VISTA, CALIF. — CareTrust REIT Inc. (NYSE: CTRE) has completed a joint venture investment to acquire La Fuente Post Acute, a 187-bed skilled nursing facility in Vista, approximately 40 miles north of San Diego. Once regulatory approval is obtained, Bayshire Senior Communities (a current tenant of CareTrust) will operate the facility pursuant to a new 15-year lease. To acquire the facility, CareTrust and a third-party regional healthcare real estate investor entered into a joint venture. CareTrust’s combined common equity and preferred equity investments in the joint venture total $25.5 million. CareTrust’s initial contractual yield on its combined preferred and common equity investments in the joint venture is approximately 9.7 percent. The lease provides for 3 percent fixed annual rent escalators and two five-year extension options. CareTrust is the managing member of the joint venture entity. The investments were funded using cash on hand.

California

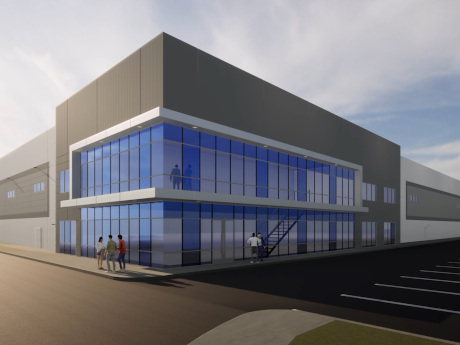

JLL Arranges $17.5M Pre-Development Financing for Industrial Site in Moreno Valley, California

by Amy Works

MORENO VALLEY, CALIF. — JLL Capital Markets has arranged $17.5 million in pre-development financing for a 22.1-acre parcel within the World Logistics Center master-planned community in the Inland Empire city of Moreno Valley. Greg Brown, Peter Thompson, Spencer Seibring and Kyle White of JLL Capital Markets’ debt advisory team secured the financing for the borrower, Newport Beach-based CapRock Partners. Upon entitlement, CapRock Partners will have the option to either commence development on an approximately 500,000-square-foot, LEED-certified industrial warehouse or exit via a land sale. The 22.1-acre industrial-zoned site will accommodate a wide range of uses, including e-commerce, manufacturing and distribution. At completion, the building would feature 36-foot clear heights, 65 dock-high doors and up to 10,000 square feet of two-story office space. Additionally, the property will offer 88 trailer parking stalls, 339 auto parking stalls, a truck court depth of 185 feet and a secured concrete yard. CapRock Global Logistics is located south of the 60 freeway at the Theodore Street on/off ramp.

Local Family Investor Buys 405,130 SF Office Campus in Fullerton, California for $76.5M

by Amy Works

FULLERTON, CALIF. — A local family investor has acquired an office campus situated on 33.7 acres in Fullerton for $76.5 million, or $188 per rentable square feet. The seller was a partnership comprising a global real estate investment, development and management firm and a global investment manager. Aerospace and weapons manufacturer Raytheon, an investment-grade credit tenant, fully leases the 405,130-square-foot campus, located at 1801 Hughes Drive. Nico Napolitano, Jeffrey Cole, Jeff Chiate, Rick Ellison, Scott Selke and Brad Brandenburg of Cushman & Wakefield’s capital markets team in Southern California represented the seller in the deal.

MERCED, CALIF. — The University of California Merced (UC Merced) and Merced College have announced plans to jointly develop a 488-bed student housing project for community college and transfer students. The California Legislature gave final approval for the $100 million mechanism that will fund the project. The Promise Housing facility will offer rooms on the UC Merced campus for income-qualified community college students that have met the academic requirements of the university’s Merced Promise agreement. The Merced Promise program was created to encourage the most promising and in-need student populations in California’s Central Valley to transform their lives through the pursuit of higher education. “This joint affordable housing project will be a game-changer for our historically underserved region, removing barriers for our students seeking to transfer to UC Merced and providing them with an opportunity to complete their transfer degree at Merced College while fully engaging in campus life at UC Merced,” says Chris Vitelli, president of Merced College. A timeline for the development was not announced.

Black Lion Acquires Whole Foods-Anchored Retail Complex in Thousand Oaks, California for $8M

by Amy Works

THOUSAND OAKS, CALIF. — Black Lion has purchased a shopping center located at 692 N. Moorpark Road in Thousand Oaks, for $8 million. The name of the seller was not released. Whole Foods Market anchors the 23,958-square-foot retail center, which will undergo rebranding. At the time of acquisition, the 11-storefront property was 55 percent occupied. The buyer plans to implement upgrades to the asset including a façade renovation, new roof and parking lot. Dan Tyner of JLL represented the buyer and seller in the transaction.

Elevation Land Co., Crow Holdings Capital Break Ground on 1.8 MSF Otay Business Park in California

by Amy Works

OTAY MESA, CALIF. — A joint venture between Elevation Land Co. and a real estate fund advised by Crow Holdings Capital has broken ground on Otay Business Park, situated on a 119-acre site in San Diego’s Otay Mesa submarket. The joint venture acquired the land site in May 2022. Otay Business Park will feature 1.8 million square feet of industrial distribution and logistics space spread across multiple buildings. The first phase of the project is slated to open in late 2025. Dempsey Construction is performing the horizontal site work, which includes grading, as well as on-site and off-site utility and road infrastructure work. Ware Malcomb served as architect for the project.

VALENCIA, CALIF. — Centennial has acquired Westfield Valencia Town Center, a 1 million-square-foot shopping mall located in Valencia, approximately 35 miles northwest of Los Angeles. Moving forward, the property, which was leased to more than 140 tenants at the time of sale, will be known as Valencia Town Center. Further details were not disclosed.

Marcus & Millichap Arranges Sale of 68-Unit Chestnut Apartments in San Bernardino, California

by Amy Works

SAN BERNARDINO, CALIF. — Marcus & Millichap has brokered the sale of Chestnut Apartments, a multifamily property located at 1398 N. Sierra Way in San Bernardino. A limited liability company sold the asset to an individual/personal trust for $8.2 million. Constructed in 1949, the value-add community features 68 apartments spread across 17 two-story residential buildings. The property offers 36 one-bedroom/one-bath units, 32 two-bedroom/one-bath units, an exterior fence, a courtyard and 72 carport parking spots. All apartments feature individual hot water heaters and wall air conditioning units. Douglas McCauley and David Covarrubias of Marcus & Millichap represented the seller and buyer in the transaction.

LANCASTER, CALIF. — Hanley Investment Group Real Estate Advisors has brokered the $2.7 million sale of a two-tenant retail building located in Lancaster, approximately 65 miles north of Los Angeles. AutoZone and Precision Eyebrow Threading occupy the 6,999-square-foot property, which is situated on a 0.6-acre plot within a Target-anchored shopping center. Kevin Fryman, Bill Asher and Jeff Lefko of Hanley represented the seller, an undisclosed private investor. The buyer was not disclosed.

Newmark Negotiates $103.5M Sale of 14-Building Industrial Portfolio in Fremont, California

by Amy Works

FREMONT, CALIF. — Newmark has arranged the sale of Bayside Industrial Portfolio, a 14-property industrial portfolio in Fremont. CIP Real Estate acquired the asset from an undisclosed seller for $103.5 million. At the time of sale, the 352,280-square-foot portfolio was 91 percent occupied by 80 tenants. The properties feature flexible industrial spaces ranging from 2,500 square feet to 25,000 square feet, 16-foot clear heights, ample power distribution throughout the campus, truck courts with depths up to 140 feet and a mix of at-grade and dock-high doors. Steven Golubchik, Edmund Najera, Jonathan Schaefler and Darren Hollak of Newmark represented the seller in the deal. Ramsey Daya and Chris Moritz of Newmark’s Debt and Structured Finance group arranged $63 million in acquisition financing, in the form of debt, for the buyer.