Badiee Development has logistics and industrial projects throughout the Western U.S., but its current focus is the region’s three S’s: San Diego, Sacramento, Calif., and Salt Lake City. “Badiee Development is prioritizing leasing at our existing projects in San Diego and Sacramento, and entitling future projects in San Diego, Sacramento and Salt Lake City,” says Ben Badiee, the firm’s founder and CEO. “Our company holds a ‘land bank’ with plans to develop more than 2 million square feet across four distinct projects in three markets.” San Diego Badiee’s headquarters is ripe with industrial ventures for the firm. These include the two-building, 242,969-square-foot Sanyo Logistics Center and the 38-acre Britannia Airway Logistics Center, both of which are being built near the Mexican border in Otay Mesa. Britannia Airway has also been entitled for an interim use of industrial outdoor storage (IOS), allowing the project to accommodate about 1,000 trucks and trailers. “Being in our ‘backyard,’ Otay Mesa has proven to be a highly successful market for the firm,” Badiee says. “It is at the forefront of the onshoring/nearshoring trend for the U.S. and Mexico, and land availabilities are scarce.” Sacramento Land scarcity has also been a driver for Badiee in Sacramento …

California

BWE Arranges $66.5M Construction Financing for Plaza de Perris Shopping Center Expansion in Perris, California

by Amy Works

PERRIS, CALIF. — BWE has arranged $66.5 million in construction financing for a new phase of development at Plaza de Perris, a retail center located in the Inland Empire city of Perris. Upon completion, the property will span 363,582 square feet and feature a Target location. Wood Investments, the borrower and developer, purchased the center in 2017 and previously completed the addition of 118,000 square feet of retail space at the property in 2019 and 2020. Upon completion of construction, Target will join the center as a tenant. Other tenants at the center, which was 99 percent leased at the time of financing, include Ross Dress for Less, Ulta Beauty, Burlington Coat Factory, Planet Fitness and Five Below. Tom Kenny and Josh Boehling of BWE secured a $55.5 million loan through a life insurance company, as well as an $11 million joint-venture equity investment, on behalf of the borrower.

SAN DIEGO — Driftwood Capital, along with architect AO and general contractor R.D. Olson Construction, has broken ground on Element Hotel by Marriott in the Mission Valley submarket of San Diego. The seven-story, 150-room hotel will be located next to the existing full-service Marriott Hotel Mission Valley. The two hotels will share the pool amenity deck and restaurant space, while each maintaining its own entrance, lobby, lounge and other amenities. Slated for completion in winter 2026, the 98,000-square-foot hotel will feature a 5,300-square-foot conference and ballroom space, a fitness center, meeting rooms and a lobby/lounge, as well as shared exterior main and lounge area. Once completed, the hotel will comply with Title 24 energy and water use criteria, which is similar to LEED’s silver level. Additional project partners include Ficcadenti Waggoner and Castle as structural engineer, Kimley-Horn as civil engineer, RTM Engineering as MEP engineer and Linda Snyder Associates as interior designer.

HUNTINGTON BEACH, CALIF. — CBRE has brokered the sale of Beachwood Apartments, a multifamily property located at 125 16th St. in Huntington Beach, approximately 35 miles southeast of Los Angeles. The asset traded for $8.6 million, or $480,556 per unit. Built in 1971, Beachwood Apartments features 18 one-, two- and three-bedroom apartments totaling 15,809 rentable square feet. Select units have private patios or balconies and some units offer ocean views. Each unit features an individual water heater and individual meters for gas and electricity. Community amenities include a courtyard, sun deck, laundry facilities, 24 garage spaces and an on-site manager. Dan Blackwell and Mike O’Neill of CBRE represented the Huntington Beach-based seller and the Fountain Valley-based buyer in the transaction.

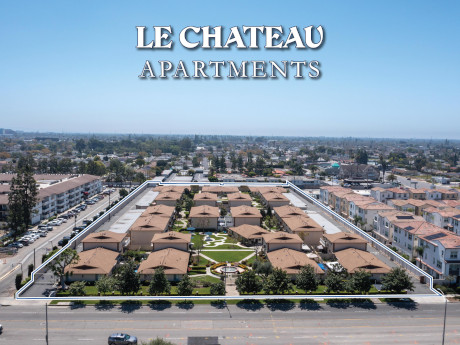

Marcus & Millichap Negotiates $27M Sale of La Chateau Apartments in Anaheim, California

by Amy Works

ANAHEIM, CALIF. — Marcus & Millichap has arranged the sale of La Chateau Apartments, a multifamily community in Anaheim. The asset traded for $27.4 million, or $361,184 per unit. Tyler Leeson, Matt Kipp and Nicholas Kazemi of Marcus & Millichap represented the undisclosed seller, while Drew Holden of Marcus & Millichap represented the undisclosed buyer in the deal. Built in 1964, Le Chateau offers 76 apartments in single-floor and townhome unit styles, all with two bedrooms. Each unit features a private patio and carport with an overhead storage bin. Community amenities include four on-site laundry facilities, a clubhouse and gated garage.

Tova Capital Acquires 18,600 SF East Willow Village Retail Center in Signal Hill, California

by Amy Works

SIGNAL HILL, CALIF. — Tova Capital has purchased East Willow Village, an inline shop and pad space in Signal Hill, for $6.7 million in an off-market transaction. Signal Hill is approximately 20 miles south of Los Angeles. Located at 2201 E. Willow St., East Willow Village features 18,600 square feet of retail space. Turner’s Outdoorsman anchors the center on a 5,600-square-foot pad. Additional tenants include food, health, wellness and community-serving retail users. Kelly Hawkshaw, Luc Hawkshaw and Eric Mandell of Ally Commercial Real Estate represented Tova Capital in the deal. The seller was not disclosed.

CULVER CITY, CALIF. AND AUSTIN, TEXAS — Sony Pictures Entertainment has acquired theater chain Alamo Drafthouse Cinema from Altamont Capital Partners, Fortress Investment Group and founder Tim League for an undisclosed price. Alamo Drafthouse was founded in 1997 in Austin, and has grown from a single mom-and-pop location to 35 cinemas across 25 metropolitan areas. The company is the seventh-largest theater chain in North America and was one of the pioneers of the in-theater elevated food and drink concept. Alamo Drafthouse will maintain its headquarters in Austin and will continue to operate all of its locations, as well as the company’s Fantastic Fest film festival, which was included in the acquisition. Sony will manage these entities under a newly established division, Sony Pictures Experiences, led by Alamo Drafthouse CEO Michael Kustermann. The acquisition is groundbreaking, as it was recently made possible through the Department of Justice’s decision in 2020 to rescind the Paramount Decrees. Put into place by the U.S. Supreme Court in 1948, the Decrees mandated a separation between film distribution and exhibition, requiring major motion picture studios to divest of any theater holdings. “We are excited to make history with Sony Pictures Entertainment and have found the right home …

RICHMOND, CALIF. — Primestor Development has acquired Hilltop Plaza, a 245,921-square-foot retail center situated on 59 acres in Richmond, roughly 18 miles outside San Francisco. An undisclosed seller sold the property for $36.5 million. Tenants at the center, which was 88 percent occupied at the time of sale, include Ross Dress for Less, City Sports Club, dd’s Discounts and Century Theatres. Geoff Tranchina, Eric Kathrein, Gleb Lvovich and Warren McClean of JLL represented both the buyer and seller in the transaction.

SANTA MONICA, CALIF. — Kennedy Wilson Brokerage, a division of Kennedy-Wilson Properties Ltd., has arranged the sale of a retail property at 2031-2037 Wilshire Blvd. in Santa Monica. Auerbach Realty Holdings sold the asset to Cypress Equity Investments for $7 million, or $2,222 per square foot. Situated on a 6,970-square-foot parcel, the shopping center offers 3,149 square feet of retail space. CEI owns the adjacent properties at 2025 Wilshire Blvd. and 1152 21st St., and this purchase will create a 25,457-square-foot assemblage. As part of the sale process, and in anticipation of the parcel’s imminent redevelopment, the Kennedy Wilson Brokerage team also assisted in the future relocation of Noma Sushi, a neighborhood restaurant that opened at the property in 1982. Ed Sachse and Christine Deschaine of Kennedy Wilson Brokerage represented the seller in the off-market transaction.

DESERT HOT SPRINGS, CALIF. — Shopoff Realty Investments has acquired a 55-acre property in Desert Hot Springs, a city in the Inland Empire East region of Southern California, with plans to develop an industrial project at the site. Upon completion, the development will comprise 1.1 million square feet of distribution and warehouse space. The property, which is situated with proximity to the site of an Amazon warehouse and with direct access to I-10, will feature 167 docks, 498 trailer stalls and a clear height of 42 feet. “This Desert Hot Springs project represents a rare opportunity to acquire a property that is already entitled and ready for development, in an area with significant demand from e-commerce companies for logistics and warehouse space,” says William Shopoff, president and CEO of the firm. “With neighbors such as Amazon and FedEx, this location has the potential to provide a great investment for many years to come and will offer third-party logistics companies significant drayage savings compared to projects in Arizona and Las Vegas.” Construction on the project is scheduled to begin in the third quarter of this year, with an anticipated timeline of 12 months. Ian DeVries and Christ DeVries of Colliers, along …