SCOTTSDALE, ARIZ. — JLL Hotels & Hospitality has arranged the sale and financing of Home2 Suites by Hilton North Scottsdale located at 20001 N. Scottsdale Road in Scottsdale. Terms of the transaction were not released. Built in December 2022, the hotel features 130 guest rooms, a fitness center, outdoor pool, complimentary high-speed Wi-Fi, business center, electric vehicle charging, pet-friendly accommodations and 500 square feet of flexible meeting space. The guest rooms offer separate living and sleeping areas, functional living space, in-room flat-screen TVs and high-speed internet access. Ketan Patel and Melvin Chu of JLL’s investment sales and advisory team represented the seller, while Adrienne Andrews spearheaded the JLL debt advisory team that procured acquisition financing for the buyer from a regional credit union.

Arizona

PHOENIX — PSRS has arranged $12 million in refinancing for an industrial warehouse on 29th Drive in Phoenix. The property is a multi-tenant facility totaling more than 250,000 square feet. Jacob Lee and Thomas Rudinsky of PSRS secured the non-recourse, fixed-rate, five-year loan, which features a step-down prepayment. A correspondent life insurance company provided the funds.

PHOENIX — Marcus & Millichap has arranged the sale of Brio 14, an apartment community in Phoenix. The asset traded for $3.8 million. Located at 2950 N. 29th Place in Phoenix, Brio 14 offers six one-bedroom/one-bath units and eight two-bedroom/two-bath units, averaging 667 square feet. The community was built in 2022. Paul Bay, Adam Saylor and Darrell Moffitt of Marcus & Millichap represented the undisclosed buyer and seller in the deal.

MESA, ARIZ. — Orion Investment Real Estate has arranged the acquisition of a neighborhood retail center in Mesa. Superstition Marketplace LLC sold the asset to Electric Ave. LLC for $11.6 million, or $211 per square foot. Nick Miner of Orion represented the buyer, while the seller was self-represented in the off-market transaction.

PHOENIX — CBRE has arranged the sale of The Blake, a multifamily community currently under development in Phoenix. A venture between StreetLights Residential and an affiliate of RED Development sold the asset to a venture between RXR and Korman Communities for an undisclosed price. Slated for completion in early 2025, The Blake will offer 400 apartments featuring 10-foot ceilings with coves in the living rooms; wood-style flooring in living areas and bedrooms; tile flooring in bathrooms; both granite and quartz countertop design options in bathrooms; walk-in closets; washers/dryers; energy-efficient stainless steel appliances; custom cabinetry and hardware; and Sonos speaker systems in all units. Community amenities will include a clubhouse with library, dining room, coffee bar, conference rooms, co-working stations and TV seating areas. The private resident bar includes a roll-up window leading to outdoor seating around a resort-style pool and spa area with cabanas, fire features, televisions, barbecue grills and dining areas. The Blake is part of the mixed-use project being developed on the former Paradise Valley Mall site. Matt Pesch, Asher Gunter, Sean Cunningham and Austin Groen of CBRE represented the sellers in the transaction.

Subtext Plans 769-Bed VERVE Tempe Student Housing Project Near Arizona State University

by Amy Works

TEMPE, ARIZ. — Subtext has announced plans for VERVE Tempe, a high-rise student housing community at 1011 E. Orange St. in Tempe. Slated for delivery in fall 2026, the 15-story property is within walking distance of the Arizona State University campus. Totaling 479,388 square feet, VERVE Tempe will feature 240 units in a mix of studio, one-, two-, three- and four-bedroom layouts, totaling 769 beds. VERVE Tempe will also offer 2,030 square feet of street-level retail space; a coffee bar with hot and nitro options; dedicated study space with booths, pods and collaboration rooms; a game room with simulators; rooftop pool deck; and a two-story fitness and wellness center with spa, sauna and yoga studio. Project partners include ESG Architecture & Design as architect and interior designer and Brinkmann Constructors as general contractor. Kennedy Wilson is providing an undisclosed amount of construction financing for the development.

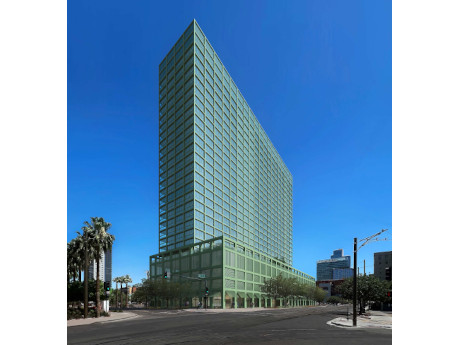

PHOENIX — JLL Capital Markets has arranged $120 million in construction financing for the development of Ray Phoenix, a 26-story residential building in downtown Phoenix. Michael Gigliotti, Brad Miner and Frank Choumas of JLL Capital Markets Debt Advisory secured the financing for the borrower, VeLa Development Partners and Ray, through an affiliate of RXR Realty Investments LLC. Located at 777 N. Central Ave., Ray Phoenix will offer 401 studio, one- and two-bedroom apartments, including duplex and penthouse units with floor-to-ceiling windows, custom cabinetry and luxury flooring and bathroom tiles. The property will feature 20,000 square feet of amenity space, including a large fitness center, yoga studio, resort-style pool, communal kitchen, fireplace lounge, sunken lounge with theater experience, dog wash stations, indoor and outdoor gardens, and workspaces. Situated within an Opportunity Zone, Ray Phoenix will be located on the Phoenix light-rail line and less than a mile north of the Footprint Center and Chase Field.

Formation Interests, Crescent Real Estate Break Ground on 427,000 SF Formation Park Industrial Project in Goodyear, Arizona

by Amy Works

GOODYEAR, ARIZ. — Dallas-based Formation Interests and Crescent Real Estate has broken ground on the first phase of Formation Park 10, an industrial development at the corner of Bullard Avenue and Celebrate Life Way in Goodyear, a suburb west of Phoenix. Willmeng Construction is serving as general contractor for the project. The first phase of Formation Park 10 will consist of 427,000 square feet spread across two buildings and includes a large, first-of-its-kind park to serve as an amenity for future tenants and the surrounding community.

Brinkmann Constructors, Scannell Properties Plan 150,000 SF Manufacturing Facility in Mesa, Arizona

by Amy Works

MESA, ARIZ. — Brinkmann Constructors, in partnership with Scannell Properties, is developing an industrial facility in Mesa for Super Radiator Coils, a company specializing in heat exchanger manufacturing. Constructed of concrete tilt-up panels, the 150,000-square-foot building will include more than 45,000 square feet of Class A office space, 130,000 square feet of fully conditioned manufacturing floor space, gantry crane systems and clean room areas that support advanced manufacturing. The state-of-the-art facility will operate as a western U.S. production hub for Chaska, Minn.-based Super Radiator Coils. The new location will consolidate and expand the company’s manufacturing capabilities to support the growth of the company’s operations in the Western region. Ware Malcomb is serving as architect for the project, which is slated for completion in fall 2024.

PHOENIX — Marcus & Millichap has arranged the purchase of an office and industrial property in Phoenix. Matt Hamblin acquired the asset for $1.9 million. Doug Fielding Jr. of Marcus & Millichap procured the buyer in the deal. Located at 4535 E. Broadway Road within Cotton Business Center, the facility offers 6,039 square feet of fully air-conditioned space, 16-foot clear heights, a 14-foot drive-up roll-up door, a lobby, various office sizes, a bullpen area, a server room, a break area, two ADA restrooms and skylights for natural light. Smart Pest Solutions occupies the space in an 80 percent office and 20 percent warehouse layout.