CERES, CALIF. — Marcus & Millichap has arranged the sale of The Vineyard, an apartment property in Ceres, a suburb of Modesto. The asset traded for $32.6 million, or $153,774 per unit. Jon Mimms of Marcus & Millichap’s Fresno office represented the undisclosed seller and undisclosed buyer in the deal. Built in 1979, The Vineyard features 212 apartments, averaging 671 square feet, with open floor plans, large kitchen pantries and central heating and air conditioning. Community amenities include two swimming pools, five laundry rooms, covered parking, pathways and a walking and jogging trail.

California

LOS GATOS, CALIF. — Marcus & Millichap has brokered the sale of a retail property, located at 52 N. Santa Cruz Ave. in Los Gatos, just south of San Jose. The asset traded for $4.5 million. Built in 1985, the 4,401-square-foot property is fully occupied and offers six commercial spaces. Yuri Sergunin and J.J. Taughinbaugh of Marcus & Millichap’s Palo Alto office represented the undisclosed seller and procured the undisclosed buyer in the deal.

ANAHEIM, CALIF. — CBRE has arranged the purchase of a seven-unit apartment building in Anaheim. A private investor acquired the asset for $2.5 million, or $360,714 per unit. Dan Blackwell and Amanda Fielder of CBRE represented the Orange County-based buyer in the deal. The seller was from Alameda County. Built in 1985, the 6,500-square-foot building is located at 406 E. South St. on a 9,148-square-foot lot. The community features individual patios, garage parking and a newly installed fire sprinkler system.

SAN DIEGO — Impact Real Estate LLC has sold a development site in San Diego to Gabriel Mauser for $1.3 million. The buyer plans to develop 11 accessory dwelling units (ADU) on the 30,493-square-foot property, which is located at 6353 Broadway. Aaron Bove of Marcus & Millichap represented the seller, while Simon Oliveri procured the buyer in the deal.

Marcus & Millichap Arranges $11.2M Refinancing for Joann-Occupied Building in Glendale, California

by Amy Works

GLENDALE, CALIF. — Marcus & Millichap Capital Corp. (MMCC) has secured $11.2 million in refinancing for a single-tenant retail building, located at 1000 S. Central Ave. in the Los Angeles suburb of Glendale. Joann, a fabric and crafts retail chain that recently declared bankruptcy, occupies the property. Ron Bayls of Marcus & Millichap Capital Corp. arranged the 10-year loan, which includes a 5.97 percent interest rate with a 30-year amortization and 50 percent loan-to-value ratio.

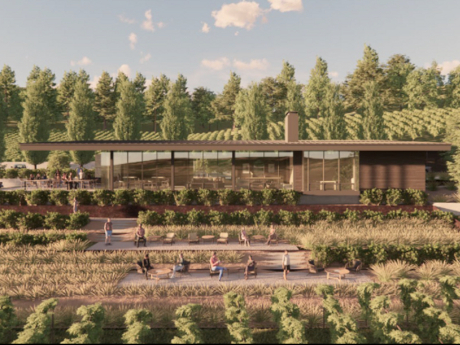

Gantry Secures $7.1M in Financing for Auteur Wines Facilities in Healdsburg, California

by Amy Works

HEALDSBURG, CALIF. — Gantry has arranged a $7.1 million construction-to-permanent loan for the build-to-suit development of dedicated facilities for Auteur Wines, a vintner-founded winery specializing in Pinot Noir and Chardonnay. Located at 10520 Wohler Road in the Sonoma County city of Healdsburg, the project will include a production winery, tasting room and vineyard on 8.2 acres. Jeff Wilcox and Andrew Ferguson of Gantry’s San Francisco production office represented the borrower, a private real estate investor. The 20-year, construction-to-permanent, fixed-rate loan was provided through one of Gantry’s banking relationships and features an initial interest-only period transitioning to an 18-year amortization.

COMMERCE, CALIF. — 99 Cents Only Stores LLC has announced plans to close all 371 of its stores and wind down business operations. The company has entered into an agreement with Hilco Global to liquidate all merchandise and dispose of fixtures, furnishings and equipment at the stores. Sales under this agreement are expected to begin today. 99 Cents Only was founded in 1982 as a deep-discount retailer where every item cost less than a dollar. The company is headquartered in the southeast Los Angeles suburb of Commerce, and currently operates stores in California, Texas, Arizona and Nevada. The company consulted its financial and legal advisors to find a way to continue operating, but ultimately decided the wind-down was necessary and the best way to maximize the value of its assets. Hilco Real Estate will manage the sale of the company’s owned and leased real estate assets. The company has appointed Chris Wells, managing director at Alvarez & Marsal, as chief restructuring officer. Additionally, Mike Simoncic, interim CEO of 99 Cents Only and managing director at Alvarez & Marsal, will step down. “This was an extremely difficult decision and is not the outcome we expected or hoped to achieve,” said Simoncic. “Unfortunately, the …

— By Pat Swanson, executive vice president, Colliers International — As Orange County enters 2024, its multifamily market stands at the brink of transformation, confronting challenges like softened rents, affordability dynamics and the resilience required in the face of tenant-related complexities. In the midst of a robust economy, the region grapples with obstacles and opportunities that will significantly shape the future of its real estate sector. Orange County’s economic vitality is evident, with a 5.2 percent growth in U.S. GDP and a thriving job market. However, the looming shadow of interest rate fluctuations and inflation above 3 percent has briefly slowed down real estate transactions. While rates are predicted to stabilize, the potential for modest reductions later in the year signals a period of nuanced economic growth and sustained higher rates. In 2024, Orange County’s multifamily housing market is set for change, departing from previous trends of rent increases. The region anticipates modest growth that will be influenced by factors like slower job growth, an influx of 510,000 new units and the mounting challenge of finding qualified tenants. Affordability takes center stage, with rent-to-income ratios reaching 29.8 percent. The widening affordability gap between owning a home and renting is further …

LOS ANGELES — Colliers has arranged the sale of an affordable apartment community located at 349 S. La Fayette Place in the La Fayette Park neighborhood of Los Angeles. The asset traded for $43.4 million, or $362,000 per unit. Kitty Wallace and Kalli Knight of Colliers represented the buyer and seller in the transaction. Situated on a 43,000-square-foot lot, the three-story property features 120 affordable apartments. The buyer paid cash to preserve the right to create and maintain affordable housing, and purchased the property with the intent of promoting and advancing workforce and affordable housing initiatives. Built in 1971 and extensively remodeled in 2017, the property features 120 subterranean parking spots with third-party billing for electric vehicle charging stations. Currently, 85 percent of the units are fully renovated. The units feature stainless steel appliances, in-suite washers/dryers, hardwood floors with carpeting in the bedrooms and mini-split air conditioners and heaters. Community amenities include a new roof, updated plumbing and boiler, a resurfaced and modernized pool, built-in barbecue area, redesigned fitness center, electric vehicle charging stations and elevator modernizations. All units also include 100-amp electrical panels and new plumbing to accommodate the installation of in-unit washers and dryers.

WESTMINSTER, CALIF. — A real estate fund managed by Ares Management has acquired a freestanding industrial distribution building in the Orange County city of Westminster from an undisclosed seller. Terms of the transaction were not released. Situated on 11.8 acres at 7400 Hazard Ave., the 258,506-square-foot building features 22- to 24-foot clear heights, ample dock-high and grade-level loading, abundant auto parking and 40 off-dock trailer parking stalls. At the time of sale, the property was 72.6 percent leased. Jeff Chiate, Jeffrey Cole, Rick Ellison and Matt Leupold of Cushman & Wakefield’s National Industrial Advisory Group – West represented the seller in the deal. Randy Ellison and Kyle McGillen of Cushman & Wakefield provided leasing advisory and were retained by the buyer to continue leading project leasing for the asset. Additionally, Rob Rubano, Brian Share, Max Schafer and Becca Tse of Cushman & Wakefield Equity, Debt & Structured Finance secured acquisition financing for the buyer.