SALT LAKE CITY — CRG and Utah-based Cole West have broken ground on Chapter Salt Lake City, a six-story student housing community at 410 S. 900 East in Salt Lake City. LJC, an integrated architecture and engineering firm of CRG, designed the community. Situated near the University of Utah, Chapter Salt Lake City will feature 251 studio, one-, two- and four-bedroom fully furnished units, totaling 693 beds. Shared amenities will include a fitness center with Pilates studio, a sauna, ski simulator, library and study spaces, a soda shop, rooftop lounge and rooftop pool and hot tub. Construction is underway, with delivery slated for summer 2028.

Western

IPA Capital Markets Arranges $44M in Financing for Two Apartment Properties in Los Angeles

by Amy Works

LOS ANGELES — IPA Capital Markets, a division of Marcus & Millichap, has arranged $44 million in financing for two multifamily communities in Los Angeles. Moderno Axis, located at 7650 Van Nuys Blvd. in the city’s Van Nuys neighborhood, received $28.3 million in financing. Moderno La Granada Hills, at 17454 Chatsworth St. in the Granada Hills neighborhood, received $15.7 million in financing. Anita Paryani-Rice of IPA Capital Markets secured the financing with a national bank on behalf of the private client. The five-year, fixed-rate, nonrecourse loans were structured with full-term interest-only payments, step-down prepay and no lender origination fees. Situated next to Van Nuys MetroLink and Amtrak Station, Moderno Axis offers 126 studio, one- and two-bedroom units. Community amenities include in-unit laundry, a fitness center, swimming pool, hot tub, bike storage, fire pits, a barbecue area, dog park and an onsite pet grooming spa. Located near California State University Northridge, Moderno La Granada Hills features 54 studio, one- and two-bedroom apartments with in-unit laundry and central air and heating. Onsite community amenities include a fitness center, pool with hot tub and sundeck, a dog park and onsite pet grooming, recreation room with media and gaming, a media theater, fire pit …

MONUMENT, COLO. — Inland Real Estate Acquisitions has negotiated and closed the purchase of Jackson Creek Senior Living, a 132-unit seniors housing property in Monument, approximately 20 miles north of Colorado Springs. Mark Cosenza of Inland Acquisitions, with assistance from Brett Smith of The Inland Real Estate Group, Law Department, completed the transaction. Constructed in 2017 at 16601 Jackson Creek Parkway, Jackson Creek features 27 independent living, 75 assisted living and 30 memory care units. The community also features a collective dining room with chef-prepared meals, a bistro, library, fitness center, salon, movie theater, complimentary transportation, daily resident safety checks and 24-hour concierge service. Additionally, the property is located 1.5 miles from the Tri-Lakes Health Pavilion and nine miles from UCHealth Memorial Hospital in Colorado Springs. Dial Senior Living will manage the property, which has maintained an average occupancy of 96 percent over the last year.

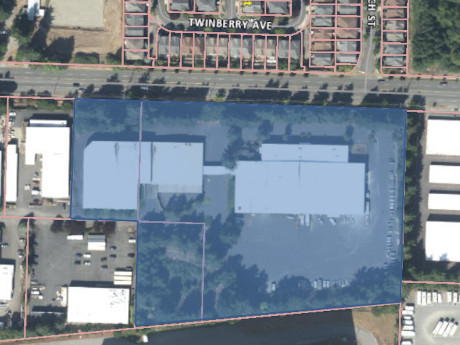

Tacoma Public Schools Acquires Two-Building Industrial Property in Washington for $12.1M

by Amy Works

TACOMA, WASH. — Tacoma Public Schools (TPS) has purchased a two-building industrial property in Tacoma from Broadstone Cable LLC for $12.1 million. Located at 4401 S. Orchard St. on 6.1 acres, the asset offers 86,000 square feet of industrial space. The buyer plans to use the property for its construction and operational plans. Vladimir Olyanich and Bob Frederickson of Coldwell Banker Commercial Danforth managed the transaction for TPS.

Eagle Partners Buys 551-Unit, Age-Restricted Apartment Portfolio in Escondido, California for $162.5M

by Amy Works

ESCONDIDO, CALIF. — Eagle Partners has acquired an affordable housing preservation portfolio in Escondido for $162.5 million in an off-market transaction. Totaling 551 units, the portfolio includes The Hendrix Apartments and The Hadley Apartments. The adjacent communities offer one- and two-bedroom residences serving the senior demographic (55+) in North San Diego County. Eagle Partners will implement a long-term affordable preservation strategy while executing a targeted capital improvement program designed to enhance the resident experience. Community amenities include resort-style swimming pools, fitness centers, landscaped common areas, a fenced dog park and covered parking. The buyer partnered with Red Stone Equity Partners, JPMorgan Chase, The California Statewide Communities Development Authority and Affordable Housing Access to execute the transaction.

USA Properties Fund Completes 147-Unit Affordable Housing Development in La Mesa, California

by Amy Works

LA MESA, CALIF. — USA Properties Fund has completed 8181 Allison, an affordable multifamily community in La Mesa’s Downtown Village. Located at 8181 Allison Ave., the five-story development offers 147 one- and two-bedroom units with energy-efficient appliances, ceiling fans, wood-plank flooring and either a balcony or patio. The apartments are designated for households earning 30 percent to 70 percent of the area median income for San Diego County. Community amenities include a community room with a kitchen, fitness center, courtyard with barbecues, a rooftop deck, hot tub, onsite laundry and a dog wash. Additional amenities include a 108-space parking garage with two electric vehicle charging stations, as well as a range of social services for residents, including budget and financial planning to health-related talks from LifeSTEPS. The community was approved for the California Housing Finance Agency (CalHFA)’s Mixed-Income Program. A public-private partnership with the City of La Mesa, CalHFA, WNC Inc. and KeyBank financed the $71.4 million development.

TEMPE, ARIZ. — ViaWest Group and Walton Street Capital have completed the disposition of Farmer Industrial Center, a two-building industrial park in Tempe. Speed Bay acquired the asset, located at 9185 and 9245 S. Farmer Ave., for $24.5 million. Totaling 93,903 square feet, the property features a clear height of 20 feet, six dock-high and 13 grade-level doors, with additional capacity through two punch-outs, wet-pipe sprinkler systems and ample parking at 2.6 spaces per 1,000 square feet. At the time of sale, the property was 94.1 percent leased to seven tenants, including aerospace, third-party logistics, home improvement services and electrical testing industries. Ben Geelan, Greer Oliver, Bryce Beecher and Gigi Martin of JLL Capital Markets represented the seller in the deal.

Jamboree Opens 32-Unit Larkin Place Affordable Housing Property in Claremont, California

by Amy Works

CLAREMONT, CALIF. — Jamboree Housing Corp. has opened Larkin Place, an affordable multifamily property in Claremont. Located at 731 Harrison Ave., Larkin Place offers 32 apartments designed to address the critical need for affordable housing for those experiencing chronic homelessness. Residents will have direct access to essential services, including case management, therapy, crisis counseling, peer groups and support coordinators that can connect residents to other resources that will help them rebuild their lives. The four-story Larkin Place features outdoor spaces, including a deck, dog run and barbecue area, along with private offices for supportive services and case management. The community is supported by a 24-hour emergency response team and onsite management staff. Services are provided by Jamboree and Tri-City Mental Health Center. Larkin Place is financed through a mix of public and private entities, including the Los Angeles County Development Authority (LACDA), which provided 32 PBVs sourced from the U.S. Department of Housing and Urban Development and $4.7 million via a permanent loan. Stakeholders of the project include Jamboree, San Gabriel Valley Regional Housing Trust, LACDA, U.S. Bancorp Impact Finance, Century Housing Corp. and Federal Home Loan Bank of San Francisco.

Granite Capital Group Divests of 105-Unit Multifamily Property in Fort Collins, Colorado

by Amy Works

FORT COLLINS, COLO. — California-based Granite Capital Group has sold Enclave Rigden Farm, a multifamily property in Fort Collins, to Avanti Residential for $40.8 million, or $389,285 per unit. Located at 2758 Iowa Drive, Enclave Ridge Farm features 105 townhome-style apartments with direct access to car garages and private patios. Built in 2007, the property was 95 percent occupied at the time of sale. Robert Bratley, Jack Sanders, Mike Grippi and Pamela Koster of Berkadia represented the seller in the transaction. The Berkadia team also arranged financing for the deal.

Sweet Creek Capital to Develop 70-Unit Rental Townhome Community in Castle Pines, Colorado

by Amy Works

CASTLE PINES, COLO. — Sweet Creek Capital, a newly launched Denver-based real estate investment and development firm, is developing The Peaks at Canyons, a rental townhome property in Castle Pines. The project is being developed in partnership with Oakwood Homes, with construction financing provided by FirstBank, now part of PNC. Slated for completion in late 2027, the community will feature 40 three-bedroom and 30 four-bedroom residences, each with 3.5 bathrooms and a private attached two-car garage. Ranging from 1,410 square feet to 1,760 square feet, the townhomes will feature modern architecture, quartz countertops, vinyl plank flooring, smart home technology, stainless steel appliances and nine-foot ceilings. Community amenities will include The Exchange Coffee House and The Canyon House Kitchen + Cocktails, two community-focused gathering spots providing dining, social space and year-round programming. The project is located within The Canyons master-planned community at the intersection of Canyonside Boulevard and Canyon Forge Drive.

Newer Posts