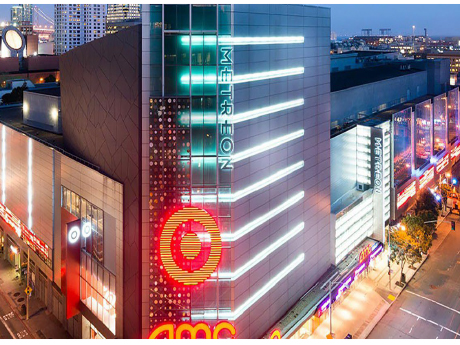

SAN FRANCISCO —TMG Partners and equity partner Bridges Capital LLC have acquired Metreon, a 320,000-square-foot, vertically oriented shopping center in downtown San Francisco. Built in 1999, the retail and entertainment destination is anchored by Target and a 16-screen AMC Theatres that features the tallest IMAX screen in North America. Locally based TMG and Bridges Capital purchased the four-story property from Acore Capital in a deed-in-lieu transaction. The sales price was not disclosed. The City and County of San Francisco will continue to retain ownership of Metreon’s ground lease through at least 2082, according to the San Francisco Business Times. The news outlet also reported Acore Capital was the mortgage lender for Metreon on behalf of the previous owner, Starwood Capital Group. “This investment in Metreon is a powerful vote of confidence in our downtown recovery,” says San Francisco Mayor Daniel Lurie. “We’re grateful for [TMG’s] partnership as we work to accelerate San Francisco’s comeback.” Metreon is located at 135 4th St. at Mission in the city’s Yerba Buena neighborhood. The property includes City View at Metreon, a 31,000-square-foot events venue with floor-to-ceiling windows offering views of the San Franisco skyline. TMG will rebrand the venue and partner with Skylight, a …

California

Newcastle Partners Receives $65.1M Construction Loan for 631,011 SF Ellis Avenue Logistics Center in Perris, California

by Amy Works

PERRIS, CALIF. — Newcastle Partners has received $65.1 million in senior construction financing for the development of Ellis Avenue Logistics Center, an industrial project in Perris. Greg Brown, Allie Black and Nick Englhard of JLL Capital Markets secured the floating-rate, five-year (inclusive of extensions) loan through Bank OZK for the borrower. The 631,0011-square-foot warehouse and distribution facility will feature a clear height of 40 feet, an ESFR sprinkler system, 87 dock-high doors, three grade-level doors, 205 trailer parking stalls and 176 auto parking stalls. Construction of the project, which is located at the intersection of Ellis Avenue and Case Road, is slated to commence in early 2026, with completion and stabilization projected for late 2026.

RIVERSIDE COUNTY, CALIF. — The County of Riverside has acquired two fully leased medical office buildings in Riverside County for a combined total of $53 million. The asset, located at 8876 Mission Blvd. in Jurupa Valley, Calif., sold for $25 million, and the property at 2813 S. Main St. in Corona sold for $28 million. Jurupa Valley Community Health Center is a single-story, 40,000-square-foot medical outpatient building built in 2019. The property is fully leased to the County of Riverside, dba Riverside University Health System (RUHS), under a long-term lease. RUHS also fully occupies the two-story, 45,204-square-foot Corona Community Health Center, which was built in 2018. Travis Lee, Gino Lollio and Tyler Morss of Cushman & Wakefield’s Healthcare Capital Markets team represented the undisclosed seller in the transactions.

Broadview Real Estate Partners Sells 100-Unit Seniors Housing Community in North Tustin, California

by Amy Works

NORTH TUSTIN, CALIF. — Broadview Real Estate Partners has completed the sale of Clearwater at North Tustin, a seniors housing property in North Tustin, to Health Wave Partners for an undisclosed price. Aaron Rosenzweig and Dan Baker of JLL’s Seniors Housing Capital Markets team represented the seller and procured the buyer in the transaction. JLL’s Debt Advisory team arranged acquisition financing on behalf of the buyer through a large national bank. Built in 2001, Clearwater at North Tustin consists of two acuity-specific, single-story buildings offering assisted living and memory care. Onsite amenities include restaurant-style dining, an outdoor amphitheater, music garden, salon and spa, an art studio, a wellness center, dog park and four distinct resident courtyards. The community is situated on 6.6 acres at 11901 Newport Ave.

SAN JOSE, CALIF. — Chicago-based Waterton has acquired Misora, a mid-rise multifamily property at 388 Santana Row in San Jose. Terms of the transaction were not disclosed. Built in 2013, Misora offers 212 studio, one-, two- and three-bedroom units, with half of the layouts featuring a loft configuration or a den and select units including a private balcony. Waterton plans to upgrade residences to a modern finish level, including vinyl plank flooring, new lighting and plumbing fixtures, quartz countertops, new backsplashes and a new technology package. Stainless steel appliance packages and cabinets will be added as needed. Community amenities include a lap pool and spa, rooftop sundeck with barbecue and dining areas, a coworking lounge and conference center, a fitness studio, demonstration kitchen for community use and private underground parking. Waterton plans to update furniture and fixtures in the amenity spaces, add new flooring and equipment in the fitness center and reconfigure underutilized spaces.

PSRS Arranges $8M in Construction Financing for Affordable Housing Development in Los Angeles

by Amy Works

LOS ANGELES — PSRS has arranged $8 million in construction financing for South Central Apartments, a multifamily development in Los Angeles. The ground-up construction project will feature 48 units fully dedicated to affordable housing. Securing the loan through a bank execution, Michael Warner of PSRS delivered a 65 percent loan-to-value structure featuring a two-year term with full-term, interest-only payments.

Barings Sells Seacliff Village Shopping Center in Huntington Beach to Asana Partners for $151M

by Amy Works

HUNTINGTON BEACH, CALIF. — Barings has completed the disposition of Seacliff Village, a core grocery-anchored shopping center in Huntington Beach, to Asana Partners for $151 million. JLL secured an $83.8 million acquisition loan for the buyer. Situated on 26.7 acres at Yorktown Avenue and Main Street, Seacliff Village features 253,234 square feet of retail space that was 95.8 percent occupied at the time of sale. The property is anchored by a 69,925-square-foot Albertsons store. Additional tenants include LA Fitness, Staples, Panera Bread, Starbucks Coffee and four banks. The property is wholly owned, including all 11 outparcel and shop buildings. Gleb Lvovich, Geoff Tranchina and Daniel Tyner of JLL brokered the transaction. Anthony Fertitta Jr. and John Marshall of JLL arranged the acquisition financing for the buyer.

IPA Secures $52M in Financing for 98-Unit Arista Glendale Multifamily Property in California

by Amy Works

GLENDALE, CALIF. — IPA Capital Markets, a division of Marcus & Millichap, has arranged $52 million in financing for Arista Glendale, a multifamily property at 520 N. Central Ave. in Glendale. Stefen Chraghchian of IPA Capital Markets secured the financing with Dwight Capital. The nonrecourse loan features a five-year, interest-only term at a 67.5 percent loan-to-value ratio. Arista Glendale features 98 two- and three-bedroom apartments with in-unit laundry, a 24/7 fitness center, swimming pool with a spa and private cabanas, a resident lounge, an outdoor firepit and barbecue area, a billiards gaming area and parking.

SAN JUAN CAPISTRANO, CALIF. — CBRE has brokered the sale of Marbella Commerce Center, a two-building office campus at 30900-30950 Rancho Viejo Road in San Juan Capistrano. A local private 1031 investor acquired the property for $9.8 million. Anthony DeLorenzo, Matt Didier, Sammy Cemo, Bryan Johnson and Jessie Tichelaar of CBRE represented the private seller in the transaction. Situated on a 2.4-acre lot, the two buildings offer 50,813 square feet of office space. Built in 2001, the asset was 96 percent leased to 17 tenants at the time of sale.

Article Student Living Receives Refinancing for 720-Unit Student Housing Property Near UC Berkeley

by Amy Works

BERKELEY, CALIF. — Article Student Living, an operating platform of QuadReal Property Group, has received refinancing for IDENTITY Logan Park, a two-phase student housing community serving the University of California, Berkeley. JLL Capital Markets secured financing with funds managed by Oaktree Capital Management for the borrower. Totaling 720 beds, IDENTITY Logan Park I and II are located at 2050 Durant Ave. and 2370 Durant Ave., less than half a mile from UC Berkeley’s campus in downtown Berkeley. The community features two buildings completed in 2022 and 2023 with a total of 204 studio, one-, two- and three-bedroom apartments. Units feature stainless steel appliances, in-unit washers/dryers and smart TVs. Community amenities include a 24-hour fitness center, rooftop sky lounge, study spaces and a dedicated campus shuttle service for residents.