SIGNAL HILL, CALIF. — Marcus & Millichap has brokered the sale of a four-tenant retail pad in Signal Hill. Knouraki Corp. sold the asset to D’Oyen Trust for $6.2 million. Situated within Signal Hill Gateway, the property is occupied by Starbucks Coffee, Chipotle Mexican Grill, Bank of America and Milano Nail Lounge on triple-net leases. Sheila Alimadadian of Marcus & Millichap represented the seller, while Jonathan Weir and Stefan Ignjatovic of Marcus & Millichap procured the buyer in the deal. Danny Abergel of Marcus & Millichap Capital Corp. arranged acquisition financing for the transaction.

California

SAN DIEGO — Lincoln Property Co. has purchased AMP&RSAND at 350 Camino De La Reina in San Diego from CIM Group for $92 million. Matt Carlson and Hunter Rowe of CBRE facilitated the sale, and Scott Peterson, Michael Kolcum and Colby Matzke of CBRE secured financing for the acquisition. Originally the home of the San Diego Union-Tribune for more than 40 years, the 13-acre site has been renovated into a Class A creative office campus. The property includes a five-story building and a three-story building totaling 343,202 square feet and connected by a 65-foot steel pedestrian bridge. The campus includes a fitness center, café, large outdoor patios and flexible conferencing spaces.

Harvest Properties, Stockbridge Acquire 22-Acre Office Campus in San Mateo, California, Plan Multifamily Redevelopment

by Amy Works

SAN MATEO, CALIF. — Harvest Properties, in partnership with Stockbridge, has purchased Clearview Business Park in San Mateo in an off-market transaction. The partnership plans to re-entitle the 22-acre property as a for-sale residential community, which will include affordable housing. Located at 3000-3155 Clearview Way, the property currently includes six office buildings, surface and structured parking and is partially leased to GoPro through 2026. Originally constructed in 1973, the campus previously served as Visa International’s headquarters before transitioning to GoPro in 2011. The redevelopment plan includes up to 225 townhomes and single-family homes with 15 percent designated as affordable. The project is expected to provide homes for up to 700 residents spanning multiple income levels.

Concord Summit Capital Arranges $16.5M in C-PACE Construction Financing for Marriott Tribute Hotel in Santa Barbara, California

by Amy Works

SANTA BARBARA, CALIF. — Concord Summit Capital has arranged $16.5 million in C-PACE construction financing for Marriott Tribute Hotel, a hospitality project underway in Santa Barbara. Tyler Beauregard of Concord Summit Capital sourced the financing through Hall Structured Finance on behalf of the borrower, Newport Beach, Calif.-based Stratus Development Partners. Marriott Tribute Hotel will offer 105 guest rooms and a rooftop amenity space overlooking the Pacific Ocean. Construction is slated to commence this month with completion scheduled for 2027. Stratus Development Partners is a full-service developer with more than 60 years of combined institutional real estate experience and a track record spanning more than $1.5 billion in development across high-barrier-to-entry markets.

Kimco Realty, Bozzuto Break Ground on 214-Unit Multifamily Project in Daly City, California

by Amy Works

DALY CITY, CALIF. — Kimco Realty and Bozzuto have broken ground on The Chester at Westlake, a mixed-use development in Daly City. Scheduled to open in winter 2027, The Chester will offer 214 one-, two- and three-bedroom apartments, more than 13,000 square feet of amenities and 9,854 square feet of leasable ground-floor retail space. The community will feature a two-story lobby and two courtyards connected by a clubroom. The west courtyard will serve as an active social hub with an outdoor kitchen and grilling stations, a water feature and ample lounge and dining areas. The east courtyard will feature a covered lounge, fireplace and lush landscaping. Additional amenities will include a 24-hour fitness center and yoga room, collaborative coworking spaces and personal focus areas, a communal bar area with lounge seating and a rooftop sky lounge and patio. Bozzuto Development Co. will serve as lead developer of The Chester, which is located at 99 Southgate Ave. and part of Kimco’s Westlake Shopping Center. The project team includes Bozzuto Management as property manager, BDE Architecture as architect, Kimley-Horn as civil engineer, Vida Design as interior designer, JETT Landscape Architecture & Design as landscape architect and Palisade Builders as general contractor.

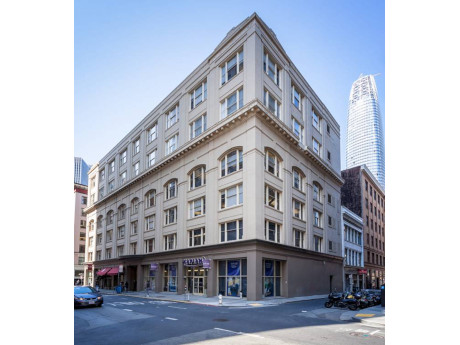

SAN FRANCISCO — TMG Partners and Bridges Capital have purchased 149 New Montgomery Street, an office building in San Francisco’s South Financial District. The partnership acquired the mortgage loan from U.S. Bank as trustee in August and has now acquired the property through a deed in lieu of foreclosure. Originally built in 1907, the property offers 80,000 square feet of office and ground-floor retail space, including Café Madeleine. The new owners plan to renovate the building.

— By Sebastian Bernt of Avison Young — The San Diego office market is beginning to stabilize in 2025. However, recovery remains uneven amid elevated vacancy, rising sublease availability and evolving workplace strategies. While quarterly leasing activity has improved modestly— up roughly 7 percent year over year through the second quarter — overall fundamentals remain challenged. San Diego’s total office availability rate stands at 18.2 percent as of the second quarter. This is flat from the previous quarter but still up more than 500 basis points from pre-pandemic norms. Sublease availability exceeds 2.2 million square feet, a lingering effect of corporate downsizing and the continued shift toward hybrid work models. Sublease inventory is most concentrated in suburban nodes such as UTC and Sorrento Mesa, as well as Downtown San Diego. Demand remains strongest for Class A assets in suburban submarkets like UTC, Del Mar Heights and Sorrento Valley where tenants prioritize modern, amenity-rich properties. Even within these markets, average deal sizes have declined by 20 percent to 30 percent compared to 2019 levels, with users often consolidating space and seeking shorter lease terms. Downtown San Diego continues to face pronounced headwinds, with vacancy topping 25 percent in several Class B …

EAH Housing, County of Santa Clara Break Ground on 90-Unit Affordable Housing Project in Los Altos, California

by Amy Works

LOS ALTOS, CALIF. — EAH Housing and the County of Santa Clara have broken ground on Distel Circle, an affordable housing rental community in Los Altos. Located at 330 Distel Circle, the property will offer 90 affordable residences for individuals and families earning between 30 percent to 80 percent of the area median income. Several units will be designated as permanent supportive housing to help address homelessness and housing instability in the region. Designed by KTGY Architects, Distel Circle will offer studio, one-, two- and three-bedroom apartments, a community room, an outdoor courtyard and dedicated on-site services. Construction is underway with completion slated for January 2027. The project’s primary funding source is Low Income Housing Tax Credit and State Credit equity. The County of Santa Clara contributed $25 million toward the development, of which $15.9 million came from the $950 million Measure A Affordable Housing Bond, which was approved by county voters in 2016, with the balance provided through the county’s No Place Like Home and HOME Investment Partnerships Program funds.

CARLSBAD, CITY OF INDUSTRY AND REDONDO BEACH, CALIF. — MetLife Investment Management has completed the sale of the Golden Coast Portfolio, an industrial portfolio totaling 600,000 square feet in Southern California. The portfolio includes three buildings in Carlsbad, City of Industry and Redondo Beach that were acquired by three separate buyers for a total price of $165.5 million. Jeff Chiate, Rick Ellison, Matt Leupold, Bryce Aberg, Aubrie Monahan, Jeff Cole and Charlie Jacobs of Cushman & Wakefield represented the seller and procured the buyers in the transactions. TA Realty acquired The Concourse, a 420,697-square-foot industrial business park in City of Industry. The property offers 69 dock-high doors, nine grade-level doors and a 160-foot truck court. Terreno purchased The Redondo Beach Two Pack, a 99,340-square-foot property that features 16 dock-high doors, three grade-level doors and a clear height of 16 feet. GID acquired Carlsbad Oaks Business Park, a 78,143-square-foot property with clear heights ranging from 22 to 26 feet, grade and dock loading capabilities, and an efficient warehouse and office layout.

CBRE Brokers $18.9M Sale of Orangewood Corporate Plaza Office Campus in Orange, California

by Amy Works

ORANGE, CALIF. — CBRE has arranged the sale of Orangewood Corporate Plaza, a two-building office campus in Orange. Khoshbin Co. acquired the asset from an undisclosed seller for $18.9 million. Anthony DeLorenzo, Bryan Johnson and Sammy Cemo of CBRE represented the seller in the transaction. Matt Didier, David Dowd and Jennifer Whittington of CBRE advised the seller on the sale. Located at 2100-2200 Orangewood Ave., the 109,644-square-foot campus was 84 percent leased at the time of sale. The property features high-end finishes, subterranean parking and recent capital improvements totaling more than $3.3 million. Renovations included upgrades to HVAC systems, roofing, landscaping and interior common areas.