LOS ANGELES — Thrive Living, along with Los Angeles city and community leaders, has broken ground on 5035 Coliseum Plaza, a mixed-use project in South Los Angeles. The community will feature a Costco Wholesale anchoring the street-level retail space and 800 units of rental housing above. The project is the first mixed-use development in the nation to have Costco as the anchor retail tenant. A total of 184 apartments, or 23 percent of the total units, will be dedicated to low-income households, and the balance of the units will be non-subsidized affordable and workforce housing. The site is designed to support families, seniors and other residents to move laterally from within the community. Community amenities will include an advanced full-service fitness center, high-tech shared workspaces for residents, study space for students, community rooms connected to landscaped courtyards and a rooftop pool. Construction of the 5035 Coliseum project will support thousands of jobs and is expected to take approximately 30 months from the start date. Additionally, the Costco location will creation an estimated up to 400 jobs once fully operational.

California

LOS ANGELES — BridgeCore Capital has provided $6.5 million in refinancing for a multifamily property on the border of the Koreatown and MacArthur Park neighborhoods in Los Angeles. The undisclosed borrower will use loan proceeds to refinance a matured loan and to pay outstanding property taxes. BridgeCore structured the loan with a six-month prepaid interest reserve to cover the shortfall between net operating income and BridgeCore’s debt service and to avoid payment default by the undisclosed borrower during the loan term. The loan features a 74 percent loan-to-value ratio. Information about the property was not disclosed.

JLL Arranges Sale of 276,529 SF Lakeview Innovation Center Flex Campus in Thousand Oaks, California

by Amy Works

THOUSAND OAKS, CALIF. — JLL Capital Markets has arranged the all-cash sale of Lakeview Innovation Center, a flex campus on 22.1 acres in Thousand Oaks. An undisclosed seller sold the asset to a partnership between Alta West Partners, an affiliate of Glendon Capital Management and A2 Capital Management for an undisclosed price. Michael Leggett, Jeffrey Bramson, Andrew Harper and William Poulsen of JLL represented the seller in the transaction. Renovated in 2023, Lakeview Innovation Center offers 276,529 square feet of research-and-development (R&D) and office space. The campus includes an onsite Equinox fitness club, Earthbar, pickleball court, walking trails, a tenant lounge and multiple outdoor patio and collaborative spaces. The tenant roster includes Marvell Technologies and Rawlings, which benefit from the property’s infrastructure, including lab-grade HVAC, excess power capacity, ample clear heights, loading docks and backup generators. Additionally, the asset offers expansion opportunities with M2 zoning, supporting up to 123,000 square feet of additional density for life sciences, R&D or office uses. The new ownership team plans to upgrade the common areas, restrooms, signage and landscaping.

MODESTO, CALIF. — Aspen Real Estate Financial (AREF), in partnership with Stanislaus Regional Housing Authority and California Affordable Housing Agency (CalAHA), has acquired the 50-unit Rumble Road Apartments in Modesto for $17 million, or $340,000 per unit. AREF handles 100 percent of the total capitalization of the acquisition, along with reserves to cover lease payments and operating expenses. The program is a long-term lease to own, where AREF donates all equity and upside value to Stanislaus Regional Housing Authority. Stanislaus Regional Housing Authority, on a 35-year lease to own the property, will begin implementing a workforce housing platform at the property where the rent levels are structured to fall within moderate income housing as defined by HUD at 80 percent to 120 percent of area median income. Located at 2531 W. Rumble Road, the community offers 10 one-bedroom units and 40 two-bedroom apartments with air conditioning, ceiling fans, stainless steel appliances, double-pane windows, walk-in closets, full-size washers/dryers and tankless water heaters. Community amenities include a clubhouse with a fitness center, play area and onsite property manager. AREF has provided funds to gate the entire community. Matt Benwitt of Lee & Associates LA North/Ventura represented the buyer, while Marcus & Millichap …

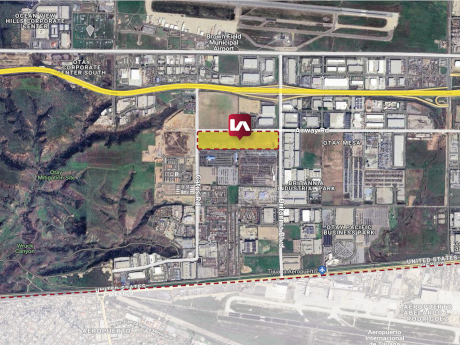

Lee & Associates Negotiates $58M Purchase of Industrial Land in San Diego’s Otay Mesa District

by Amy Works

SAN DIEGO — Lee & Associates has arranged the acquisition of 37.9 acres of industrial land at 5761 Airway Road in San Diego’s Otay Mesa neighborhood. Hyundai Translead purchased the asset for $58 million in an off-market transaction. The site will support Hyundai Translead’s operations in San Diego, which will allow the company to continue to utilize the location of Otay Mesa as a thoroughfare for its cross-border operations. Rusty Williams, Chris Roth, Jake Rubendall and Andrew Kenny of Lee & Associates – NSDC, as well as Eugene Kim of Lee & Associates LA North/Ventura, represented the buyer in the transaction.

OCEANSIDE, CALIF. — Marcus & Millichap has arranged the sale of 1210 South Nevada Street, an apartment property in Oceanside. Matt Vessell sold the asset to Matt Pace for $3.3 million. The apartment building features eight two-bedroom/one-bath units and three one bedroom/one-bath units. Community amenities include 11 single-car garages and 12 offsite parking spaces. Adrian Grobelny and Conor Brennan of Marcus & Millichap’s San Diego Del Mar office represented the seller and procured the buyer in the deal.

Southern California Gas Leases 198,553 SF at City National 2CAL in Downtown Los Angeles

by Amy Works

LOS ANGELES — Southern California Gas Co. (SoCalGas) has signed a long-term lease for 198,553 square feet of office space at City National 2CAL in downtown Los Angeles. CIM Group owns the 1.4 million-square-foot, 52-story office building at 350 S. Grand Ave. in downtown’s Bunker Hill district. SoCalGas will relocate to City National 2CAL from its namesake downtown Los Angeles building, Gas Company Tower, where it has been located since the building’s opening in 1991. At its new space, SoCalGas will have project and building top signage at the property. Geno St. John from CIM Group’s in-house office leasing team, in partnership with Peter Hajimihalis and Hayley Blockley of JLL, represented the owner in the lease negotiations. Clay Hammerstein and Danny Rees of CBRE represented the tenant.

Walker & Dunlop Arranges $66M Refinancing for Apartment Community in Chula Vista, California

by Amy Works

CHULA VISTA, CALIF. — Walker & Dunlop has arranged $66 million for the refinancing of Boardwalk at Millenia, a multifamily property in Chula Vista. Aaron Appel, Jonathan Schwartz, Keith Kurland, Adam Schwartz, Mo Beler, Michael Ianno and William Herring of Walker & Dunlop’s New York Capital Markets team arranged the transaction on behalf of the borrower, Barings Core Property Fund. The team also identified the lender, Kohlberg Kravis Roberts & Co. LP. Located at 1660 Metro Ave., Boardwalk at Millenia offers 309 apartments, a resort-style pool and spa, outdoor fireplaces and lounges, upscale fitness studio, children’s play area and coworking spaces with private conference rooms. The property was built in 2018. In 2019, Barings purchased the property from Trammell Crow Residential and recently secured the new financing, a five-year, floating-rate loan, to refinance the previous loan.

SAN DIEGO — MIG has completed the disposition of Four Governor Park, a two-building office property in San Diego. Cast Capital Partners acquired the asset for $11 million. Situated on 2.7 acres, Four Governor Park includes a 21,715-square-foot building at 5080 Shoreham Place and a 28,521-square-foot building at 5090 Shoreham Place that are connect by a courtyard. At the time of sale, the property was 96 percent occupied by a mix of office tenants. The buyer plans to sell the individual units. Matt Pourcho, Anthony DeLorenzo and Matt Harris of CBRE represented the seller, while Bret Morris of Cast Capital Partners and Ryan King of Voit represented the buyer in the transaction.

— By David Nelson, regional president of brokerage for Northern California and Nevada, Kidder Mathews — After record figures across most U.S. industrial markets in 2021 and 2022, key fundamentals cooled in 2023 and have been recalibrating ever since. Total net absorption has been negative in recent quarters, sublease space is on the rise, vacancy and availability rates have been steadily inching up, and average asking lease rates are relatively flat. Furthermore, the recent surge in development activity due to the rise in ecommerce penetration has been slowly drying up with construction starts dropping by more than 60 percent in 2023 and 2024. Core industrial markets in the Bay Area experienced notable increases in both vacancy and availability. Silicon Valley vacancy rose from between 1.5 percent and 2.5 percent last year to 3 percent and 4 percent in 2024. Meanwhile, East Bay rose from 3.5 percent and 4 percent in 2023 to 5.5 percent and 6.5 percent in second-quarter 2024. During the first half of the year, an increase in sublease space has been a major contributor to the higher rates. They have increased from the pre-COVID average of 9 percent of total available space to 19 percent at the end …