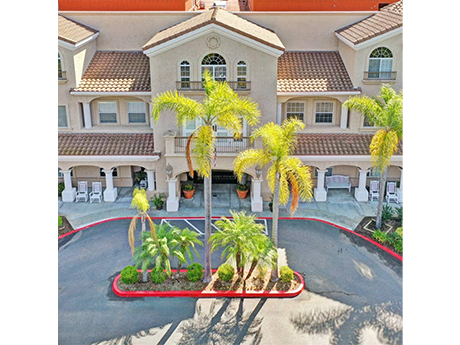

SAN CLEMENTE, Calif. — CareTrust REIT Inc. (NYSE:CTRE), a San Clemente-based seniors housing investor, has acquired three continuing care retirement communities (CCRCs) located in Los Angeles, Orange, and San Diego counties. The portfolio totals 475 assisted living, skilled nursing and memory care beds/units. Bayshire Senior Communities, an existing CareTrust tenant based in Southern California, has taken over management of all three properties. The highest profile property of the three is Torrey Pines Senior Living in San Diego. CareTrust paid $32.3 million for the asset, including transaction costs. Annual cash rent for the first year is approximately $2.6 million, increasing to approximately $3 million in the second year with CPI-based annual escalators thereafter. CareTrust completed the acquisition of the other two CCRCs through a joint-venture arrangement with a third-party regional healthcare investor. Pursuant to the arrangement, CareTrust is the managing member of the joint-venture entity. CareTrust provided a combined common equity and preferred equity investment amount totaling approximately $28 million. The joint-venture landlord has leased these facilities to Bayshire pursuant to a new, triple-net master lease agreement with an initial term of 15 years with two five-year extension options. CareTrust’s initial contractual yield on its combined preferred and common equity investments …

California

LOS ANGELES — JLL Capital Markets has arranged $65 million in financing for Wateridge, a six-building office and retail campus in West Los Angeles. LPC Realty Advisors I LLC, an investment advisory affiliate of Lincoln Property Co., is the borrower. Todd Sugimoto, Mark Wintner and Chad Morgan of JLL Capital Markets secured the five-year, fixed-rate financing with Deutsche Bank. Built between 1989 and 2005 on 21 acres, Wateridge features three multi-tenant office buildings, a single-tenant medical office building, a standalone 24-hour fitness facility and a multi-tenant retail strip center. At the time of financing, the 583,580-square-foot campus was 80 percent occupied and leased by credit tenants, including Kaiser Health Foundation, County of Los Angeles and Providence Health.

Progressive Real Estate Partners Negotiates $6.1M Sale of Value-Add Retail Property in Desert Hot Springs, California

by Amy Works

DESERT HOT SPRINGS, CALIF. — Progressive Real Estate Partners has brokered the sale of a retail property, located at 13000-13160 Palm Drive in Desert Hot Springs, located in the Coachella Valley. An Orange County-based private investor sold the property to a Los Angeles County-based private investor for $6.1 million in an all-cash transaction. Totaling 33,004 square feet, the property features a multi-tenant building and two pad buildings, one of which is occupied by Chase Bank. Greg Bedell of Progressive Real Estate Partners represented the seller, while Heather Sharp of Progressive Real Estate Partners procured the buyer in the transaction.

FONTANA, CALIF. — JLL Capital Markets has arranged the $197 million sale of Commerce Way Distribution Center in Fontana, which is located about 50 miles east of Los Angeles in the Inland Empire. EQT Exeter was the buyer. Built in 2000, Commerce Way Distribution Center totals 819,004 square feet. Located on Santa Ana Avenue, the property features a cross-dock configuration and a clear height of 30 feet. JLL says the facility benefits from its location in the Inland Empire, the largest industrial market nationwide with immediate access to critical supply chain infrastructure and Southern California’s population of more than 25 million people. As of the fourth quarter of 2023, the vacancy rate for the Inland Empire industrial market was 5.9 percent, a 90-basis-point increase quarter-over-quarter due to a high volume of new industrial space delivered by developers, according to JLL. The market experienced positive net absorption despite the 10.5 million square feet of new space delivered in the quarter. Patrick Nally, Mark Detmer, Evan Moran and Makenna Peter of JLL represented the seller, Manulife Investment Management on behalf of clients, and procured the buyer. JLL’s debt advisory team on the deal included Kevin Mackenzie, Brian Torp and Samuel Godfrey. Mike …

— By John R. Read, senior vice president, CBRE Retail Investment Properties-West — Undoubtedly, 2023 proved to be a volatile year. It was marked by persistent inflationary pressures, four 25-basis-point interest rate hikes by the Fed and a surge in the 10-year U.S. Treasury yield (from the high 3 percent range in January to peak levels near 5 percent in October). These changes had a pronounced impact on retail real estate investors, businesses occupying retail centers and consumers who frequented these establishments. The real estate sector particularly grappled with the cost of financing in an environment of higher interest rates. While these challenges did temper Orange County’s retail market to some extent, it largely remained resilient due to its strong underlying fundamentals. These include a substantial population of high-income earners, flourishing industries like tourism and destination-oriented shopping centers, as well as a supply constrained retail property base with limited large-scale retail development. The unemployment rate in Orange County remained steady at 3.8 percent in December 2023, unchanged from November’s revised rate. This rate is notably higher than the year-ago estimate of 2.7 percent. In comparison, California’s unemployment rate stands at 5.1 percent rate, while the national rate during the same …

Marcus & Millichap Arranges $5M Refinancing for Larson Apartments in Garden Grove, California

by Amy Works

GARDEN GROVE, CALIF. — Marcus & Millichap has arranged $5 million in refinancing for Larson Apartments at 8101 Larson Ave. in the Orange County city of Garden Grove. Constructed in 1980, the two-story building features 21 apartments in a mix of studio, one-, two- and three-bedroom layouts. Ron Balys of Marcus & Millichap Capital Corp. secured the bank financing on behalf of the private client. Terms of the 30-year loan include 65 percent loan-to-value ratio and a 6.3 percent interest rate with a 30-year amortization schedule.

PLACENTIA, CALIF. — NewMark Merrill Cos. has acquired a retail building within Placentia Town Center, a 142,666-square-foot shopping center in the Orange County city of Placentia, for an undisclosed price. CVS/pharmacy occupies the 28,800-square-foot retail building. With the acquisition of the CVS building, NewMark Merrill now owns the entire shopping center. Additional tenants include Marshalls, Ross Dress for Less, Massage Envy, Philly’s Best, KC Nails, Avalon Bagels, Courtesy Cleaners, Mr. D’s Diner & Bar, Uptown Cheapskate and Beauty Avenue. Greg Giacopuzzi of NewMark Merrill, along with Tony Veiller of Pegasus Investments, represented NewMark Merrill in the transaction.

Kennedy Wilson Provides $95M Construction Loan for Multifamily Development in Santa Clarita, California

by Amy Works

SANTA CLARITA, CALIF. — Kennedy Wilson’s debt platform has provided a $95 million senior construction loan to a joint venture between Greystar Real Estate Partners and The Resmark Cos. The funds will be used for the development of a multifamily and build-to-rent project in Santa Clarita, approximately 33 miles northwest of downtown Los Angeles. Situated within Sand Canyon Plaza, the community will feature 259 rentable multifamily units and 64 build-to-rent townhomes. The multifamily residents will have access to a fitness center, club room, courtyard, game lounge, coworking space and a fourth-floor sky deck with unobstructed mountain views. The build-to-rent townhomes will offer expansive green space areas, multiple open turf play areas and a tot lot that will cater to young families renting in the community. The project will also feature a resort-style pool and spa that will be shared by both multifamily and build-to-rent townhome residents. Upon completion, the 87-acre Sand Canyon Plaza will feature parks, open spaces, a walking trail system and a 45,000-square-foot retail center anchored by Sprouts Farmers Market, which is slated to break ground this year.

World Premier Investments Acquires Newport and Walnut Center Strip Mall in Tustin, California

by Amy Works

TUSTIN, CALIF. — World Premier Investments has purchased Newport and Walnut Center, a retail strip center in the Orange County city of Tustin. A private family trust sold the asset for $6.2 million. Daniel Tyner, Gleb Lvovich and Geoff Tranchina of JLL Capital Markets represented the seller and buyer in the deal. Located at 13812 Newport Ave., Newport and Walnut Center features 9,624 square feet of retail space. The center is fully occupied by eight tenants, including HiroNori Craft Ramen, Crown Beauty, Studio 18 Nail Bar and Moon Lash Beauty.

G Capital Markets Arranges $15.5M Recapitalization for Seniors Housing Project in Livermore, California

by Amy Works

LIVERMORE, CALIF. — G Capital Markets (GCap), a capital advisory firm based in Carmel, has arranged a recapitalization for Bethany Home, a 59-bed assisted living community in Livermore on the eastern edge of the Bay Area. Built in 2021 by a regional owner-operator, the property leased up in 2022 and has shown consistently strong performance for several years with cash flow margins well over 40 percent and occupancy of 90 percent, according to GCap. The bridge-to-HUD loan was structured with a large equity-out component and sized to maximize the takeout refinancing while allowing the borrower to submit a HUD application in 2024 without the need to wait the typical two years of debt seasoning. GCap arranged the $15.5 million credit facility with a regional bank partner. The loan carries an interest rate SOFR spread in the low 300s and a below-market financing fee. The borrower is an existing client of GCap, and this property will be part of a broader permanent portfolio refinancing that is scheduled to close in 2025.