— By Kalli Knight of Colliers — The Los Angeles multifamily market faces several headwinds, including rising expenses, the aftermath of recent fires, insurance exclusions and Measure ULA. These factors impact transaction volumes, leading many investors to remain on the sidelines. However, Southern California and Los Angeles will continue to have strong fundamentals, attracting a unique pool of buyers. This includes qualified, high-net-worth family offices eager to take advantage of limited competition to acquire new construction at prices below replacement costs or favorable debt terms. Management companies are increasingly critical in supporting property stabilization post-pandemic, with a growing urgency to enhance operations and increase net operating income. As construction loans mature, their impact on property stabilization is significant. Though the concession rate of 0.7 percent is significantly less than the national concession rate of 1.1 percent, many developers now offer four to six weeks of concessions to lease properties and meet projected rents outlined in their financial analyses. Some developers have also opted for creative strategies, such as providing customized closets to attract renters at higher luxury price points instead of relying solely on weekly concessions. Vacancy rates in the market vary, but have generally improved since 2024. They have …

California

INGLEWOOD, CALIF. — Five new tenants have signed leases to join the Shops at Hollywood Park, the 390,000-square-foot retail district located within the larger Hollywood Park mixed-use development in Inglewood. The new round of leases — which total 13,000 square feet — includes food-and-beverage concepts Raising Cane’s, The Melt, Panini Kabob Grill, Lan Noodle and Rhythm Bar and Lounge. Hollywood Park is owned, developed and operated by Los Angeles Rams owner Stanley Kroenke. Hollywood Park spans 300 acres across 890,000 square feet. In addition to retail, the development features hospitality, residential, office and entertainment space, as well as public parks. Construction of Hollywood Park Studios, a film studio and Olympic broadcast facility, is scheduled to begin at the property this summer. Additional retail tenants include Cinépolis Luxury Cinemas, JD Sports, Iconix Fitness, Cosm and The Meeting Spot, with Phenix Salon Suites, Code Next Lab and Verizon Wireless opening soon.

NEWPORT BEACH, CALIF. — CBRE has negotiated the sale of an office property located at 1303 Avocado Ave. in Newport Beach. A local family office acquired the asset from a local private partnership for $11.5 million. Built in 1973, the two-story, 15,200-square-foot property was 96 percent occupied at the time of sale. Anthony DeLorenzo, Sammy Cemo, Bryan Johnson and Harry Su of CBRE represented the seller in the deal.

COSTA MESA, CALIF. — PSRS has arranged a $5.5 million loan for the refinancing of Ocean Business Park, a flex industrial business park in Costa Mesa. At the time of financing, the property was 100 percent occupied by a diverse tenant mix. Michael Tanner and George Gianoukakis of PSRS secured the financing through one of PSRS’ correspondent life insurance company lenders. The transaction provided the undisclosed borrower with a nonrecourse loan featuring a 10-year term and 30-year amortization.

EAH Housing to Convert Assisted Living Facility into Affordable Housing Units in Glendale, California

by Amy Works

GLENDALE, CALIF. — EAH Housing, in collaboration with Egan | Simon Architecture and ICON National, will convert Parkview Glendale, an assisted living facility in Glendale, into an affordable housing property. Originally built in 1973, the former assisted living facility will be adapted to feature 20 studio apartments ranging from 350 square feet to 360 square feet, 47 one-bedroom apartments ranging from 400 square feet to 475 square feet, and a 750-square-foot manager unit. All units will feature energy-efficient appliances, central heat and air and window coverings. Designed to serve older adults earning 30 percent to 60 percent of the area median income, the 43,000-square-foot community will offer a community room, community garden, spacious courtyards, a resident lounge, elevator, onsite laundry, management offices and ample parking. EAH Housing will also provide an onsite resident services coordinator and collaborate with local organizations to offer specialized programs to enhance residents’ well-being.

Pacific Coast Commercial Negotiates $11.5M Sale of Industrial Building in Santee, California

by Amy Works

SANTEE, CALIF. — Pacific Coast Commercial has arranged the acquisition of a 4.7-acre industrial property located at 8520-8575 Roland Acres Road in Santee. Bailey Roland Acres LP, a local investor, acquired the asset for $11.5 million in an all-cash transaction. The property features five metal warehouse buildings totaling approximately 50,668 square feet, along with large, fenced yards and two overhead cranes. The two-parcel site is fully leased to five tenants. Nick Mane, Ken Robak and Jasmine Golia of Pacific Coast Commercial represented the buyer, while Colliers represented the seller, Mary Jude LLC, in the deal.

WESTMINSTER, CALIF. — PSRS has arranged the $8 million refinance of a retail property in Westminster. The 58,834-square-foot asset is situated in the city’s Little Saigon district. Rob Joseph and Ari Zeen of PSRS secured the 25-year loan, which features a 25-year amortization and a 35 percent loan-to-value ratio, through one of PSRS’ correspondent life insurance companies.

SANTA CLARA, CALIF. — Zscaler has signed a sublease for 301,163 square feet of office space at 4301 and 4401 Great America Parkway in Santa Clara. The company, which provides Zero Trust cybersecurity, will use the facility as its new Silicon Valley global headquarters that is set to open in summer 2026. Mike Saign and Rich Hoyt of Newmark represented Zscaler in the lease negotiations.

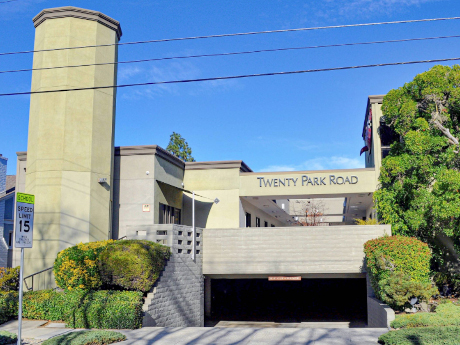

Matthews Real Estate Brokers Sale of 6,815 SF Office Property in Burlingame, California

by Amy Works

BURLINGAME, CALIF. — Matthews Real Estate Investment Services has arranged the sale of The Clock Tower, an office building in Burlingame. Sazze Partners, a venture capital firm from South Korea, acquired the asset for $5.4 million and plans to establish a U.S. office at the site. Located at 20 Park Road, The Clock Tower offers 6,815 square feet of office space. Marko Buljan of Matthews facilitated the transaction.

LOS ANGELES — Live Oak Bank has provided a $25 million bridge-to-sale loan to finance a community located near Los Angeles. An entity doing business as Harbert Seniors Housing Fund I LP is the borrower. The financing features a three-year initial term, 36 months of interest-only payments and $2.8 million in potential future earnout proceeds. The property totals 97 units, with independent, assisted living and memory care residences.