BUCKEYE, ARIZ. — Thompson Thrift has released plans for The Maddox, a multifamily property located in the Phoenix suburb of Buckeye. Construction started this month with completion slated for late 2024. Located at the intersection of West Yuma Road and South Waterson Road, The Maddox will consist of seven three-story buildings with 80 detached garages. The community will feature 252 apartments in one-, two- and three-bedroom layouts with quartz countertops, tile backsplashes, stainless steel appliances, designer fixtures and finishes, an Alexa-compatible smart hub to integrate all smart devices, smart thermostats, smart door locks, walk-in closets and full-size washers/dryers. Units are available with patio, balcony and private yard options. Onsite amenities will include a clubhouse, heated swimming pool, 24-hour fitness center, Amazon Package Hub, courtyards, grilling stations, outdoor game area, firepits with seating areas, dog park, pet spa with grooming station, and a pickleball court. The community is situated on 10.6 acres within walking distance of Buckeye’s core retail corridor, including Fry’s Signature grocery store, Walmart, Lowe’s Home Improvement Warehouse and multiple dining options.

Arizona

SCOTTSDALE, ARIZ. — Taylor Street Advisors has arranged the sale of LP on 85th Apartments, a multifamily community located at 1221 N. 85th Place in Scottsdale. A local syndicator sold the asset to an out-of-state buyer in a 1031 exchange for $8 million, or $333,333 per unit. Built in 1984, LP on 85th features 24 units in a mix of eight one-bedroom/one-bath layouts and 16 two-bedroom/two-bath layouts. The property was renovated in 2022. Updates included a modernized paint scheme, a swimming pool, landscaping, exterior lighting, white Shaker cabinets, quartz countertops, tile backsplashes, stainless steel appliances and modern lighting. Brian Tranetzki and Anton Laakso of Taylor Street Advisors represented the seller and buyer in the deal.

SCOTTSDALE, ARIZ. — Chicago-based Optima has purchased a 22-acre development site on the southeast corner of Scottsdale Road and Loop 101 Freeway in Scottsdale for the development of Optima McDowell Mountain Village, a $1 billion residential project that recently received city approval. John Lund sold the land parcel for $44.7 million. The community will consist of six eight-story buildings totaling 1,330 residential units, as well as 36,000 square feet of commercial space. Four of the buildings will be rental apartments and two buildings will offer for-sale condominiums. The unit mix will include studios, one-, two- and three-bedroom layouts ranging from 775 square feet to 2,025 square feet. Each of the six buildings will offer a rooftop deck with a 50-meter, Olympic-length swimming pool, sauna, spa, cold plunge, running track, outdoor fireplaces, lounge seating, and outdoor kitchens with barbecues and dining spaces. Additionally, each building will feature lobbies, a fitness center, yoga studio, sauna, steam room, residents’ club with game room and theater, an indoor basketball and pickleball court, an outdoor pickleball arena, a golf simulator, an outdoor putting/chipping area, indoor and outdoor kids’ play spaces, a massage room, a dog park and pet spa, business center, and conference room. Parking …

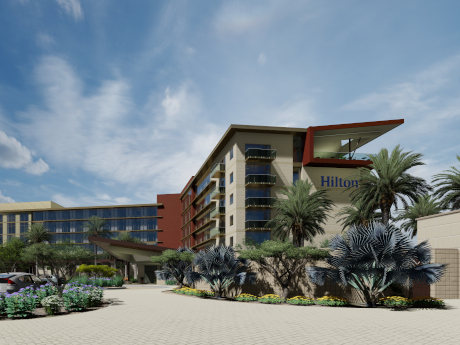

Nationwide Realty Investors Opens 237-Room Hilton at Cavasson Hotel in Scottsdale, Arizona

by Amy Works

SCOTTSDALE, ARIZ. — Nationwide Realty Investors has opened Hilton at Cavasson, a hotel and event center in the master-planned Cavasson development in Scottsdale. Nationwide Realty Investors owns the hotel, which Columbus Hospitality Management operates. The six-story hotel features 237 guest rooms, resort-style amenities and a 15,000-square-foot event space. The full-service property also offers a top-floor event space and terrace, a coffee shop, fitness center, swimming pool and Desert Pony Tavern, a bar and restaurant.

GILBERT, ARIZ. — Sethi Management has completed the disposition of Hyatt Place Gilbert, a six-story hotel located at 3275 S. Market St. in Gilbert. HWC Hospitality acquired the asset for $19.5 million. Bill Murney and Jesse Heydorff of Cushman & Wakefield represented the seller in the deal. The hotel features 127 guest rooms, 1,100 square feet of event space, a 24-hour business center, express check-in/check-out and free onsite self-parking.

PHOENIX AND GLENDALE, ARIZ. — Tides Equities has purchased three multifamily properties in Phoenix and Glendale from Denver-based PaulsCorp for an undisclosed price. The portfolio includes 445 studio, one- and two-bedroom units. Constructed in 1985 and 1986, the communities were each at least 95 percent occupied at the time of sale. The portfolio includes: The Perry, a 148-unit property at 6231 N. 67th Ave. in Glendale Serena Park, a 141-unit community at 8546 N. 59th Ave. in Glendale Red Sage, a 156-unit asset at 5704 W. Thomas Road in Phoenix Brad Cooke, Cindy Cooke, Matt Roach and Chris Roach of Colliers Arizona handled the transaction.

PHOENIX — Taylor Street Advisors has brokered the sale of The Hepburn, a multifamily property located at 631 N. 4th Ave. in Phoenix. A local syndicator sold the asset to an out-of-state 1031 exchange investor for $3.9 million, or $243,750 per unit. The fully renovated property features 16 apartments with quartz countertops, new cabinetry, stainless steel appliances, in-suite washers/dryers, and upgraded bathrooms with custom tile showers and vanities. Built in 1957, the property underwent renovations in 2022 that included a new roof, plumbing, electrical, exterior and interior doors, lighting, exterior paint, courtyard landscaping, fencing, gates and asphalt parking. Brian Tranetzki and Anton Laakso of Taylor Street Advisors represented both parties in the transaction.

MESA, ARIZ. — Scottsdale-based Taylor Morrison has completed the disposition of a 145-unit build-to-rent community located at 250 N. Ellsworth Road in Mesa. San Diego-based Ellsworth Housing Partners acquired the property for $53 million, or $368,055 per unit, and plans to brand the community as The Logan at Ellsworth. Built in 2022, the community features 58 one-bedroom, 650-square-foot units and 87 two-bedroom, 995-square-foot units. In-home features include kitchens with quartz countertops, stainless steel appliances, wood-inspired flooring, high ceilings, dual-pane windows, full-size washers/dryers, walk-in closets and maintenance-free private backyards. The property offers smart-home technology, including satellite TVs with HD and DVR, mobile phone controls, smart-home touchscreen panels, USB outlets, keyless entry, self-monitored security systems with doorbell cameras and door and motion sensor alarms, and smart thermostats. The community features 20 detached garages, as well as 168 covered and 137 uncovered spaces. Onsite amenities include a heated swimming pool and spa, poolside ramadas with outdoors TVs, a fitness studio, an event lawn and a roving patrol. Trevor Koskovich, Jesse Hudson, Ryan Boyle and Logan Baca of Northmarq’s Phoenix investment sales team represented the seller in the deal.

GLENDALE, ARIZ. — Logistics Plus, a worldwide provider of transportation, logistics and supply chain solutions, has signed a full-building lease at Building A of Sarival Logistics Center in Glendale. The 1.15 million-square-foot building was built on a speculative basis and is the first phase of a larger development, which can accommodate more than 2 million square feet of industrial space at full build out. Building A features 40-foot clear heights, 845 auto parking spaces, 409 trailer stalls, 218 dock doors, four drive-in doors, wide column spacing, ESFR sprinklers, 6,000 amps of heavy power and LED warehouse lighting. Andy Markham, Mike Haenel and Phil Haenel of Cushman & Wakefield represented the undisclosed landlord, while Jeremy Trotter of Foremost Commercial represented the tenant in the lease transaction.

SCOTTSDALE, ARIZ. — Real estate development firm Optima has received city approval for Optima McDowell Mountain Village, a $1 billion apartment and condominium project in North Scottsdale. Plans call for six buildings comprising 1,330 luxury units as well as 36,000 square feet of commercial and retail space. Construction is scheduled to begin in spring or summer 2023. Each of the six buildings within the development will contain its own amenity offering, including a rooftop deck with Olympic-length pool, sauna, spa, running track, outdoor kitchen and lounge seating. Each rooftop will offer views of the McDowell Mountains. The ground floor of each building will be outfitted with a lobby, fitness center, yoga studio, steam room, game room, theater, indoor basketball and pickleball court, golf simulator, massage room, business center and dog park. The project will be the largest private rainwater harvesting site in the U.S., according to the developer. The residences are expected to use half as much water as the average Scottsdale multifamily residence and a quarter as much water as the average Scottsdale single-family home. Optima is also providing the city with 2,750 acre-feet of water that will be deposited into the Scottsdale water system. The community will also …