PHILADELPHIA — Josh Harris and David Blitzer, managing directors of the National Basketball Association’s Philadelphia 76ers, have formed a development corporation for construction of the team’s new arena, known as 76 Place, in Center City Philadelphia. Development costs are estimated at $1.3 billion, with plans to complete construction before the 2031-2032 NBA season. The property will be part of Fashion District Philadelphia, a 900,000-square-foot mall redevelopment that opened in September 2019. The team will partner closely with Macerich, which owns Fashion District, on the project. The transit-oriented site is located at Market Street and South 11th Street, adjacent to five SEPTA public transit lines and three blocks from city hall. The Fashion District project was once a highly regarded development with top-tier retailers, but struggled due to the COVID-19 pandemic closing the doors on many retailers just six months after opening. “The decision to repurpose part of Fashion District Philadelphia to include the new 76ers arena is a natural evolution of the site and a unique and once-in-a-lifetime opportunity for our company,” says Tom O’Hern, CEO of Macerich. Team owner Harris Blitzer Sports & Entertainment tapped local real estate magnate David Adelman, CEO of Campus Apartments, co-founder of FS Investments …

Top Stories

Good + West Secures Joint Venture Partner for $400M Build-for-Rent Pipeline Located Across Texas

by Katie Sloan

DALLAS AND AUSTIN, TEXAS — Good + West has partnered with a Dallas-based private equity fund for the development of four build-for-rent (BFR) projects in the state of Texas. Development costs are set to total $400 million. The communities will be built under the Austin, Texas-based development firm’s Perch banner over the course of the next four years. Heather McClure of Walker & Dunlop advised Good + West in identifying its joint venture partner for the projects. Perch communities offer a seres of single-family buildings with fenced-in yards and patios, alongside shared amenities including resort-style swimming pools, outdoor kitchens with gas grills, fire pits, game lawns, pet parks, fitness centers and landscaped courtyards. The company currently has $150 million worth of BFR development underway in the state of Texas, including the joint venture’s first project, Perch Denton. Located in the Dallas-Fort Worth suburb of Denton, the community is scheduled for delivery in 2023 and will offer 195 units. Additional Good + West BFR projects currently underway include Perch Chisolm Trail in Fort Worth and Perch Manor Downs, located outside Austin in Manor. Phase I of both projects are set for delivery in 2023 and 2024, respectively. The pace of development …

ATLANTA — KKR has acquired Atlantic Yards, a two-building office property located in Midtown Atlanta that is fully leased to Microsoft Corp. A joint venture between Hines and Invesco Real Estate sold the asset for an undisclosed price. Atlantic Yards spans 523,511 square feet across two Class A office buildings. The property, built in 2021, is located within Atlantic Station, a 12.5 million-square-foot mixed-use development. The Atlantic Station site was once the home of the Atlantic Steel Mill and rail yards. Designed for LEED Gold certification, Atlantic Yards features a number of outdoor areas, fitness facilities, bike storage and 861 parking spaces. Microsoft committed to Atlantic Yards in spring 2020 and its lease goes through 2035. The company expects to house roughly 1,500 to 2,000 employees at the facility. The Atlantic Yards office focuses on artificial intelligence and cloud-based services, and includes space for engaging directly with customers. “Atlanta is one of the fastest-growing technology hubs in the Sunbelt, thanks to its great academic institutions, diverse talent and long history of serving as home to leading Fortune 500 companies,” says Roger Morales, partner and head of real estate acquisitions in the Americas for KKR. “As one of the highest-quality properties …

Coors Family Begins $900M Mixed-Use Redevelopment of CoorsTek Headquarters Campus in Golden, Colorado

by John Nelson

GOLDEN, COLO. — The Coors family, a magnate responsible for Coors beer products, has begun Phase I of the mixed-use redevelopment of its CoorsTek Inc. campus in downtown Golden, just west of Denver. CoorsTek, formerly Coors Porcelain, was founded in 1910 at the multi-block site at Washington Avenue and 9th Street, which is the historical location of the invention of the aluminum beer can in 1959. The new global headquarters for CoorsTek will anchor the 1.3 million-square-foot project, which is the largest redevelopment in the history of downtown Golden. At full buildout, the development will feature new and adaptive reuse office space, multifamily residences, shops, restaurants and a hotel. The costs for the redevelopment weren’t disclosed, but the Denver Business Journal reports that the Coors family is investing $900 million in the project. AC Development, a master-planned community developer established by the Coors family in 2020, is overseeing construction. Owned by the Coors family since 1884, the site was in continuous use for industrial purposes for over 100 years, ceasing its operations earlier this year. CoorsTek is privately owned by the Coors family and is not part of Molson Coors Beverage Co. (NYSE: TAP), the producer of beer and seltzer …

NEW YORK CITY — MCR, a New York City-based hospitality development and investment firm, has received a $420 million loan to refinance a portfolio of 30 hotels totaling 3,792 rooms across 17 states. The majority of the properties are located in high-growth markets within states such as Florida, Utah, Nevada, Colorado, Texas and South Carolina. Locations range from leisure destinations such as the Hilton Garden Inn Orlando at SeaWorld to urban assets like the Courtyard by Marriott Milwaukee Downtown, as well as university-driven markets. The portfolio features eight different brands across the select-service and extended-stay segments of the market. These brands include Homewood Suites, Hampton Inn & Suites, Hilton Garden Inn, Home2 Suites, Residence Inn, Courtyard by Marriott, SpringHill Suites and TownePlace Suites. Wells Fargo led the consortium of lenders, including BMO Harris, Bank of America and Square Mile Capital, that provided the funds. Fried, Frank, Harris, Shriver & Jacobson LLP served as legal advisor to MCR on the transaction, and Eastdil Secured served as financial advisor. MCR’s in-house team manages the hotels, all of which have recently undergone capital improvements. Specific loan terms were not disclosed, but the debt was priced with an interest rate that was 3.73 percent …

DENVER — PepsiCo Beverages North America (PBNA), a subsidiary of food and beverage giant PepsiCo Inc. (NASDAQ: PEP), has acquired nearly 152 acres of land in Denver. The company plans to build a 1.2 million-square-foot manufacturing facility on the site, which will be its largest in the country. The project will be triple the size of Pepsi’s existing facility in Denver’s River North Art District, where the company has operated since the 1950s. The new plant is scheduled to open in 2023 and will produce a variety of the company’s name-brand beverages, such as Pepsi, Pepsi Zero Sugar, Gatorade, bubly, Rockstar, Propel and Muscle Milk. The site is located within the Denver High Point development area, a massive, 5 million-square-foot industrial park currently under construction approximately 18 miles east of downtown near Denver International Airport. The new Pepsi plant will be the company’s most sustainable yet, according to the company, with plans for 100 percent renewable electricity, best-in-class water efficiency and reduced virgin plastic use. The initiative is part of Pepsi’s “pep+” pledge to positively impact the planet. Pepsi says the new location will also create 250 new jobs, in addition to the 250 employees already working at the downtown …

MIAMI — Helm Equities has announced plans for Parterre 42, a $300 million office building that will occupy a full city block between NE 42nd and 43rd streets in Miami’s Design District. The 500,000-square-foot development will offer 80,000 square feet of functional outdoor space dispersed across each floor of the building with communal work tables, outdoor power and charging stations, and flexible furniture groupings. COOKFOX Architects designed the project. Additional amenities at the property, which features unobstructed views of Biscayne Bay and the downtown Miami skyline, will include an indoor-outdoor cafe, multi-level fitness center, bike and scooter storage, and valet parking alongside retail space. The project was designed to achieve LEED Gold and WELL Gold certifications with a dedicated outdoor air system and an all-electric HVAC system. “We worked with COOKFOX to turn the typical office building inside-out, incorporating massive amounts of functional outdoor space on every floor so that occupants of Parterre 42 feel like they are truly working in nature,” says Ayal Horovits, principal at Helm Equities. Paul Amrich, Neil King, Gordon Messinger and Camron Tallon of CBRE have been tapped to lease the project’s 320,000 square feet of office space. A timeline for construction was not announced. …

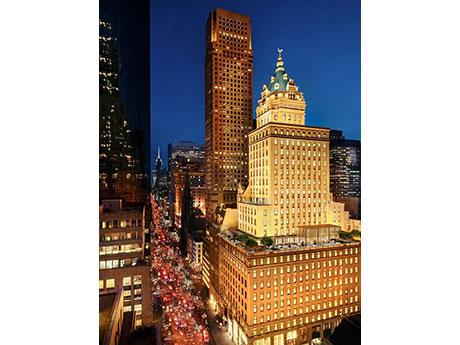

NEW YORK CITY — Walker & Dunlop Inc. has arranged $754 million in financing for Aman New York, a luxury hotel and condo development in Midtown Manhattan. Aman New York occupies the top 20 floors of the 100-year-old Crown Building at the corner of 57th Street and Fifth Avenue, across the street from Trump Tower. OKO Group was the developer. The 95,000-square-foot residential portion includes 22 units, while the 117,000-square-foot hotel section contains 83 guest rooms and suites. The rooms are among New York’s largest, and the hotel is the only one in New York to offer working fireplaces in each room. The lower floors of the building remain retail space. The hotel portion is scheduled to open on Tuesday, Aug. 2. Reservations will be available beginning Monday, July 25. The development is Aman’s first U.S. urban residence project and provides special features for owners such as private entrances, plus access to three dining venues, a jazz club, wine room and 25,000-square-foot Aman Spa. Nearly all of the condos are pre-sold, with one of the units selling for $55 million, marking one of the priciest residential transactions in New York so far this year. Originally built in 1921, the Crown …

BOSTON AND NEW YORK CITY — American Tower Corp. (NYSE: AMT), a multitenant communications REIT, has agreed to sell a 29 percent stake in its data center platform to Stonepeak, an alternative asset management firm based in New York City. The deal, which comprises common and preferred equity from Stonepeak’s affiliated investment vehicles and debt commitments, is valued at $2.5 billion. The AMT data center portfolio consists of 27 data centers in 10 U.S. markets. AMT purchased Denver-based CoreSite Realty Corp. in a $10.1 billion deal that was announced last November. AMT will retain managerial and operational control, as well as day-to-day oversight of its U.S. data center business, and Stonepeak will obtain certain governance rights. The transaction is expected to close in third-quarter 2022, subject to customary closing conditions. “We are pleased to partner with Stonepeak in our U.S. data center business,” says Tom Bartlett, president and CEO of American Tower. “While this transaction supports the equity financing component for our previously completed CoreSite acquisition, it also creates a platform through which growth opportunities can be strategically evaluated and financed.” Andrew Thomas, managing director and co-head of communications at Stonepeak, says that AMT’s data center platform aligns with Stonepeak’s …

BLOOMINGTON, MINN. — Cushman & Wakefield has arranged the sale of Normandale Lake Office Park, a 1.7 million-square-foot complex in the southern Minneapolis suburb of Bloomington. The price was not disclosed, but the property sold for $370 million when last it traded hands in 2014, according to the Star Tribune. David Knapp, Jeremiah Olsen, Tom O’Brien, Avery Ticer, Sam Maguire, Dan Phoel and Adam Spies of Cushman & Wakefield represented the seller, a partnership between insurance giants MetLife Investment Management and Allstate, in the transaction. The buyer was New York City-based Opal Holdings. Normandale Lake Office Park consists of five buildings that were developed between 1983 and 2009. The structures vary in height from 11 to 17 stories and range in size from 242,598 to 467,016 square feet. Amenities include a wellness center, fitness center with locker rooms, multiple conference rooms, heated executive parking structures and walking and biking trails. In addition, the development offers several services for tenants, such as a floral shop, childcare center, car wash and hair salon. Normandale Lake Office Park is also home to a fine dining restaurant, two casual dining concepts and a Caribou Coffee location. At the time of sale, the property was 91 …