SAN RAMON, CALIF. — Belmont Village Senior Living, in partnership with Sunset Development, has broken ground on Belmont Village San Ramon. Located at 6151 Bollinger Canyon Road within the Bishop Ranch neighborhood of San Ramon, the 175,320-square-foot community will feature a heated saltwater pool, putting green, farm-to-table gardening areas, al fresco dining, outdoor yoga lawn and group fitness space, and a dog park. Slated for completion by fall 2024, Belmont Village San Ramon will feature 177 studio, one- and two-bedroom residences for independent living, assisted living and memory care needs. The property will offer residents concierge and transportation services, valet parking, onsite physiotherapy, a fitness center, art studio, screening room, club lounge, full-service salon and spa, personal wine storage and multiple dining venues. Aron Will, Tim Root and Michael Cregan of CBRE National Senior Housing secured the non-recourse construction financing for the project on behalf of a joint venture between Belmont Village Senior Living and Harrison Street Real Estate Capital. The project team includes W.E. O’Neil Construction and HKIT Architecture.

California

PSRS Arranges $16.3M Refinancing for Eastlake Village Center Retail Space in Chula Vista, California

by Amy Works

CHULA VISTA, CALIF. — PSRS has secured a $16.3 million non-recourse loan for the refinancing of a 43,471-square-foot retail space at Eastlake Village Center in Chula Vista. James Mulvihill and Kevin Mulvihill of PSRS arranged the loan, which a life insurance company provided. PSRS will service the mortgage as part of its $6.6 billion loan serving portfolio.

Paladin Equity Capital Acquires Land Parcel in San Bernardino for Everhome Suites Hotel Development

by Amy Works

SAN BERNARDINO, CALIF. — Paladin Equity Capital has purchased a 1.7-acre land site at 898 E. Harriman Place in San Bernardino from Los Angeles-based NHOS Enterprises. The buyer plans to develop an Everhome Suites extended-stay hotel on the site. Slated to break ground in summer 2023, the 60,000-square-foot hotel will feature 117 apartment-style guest rooms with fully equipped kitchens and customizable space, including workstations, full-size closets, additional storage and spa-like bathroom. Onsite amenities include public spaces, a fitness center and a 24/7 self-service marketplace with a variety of food and beverage options. Brad Umansky and Paul Galmarini of Progressive Real Estate Partners represented the seller, while Kevin Barry of Irish Commercial Brokerage represented the buyer in the transaction.

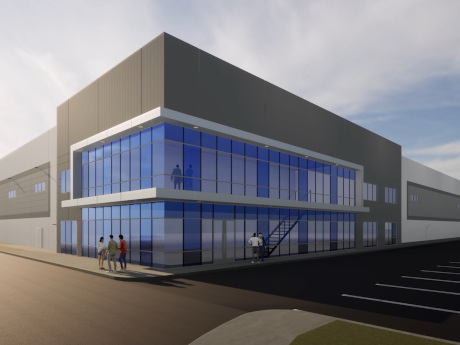

SAN DIEGO — A joint venture between San Diego-based Elevation Land Co. and a real estate fund advised by Crow Holdings Capital has unveiled plans to develop Otay Business Park, a 1.8 million-square-foot industrial, distribution and warehouse property in the Otay Mesa submarket of San Diego. Current construction plans for Otay Business Park include the development of eight speculative or build-to-suit buildings that can accommodate users ranging from 45,000 square feet to 500,000 square feet. The buildings will feature 32-foot to 36-foot clear heights, 325 dock-high loading positions, 175 trailer stalls and 16 grade-level loading doors. Slated for completion in the second half of 2024, Phase I will consist of 1 million square feet of space spread across five buildings. Phase II will consist of 770,000 square feet across the buildings, with completion scheduled for 12 months after Phase I is delivered. All buildings are planned for speculative development but can be delivered on a build-to-suit basis for occupants. The developers acquired a total of 263 acres of land where the project is being developed during the second quarter of 2022 for $165 million. The land purchased included the 119 acres that Otay Business Park will occupy, along with several …

LOS ANGELES — Sony Pictures Entertainment has signed a long-term, multi-floor lease to occupy 225,239 square feet of office space at Wilshire Courtyard, a two-building, Class A office campus on Los Angeles’ Miracle Mile. The company is relocating select divisions from Culver City to the new offices at 5750 Wilshire Blvd. Josh Bernstein, Peter Collins, Scott Menkus and Alexa Delahooke of Cushman & Wakefield represented the landlord, Onni Group, while Josh Gorin and Mike Catalano of Savills represented Sony in the lease negotiations. Neal Linthicum of Onni managed the transaction on the company’s behalf. Wilshire Courtyard comprises two six-story office buildings, located at 5700 and 5750 Wilshire Blvd., totaling 1 million square feet. The buildings were originally developed in the late 1980s and underwent significant interior and exterior renovations in 2015. The asset features 125 tiered outdoor balconies for indoor/outdoor work, an onsite Equinox Fitness, renovated common areas and plazas, and a park with jogging trails. Additionally, Onni is adding an amenity center to the property with a golf simulator, multi-screen entertainment center, tenant lounge and conference facility.

Progressive Real Estate Partners Brokers $11.9M Sale of Retail Property in Norco, California

by Amy Works

NORCO, CALIF. — Progressive Real Estate Partners has arranged the sale of a gas station, car wash and multi-tenant retail space at 996 Mountain Ave. in Norco. A Los Angeles private investor sold the asset to a Los Angeles-based private investor that operates gas station properties for $11.9 million in an all-cash transaction. Built in 2000 and fully remodeled in 2020, the property features 18 Chevron fueling positions, a self-service express car wash with a 150-foot tunnel, a 22,000-square-foot ExtraMile convenience store and two retail spaces that Valvoline and a window tinting company occupy. Victor Buendia of Progressive Real Estate represented the seller, while Grace Sue of Meiguo Realty represented the buyer in the deal.

SAN DIEGO — CBRE has arranged the sale of an office building located at 10200 Willow Creek in San Diego’s Scripps Ranch submarket. Espten Grinnell & Howell APC sold the asset to a private buyer, completing a 1031 exchange, for $6 million. Matt Pourcho, Jeb Bakke, Anthony DeLorenzo, Matt Harris and Nick Williams of CBRE Private Capital Partners represented the seller, while the buyer was self-represented in the transaction. Built in 1980 on 2.2 acres, the one-story property features 23,524 square feet of office space and 92 parking spaces. At the time of sale, the building was fully leased.

IRA Capital Sells 157,322 SF Poinsettia Plaza Shopping Center in Ventura, California for $66M

by Amy Works

VENTURA, CALIF. — IRA Capital has completed the disposition of Poinsettia Plaza, a shopping center located at 4220-4360 E. Main St. and 4687-4731 Telephone Road in Ventura. An undisclosed buyer acquired the property for $66 million. At the time of sale, the 157,322-square-foot Poinsettia Plaza was 96.5 percent occupied. Current tenants include Ross Dress for Less, Office Depot, Petco, FedEx, Lamps Plus and Aldi. Recent renovations at the property include modernizations of existing facades, new landscaping and parking lot upgrades. Pete Bethea, Rob Ippolito and Glenn Rudy of Newmark represented the seller in the deal.

Hanley Investment Group Brokers $21.2M Sale of El Dorado Shopping Center in Long Beach, California

by Amy Works

LONG BEACH, CALIF. — Hanley Investment Group Real Estate Advisors has arranged the sale of El Dorado Shopping Center, a retail property located at 8105-8195 E. Wardlow Road in Long Beach. A partnership managed and represented by Orange-based Milan Capital Management acquired the asset from El Segundo-based DPI Retail for $21.2 million. Grocery Outlet and Dollar Tree anchor the 74,500-square-foot shopping center. Built in 1965 and renovated in 2003, the asset was 93 percent occupied at the time of sale. Kevin Fryman and Ed Hanley of Hanley Investment Group represented the seller in the transaction.

Dunbar Real Estate Holdings Buys 92,640 SF Retail/Industrial Portfolio in Los Angeles County

by Amy Works

GARDENA, CALIF. — El Segundo, Calif.-based Dunbar Real Estate Holdings LLC has acquired two freestanding retail and industrial buildings from T.A. Properties LTD for $22.7 million in an off-market transaction. The buildings are located at 1355-1361 W. 190th St. in Gardena. AutoZone, 3 Day Suit Broker, Off Broadway West and 4 Wheel Parts are tenants at the 92,640-square-foot asset. The property consists of two concrete tilt-up buildings situated on 3.7 acres. The buildings offer 18-foot and 19-foot clear heights, fire sprinklers, dock-high loading doors, private security fenced yards and ample grade-level parking. Chuck Brill of DAUM Commercial represented the buyer, while The Altemus Co. represented the seller in the deal.