BOSTON — New York City-based real estate giant Tishman Speyer has received $750 million in construction financing for Phase I of Harvard Enterprise Research Campus, a 900,000-square-foot mixed-use project that will be located in the Allston neighborhood of Boston. Phase I of the development will consist of two life sciences buildings totaling 440,000 square feet, a 343-unit apartment complex and a hotel, all of which will be developed on a nine-acre parcel. Tishman Speyer is developing the project in partnership with the Harvard Allston Land Co. The site is adjacent to the Harvard Business School and Harvard Science & Engineering Complex in Allston. Breakthrough Properties, a joint venture of Tishman Speyer and Bellco Capital, will oversee the development, operations and leasing of the life sciences component. Tishman Speyer will also develop a conference facility on behalf of Harvard University. Within the multifamily component, 25 percent of the units will be designated as affordable housing for households earning between 30 and 100 percent of the area median income. At full build-out, Enterprise Research Campus will also include retail and restaurant space, as well as two acres of open green space that will host farmers markets, live music and outdoor fitness classes. …

Top Stories

KPG Funds Receives $50M Construction Loan for Boutique Office Project in Lower Manhattan’s SoHo District

by Jeff Shaw

NEW YORK CITY — KPG Funds has received a $50 million construction loan for 40 Crosby, a boutique office redevelopment project in the high-end SoHo district of Lower Manhattan. The five-story cast iron building totals 70,000 square feet, including prime retail space on the ground floor with Broadway frontage. KPG plans to rebrand the property as The Crosby upon completion. KPG bought the asset in early 2022 and immediately began planning the redevelopment. Sabal Investment Holdings and GDS Brightstar provided the construction loan. Nick Scribani, Dustin Stolly and Jordy Roeschlaub at Newmark arranged the financing. According to Rod Kritsberg, KPG’s co-founder and chief investment officer, the three-year construction loan will be used to give 40 Crosby a full-building renovation, keeping in line with KPG Funds’ standard to transform it into one of the “most desirable office and retail assets in the neighborhood.” Improvements will consist of a separate entrance on Crosby Street with high-end, pre-built office space and significant capital allocated to the lease-up of the specialty retail space fronting Broadway. The asset offers flexible floorplates to cater to multiple tenants or contiguous floors for a flagship headquarters location. The office space features up to 18-foot ceiling heights, 20 oversized windows bringing …

AWC, Nobu Hospitality to Develop 145-Room Luxury Hotel on Manhattan’s Upper East Side

by Katie Sloan

NEW YORK CITY — A partnership between Asset World Corp. (AWC) and Nobu Hospitality has announced plans for Plaza Athenee Nobu Hotel and Spa New York, a 145-room luxury hotel development on Manhattan’s Upper East Side. Located on 64th Street between Park and Madison avenues, the hotel will offer suites with indoor and outdoor glassed terraces. The property will also offer a townhouse rental option. Unique amenities include a traditional Japanese onsen or bathing facility, as well as a spa and wellness center. The projected development cost was undisclosed. Plaza Athenee Nobu Hotel and Spa New York will also feature a Nobu restaurant offering an omakase experience — a form of Japanese dining in which guests leave their order up to the chef. The hotel will also include a bar and lounge, and a rooftop area for private parties with a panoramic view of the New York City skyline. Scheduled for completion in 2026, AWC will oversee the overall development of the project, along with its conceptualization and design. The partnership has also announced plans for the development of The Plaza Athenee Nobu Hotel and Spa Bangkok in Thailand. Thailand-based AWC is a real estate group focused on the development of hospitality …

PRINCE GEORGE’S COUNTY, MD. — Turnbridge Equities and Manekin LLC have received $275 million in debt and equity financing for the development of Phase I of the National Capital Business Park (NCBP) in Prince George’s County, a suburb immediately east of Washington, D.C. The project will consist of five Class A industrial buildings totaling 1.3 million square feet. A fund managed by an affiliate of Apollo Global Management provided a $165 million construction loan. A joint venture of the Qatar Investment Authority and PCCP are providing roughly $110 million of equity. The buildings will range in size from roughly 160,000 to 360,000 square feet across 94 acres. Four of the buildings will be constructed on a speculative basis. Ferguson Enterprises, a plumbing, fire suppression and HVAC provider, will occupy a 358,400-square-foot facility. All of the properties will feature solar panels on the rooftops. At full build-out, NCBP will consist of up to 3.5 million square feet of Class A industrial space serving a variety of users, including distribution, logistics, light manufacturing, storage and cold storage. NCBP will also include an adjacent 20-acre park for the community and the onsite preservation of nearly 200 acres of stream valley and forest. Sitework …

OLIVE TOWNSHIP, IND. — A joint venture between General Motors Co. (NYSE: GM) and Samsung SDI, part of the South Korean-based Samsung Electronics group, plans to build a $3 billion electric vehicle (EV) battery plant in Olive Township. The duo plan to begin operations at the Northwest Indiana plant in 2026. The new facility will house production lines to build prismatic and cylindrical battery cells and is expected to help significantly increase the accessibility and affordability of GM’s line of EVs. Once complete, the plant will support about 1,700 full-time jobs, in addition to 1,000 construction jobs during the build-out. “We are grateful that Samsung SDI can contribute to boosting the economy of Indiana and creating new jobs here,” says Yoonho Choi, president and CEO of Samsung SDI. “Securing Indiana as a strong foothold together with GM, Samsung SDI will supply products featuring the highest level of safety and quality in a bid to help the U.S. move forward to an era of EVs.” GM and Samsung SDI announced their joint venture in April and ultimately selected Olive Township, a city in St. Joseph County near the Indiana-Michigan border and 15 miles west of South Bend, home of Notre Dame …

NEW YORK CITY — JLL has arranged $520 million in financing for Sackett Place & Society Brooklyn, a waterfront multifamily development located in Brooklyn’s Gowanus neighborhood. The financing includes a $335 million construction loan and $165 million in limited partnership equity. The borrower and developer is a joint venture between two New York City-based investment firms, Property Markets Group (PMG) and Carlyle. Sackett Place & Society Brooklyn will ultimately consist of two 21-story residential towers totaling 517 units and 10,000 square feet of retail space. The two towers are situated on the corner of Bond and Union streets overlooking the Gowanus Canal. An undisclosed number of units will be reserved as affordable housing as part of a rezoning initiative for permanent affordable housing in the Gowanus area. Construction is slated for a 2025 completion. Christopher Peck, Andrew Scandalios, Peter Rotchford, Nicco Lupo, Rob Hinckley, Jeff Julien and Jonathan Faxon of JLL arranged the debt and structured the equity partnership between PMG and Carlyle. The direct lender on the construction loan was not disclosed. “Developments with an affordable component continue to make sense to lenders seeking to deploy equity in a highly fractured market,” says Peck. “With its best-in-class sponsors and …

PEORIA AND GLENDALE, ARIZ. — Empire Group has received $120.5 million in financing for two build-to-rent (BTR) communities in the Phoenix metropolitan area. Kyle McDonough and George Maravilla of Tower Capital arranged the financing on both deals. Empire Group received $78.5 million in nonrecourse bridge financing for Village at Pioneer Park, a BTR community in the northwestern Phoenix suburb of Peoria. The bridge loan refinanced the project’s construction loan upon opening and allows Empire Group time to stabilize the asset prior to putting a permanent loan in place. Village at Pioneer Park was built in 2022 and offers 332 units averaging 921 square feet in size, as well as amenities including a clubhouse, pool, fitness center, pet wash station and dog park. Units come in one-, two- and three-bedroom floor plans, according to Apartments.com. The Scottsdale-based developer also received $42 million in nonrecourse construction financing for the Village at Skyline Ranch in Glendale. Located approximately 1.2 miles from Luke Air Force Base and related off-base housing, Village at Skyline Ranch is slated for delivery in 2024. The project will consist of 167 BTR units featuring one- and two-bedroom floor plans. Amenities will include walking paths, a dog park, clubhouse, fitness …

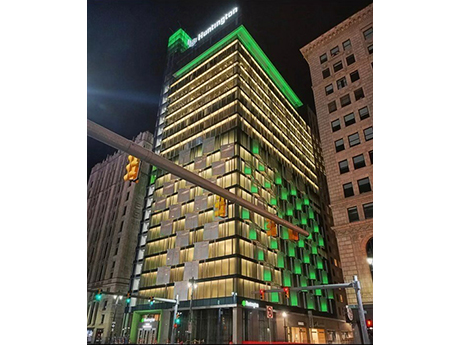

DETROIT — The Herrick Co. has acquired a 21-story office tower at 2025 Woodward Ave. in downtown Detroit for $150 million. Locally based architecture firm Neumann Smith designed the 421,481-square-foot building, which was delivered in fall 2022 and acts as a headquarters for Huntington National Bank’s (NASDAQ: HBAN) commercial division. The bank fully occupies the property on a triple-net-lease basis. The building features ground-floor retail space, including a Huntington Bank branch; 10 floors of structured parking; a cafe; and a rooftop terrace with space for movies or sporting events to be projected on the side of the tower. The deal is the largest building acquisition to close in Detroit since the start of the COVID-19 pandemic, according to Crain’s Detroit Business. The seller was not disclosed. Huntington acquired TCF Financial Corp. in 2020 for $22 billion. The combined company operates more than 1,000 branches in 11 states. The bank’s stock price closed at $11.42 per share on Wed. June 7, down from $13.10 one year ago. The Herrick Co. is a national real estate investment firm that has completed more than $6 billion in transactions. The company focuses on acquiring single-tenant buildings net leased to office, industrial and retail users, …

NASHVILLE, TENN. — Albion Residential has purchased land in Nashville with plans to build Albion Music Row, a two-tower luxury apartment project totaling 850 units. The first tower will rise 29 stories and 350 feet. Albion plans to begin construction prior to the end of the year on the 458-unit building, followed by the second tower, which will feature 392 units and rise 20 stories. Both buildings will offer retail and restaurant spaces on the ground floors. The centerpiece of the development will be a public green space that will feature art, a performance stage and a lawn designed for music uses. Albion Music Row will also feature an active recording studio. Albion Music Row will offer micro units at a lower price point in addition to studios, one-, two- and three-bedroom floor plans. There will also be duplex units. The site comprises five lots located at the southwest corner of the intersection of McGavock Street and 14th Avenue. Albion paid $31 million for the property. The project team includes Hartshorne Plunkard Architecture, civil engineer Barge Cauthen & Associates, landscape architect Hodgson Douglas, structural engineer SDL and MEP engineer I.C. Thomasson. Albion Residential is pursuing a LEED Silver designation for …

Ryman Hospitality to Acquire JW Marriott San Antonio Hill Country Resort from Blackstone REIT for $800M

by John Nelson

SAN ANTONIO — Ryman Hospitality Properties Inc. (NYSE: RHP) has entered into a definitive agreement with Blackstone Real Estate Income Trust Inc. (BREIT) to purchase the JW Marriott San Antonio Hill Country Resort for $800 million. The 640-acre resort opened in 2010 and includes 1,002 rooms and 268,000 square feet of indoor and outdoor meeting and event spaces. BREIT has owned the property since 2018. Ryman plans for the resort to continue to operate under the JW Marriott flag. The Nashville-based lodging and hospitality REIT now owns two of the largest group-oriented resorts in Texas, with the Gaylord Texan Resort & Convention Center in the Dallas suburb of Grapevine being the other. “We identified the JW Marriott Hill Country as an ideal acquisition target quite some time ago,” says Mark Fioravanti, president and CEO of Ryman Hospitality. “Located in an attractive and growing market with no emerging competitive supply, this beautiful resort is a natural complement to our existing Gaylord Hotels portfolio and offers significant opportunities to serve the group and leisure sides of our business.” “This sale, which generates approximately $275 million in profit over a five-year hold period through Covid, represents a terrific outcome for BREIT shareholders,” says Nadeem Meghji, head of Blackstone Real Estate …