MESA, ARIZ. — StarPoint Properties has received a $52 million loan for the construction of Lotus Point, a 245-unit apartment community in Mesa. Jeff Sause, Wyatt Strahan and Elle Miraglia of JLL Capital Markets arranged the construction financing for the project through a debt fund. Lotus Point will rise four stories and offer studio, one- and two-bedroom units. Amenities will include a fitness center, clubhouse, coworking facility and community kitchen. On-site parking will include a mix of tuck-under and grade-level parking. Development is slated for completion by early 2025.

Arizona

PHOENIX — ABI Multifamily has brokered the $2.2 million sale of an eight-unit apartment property at 4229 North 17th St. in Phoenix. The buyer and seller are based in Arizona. Mitchell Drake, Dallin Hammond and Carson Griesemer represented the seller in this transaction. The property was originally built in 1982 and renovated in 2020. Interior renovations include contemporary cabinets, stainless-steel appliances, vinyl flooring, floating bathroom vanities and more. Units come in two-bedroom layouts. Exterior renovations include a dog run, community patio grill and picnic area. 4229 North 17th Street is a garden-style community with gated access.

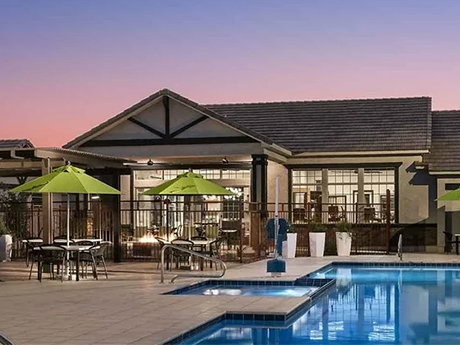

PHOENIX — WhiteHaven has purchased Clarendon Park Apartments, a 138-unit community in Phoenix, for $37 million. The company rebranded the property as Haven at Midtown. Built in 2002, Haven at Midtown offers studio, one- and two-bedroom units. Amenities include a pool with a grilling area, a gym, internet access, a dog park, garages and covered parking. Greystar will be the property manager for this asset.

GOODYEAR, ARIZ. — Eight tenants are joining Canyon Trails Towne Center, a 90-acre, mixed-use development in Goodyear, roughly 19 miles west of Phoenix, bringing the property to full occupancy. Chipotle Mexican Grill recently opened a restaurant at the center, and Michael’s and Five Below will occupy 18,300 and 10,434 square feet, respectively. Target and Ross Dress for Less have also signed leases at the property, and Starbucks Coffee, Freddy’s Steakburgers and Denny’s are currently underway on the construction of spaces scheduled to open this fall. The landlords, principals of Santa Cruz Seaside Co., are additionally negotiating leases with two retail big box stores to occupy 30,000 square feet of new, ground-up construction. Vestar manages the property.

PHOENIX — An affiliate of Reliant Group Management has purchased Phoenix Manor, a 405-unit apartment property in Phoenix. Phoenix Manor comprises 38 buildings, a 16,750-square-foot clubhouse with a leasing center, 6,750-square-foot auditorium, 4,200-square-foot maintenance shop, two pools, two lagoons, three pavilions, a dog park, putting green and four shuffleboard courts. The property offers studio, one- and two-bedroom floor plans. Cindy Cooke, Brad Cooke, Chris Roach and Matt Roach of Colliers represented the seller, Phoenix Manor LLC.

MESA, ARIZ. — Arizona Gynecology Associates (AZGYN) is renovating a former Banner urgent care facility in Mesa. The 4,307-square-foot medical office building will undergo exterior and interior upgrades, including the addition of an X-ray suite and a dedicated women’s urgent care center. The expanded location will triple AZGYN’s footprint in Mesa and provide enhanced healthcare services to the community. Renovations are underway for completion by the end of the year. JLL’s Mari Lederman and Katie McIntyre represented AZGYN in the acquisition. Chad Shipley and Rommie Mojahed of SVN represented the building seller, Summit Properties Group LLC.

Empire Group Obtains $88.5M Construction Financing for Build-to-Rent Residential Community in Phoenix

by John Nelson

PHOENIX — Empire Group, a multifamily and commercial real estate development firm based in Scottsdale, Ariz., has obtained an $88.5 million construction loan for the development of Village at Bronco Trail. The 354-unit build-to-rent (BTR) community will be situated on a 30-acre site at 29th Avenue and Sonoran Desert Drive on the city’s north side. Empire Group expects to deliver the first swath of single-family homes at Village at Bronco Trail in 2024. Homes will average 920 square feet and amenities will include detached garages, a dog park, grilling area, resort-style pool, clubhouse and common area open spaces. Each home will have a private yard; kitchen with quartz countertops, stainless steel appliances and backsplashes; full-size washers and dryers; and upgraded smart-home features and technology. The property will be situated within two miles of the chip manufacturing plant for Taiwan Semiconductor Manufacturing Co., which is a $40 billion facility and a major economic demand driver for the North Phoenix residential market. Kyle McDonough and George Maravilla of Tower Capital arranged the financing on behalf of Empire Group. The direct lender was not disclosed, but the mortgage brokerage firm was able to secure multiple term sheets from lenders during due diligence. “The BTR …

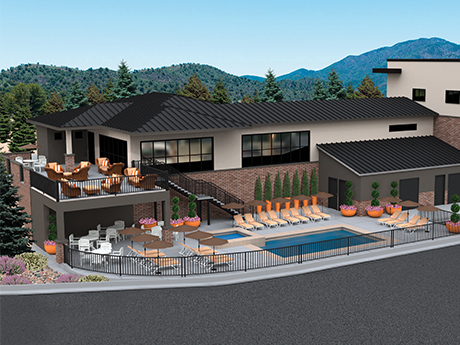

PRESCOTT, ARIZ. — Montezuma Heights Investors has unveiled plans for Montezuma Heights, a $41 million luxury multifamily development in Prescott. The groundbreaking ceremony will be held July 13. The development, located at 609 Bagby Drive, will feature 144 apartment units with one- to three-bedroom floor plans. Amenities will include a state-of-the-art gym, lounge, outdoor grotto with grilling area, dog parks, multiple fire pits and electric car charging stations. The community will also have a trail connection to Granite Creek Park and the Depot shopping center. The developer expects the construction process to take 20 months. MEB Management will serve as the community’s manager and leasing agent.

Ryan Cos. Begins Construction of 101,136 SF Medical Office Building in Scottsdale, Arizona

by Jeff Shaw

SCOTTSDALE, ARIZ. — Ryan Cos. has begun construction on a multi-tenant medical office building in Scottsdale. The two-story, 101,136-rentable-square-foot building is called One Scottsdale Medical. It is 80 percent preleased, with the City of Hope and Exalt Health serving as anchor tenants. They will occupy about 30,000 and 50,000 square feet, respectively. The building will provide additional space for lease to medical tenants. One Scottsdale Medical is scheduled for completion by third-quarter 2024. Mari Lederman and Katie McIntyre from JLL’s Phoenix office are the project’s exclusive leasing brokers.

PHOENIX — Topp Corp. has purchased The Marlowe, a 53-unit apartment complex in Phoenix, for $8.4 million. Built in 1968, the majority of the apartment interiors have been renovated with new cabinets, countertops, appliances, flooring and lighting. The average unit size is 552 square feet. The Marlowe offers new ownership an opportunity to implement a comprehensive value-add strategy by renovating the remaining 20 percent of apartment interiors and adding custom touches to enhance the community. The community enjoys a central location near Tempe, Scottsdale and Phoenix Sky Harbor International Airport. It features a central garden courtyard, swimming pool, laundry facility and assigned parking. Paul Bay and Darrell Moffitt of Marcus & Millichap, in conjunction with Cliff David and Steve Gebing of IPA, represented the seller, Living Well Homes, and procured the buyer.