FAIRFIELD, CALIF. — A partnership between Faris Lee Investments and John Cumbelich & Associates has negotiated the sale of a 24,604-square-foot, two-building retail center located at 1370-1380 Holiday Lane in Fairfield. Built in 2005 on 2.3 acres, the center is roughly 42 percent occupied. Tenants include Aspen Dental, Peet’s Coffee & Tea, Togo’s Sandwich Shop and Golden 1 Credit Union. Additionally, the center features an anchor space totaling 14,375 square feet, which is currently unleased. Scott DeYoung, Jeff Conover and Greg Lukosky of Faris Lee, along with John Cumbelich and Joe Kuvetakis of John Cumbelich & Associates, represented the undisclosed seller in the transaction.

California

Shopoff Realty Investments Sells Final Retail Parcel at Sunrise Village in Fullerton, California for $2.5M

by Amy Works

FULLERTON, CALIF. — Shopoff Realty Investments has sold the last remaining retail parcel at Sunrise Village, a 14-acre neighborhood shopping center located in the Orange County city of Fullerton, for $2.5 million. The recently sold property totals nearly half an acre and houses a veterinary clinic. The unused space at the parcel will be transformed into a fast-casual Korean restaurant. The remaining retail parcels at the property were previously sold to separate owners. The first parcel sale included a 1.4-acre corner retail space, which featured a drive-thru Del Taco and three adjacent retail pads. The other two retail parcels totaled roughly 1 acre apiece. Lennar Homes purchased The Pines at Fullerton, the 9.9-acre residential portion of Sunrise Village, in October 2023, with plans to build 113 homes. Construction is already underway on the site, with the first set of homes scheduled for delivery in 2026. Shopoff originally acquired the shopping center in 2021 for $26.5 million and secured approvals to redevelop the property into a mixed-use center with service-based tenants and housing options.

SAN DIEGO — On behalf of Sunroad Enterprises, JLL Capital Markets has arranged a $1.1 billion venture with Fairfield to capitalize a 15-property multifamily portfolio that spans six states. JLL also arranged $415 million in financing with Freddie Mac for 10 assets. The loan will be serviced by JLL Real Estate Capital, a Freddie Mac Optigo Lender. Additionally, $250 million of financing was secured from accounts managed by KKR. The assets, which represent a portion of Sunroad’s overall portfolio, were assembled over a six-year period. Totaling 3,830 units, the portfolio consists of six Class A core assets and nine value-add assets with ongoing renovations underway. The assets have an average vintage of 2011 and are a mix of 65 percent garden-style communities and 35 percent mid-rise communities, with six in Arizona, one in Nevada, three in Colorado, two in North Carolina, two in South Carolina and one in Georgia. Aldon Cole, Roberto Casas, Tim Wright and Bharat Madan of JLL handled the majority of the transactions, while Mark Wintner of JLL handled the Colton Apartments asset in Henderson, Nev.

WEST COVINA, CALIF. — CBRE has directed the $26.3 million purchase of Cambridge Apartments, a multifamily property in West Covina. A multifamily investment group acquired the asset, which is located at 2601 E. Valley Blvd. Situated on 5.5 acres, Cambridge Apartments offers 76 one- and two-bedroom units. Eric Chen and Justino Fa’aola of CBRE represented the buyer in the transaction.

SAN DIEGO — Marcus & Millichap has brokered the sale a retail property located at 1631 Sixth Ave. in downtown San Diego’s Cortez Hill submarket. Mills at Cortez LLC sold the asset to an undisclosed buyer for $1.9 million. 7-Eleven and Barber Craft Retail Condo occupy the 3,251-square-foot property. Reed Hamilton, Bill Rose and Parker Wada of Marcus & Millichap represented the seller in the deal.

Mesa West Capital Provides $43.5M Loan for Refinancing of Apartment Community in Los Angeles

by Amy Works

LOS ANGELES — Mesa West Capital has provided a joint venture between Alliance Residential and PCCP with $43.5 million in short-term, first mortgage debt to refinance Broadstone Los Feliz, a multifamily property located at 1800 N. New Hampshire in Los Angeles’ Los Feliz neighborhood. Troy Tegeler, Trevor Breaux, Ryan Greer and CJ Connolly of CBRE arranged the five-year, floating-rate loan. Built in 1986, Broadstone Los Feliz offers 134 studio, one- and two-bedroom apartments, a rooftop lounge and barbecue area, an indoor swimming pool and spa, a fitness center and electric vehicle charging stations. At the time of financing, the property was 95 percent occupied. Since acquiring the asset in 2022, the owners have invested more than $1 million to upgrade the common areas and renovate the interiors of 33 units with hardwood flooring, quartz countertops, stainless steel appliances and new wood-grain cabinets. The sponsor plans to renovate the remaining 45 units within the next two years.

LOS ANGELES — Los Angeles-based Prime Pizza, a rapidly expanding New York-style pizza restaurant, has signed leases for five new locations in Southern California. The locations are at Alicia Landing Shopping Center in Mission Viejo; Gaslight Square in Brea; Farmers & Merchants Bank Center in Torrance; and two freestanding locations, one in Thousand Oaks and another in Valley Village, Calif. Mark Seferian of RCI Brokerage represented Prime Pizza in the transactions, which ranged from 1,256 to 1,951 square feet. The Mission Viejo and Brea locations are slated to open in the fourth quarter of 2025, while the Valley Village, Thousand Oaks and Torrance locations will open during the second quarter of 2026.

Sack Capital Partners, Belveron Partners Buy 164-Unit Multifamily Property in San Jose, California

by Amy Works

SAN JOSE, CALIF. — A joint venture between Sack Capital Partners and Belveron Partners has acquired Fountain Park, an apartment community in San Jose. Terms of the transaction were not released. Located at 1026 S. De Anza Blvd., Fountain Park offers 164 studio, one- and two-bedroom units. Community amenities include a clubhouse, barbecue area, resort-style swimming pool with spa hot tub, sauna, covered parking with electric vehicle charging and a dog park. The new owners have a long-term commitment to convert a portion of the apartments into affordable housing. Sack will provide property management services for the asset.

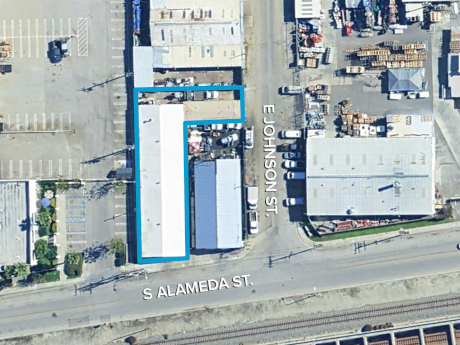

COMPTON, CALIF. — FallTech has purchased an industrial building located at 1414 S. Alameda St. in Compton from Accurate Glass & Mirror Corp. for $1.5 million. Situated on a 9,269-square-foot site, the 6,432-square-foot property features one ground-level door and a clear height of 14 feet. FallTech, which makes fall protection, will use the property to expand its operations. Scott Anderson of The Klabin Co. represented the seller, while Matt Stringfellow of The Klabin Co. represented the buyer in the transaction.

PINOLE, CALIF. — Step Up Housing has purchased Bayside Apartment Homes at 530 Sunnyview Drive in Pinole. Sack Capital Partners and Align Finance Partners arranged structured financing for the acquisition. Additionally, Sack will provide asset and property management for the 148-unit affordable housing community. Originally built in 1974 and renovated in 2017, Bayside features two- and three-bedroom apartments near the shoreline of San Pablo Bay at Point Pinole Regional Shoreline. Institutional Property Advisors, a division of Marcus & Millichap, represented the undisclosed seller in the transaction.