REDWOOD CITY, CALIF. — Diamond Investment Properties has received a $37.7 million loan for the refinancing of 101 Redwood Shores, a Class A office building in Redwood City. Zuora, an enterprise software company, fully occupies the 100,000-square-foot office building and has approximately five years remaining on its lease. Mike Walker and Brad Zampa of CBRE’s Northern California Capital Markets Institutional Properties office represented arranged the loan on behalf of Diamond Investment Properties. A Chicago-based financial institution originated the loan.

California

PETALUMA, CALIF. — MBK Rental Living has completed the development of The Haven at Deer Creek, a Class A apartment property located at 495 N. McDowell Blvd. in Petaluma. The Haven at Deer Creek offers 134 three-story garden-style and three-story podium-style apartments. The community features 93 one-bedroom units and 41 two-bedroom units ranging from 715 square feet to 1,206 square feet, with rents ranging from $2,350 for a one-bedroom to $2,858 for a two-bedroom. The units offer open floor plans with ample natural light, stainless steel appliances, wood-style plank flooring, quartz countertops, ceiling fans, kitchen tile backsplashes, undermount stainless steel sinks, private patios or balconies, in-unit washers/dryers and double-pane, low-E windows. Community amenities include an outdoor living area featuring a spa, grilling stations, a pizza oven and fireplace. The resident lounge offers a fireplace, communal tables, dedicated work-from-home areas, a pool table and a fully equipped entertainer’s kitchen.

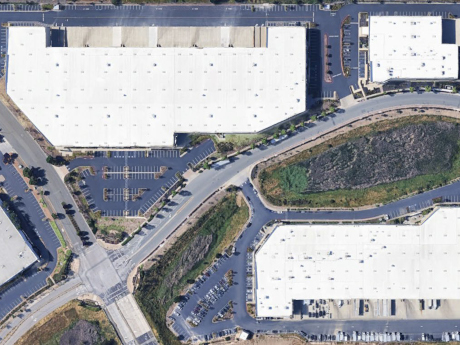

ONTARIO, FONTANA AND SAN BERNARDINO, CALIF. — Cabot Properties has purchased a four-property, 669,057-square-foot industrial portfolio in Inland Empire from a private institutional seller for $202.1 million. The portfolio includes a 263,670-square-foot building at 1670 Champagne Ave. and a 147,484-square-foot facility at 1651 S. Carlos Ave. in Ontario; a 103,343-square-foot building at 10917 Cherry Ave. in Fontana; and a 154,560-square-foot building at 750 S. Valley View Ave. in San Bernardino. Institutionally managed, each building is fully occupied on a triple-net lease with a remaining weighted average lease term (WALT) of 3.6 years with mostly investment-grade tenants. Michael Kendall, Gian Bruno, Kenny Patricia, Kylie Jones, Thomas Taylor, Steve Bellitti and Joey Jones of Colliers represented the buyer and seller in the transaction.

Private Investor Sells Gas Station, Convenience Store, Car Wash Asset in Highland, California for $9.5M

by Amy Works

HIGHLAND, CALIF. — A San Diego-based investor has completed the disposition of a Chevron gas station, ExtraMile convenience store and car wash property located at 27981 Greenspot Road in Highland. G&M Oil Co., the largest Chevron franchisee in California with more than 200 locations, purchased the Highland property for $9.5 million. Victor Buendia of Progressive Real Estate Partners represented the seller, while Scott Olson of C-Store Realty represented the buyer in the all-cash transaction. Built in 2012, the property features an eight-pump Chevron station, a self-service express car wash and a 3,000-square-foot ExtraMile convenience store.

AcquisitionsAffordable HousingCaliforniaMultifamilyNew YorkNortheastSeniors HousingTop StoriesWestern

Standard Communities Acquires $1B Affordable Housing Portfolio Across Four States

by Katie Sloan

LOS ANGELES AND NEW YORK CITY — Standard Communities has acquired a portfolio of 60 affordable housing properties totaling approximately 6,000 units for $1 billion. The transaction is the largest affordable housing acquisition this year, according to the firm. The portfolio includes both traditional multifamily and seniors housing communities and locations across four states, growing the firm’s portfolio in California to 11,000 units and expanding its presence to three new states: Arizona, Colorado and Texas. Properties include the Oaks at Georgetown multifamily community in Georgetown, Texas; Harmony Court, an affordable seniors living community in Redondo Beach, Calif.; and Maroon Creek Apartments in Aspen, Colo. The undisclosed seller developed many of the properties around 2002. Standard plans to invest over $30 million in capital improvements and deferred maintenance across the portfolio. No residents will be displaced during renovations and the communities will remain within the affordable price point, according to the new ownership. An increasing number of households have been designated as “cost burdened” over the past year, leading to a push from policymakers to increase the amount of available affordable housing, according to a recent report by Yardi Matrix. In 2024, 69,600 units are expected to come on line with …

Dwight Capital Finances $59.9M HUD-Insured Loan for Apartment Community in Davis, California

by Amy Works

DAVIS, CALIF. — Dwight Capital has closed a $59.9 million HUD 223(f) refinance for Tanglewood @ Davis, a garden-style apartment complex in Davis. Spanning 14.3 acres, the property offers 216 one-, two- and three-bedroom units across 30 two-story residential buildings. Units include modern appliances, granite countertops, fireplaces and balconies or patios. Community amenities include private parking garages, a basketball court, dog park, fitness center, barbecue and firepit lounge and a swimming pool. Elliot Haft of Dwight Capital originated the transaction. The borrower was not disclosed.

Hanley Investment Group Brokers Sale of 7,914 SF Vacant Restaurant Building in Aliso Viejo, California

by Amy Works

ALISO VIEJO, CALIF. — Hanley Investment Group Real Estate Advisors has arranged the sale of a vacant restaurant building within Aliso Viejo Town Center in Southern California. ValueRock Realty Partners acquired the asset from a private investor for $5.3 million. Located at 26641 Aliso Creek Road in Aliso Viejo, the freestanding, 7,914-square-foot building was built on 1.3 acres in 1997. The property was formerly occupied by Macaroni Grill. Other tenants at Aliso Viejo Town Center include Ralphs, CVS Pharmacy, Staples, T.J. Maxx, HomeGoods, PetSmart and Regal Cinemas. Sean Cox, Bill Asher and Kevin Fryman of Hanley Investment Group represented the seller and buyer in the transaction.

PCCP Provides $85M Acquisition Loan for Three-Building Industrial Park in Richmond, California

by Amy Works

RICHMOND, CALIF. — PCCP has provided an $85 million loan to an affiliate of WPT Capital Advisors for the acquisition of a three-building industrial park at 6000, 6015 and 6025 Giant Road in Richmond. Built in 2015 and 2016, the 517,894-square-foot asset is 57 percent leased to two tenants. The Class A logistics asset features 30- to 32-foot clear heights, LED lighting and ESFR sprinklers. The property is located within Pinole Point Business Park, a 100-acre master-planned industrial park offering 2.2 million square feet of Class A space.

Equity Oak Ventures Receives $12.2M in Financing for Four-Building Flex Portfolio in San Diego County

by Amy Works

RANCHO BERNARDO AND CARLSBAD, CALIF. — Equity Oak Ventures has received $12.2 million in portfolio financing for a four-building flex industrial, research-and-development (R&D) and office portfolio in San Diego County. Alex Witt, Chris Collins and Daniel Pinkus of JLL Debt Advisory’s team represented Equity Oak Ventures in securing a fixed-rate, three-year loan. The fully leased portfolio includes a 42,865-square-foot, three-building flex industrial and office campus in Rancho Bernardo and a 44,757-square-foot R&D and cGMP (Current Good Manufacturing Practice) facility within Carlsbad Research Center, repositioned post-acquisition with long-term leases. The Rancho Bernardo asset, located at 11225, 11235 and 11245 W. Bernardo Court, consists of three buildings totaling 42,865 square feet, including a single-tenant, 29,000-square-foot flex industrial building. Located at 1900 Aston Ave. in Carlsbad, the property occupies a corner lot and features dock-level doors, multiple roll-up doors, temperature-controlled industrial space and high-quality office improvements. The newest tenant has signed a long-term lease and is making an investment in a large-scale cGMP facility.

Highridge Costa, Western Community Housing Open Affordable Housing Development in Los Angeles

by Amy Works

LOS ANGELES — Highridge Costa and Western Community Housing, along with Los Angeles Housing Department, Los Angeles County Department of Mental Health and the Housing Authority of the City of Los Angeles, have opened Main Street Apartments, an affordable housing development in the South Park neighborhood of Los Angeles. The community provides 57 fully furnished, permanent supportive housing apartment homes to homeless veterans and families earning at or below 30 percent to 50 percent of the area median income (AMI). The property offers 42 studio units targeted toward homeless veterans, 14 two-bedroom units targeting homeless families and a one-bedroom unit reserved for the onsite property manager. With 23 units set aside for homeless persons experiencing a mental health disorder, the community is also fully accessible, including all indoor and outdoor spaces, to those with physical disabilities. While 56 of the residences are fully adaptable units, an additional seven units have features for mobility accessibility and four units have features for communication accessibility. Units will include a bed, couch, dresser, dining table, chairs, kitchenette, closet and a private bathroom. Community amenities include a community room, residential courtyard, roof terraces, bike storage, laundry facilities and onsite resident services, as well as 1,500 square …