LAS VEGAS; SCOTTSDALE, ARIZ.; AND ALBUQUERQUE, N.M. — Kennedy Wilson has acquired three multifamily communities totaling 1,110 units in three separate off-market transactions for $418 million, excluding closing costs. The properties are Palms at Peccole Ranch in Las Vegas, La Privada in Scottsdale and San Miguel del Bosque in Albuquerque. The company invested $255 million of total equity in the three communities, which are expected to generate approximately $15 million of initial annual net operating income to Kennedy Wilson. Beginning immediately, Kennedy Wilson will implement a $19 million value-add asset management plan, including renovating more than 65 percent of existing units, refreshing common areas and enhancing amenities to further grow net operating income.

California

Majestic Realty, Sunroad Enterprises Start Construction of 1.1 MSF Spec Industrial Expansion in San Diego

by Amy Works

SAN DIEGO — Majestic Realty Co. and Sunroad Enterprises have started construction on the second half of their four-building Landmark at Otay development, located at the intersection of state routes 905 and 125 in San Diego. Construction is underway on 50 acres of the 67-acre master-planned development, including a 240,975-square-foot building at 1610 Landmark Road and a 235,085-square-foot building at 1910 Landmark Road. Both buildings will feature 36-foot ceiling clearance and 185-foot secure truck courtyards with individual trailer storage. Additionally, the buildings will offer ESFR fire systems, 51 trailer parking stalls, 40 dock-high doors and two ground-level doors with ramps, as well as Superflat warehouse floors and building-wide clerestory windows. Mark Lewkowitz, Chris Holder and Will Holder of Colliers San Diego are marketing and leasing Phase II of the project. Completion is slated for February 2023. The development team plans to break ground on Phase III, a two-building component including 150,000-square-foot and 115,000-square-foot buildings, this summer.

Halftery Development, Trinity Investors Receive $39.4M Construction Loan for Shopping Center in French Valley, California

by Amy Works

FRENCH VALLEY, CALIF. — Marcus & Millichap Capital Corp. (MMCC) has secured $39.4 million in construction financing for French Valley Marketplace, a grocery-anchored shopping center development in French Valley. The nonrecourse loan will provide funds to complete the horizontal and vertical construction of the project. A partnership between Texas-based Trinity Investors and Pasadena-based Halftery Development Co. are leading the fully entitled, 22-acre project. Current tenants include Grocery Outlet, Rite Aid, EoS Fitness, McDonald’s, AutoZone and 7-Eleven. Brandon Wilhite of MMCC and Sunny Sajnani and Todd McNeill of Institutional Property Advisors, a division of Marcus & Millichap, arranged the financing. The origination team is based out of MMCC’s Dallas office. Trez Capital operated as the lender for the transaction.

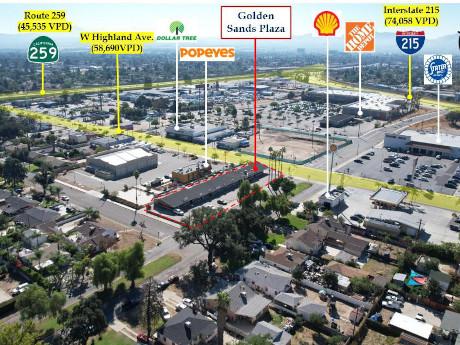

SAN BERNARDINO, CALIF. — Marcus & Millichap has brokered the sale of Golden Sands Plaza, a retail property located at 1090 W. Highland Ave. in San Bernardino. Built in 1962, the 10,057-square-foot property was 90.3 percent leased at the time of sale. A Northern California-based limited liability company sold the asset to another Northern California-based limited liability company for $1.1 million. Julia Evinger of Marcus & Millichap’s Indianapolis office represented the seller and secured the buyer in the deal. Adam Christofferson of Marcus & Millichap’s Los Angeles office served as broker of record for the transaction.

LOS ANGELES — Breakthrough Properties, a joint venture between Tishman Speyer and Bellco Capital, has closed its Breakthrough Life Science Property Fund. The venture raised $3 billion in direct capital and co-investments, to scale a global portfolio of ecosystems for early-, mid- and late-stage life science companies. Founded in 2019, Breakthrough will use the newly raised funds to finance its ongoing developments, which are in various stages of design, construction and pre-development, as well as and fuel its acquisition of additional opportunities throughout the United States and Europe. The venture currently has 4.6 million square feet of projects in the pipeline across San Diego, Boston and Cambridge, Mass., Philadelphia, Amsterdam and Oxford and Cambridge, UK. In 2021, Breakthrough broke ground on its 515,000-square-foot Torrey View by Breakthrough development, a 10-acre research and development campus in San Diego. The biosciences arm of BD (Becton, Dickinson and Co.) signed a lease at the campus prior to completion.

SAN DIEGO — Davlyn Investments has completed the sale of Northridge Summit, a Class A office property located at 12220 Scripps Summit Drive in San Diego’s Scripps Poway Parkway submarket. DivcoWest purchased the asset for $76.1 million. At the time of sale, the single-tenant, 130,000-square-foot building was fully leased. The property features 43,000-square-foot rectangular floorplates, one level of below-grade parking, electric vehicle charging stations and a courtyard. Nick Psyllos, Lynn LaChapelle and Kurt Luedtke of JLL Capital Markets represented the seller in the deal.

SAN FRANCISCO — SHVO and architects Foster + Partners have unveiled plans for Three Transamerica at 545 Sansome St. in San Francisco, including the expansion and upgrade of the building to a contemporary, high-design office building. Built in the 1930s, the historic Art Deco structure was originally designed for the California Ink Co. The building’s new design emphasizes sustainability while revitalizing the historic structure. The building’s interior will be completely modernized and brought up to date with current building codes while preserving the integrity of the historic structure. Its two Art Deco façades will be restored, and the building floor plates extended toward Washington Street and Redwood Park creating double-height office spaces. Additionally, new office space will be created above the existing building, set back from the historic Sansome Street façade, creating an additional 50,000 square feet of office space. Estimated development costs were not disclosed. The 10-story building is part of Transamerica Pyramid Center, which also includes an iconic, 48-story, pyramid-shaped anchor building built in 1972. SHVO bought the two buildings and the small, urban park between them in October.

LOS ANGELES, BEVERLY HILLS AND LONG BEACH, CALIF. — Bellwether Enterprise Real Estate Capital (BWE) has arranged $108 million in refinancing for nine multifamily properties totaling 400 units in California. Jason Krupoff of BWE’s Irvine office originated the loan for the borrower, Redwood Urban. The properties were refinanced with a Fannie Mae credit facility. The properties include: 1820 Whitney Ave., 1837 Whitley Ave., 1912 Whitley Ave., 1823 Grace Ave., 6600 Yucca St. and 6651 Franklin Ave., totaling 267 units in Los Angeles’ Hollywood neighborhood 9152 Alden Way and 8600 Burton Way, totaling 29 units in Beverly Hills 104 units at 210 Third Lofts at 210 Third Ave. and 225 Long Beach Blvd. in Long Beach The Hollywood properties are within walking distance to a variety of amenities and opportunities. The Beverly Hill properties offer in-unit laundry, marble countertops and garage parking. The Long Beach community features private balconies, in-unit laundry, updated appliances, gas stoves and 15,000 square feet of ground-floor retail space.

Masagana Properties Sells Two Dollar General-Occupied Properties Near San Bernardino for $6.5M

by Amy Works

YUCCA VALLEY AND LUCERNE VALLEY, CALIF. — Masagana Properties has completed the sale of a two-property retail portfolio near San Bernardino. An undisclosed buyer acquired the portfolio for $6.5 million. The 9,100-square-foot Dollar General, located at 1059 Old Woman Springs Road in Yucca Valley, sold for $3 million. The second 9,100-square-foot Dollar General, located at 32510 CA-18 in Lucerne Valley, sold for $3.4 million. Jaime Salazar and Daniel Hurd of Marcus & Millichap’s Tampa office represented the seller and buyer in the deal. Garrett Fierstein of Marcus & Millichap secured a 10-year, fixed-rate loan with a 30-year amortization for the buyer.

Clearwater Living Nears Completion of 117-Unit Seniors Housing Community in Glendora, California

by Amy Works

GLENDORA, CALIF. — Clearwater Living has opened the sales office at Clearwater at Glendora, a 117-unit assisted living and memory support community in Glendora, approximately 25 miles east of Los Angeles. Construction on Clearwater at Glendora began in spring of 2021. The two-story, 117,000-square-foot property is being built on nearly three acres. When it is completed later this year, the community will feature 88 assisted living and 29 memory care apartments with studio, companion, one-bedroom and two-bedroom layouts.