RANCHO MISSION VIEJO, CALIF. — Westar Associates has released plans for Esencia Commons, a 175,000-square-foot retail center in Rancho Mission Viejo. Upon completion, the property will feature a supermarket, fitness center, gas station and other retail and restaurant spaces. Groundbreaking for the project — which will be located within a 50-acre mixed-use development that includes an apartment community, business park, self-storage facilities and planned medical offices — is scheduled for the fourth quarter of this year. Westar will manage the property and has begun leasing efforts for the center.

California

LOS ANGELES — TTM Real Estate Capital has purchased HHLA, a 248,841-square-foot retail center located in the Westchester neighborhood of Los Angeles. Newmark and JLL brokered the sale. TTM also announced the addition of two tenants to the property, 60out Escape Rooms and Genio Global Entertainment’s Muhammed Ali Experience, which will open later this year. At the time of sale, the property was home to tenants including CineMark, Ben & Jerry’s, Buffalo Wild Wings, Dave & Buster’s and Starbucks Coffee. Rebranded from The Promenade at Howard Hughes Center, the property underwent a $35 million renovation following its acquisition by the previous owner, Laurus Corp. Torchlight Investors LLC was a preferred equity partner when Laurus acquired the asset in 2015 for $111 million.

PALO ALTO, CALIF. AND LAS VEGAS — Simon Property Group and José Andrés Group (JAG) have announced plans to collaborate and bring restaurants to three properties located in Las Vegas and Palo Alto. The partnership will introduce new dining concepts to Stanford Shopping Center in Palo Alto and The Shops at Crystals in Las Vegas. The collaboration will also bring Turkish, Greek and Lebanese restaurant Zaytinya to The Forum Shops at Caesars Palace in Las Vegas.

Watermark Opens Leasing Center at Seniors Housing Community in Laguna Niguel, California

by Jeff Shaw

LAGUNA NIGUEL, CALIF. — Tucson-based Watermark Retirement Communities and Alliance Residential Company have opened the leasing office at Watermark Laguna Niguel. The assisted living and memory care community is scheduled to open this summer.

LOS ANGELES — Silverstein Properties has completed its $60 million capital improvement program at U.S. Bank Tower in downtown Los Angeles. The two-year renovation was designed to meet the evolving needs of traditional and creative office tenants. Silverstein acquired the tower in September 2020 and began the capital improvements in May 2021. Informed by hospitality design, upgrades across 35,000 square feet of common spaces include a redesigned main entrance and lobby; new contactless elevators and elevator lobbies; a new day-to-night juice and cocktail bar; a grab-and-go market; and seating and collaboration areas. By November 2020, five new leases were signed at the tower, including Walter P. Moore, a global management consulting firm, Lincoln International, Rothschild & Co. and Morgan & Morgan.

ANAHEIM, CALIF. — A joint venture between MBK Rental Living and Haseko Corp. has started construction of the 315-unit Zia multifamily community in Anaheim. Located at 1600 W. Lincoln Ave., the development will feature luxury interior finishes and sustainable elements, including quartz countertops, stainless-steel appliances, distinctive wood-style plank flooring and large-scale precision windows. Zia will offer studio to three-bedroom floorplans ranging from 600 to 1,900 square feet. The grand opening is scheduled for mid-2024.

ALMQUIST Signs 21 Tenants to River Street Marketplace in San Juan Capistrano, California

by Jeff Shaw

SAN JUAN CAPISTRANO, CALIF. — ALMQUIST has signed 21 tenants to River Street Marketplace, a 60,000-square-foot retail development currently underway in San Juan Capistrano. Concepts that will join the lineup include Bred’s Hot Chicken, Capistrano Brewing, Common Thread, Fermentation Farm, Finca by David Pratt, Free People, Gueros Cevicheria, Hudson’s Cookies, Kozan Teahouse & Boba, La Vaquera, McConnell’s Ice Cream, The Meat Cellar Market and Steakhouse, Mendocino Farms, Nana’s Fish Chippery, Nom, SALT., Seager, Shootz Hawaiian, Toes on the Nose, Ubuntu Café and Wildfire Mercantile.

Orange County’s Retail Vacancy is Tight, but Capital Markets Activity Will Be Sluggish this Year

by Jeff Shaw

— By Terrison Quinn, Managing Principal, SRS Real Estate Partners — The Orange County retail property market was very active last year for both leasing and capital markets. At 4 percent, Orange County’s retail vacancy was back down to pre-pandemic levels. There was an annual net positive absorption of 445,000 square feet with 191,000 square feet of new space delivered in 2022, per CoStar. Average rents increased 5 percent from an average market rent of $34.84 per square foot, per year to $36.58 — the highest rate of rent growth in 10 years. We don’t see rents coming down at all this year, especially as there’s only 170,000 square feet of new space currently under construction and we continue to experience favorable consumer demand. From a capital markets perspective, investment activity remains to be seen. In line with national trends, many investors and lenders are putting capital deployment on pause as they analyze economic activity and adjust to a period of higher interest rates, higher inflation and, perhaps surprisingly, strong employment. Despite the angst that comes from uncertainty, there is a lot of positive sentiment toward economic corrections, creating investment opportunities over the coming years. This is certainly the …

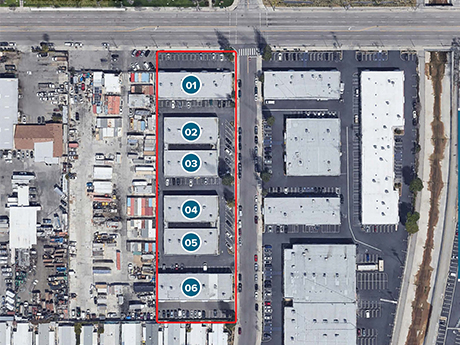

LOS ANGELES — Selective Eton Nordhoff LLC has acquired a 48,550-square-foot industrial property in the Chatsworth and Canoga Park communities of Los Angeles. Though the purchase price was not disclosed, the asset was listed at nearly $10.5 million and sold for above asking price. The multi-tenant industrial property was built in 1977. It has largely remained the same since that time, save for cosmetic updates over the years. Arthur Pfefferman of Coldwell Commercial Quality Properties represented both the buyer and the seller.

CARLSBAD, CALIF. — PSRS has arranged $5.9 million in financing for the acquisition of a 32,000-square-foot industrial property in Carlsbad. The deal closed in 35 days to meet the borrower’s 1031 exchange deadline. The non-recourse loan features a five-year term with a 5.55 percent interest rate and a 30-year amortization. Ryan Frankman and Ari Zeen of PSRS arranged the financing through an insurance company.