TUCSON, ARIZ. — Cushman & Wakefield has arranged the sale of a last-mile distribution building located at 775 W. Silverlake Road in Tucson. A California family trust acquired the property from an East Coast investor for $22.3 million, or $451 per square foot. Situated on 10.7 acres, the 49,500-square-foot facility features 15 loading docks and close proximity to interstates 10 and 19, downtown Tucson and Tucson International Airport. At the time of sale, the property was fully leased to a Fortune 10 global e-commerce company. Andrew Bogardus and Douglas Longyear of Cushman & Wakefield San Francisco, in collaboration with Stephen Cohen of Cushman & Wakefield | Picor in Tucson, represented the seller in the transaction.

Arizona

SCOTTSDALE, ARIZ. — 29th Street Capital (29SC) has purchased Dwell Apartment Homes, a multifamily community in Scottsdale, from Denver-based Avanti Residential for $41.6 million. This transaction marks the company’s 20th multifamily acquisition in the metro Phoenix market. Developed in 1963/1975, Dwell features 193 apartments in a mix of studio, one- and two-bedroom apartments, three swimming pools, a fitness center, business center, dog park and an outdoor grilling and picnic area. 29SC plans to renovate both interior units and exterior amenities. Renovations include converting the garden to an outdoor game area and dog park, upgrading the gym and pool areas and enhancing apartment interiors. Unit upgrades will include adding smart home technology packages, while upgrading kitchen appliances, countertops, backsplashes, cabinet faces, hardware, flooring, baseboards, bathroom mirror frames, ceiling fans and lighting packages. Haven Residential, the 29SC-owned property management company, will oversee management and leasing. Steve Gebing and Cliff David of Institutional Property Advisors, a division of Marcus & Millichap, represented the seller, while 29SC was self-represented in the deal.

TEMPE, ARIZ. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Eden Apartments, a multifamily community in Tempe. Living Well Homes sold the asset to Rise48 Equity for $26.5 million, or $236,607 per unit. Built in 1980, Eden Apartments features 112 apartments spread across eight two-story buildings. Each residence features an in-unit washer/dryer connection and a private balcony or patio. Community amenities include a swimming pool, fitness center, laundry facility, picnic area and courtyard. Cliff David and Steve Gebing of IPA represented the seller and procured the buyer in the transaction. The IPA Capital Markets team led by Brian Eisendrath and Cameron Chalfant arranged acquisition financing for the buyer.

Cubework Leases 916,150 SF Building at Cotton 303 Logistics Center in Glendale, Arizona

by Amy Works

GLENDALE, ARIZ. — Cubework, a City of Industry, Calif.-based industrial co-working company, has signed a long-term lease to occupy a 916,150-square-foot industrial warehouse/distribution building in Glendale. The property is located within Cotton 303 Logistics Center at 6801 N. Cotton Lane. With this lease, Cubework now occupies nearly 2 million square feet of space in greater Phoenix metro. Cubework offers on-demand warehouse units and co-working spaces complete with on-site staff. Don MacWilliam and Payson MacWilliam of Colliers Arizona represented the landlord, Chicago-based Heitman Capital Management, while Kander Paciific represented Cubework in the lease negotiations.

— Kyle Davis, Sales & Leasing Agent, Commercial Properties Inc., a CORFAC International Firm — A market cooldown is likely in 2023 as interest rates rise and the investor pool becomes more cautious to some degree. I believe many investors recall lessons from the Great Recession and are not as significantly overleveraged, which means the effects of this market correction may not be nearly as drastic. Phoenix’s retail market also has some bright spots. The area’s retail net absorption was positive at more than 1.5 million square feet, with vacancy rates down to 5.1 percent at the end of the fourth quarter of 2022. This is compared to the 1,071,783 square feet of absorption and 6.6 percent vacancy rate a year ago. Many look at factors like unemployment, interest rates, housing starts, etc., to speculate about the coming market. What will impact our industry most directly, however, is how the lending market reacts to these indicators. As with 2008 and 2020, creditors may look at the same data points as investors and lower their risk profiles significantly faster than investors are able to counteract. There will be many commercial property loans set for refinancing in the near or upcoming future, as commercial property …

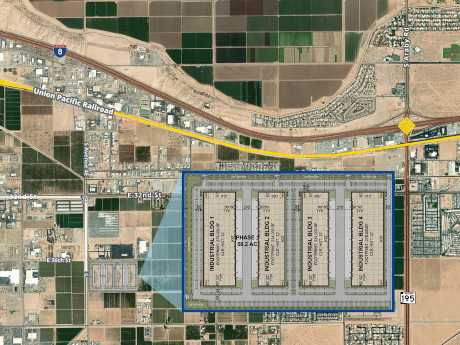

YUMA, ARIZ. — Panattoni Development has unveiled plans to develop a 1 million-square-foot industrial park at 36th Street and South Avenue 4E in Yuma. The initial phase of Panattoni’s Yuma Industrial Park is slated to include four buildings ranging from 234,000 square feet to 279,000 square feet each. The buildings will feature two grade-level doors, 49 rear-load, dock-high doors and 32-foot clear heights.

GREEN VALLEY, ARIZ. — Northmarq has arranged the sale of Sahuarita Mission, a multifamily community located at 1091 W. Beta St. in Green Valley. Sahuarita Mission Owner LLC (FSO Capital Partners) sold the asset to Cypress, Calif.-based WNC Apartment Ventures for $8.8 million, or $169,231 per unit. Built in 2000, Sahuarita Mission is an affordable multifamily community with four two- and three-story buildings on 2.9 acres. The fully occupied property features 52 two- and three-bedroom units, ranging in size from 822 square feet to 1,013 square feet, with walk-in closets, balcony or patio, plush carpet and automatic dishwashers. Community amenities include a clubhouse, children’s playground, picnic area with grill, laundry facilities and on-site leasing office. Trevor Koskovich, Jesse Hudson, Ryan Boyle and Logan Baca of Northmarq Phoenix’s investment sales team represented the seller in the deal. Bryan Mummaw, Bryan Liu, Brandon Harrington, Christopher Gitibin, Brad Burns and Tyler Woodard of Northmarq’s debt and equity team secured a $5.9 million loan for the buyer through Northmarq’s relationship with Freddie Mac.

PHOENIX — Holualoa Cos. and LaPour Partners have completed the disposition of the AC Hotel Phoenix Biltmore by Marriott in Phoenix. Nella Invest bought the asset for $67.8 million, or $423,750 per room. Located at 2811 E. Camelback Road, the five-story hotel features 160 rooms in a mix of traditional rooms and suites. Amenities include AC Kitchen & Lounge, a fitness center, business center, outdoor pool, sundry shop, guest laundry and more than 5,000 square feet of meeting space. The hotel was developed as part of a mixed-use project along with the Camelback Collective Office Building, which sold in July 2022. Co-developers Holualoa and LaPour Partners purchased the site in October 2016. Melvin Chu, John Strauss and Ben Geelan of JLL Hotels & Hospitality represented the seller, with Halo Hospitality and DCA Partners as advisors to the buyer. Azul Hospitality Group operates the hotel.

— By John Kobierowski, President and CEO, ABI Multifamily — As we enter a New Year, investors are looking for multifamily markets that will continue to offer consistent returns and stability. Thankfully, Phoenix is still regarded as one of the darlings of the multifamily markets. Investors from both coasts are talking to us about the Phoenix market again after not having invested here in a while — or, in some cases, ever. They say they’re realizing Phoenix just might be one of the few markets with predictable multifamily growth. Companies locating in Phoenix are creating tremendous job growth. For example, Taiwan Semiconductor recently announced an investment increase in the manufacturing plant it’s currently building in Phoenix — from $12 billion to $40 billion. That might be one of the largest single investments in the U.S. We’re eagerly anticipating the Southwest winter and spring events that draw the envious attention of a national audience, including WM Phoenix Open golf tournament, Super Bowl, Barrett Jackson collector car auction and Cactus League Spring Training. Our bright, sunny skies, green grass, and smiling people in t-shirts and flip flops will stand in stark contrast to those stuck in freezing cold winter temperatures and paying expensive home heating costs. …

MESA, ARIZ. — A joint venture between PCCP and The Dinerstein Cos. has unveiled plans to develop Atlas Mesa, a Class A multifamily community in Mesa. The partnership plans to break ground on the property in late July, with initial occupancy slated for first-quarter 2025 and final completion scheduled for late 2025. Located at the northwest corner of East Baseline Road and South Sunview, Atlas Mesa will feature 394 studio, one-, two- and three-bedroom layouts, ranging from 562 square feet to 1,394 square feet. Situated on 9.8 acres, the 400,000-square-foot community will consist of four four-story buildings served by elevators and a leasing and amenity building. Community amenities will include an outdoor pool with spa, clubhouse and coworking space. Additionally, the property features smaller outdoor amenity spaces throughout the community.