ADDISON, TEXAS — AMLI Residential and Stream Realty Partners have been named master developers for a $472 million, 18-acre, mixed-use development in Addison, roughly 15 miles north of Dallas. The Town of Addison has been acquiring land for the project since the inception of the DART Light Rail system in 1983 with plans for a transit-oriented development. The project is centered on a DART Silver Line station currently under construction near Addison Circle Park, a 10-acre, master-planned public park. DART has partnered with the Town of Addison through a ground-lease structure that allows for the inclusion of both the train and bus stations in the development. Phase I of the project is set to include: A six-story, Class A office building with 150,000 square feet of leasable space and 9,000 square feet of ground-floor retail; a 13-story luxury multifamily community with 9,000 square feet of ground-floor retail space; a seven-story luxury multifamily building with 5,000 square feet of ground-floor retail space; a 650-stall parking structure with ground-floor retail; and a 45,000-square-foot entertainment complex operated by The HUB, a Texas-based creator of entertainment and restaurant venues with an emphasis on daily events and festivals. Cushman & Wakefield has represented the Town …

Top Stories

ROCHESTER, MINN. — CBRE Investment Management has acquired The Berkman, a 350-unit luxury apartment complex in Rochester, a city in Southeast Minnesota. The purchase price was $187.6 million, according to local media reports. The sellers were Kayne Anderson Real Estate and Alatus LLC. Located at 217 14th Ave. SW, The Berkman sits across the street from the Mayo Clinic’s Saint Marys Campus, which is the nation’s largest intensive care unit. The property is also less than one mile from the Mayo Clinic’s downtown campus. The community opened in 2020. The Berkman features several environmentally friendly components, including low-flow plumbing fixtures, efficient electric heat pumping technology and sustainable building materials. David Selznick, chief investment officer with Kayne Anderson, says the objective of the development was to provide an environmental, social and governance (ESG)-oriented community to support the Mayo Clinic’s staff, patients and overall Rochester resident base. “We believe that this asset’s proximity to the area’s elite base of education, research and world-renowned medical institutions, combined with strong demographic fundamentals, will position this property as a quality asset that will capitalize on durable demand from ‘eds and meds,’” says Benjamin Green, managing director of residential transactions at CBRE Investment Management. Community amenities …

NASHVILLE — California-based investment and development firm KBS has acquired UBS Tower, a 29-story office tower in downtown Nashville. The sales price was approximately $175 million, according to The Nashville Business Journal. Located at 315 Deaderick St., the 605,000-square-foot UBS Tower is the second-tallest office building in the city and occupies a full city block. The property was originally constructed in 1972 and has been renovated several times over the ensuing decades. The namesake tenant and investment banking firm renewed its 138,000-square-foot lease in 2021 and will serve as the building’s anchor tenant until 2034. The most recent capital improvement program delivered new and revamped amenity spaces, including the lobby, tenant lounge, coffee bar, fitness center and conference facilities. This project also upgraded the building’s mechanical systems. “With a population quickly approaching 2 million, Nashville is a vital business, tourism and transportation center,” says Marc DeLuca, CEO and Eastern regional president at KBS. “Nashville boasts a thriving economy that is predicted to see a 3.9 percent growth in employment in 2022. This activity creates numerous office-using jobs and significantly increases the rental growth and demand in the market.” According to CoStar Group, Nashville has approximately 80 percent more office-using jobs …

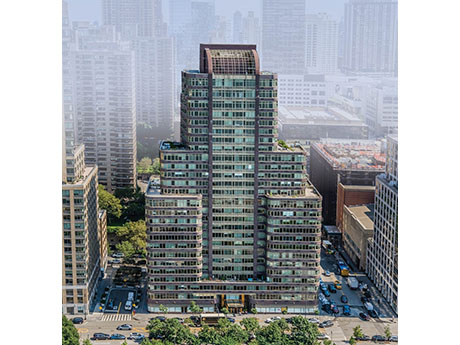

A&E Real Estate Acquires Apartment Tower in Manhattan from Equity Residential for $266M

by John Nelson

NEW YORK CITY — A&E Real Estate, a private multifamily investment and management firm based in New York City, has purchased 140 Riverside Boulevard, a luxury 354-unit apartment tower on the Upper West Side of Manhattan. Equity Residential (NYSE: EQR), a multifamily REIT based in Chicago, sold the 28-story community for $266 million. Darcy Stacom and Ryan Silber of CBRE represented Equity Residential in the sale. Built in 2002, the apartment tower features controlled access, a doorman, fitness center, interior courtyard, multiple tenant lounges, onsite management, package services, storage space and concierge services. The property is situated opposite Riverside Park South, a New York City park that fronts the Hudson River. Additionally, the community includes commercial space currently leased to New York Cat Hospital, a veterinarian’s clinic, and Dwight School, a private school catering to pre-K and kindergarten students. “140 Riverside Boulevard is a stand-out in the New York market, situated both waterfront and park-front with direct access to the Hudson River Park system,” says Stacom. “The property has been meticulously maintained and is truly excellent real estate — as this transaction validates.” Founded in 2011, A&E Real Estate began with the acquisition of a 49-unit apartment community in Brooklyn. …

GAINESVILLE, GA. — Farming and construction machinery producer Kubota North America Corp. has opened a 280-acre research and development (R&D) center in Gainesville, approximately 50 miles northeast of Atlanta. The firm invested more than $85 million to build the new facility. The center houses engineering offices, workshops and testing labs. Outside of the facility, there are tracks for testing turf, utility vehicles, tractors and construction equipment. Kubota is opening the facility with 70 engineering and technical employees and plans to grow to nearly 200 employees over the next five years. According to Phil Sutton, vice president for Kubota Manufacturing of America, the firm already employs more than 3,000 team members in the state of Georgia across manufacturing, sales, distribution and engineering operations. The new R&D center is fully powered by renewable energy and built on the sustainable principles. The center is powered in part by solar panels and the parking lot features a solar-powered roof to support electric vehicle charging stations. Kubota North America Corp. is the parent company for Grapevine, Texas-based Kubota Tractor Corp. and Gainesville-based Kubota Manufacturing of America. “This new R&D center here in Georgia is going to allow us to continue to innovate products and solution …

DALLAS AND COPPELL, TEXAS — Dave & Buster’s Entertainment Inc. (NASDAQ: PLAY) has agreed to acquire family entertainment concept Main Event for $835 million in an all-cash transaction. The seller is a joint venture between Ardent Leisure Group Limited and Red Bird Capital Partners, and the deal is expected to close later this year. Chris Morris, current CEO of Main Event, will serve as CEO of the combined entity upon closing. The move ends the search for a new Dave & Buster’s CEO, which has been ongoing for approximately seven months following the retirement of Brian Jenkins. The purchase price represents a valuation of approximately nine times Main Event’s 12-month adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) as of Dec. 31. Deutsche Bank Securities Inc., JPMorgan Chase Bank, N.A. and BMO Capital Markets Corp. are the joint lead arrangers and joint book-runners on the transaction. “From a strategic fit perspective, Main Event’s business model, footprint and asset quality aligns well with Dave & Buster’s,” says Kevin Sheehan, board chair and interim CEO of the Coppell-based buyer. “Main Event targets a different demographic — families with younger children — while Dave & Buster’s primarily targets young adults,” he continues. …

INDIANAPOLIS — KennMar has acquired The Pyramids office park in Indianapolis for an undisclosed price. New York City-based Sterling American Property Inc. was the seller, according to the Indianapolis Business Journal. Located at 3500 Depauw Blvd., The Pyramids consists of three 11-story office buildings totaling 366,704 square feet. KennMar acquired the landmark, pyramid-shaped property with assistance from INVST LLC, an SEC-registered investment advisor based in Indianapolis, and lender Teachers Credit Union. Indianapolis-based KennMar plans to renovate the property by upgrading the façade, enhancing interior common areas and adding some new external amenities. “While the pandemic has created uncertainty around the office market, we are bullish on the sector and anticipate that businesses will eventually return to an in-person work setting over the next several years,” says Brent Benge, president and CEO of KennMar. “We want to create an office environment that gets people excited about returning to work.” KennMar says the acquisition fits in well with its strategy to redevelop the site formerly occupied by Caribbean Cove, an indoor water park and hotel located on the same road as The Pyramids that closed in late 2017. KennMar currently has several projects underway on that site, including a freestanding Starbucks and …

BETHESDA, MD. AND COSTA MESA, CALIF. — Bethesda-based retail real estate owner First Washington Realty (FWR) has purchased Donahue Schriber Realty Group Inc., a shopping center owner based in Costa Mesa. An affiliate of FWR acquired the private retail REIT and its portfolio of grocery-anchored, open-air centers from institutional investors advised by J.P. Morgan Global Alternatives. The transaction adds 47 shopping centers, as well as one DSRG-owned office property, for a combined 6 million square feet to FWR’s holdings. The sales price was not disclosed, but Bloomberg reported in February that the negotiations for the deal valued DSRG and its assets at north of $3 billion. The news outlet also reports that the California Public Employees’ Retirement System (CalPERS) was an equity partner with FWR on the deal and that JPMorgan Asset Management and the New York State Teachers’ Retirement System (NYSTRS) were among DSRG’s largest investors. For FWR, the deal expands its presence on the West Coast, including in high-profile markets such as the Bay Area, Orange County, Seattle, Portland, San Diego and Sacramento. The deal also expands FWR’s corporate base on the West Coast, as its executive management team now oversees DSRG’s existing offices in Orange County, San …

BOULDER, COLO. — BioMed Realty, a San Diego-based owner-operator of healthcare real estate and a Blackstone portfolio company, has acquired Flatiron Park, a 1 million-square-foot office and life sciences campus in Boulder, a northwestern suburb of Denver. The sales price was not disclosed, but The Wall Street Journal reports that BioMed Realty paid more than $600 million for the property. JLL represented the seller, a joint venture between Crescent Real Estate, Goldman Sachs Asset Management and Lionstone Investments, in the transaction. BioMed Realty plans to invest about $200 million in capital improvements to the campus, an endeavor that is expected to create about 400 local construction jobs. Flatiron Park consists of 22 buildings that were approximately 90 percent leased at the time of sale. The buildings range in size from approximately 15,000 to 133,000 square feet. BioMed officials say that the campus will “anchor” its presence in the greater Denver area, which the company says has an exceptionally talented workforce “Boulder has always been a market to watch, driven by highly educated talent, robust capital flow, an existing base of life sciences and tech pioneers and great quality of life,” says Mike Ruhl, vice president of leasing at BioMed Realty. …

AUSTIN, TEXAS — Carr Properties has broken ground on Block 16, a 43-story office tower in Austin. Carr Properties has chosen Austin-based Manifold Development as its local partner for the project. Block 16 will offer over 738,000 square feet of space. Building amenities will include a fitness facility, multiple meeting areas and food and beverage offerings. The development cost was not disclosed. Designed by Gensler, each floor will offer 10-foot, floor-to-ceiling windows and a virtually column-free workplace. Additionally, Carr Properties is planning to implement improved indoor air quality measures in order to maximize the health and wellness of the customers in the building. “I think we have a real opportunity to deliver a project of world-class design with incredible amenities that best meets the needs of today’s ever-changing work environment,” says Tyler Grooms, the president of Manifold. Located in downtown Austin, Block 16 is situated at the intersection of San Jacinto Boulevard, Trinity and Second streets. The project will offer easy access to the Central Business District, the Rainey Entertainment District and Lady Bird Lake Hike & Bike Trail. Block 16 is also close to the Austin Convention Center and the city’s future rail station. The project is currently available …