JERSEY CITY, N.J. — Walker & Dunlop has arranged an $85.4 million bridge loan for the refinancing of City Line East and City Line West, two adjacent apartment complexes totaling 342 units in Jersey City. Both properties are located within the University Place mixed-use development and feature studio, one- and two-bedroom units and Class A amenities. John Banas, Kris Wood, Christopher Philipps, John Wilson, Rhett Saltiel and Erik DiGirolamo of Walker & Dunlop arranged the two-year, fixed-rate loan through an undisclosed debt fund on behalf of the New Jersey-based borrower.

Walker & Dunlop

AcquisitionsCaliforniaContent PartnerDevelopmentFeaturesLeasing ActivityMultifamilyWalker & DunlopWestern

LA Multifamily Investment Deals See Volume Normalization, Pricing Resets for Select Assets

Multifamily investment transaction volume had an unprecedented year in 2021, and the first six months of 2022 were quite robust. Now, economic uncertainty in the form of rising interest rates and a cooling economy has created some hesitancy on the part of investors. “Some normalization is occurring in the market now, in addition to a pullback because of what is going on in the capital markets and economy,” says Paul Darrow, a managing director of Walker & Dunlop’s investment sales team based out of Los Angeles. Walker & Dunlop is one of the largest providers of capital to commercial real estate industry in the United States. Darrow sat down with REBusinessOnline to talk about multifamily investment sales trends in the Los Angeles area and the opportunities he sees for investors down the road. REBusiness: Investor interests have shifted in the past few months. What kinds of properties are investors most interested in now? Darrow: It’s a mixed bag when it comes to investor appetite. Those who raised money to buy specific types of buildings are obviously guided by what they’ve promised their investors in the form of return profiles and risk. Core funds, for example, can’t just switch to value-add or …

ILLINOIS — Walker & Dunlop Inc. has structured $57.6 million in HUD-insured loans for the refinancing of three skilled nursing facilities in Illinois. Joshua Rosen of Walker & Dunlop led the origination team. The first transaction consisted of a $15.6 million loan for Avantara Park Ridge, a 154-bed community in Park Ridge. Walker & Dunlop also arranged a $28.7 million loan for Moraine Court Supportive Living, a 185-bed community in Bridgeview, and a $13.3 million loan for Aperion Care Elgin, a 101-bed property in Elgin. The borrower was undisclosed.

Content PartnerFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

How to Maintain Multifamily Investment Momentum in the Face of Rising Interest Rates

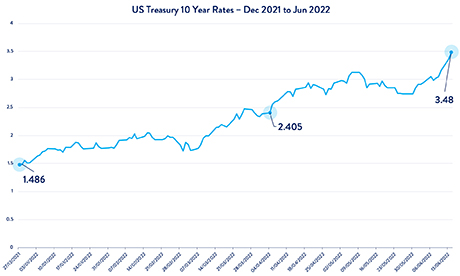

By Melissa Jahnke, associate director of operations, Walker & Dunlop The Federal Reserve raised interest rates by 75 basis points in June and then another 75 basis points in July, sending shockwaves across the commercial real estate industry. Fortunately, there are opportunities and solutions to bypass these potential roadblocks. Specifically, investors in a segment of multifamily housing known as small balance lending (SBL), encompassing five- to 150-unit properties, have several options to realize their aspirations for financing multifamily portfolios. View a higher resolution version of the timeline above here. During a recent webcast “Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans,” Walker & Dunlop’s market experts spoke about navigating today’s financing landscape. The expert panel included Allison Williams, senior vice president and chief production officer; Allison Herrera, senior director of SBL; and Tim Cotter, director of capital markets. These experienced professionals have found ways to make deals happen in a wide variety of financing environments and have shared their perspectives and guidance. If you are an owner of five- to 150-unit properties that require loans between $1 million to $15 million, the following will help you navigate today’s financial environment and build your momentum. Step 1: Consider the …

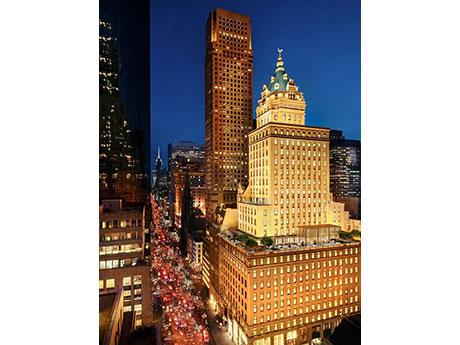

NEW YORK CITY — Walker & Dunlop Inc. has arranged $754 million in financing for Aman New York, a luxury hotel and condo development in Midtown Manhattan. Aman New York occupies the top 20 floors of the 100-year-old Crown Building at the corner of 57th Street and Fifth Avenue, across the street from Trump Tower. OKO Group was the developer. The 95,000-square-foot residential portion includes 22 units, while the 117,000-square-foot hotel section contains 83 guest rooms and suites. The rooms are among New York’s largest, and the hotel is the only one in New York to offer working fireplaces in each room. The lower floors of the building remain retail space. The hotel portion is scheduled to open on Tuesday, Aug. 2. Reservations will be available beginning Monday, July 25. The development is Aman’s first U.S. urban residence project and provides special features for owners such as private entrances, plus access to three dining venues, a jazz club, wine room and 25,000-square-foot Aman Spa. Nearly all of the condos are pre-sold, with one of the units selling for $55 million, marking one of the priciest residential transactions in New York so far this year. Originally built in 1921, the Crown …

Last year, a city known more for music than multifamily development led the nation in new construction growth rates, with luxury high rises popping up from downtown to the Gulch to along the Cumberland River. Nashville, attracting an abundance of debt and equity funding from sources old and new, is now considered an institutional-grade market. The driving force behind this growth: technology. Today, singers, songwriters and studio artists share the city with a growing number of software developers, systems architects and startup founders — and all of these innovators need a place to live, work, shop and play. Nashville’s tech evolution started from a solid foundation in healthcare, automotive and education, including HCA Healthcare and its associated startups, spinoffs and subsidiaries and an automotive hub that includes North American headquarters for Nissan and Korean tire manufacturer Hankook, as well as EV and battery cell manufacturing plants for GM. Twenty nine institutions of higher education, including Vanderbilt University, further helped develop a strong pipeline of tech talent. This ecosystem and a business-friendly climate have attracted some of the nation’s top tech employers: Amazon, who chose the metropolitan area for its much-coveted Center of Excellence; Oracle, relocating from Austin; and Capgemini, whose …

Content PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

Walker & Dunlop: Spring Multifamily Market Contends with Inflation, Housing Bubble Fears

By Walker & Dunlop’s Research Department Inflation and a New Era of Monetary Tightening Amid 40-year high inflation rates, home prices that have surged by over 40 percent in the past three years and double-digit price increases in basic necessities such as food, gas and electricity, the United States seems to be beset on all sides. Inflation has become the question of the day with little relief even after monetary tightening began earlier in the year. After a quarter point increase in the Federal Reserve target rate in March, the Fed implemented a whopping 50 basis point increase in the target Federal Funds rate in May after April inflation remained at 8.2 percent, near the March high of 8.6 percent.[1] The central bank’s goal is to reduce inflation to an annual rate of approximately 2 percent. The employment base, the Fed’s other prime objective, seems to remain strong. Unemployment (at 3.6 percent in April) remains low and employment growth of 390,000 in May beat economist expectations. The Fed’s job now is to beat inflation and prevent it from becoming embedded in consumer expectations. Why? Because once inflation becomes embedded in expectations, it changes consumer behavior and becomes somewhat of a …

Capitalizing on a changing marketplace and employing technology to streamline processes are essential strategies in helping small balance clients meet their goals. Ana Ramos, managing director and regional production head at Walker & Dunlop, emphasizes the importance of speed, creativity and using technology to assist in mortgage lending processes. She also emphasizes the centrality of teamwork, company ethos and technology to put a big emphasis on small balance loans. Walker & Dunlop defines “small loan” as up to $15 million for multifamily properties with five or more units. These clients are usually composed of smaller individual investors who need attention and education when it comes to mortgage lending. “It’s really hard for a large producer to think small, but it’s really easy for small producer to think big,” Ramos says. “It’s difficult for producers who are accustomed to institutional lending, with its higher fees and complex vesting structures to consider the credit parameters that are necessary in small balance loans. Small loans is a niche type of mortgage lending, and it only works if you have a company within a company, like Walker & Dunlop with its dedicated small loan team that works together through application, underwriting and closing.” Tech’s …

COLUMBUS, OHIO — Walker & Dunlop Inc. has arranged $59.8 million in debt and equity financing for the construction of Green|House, an apartment project in the Short North Arts District of Columbus. The seven-story development will feature 158 units and 3,700 square feet of retail space. Amenities will include a fitness center, outdoor pool, spa, sauna and community room. The project is the adaptive reuse of an existing building. Kaufman Development is the developer. Jeff Morris, Chad Kiner and A.J. Mangan of Walker & Dunlop arranged the debt through a regional bank and secured a national insurance company as the equity partner. The loan features a fixed interest rate and a three-year term.

As the pandemic recedes, unusual supply and demand trends have taken root in retail and industrial markets throughout the nation. Factors that caused upheaval even before the arrival of COVID — the changing face of retail due to e-commerce and the growing demand for industrial real estate — continue unabated two years past the pandemic lockdowns. Los Angeles County may act as a bellwether for the rest of the country in retail and industrial trends, especially in high-cost, high-density areas, where these two real estate types often compete for space. Bayard (By) Cartmell, senior director at Walker & Dunlop, Los Angeles, has extensive experience with commercial real estate in the Los Angeles area. He has seen unprecedented demand for industrial space and growing investor interest in retail cap rates in the Los Angeles area. Cartmell sat down with REBusinessOnline to talk about the outlook for industrial and retail in Los Angeles, their intersections and the sector trends he expects to see in the coming year. Los Angeles Industrial — High Demand REBusiness: What are you seeing in terms of demand for industrial space — particularly in Los Angeles? Cartmell: There is currently almost unlimited demand for industrial space, of any size, …