Phoenix residential market. Kyle McDonough and George Maravilla of Tower Capital arranged the financing on behalf of Empire Group. The direct lender was not disclosed, but the mortgage brokerage firm was able to secure multiple term sheets from lenders during due diligence. “The BTR …

NEW YORK CITY — A partnership between Gilbane Development Co., Hudson Cos. and MHANY Management Inc. has received $297 million in financing to develop the second phase of The Peninsula, a mixed-use project in the Hunts Point neighborhood of The Bronx. Construction of Phase II is scheduled to begin later this summer and to be complete in 2026. Phase II of The Peninsula will consist of 359 affordable housing units across two buildings, a 50,000-square-foot public plaza, open green space, a 155-space parking garage and a 20,000-square-foot community center. The site spans a full city block and formerly housed the Spofford Juvenile Detention Center. WXY Studios is the lead architect for the project. The majority (312) of the residences will be reserved for households earning 60 percent or less of the area median income, and the remainder will be set aside for renters that were formerly homeless. Units will come in studio, one-, two- and three-bedroom floor plans. Residential amenities will include a fitness center, children’s play area, tenant lounge and outdoor terraces. The development team is now accepting resident applications. Phase I of the development was completed in 2022 and comprises 183 affordable housing units, a 14,000-square-foot cultural arts …

PALATKA, FLA. — Saint-Gobain North America has announced plans to invest $235 million to expand manufacturing space at its CertainTeed gypsum facility in Palatka, near the Port of Jacksonville on the St. Johns River in northern Florida. The Palatka facility, which currently employs more than 150 people, began operations in 2001. According to Saint-Gobain, the facility is one of the largest gypsum plants in the Southeast. The firm’s expansion project received more than $7 million in cash benefits and high-impact investment tax credits, including a State of Florida Capital Investment Tax Credit, a Career Source Florida Quick Response Training Grant, a grant from Putnam County and a Clay Cooperative Economic Development Rate. According to Saint-Gobain, the expansion will more than double the production capacity of the existing manufacturing plant, as well as create more than 100 new jobs. The investment will be made over the next two years through the firm’s building products subsidiary, CertainTeed Interior Products Group. In line with Saint-Gobain’s goal for carbon neutrality by 2050, the firm plans for sustainability to be an essential aspect of the project. The development will include the installation of new energy-saving equipment and automation technologies, including an energy board dryer that …

DEBARY, FLA. — Mosaic Development LLC has purchased 13.1 acres of land in Debary, roughly 23 miles north of Orlando, for the development of the first phase of a mixed-use project to be located immediately north of the city’s SunRail station. Upon completion, the “Main Street-style” development will feature 500 apartment units, 40,000 square feet of retail space and a central park and community plaza. Construction on the project is scheduled to begin early next year. Mosaic purchased the land parcels, which are zoned as a transit-oriented development (TOD) district, from private landowners as well as the City of DeBary for a total $4.2 million. Mosaic is currently under contract to purchase an additional 5.7 acres within three years for the second phase of the development. Colliers worked to bring the private owners into a joint marketing agreement with the city. Ken Krasnow, Brooke Mosier and David Calcanis of Colliers represented the sellers, which included Miller Land Trust, Ray Sands/Frank Slabodnik, Empire Cattle and DeBary Central LLC, in addition to the city. Casey Babb of Colliers represented Mosaic in the transaction. “I envision a main street that serves as the vibrant heart of our community — a place where neighbors …