MCDONOUGH, GA. — Global cold storage developer and owner NewCold has released plans for a $333 million facility in McDonough, a southern Atlanta suburb in Henry County. The developer says the project will create 170 new jobs upon completion. No construction timeline was disclosed. NewCold’s automated storage and distribution facility will be situated within Midland Industrial Park, which sits about one mile from the I-75 and Ga. Highway 155 interchange. Project manager Cameron Barnhill represented the Georgia Department of Economic Development’s Global Commerce team on the NewCold project in partnership with the Henry County Development Authority, the Georgia Department of Transportation, Georgia Quick Start, Norfolk Southern and Georgia Power. NewCold’s investment represents the largest single investment in the history of Henry County, according to Carlotta Harrell, chair of the Henry County Board of Commissioners. “This highly automated facility will bring additional high-skilled jobs while also increasing Henry County’s already strong portfolio of foreign direct investment,” says Irv Culpepper, chairman of the Henry County Development Authority. Georgia is a prominent hub for food logistics companies. The state currently has more than 189 million cubic square feet of cold storage space, according to the governor’s office. Founded in the Netherlands and with …

Top Stories

VERNON HILLS, ILL. – Dallas-based real estate firm Centennial has revealed plans to expand on its Hawthorn 2.0 redevelopment of Hawthorn Mall, a super-regional shopping center in Vernon Hills, a northern suburb of Chicago. Built in 1973, the mall currently houses over 120 retailers. Centennial first announced the redevelopment of Hawthorn Mall in 2019, which included new retail and dining options, luxury multifamily housing and indoor/outdoor gathering spaces. The expanded plans nearly triple the new development at the property and include 162 units of seniors housing, a 25,000-square-foot grocery store and 109,000 square feet of open-air retail. The center started its redevelopment with the 2020 unveiling of Center Park, a 15,190 square-foot outdoor space in the mall’s former Center Court. Center Park features both lawn games and soft furnishings. The expanded plan calls for the relocation of 250 apartments to create a larger outdoor public plaza to increase pedestrian access to the mall and a new main entrance for the shopping center. Hawthorn 2.0 will also create more retail, restaurant and entertainment space surrounding the exterior of the Hawthorn Row integrated streetscape. “The expansion of our Hawthorn 2.0 plans enhances the original vision we had for the center as a …

HOUSTON — Locally based investment and development firm Midway has unveiled plans for Watermark District at Woodcreek, a 70-acre mixed-use development that will be located at the site of the former ConocoPhillips headquarters campus in West Houston. Once completed, Watermark will house 650,000 square feet of Class A office space, with a focus on natural light and flexible floor plans. The development will also include retail and restaurant space and boutique hotels. Midway also plans to modernize the existing 100,000-square-foot wellness and fitness facility. Construction is scheduled to begin in the first half of 2023. Midway also intends to repurpose a portion of the site’s existing infrastructure, which includes 16 three-story office pavilions connected by bridges over ponds and grassy areas. Repurposing existing buildings contributes to Midway’s intention toward environmental sustainability in the project. To that end, the firm has partnered with 374Water to introduce an integrated wastewater management system to the development. Wastewater, along with food wastes, will be processed and recovered as clean water, energy and minerals. Plans for infrastructural upgrades also include a new urban grid system. Architect Kevin Roche designed the property in 1978 for Conoco with an aesthetic emulating that of a Japanese fishing village. …

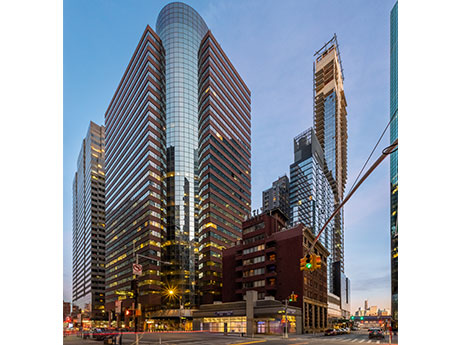

DUNWOODY, GA. — Dallas-based corporate development and investment firm KDC has acquired two office buildings totaling more than 1.6 million square feet in Park Center, a 17-acre master-planned, transit-oriented project in the northern Atlanta suburb of Dunwoody. Park Center Buildings 2 and 3 were acquired in a sale-leaseback deal with insurance giant State Farm, along with approximately 40,000 square feet of retail space, a parking structure with more than 4,000 parking spaces and a 2.6-acre parcel for future development. The price was not disclosed. Park Center Building 2 was completed in 2020 and comprises 621,000 square feet, including 39,000 square feet of retail space. Park Center Building 3 is a 440,000-square-foot office tower completed in 2021. KDC described the properties as “a state-of-the-arm, Class A office project.” KDC was the original developer of Park Center. The company purchased the property with its internal capitalization established with an investment by Cadillac Fairview in 2021, along with ongoing ownership and funding from KDC and Compatriot Capital. Northmarq’s Dallas debt and equity team, including Phillip Askew, Ronald Reese and Charlie Robinson, arranged financing for KDC’s acquisition through its life insurance company relationships. KDC has begun planning for future phases of Park Center. According …

Dermody Properties Completes Acquisition of Former Allstate Campus in Metro Chicago, Plans 3.2 MSF Industrial Campus

by Katie Sloan

GLENVIEW, ILL. — Dermody Properties has completed its acquisition of the 232-acre former corporate office campus of Allstate Corp. located on Sanders Road in Glenview, roughly 22 miles northwest of downtown Chicago. While the acquisition price was not disclosed, REBusinessOnline reported last year that the transaction would be valued at $232 million. Dermody plans to redevelop the property into a 10-building logistics park. The redevelopment, named The Logistics Campus, will span 3.2 million square feet upon completion, with flexibility to accommodate additional build-to-suit development. Construction on Phase I of the project is scheduled to begin immediately and will include five buildings totaling 1.2 million square feet. The initial phase of development is slated for completion in 2023. “This redevelopment project stands at the intersection of two significant and durable trends — work from home and e-commerce,” says Douglas Kiersey Jr., president of Dermody Properties. “The conversion of the office campus — with buildings dating back to the 1960s and 1970s — into modern logistics buildings offers many benefits to the community.” The site is located adjacent to Interstate 294 and southwest of the Willow Road interchange, which will allow for efficient access to O’Hare International Airport. The project benefits from …

CHARLOTTE, N.C. — Charlotte-based Extended Stay America has signed a development agreement with a partnership comprising Concord Hospitality and Whitman Peterson to build 15 new Extended Stay America Premier Suites hotels. The properties will be located in major markets throughout the West, including Denver, Phoenix, Las Vegas and Salt Lake City. Concord Hospitality is a hotel management and development company based in Raleigh, N.C., and will handle the development, branding and operations of the properties. Whitman Peterson is a private real estate equity company based in Westlake Village, Calif. The firm will provide equity, identify markets and assist with development. “Extended Stay America Premier Suites has a unique business model that will allow us to reach business and corporate extended-stay travelers looking for a higher level of amenities,” says Mark Laport, CEO and president of Concord. “This agreement is the first step in increasing our presence in the higher-end extended-stay segment.” The Extended Stay America Premier Suites brand comprises both new construction and renovated properties with upgraded amenities, including fully equipped kitchens, apartment-style layouts for working and dining, free in-room Wi-Fi, cable, onsite guest laundry, free breakfast and upgraded design elements such as larger TVs, increased storage space and a …

Tennessee Titans, Local Government Agree to Terms for New $2.1B Enclosed Stadium in Nashville

by John Nelson

NASHVILLE, TENN. — The NFL’s Tennessee Titans and the Metropolitan Government of Nashville and Davidson County (Metro) have agreed to terms to bring a new $2.1 billion football stadium to Nashville’s East Bank district. The enclosed stadium will span 1.7 million square feet and will be situated near the Cumberland River to the east of the Titans’ current arena, Nissan Stadium. The site for the new stadium currently comprises surface parking lots. Once complete, the project will represent the largest building project in the Metro’s history and will attract marquee events such as the Super Bowl and CMA Fest country music festival, according to ESPN. “When my father brought this team to Tennessee 25 years ago, I don’t think he could have imagined a better home for our organization,” says Titans controlling owner Amy Adams Strunk. “The way the people of Tennessee have embraced this team as their own is truly something special, and I am thrilled that with this new agreement, we will cement our future here in Nashville for another generation.” Funding for the new stadium comprises four categories, with football-related sources (i.e. the Titans, the National Football League and personal seat license sales) representing the largest source …

NEW YORK CITY — JLL has arranged the $252 million sale of the former AIG global headquarters to 99c LLC, a real estate firm specializing in adaptive reuse development in urban markets. The 31-story property is located at 175 Water St. in Lower Manhattan’s Seaport submarket and comprises 684,500 square feet of rentable space. Vanbarton Group was the seller. The purchase represents 99c’s entry into the New York market following a focus on London, where it acquired millions of square feet of commercial office space. The firm is currently one year into a four-year plan to do the same in New York. 175 Water St. features 12-foot ceilings, 24,000-square-foot floor plates, center-core configuration and an efficient design. The building’s flexibility also includes an unused ground floor, which is being primed for a reimagined lobby along with two usable rooftop terraces with amenities. The building is completely vacant, following AIG’s move to a new location in 2021. Andrew Scandalios, David Giancola, Vickram Jambu, Marion Jones, Steven Rutman and Alexander Riguardi led JLL’s capital markets investment sales advisory team representing the seller. “175 Water St. received a generous amount of investor interest given the nature of the building, which provided a blank canvas …

CINCINNATI AND BOISE, IDAHO — Kroger Co. (NYSE: KR) and Albertsons Cos. Inc. (NYSE: ACI) have agreed to a merger under which Kroger will acquire all outstanding shares of Albertsons’ common and preferred stock for an estimated total consideration of $34.10 per share, or a total enterprise value of approximately $24.6 billion. The deal includes the assumption of $4.7 billion of Albertsons’ net debt. Both companies’ boards of directors unanimously approved the agreement. The purchase price represents an approximately 32.8 percent premium to the closing price of ACI stock on Oct. 12, and 29.7 percent to the 30-day volume-weighted average price. The exact motivation for the merger was not stated in the press release, but The Wall Street Journal notes that by combining, the companies would have greater leverage in negotiations with vendors and compete better with companies such as Walmart and Amazon. Together, Boise-based Albertsons and Cincinnati-based Kroger currently operate a total of 4,996 stores, 66 distribution centers, 52 manufacturing plants, 3,972 pharmacies and 2,015 fuel centers. The two companies employ a combined 710,000 associates. On a combined basis, the companies delivered approximately $210 billion in revenue and $3.3 billion in net earnings in the fiscal year 2021. The …

Thompson Thrift Breaks Ground on 1 MSF Elliot Tech Center Mixed-Use Campus in Mesa, Arizona

by Katie Sloan

MESA, ARIZ. — Thompson Thrift has broken ground on Elliot Tech Center, a 1 million-square-foot industrial and retail campus located at the intersection of Elliot and Signal Butte roads within Mesa’s Elliot Road Technology Corridor. At full build-out, the project will span 75 acres and include eight industrial and retail buildings. The project is located northeast of Phoenix-Mesa Gateway Airport, north of Apple’s Global Command Center and east of Meta’s Mesa Data Center, which is currently under construction. Phase I of the development is scheduled for completion in fall 2023 and will include three industrial buildings ranging from 79,000 square feet to 89,000 square feet and five retail pads. The industrial buildings will feature secure truck courts, a variety of bay sizes and clear heights from 28 feet to 32 feet. Black Rock Coffee Bar and an unnamed convenience store are set to open within the retail portion of Phase I, and lease negotiations are currently underway for a 4,000-square-foot, full-service restaurant. Ken McQueen and Chris McClurg of Lee & Associates are handling leasing for the industrial portions of the development, and Phoenix Commercial Advisors is marketing the retail component. The design-build team for Phase I of the project includes Butler …