CARLSBAD, CALIF. — Three new tenants have signed leases at Carlsbad Arcade in the Village, a retail center comprising 13,000 square feet in Carlsbad, roughly 35 miles north of San Diego. Village Florist Co., Carlsbad Golf Carts and Joey Snow Design Co. will occupy 1,180; 1,250; and 1,060 square feet, respectively. Serena Patterson and Luke Holler of Urban Property Group represented both the tenants and the landlord, Carlsbad One LLC, in the leasing transactions.

California

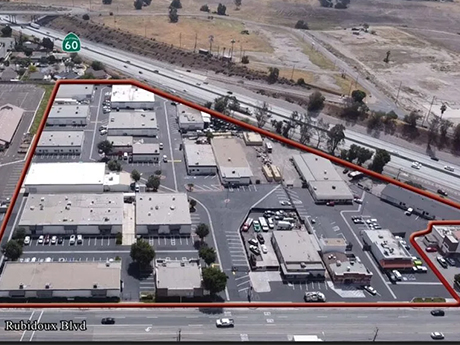

Lee & Associates-Ontario Negotiates $19.5M Sale of Riverside Business Park in Jurupa Valley, California

by Jeff Shaw

JURUPA VALLEY, CALIF. — Lee & Associates-Ontario has facilitated the sale of Riverside Business Park, a fully occupied, multi-tenant business park in Jurupa Valley. Intersection Equities LLC acquired the asset, consisting of 37 units across 22 buildings, for $19.5 million. The park features ground-level and dock-high door loading, private yards, and clear heights of up to 16 feet. The sellers were Bravo Whiskey Properties LLC and Transition Properties LLC. The selling agent, Barret Woods of Lee & Associates-Ontario, represented himself as a principal in the transaction. Brad Yates and Stefan Pastor of Stream Realty represented the buyer.

Bayview Provides $19.8M C-PACE Financing for Hotel Development Near Yosemite National Park

by Jeff Shaw

OAKHURST, CALIF. — Bayview PACE has provided a $19.8 million financing agreement for the construction of a new 125-room hotel in Oakhurst, about 16 miles south of Yosemite National Park. The financing will enable the start of construction on the resort, which aims to attract adventure and lifestyle travelers. The project will feature luxury accommodations, a full restaurant and bar, meeting spaces and other amenities. Waterton and equity partner Argosy Real Estate are the developers.

CAMPBELL AND SANTA CLARA, CALIF. — JLL Capital Markets has arranged the sale of three garden-style apartment communities in Silicon Valley for approximately $70 million. The portfolio includes: Appletree, a 72-unit community in Campbell; Vista Point, a 68-unit property in Santa Clara; and Cedartree, a 50-unit asset that is also located in Santa Clara. All properties offer one- and two-bedroom floor plans. Ryan Wagner, Brandon Geraldo and Matt Kroger led the team that represented the private seller and procured three unique buyers. Further details were not disclosed.

COSTA MESA AND ANAHEIM, CALIF. — CBRE has arranged the sale of two multifamily communities totaling 38 units in Orange County for $12.1 million. The communities traded hands in a 1031 exchange. All parties involved in both transactions were private investors based in Southern California. Dan Blackwell, Mike O’Neill and Andrew Boukather represented both the buyer and seller of 18 units at 1800 W. Glencrest Ave. in Anaheim for $4.8 million. The property was built in 1962 and comprises a pair of two-story buildings. The buildings recently underwent renovations including new flooring, appliances, bathrooms, kitchens, windows, stairs, railings and fascia. Blackwell and O’Neill also represented the seller of the 20 units at 1887 Monrovia Ave. in Costa Mesa. The asset traded hands for $7.3 million. Built in 1959, 1887 Monrovia Ave. comprises one two-story building with a pool, barbeque area and a community laundry room. Recent updates to select units include granite countertops, wood-style flooring and stainless-steel appliances.

SAN DIEGO — Fruit juice concept Sip Fresh has entered a three-unit franchise agreement with operator Kevin Tam for locations in metro San Diego. The deal includes the acquisition of an existing store located in the Westfield UTC Mall and plans for two additional locations in the area. Tam’s previous experience includes concepts Wetzel’s Pretzels and Sweetgreen, as well as other quick-service restaurant brands and food trucks. Sip Fresh plans to sign 35 new franchise agreements by the end of the year.

LOS ANGELES — CIM Group has broken ground on a 168-unit mixed-income multifamily development with 40,000 square feet of ground-floor retail space in Los Angeles. The project at 3045 Crenshaw Blvd. is located on the former north campus of the West Angeles Church of God in Christ. The six-story apartment community will offer 17 affordable housing units. Floor plans will consist of studios, one- and two-bedroom units. Amenities will include a courtyard, pool, fitness center, clubroom and two outdoor sky decks on the fifth level. The development offers convenient access to the Metro E Line light rail station on Crenshaw Boulevard, which connects east to downtown Los Angeles and west to Santa Monica. After 43 years at its north campus location, West Angeles Church has consolidated its facilities and now operates from its south campus location at 3600 Crenshaw Blvd. West Angeles Church’s sale of the property at 3045 Crenshaw Blvd. to CIM Group took place in March and was part of the church’s long-planned property dispositions announced in 2019 to bring new community-serving developments to the neighborhood. The church used the sale proceeds to fund various church programs and initiatives, including the construction of a Family Life Center that …

WEST SACRAMENTO, CALIF. — Avanath Capital Management LLC has acquired Rivers Senior, a 120-unit affordable seniors housing community in West Sacramento, for $19 million. Constructed in 2008, Rivers Senior was built utilizing the California Tax Credit Allocation Committee’s Low-Income Housing Tax Credits (LIHTCs) along with bond financing via multiple agencies. Additionally, the asset benefits from the State of California’s Welfare Tax Exemption. The community features 96 one-bedroom and 24 two-bedroom units, 60 of which are reserved for residents earning up to 50 percent of area median income (AMI) and 59 units of which are reserved for residents at 60 percent of AMI. The property consists of nine two-story buildings situated on 4.8 acres, located approximately 2.5 miles west of downtown Sacramento, the main employment center for the city of Sacramento. The property, Avanath’s 19th acquisition in Northern California and its 13th in the greater Sacramento area, was purchased in an off-market transaction with the seller, from which Avanath has previously purchased numerous Sacramento-based multifamily assets. Avanath will manage the property internally and plans to implement several capital improvements at the property, including replacing the roofs and boilers. The firm will also incorporate ESG principles aligned with its mission, including upgrading …

CBRE Brokers $10M Sale of Courtyard Apartments at La Pat Place in Westminster, California

by Jeff Shaw

WESTMINSTER, CALIF. — CBRE arranged the sale of Courtyard Apartments at La Pat Place, a 30-unit community in Westminster. A private investor purchased the property for $10 million. Courtyard Apartments at La Pat Place was built in 1963 and offers a mix of studio, one-, two- and three-bedroom floor plans. All 30 units were remodeled as part of the $1 million in renovations completed by the seller. Dan Blackwell and Andrew Boukather represented the buyer and undisclosed seller in this transaction.

PICO RIVERA, CALIF. — CapRock Partners has acquired Olive Tree Industrial, a 3.1-acre, value-add industrial outdoor storage property in Pico Rivera, just southeast of Los Angeles. The property features about 31,000 square feet of warehouse space and a large, secured storage yard. CapRock intends to transform the property into a modern and functional facility. The firm continues to seek value-add investment opportunities throughout the Western and Central U.S. Mark Repstad and Carla Chen with Southland CRE represented CapRock in the purchase transaction. They were also retained to market and lease Olive Tree Industrial’s available space.