DENVER — John Propp Commercial Group has arranged the sale of an industrial property in Denver. River Rise Capital acquired the building from LG Investments for $5 million. Located at 4391 York St., the asset includes a 30,078-square-foot building situated on 1.7 acres. John Propp and Michael Honc of John Propp Commercial Group represented the seller in the deal. The new owner plans to hold the property as an investment after re-signing the tenant, United States Building Supply Co., to a new long-term lease.

Colorado

JRK Property Holdings Sells 248-Unit Courtney Park Apartment Community in Fort Collins, Colorado

by Amy Works

FORT COLLINS, COLO. — JRK Property Holdings has completed the disposition of Courtney Park, a garden-style multifamily property in Fort Collins, to ColRich Multifamily for $64.1 million. Terrance Hunt, Shane Ozment, Chris Hart and Brad Schlafer of CBRE represented the seller in the deal. Located at 4470 S. Lemay Ave., Courtney Park offers 248 one- and two-bedroom apartments spread across 13 two- and three-story residential buildings. Each unit features stainless steel appliances, walk-in closets, in-unit washers/dryers and private balconies or patios. Community amenities include a clubhouse building, business center, fitness center, swimming pool, hot tub, an outdoor grilling area, a playground, pet park and 441 parking spaces. Built in 1986, the property was renovated in 2008. Renovations include upgrades to the apartment interiors, clubhouse and common area.

LONGMONT, COLO. — Broomfield, Colo.-based Profere Partners has completed the disposition of Longmont Medical Campus, a medical outpatient building located at 1551 Professional Lane in Longmont. Terms of the transaction were not released. Originally built in 2002 and most recently renovated in 2022, the two-story multi-tenant facility offers 104,438 square feet of medical office space. At the time of sale, the property was 92 percent leased to 19 tenants, anchored by University of Colorado Medicine. Aaron Johnson, Travis Ives, Jon Hendrickson, Mitch Veremeychik, Gino Lollio and Tyler Morss of Cushman & Wakefield represented the seller in the deal.

ENGLEWOOD, COLO. — A joint venture between DPC Cos. and Ogilvie Partners has acquired Englewood CityCenter for an undisclosed price. Brad Lyons of CBRE handled the transaction. Englewood CityCenter offers 220,000 square feet of office, retail and multifamily space. The joint venture is working with the City of Englewood on a master redevelopment plan to transform Englewood CityCenter into a community center with multifamily housing, open space for community gathering and a walkable live/work/shop area with retail, services, restaurants and a hotel within the 12-acre site. At the time of sale, the property was 40 percent leased. Current tenants include Harbor Freight, Ross Dress for Less, Petco, Tokyo Joe’s, Jersey Mike’s Subs and Einstein Bros.

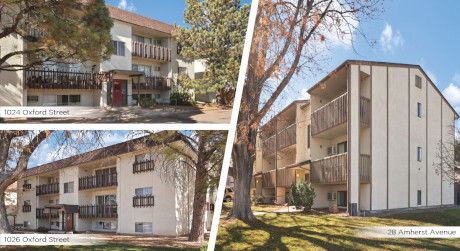

Pinnacle Real Estate Advisors Negotiates Sale of Oxford Pines Apartments in Pueblo, Colorado

by Amy Works

PUEBLO, COLO. — Pinnacle Real Estate Advisors has arranged the sale of Oxford Pines Apartments, located at 1024-1026 Oxford St. and 28 Amherst Ave. in Pueblo. The three-building property offers 35 one- and two-bedroom units, many with private balconies, as well as 23 carports and two garages. Chris Knowlton of Pinnacle Real Estate Advisors represented the undisclosed seller and undisclosed buyer in the deal. The asset traded for $3.1 million, or $90,000 per unit.

DENVER — Pinnacle Real Estate Advisors has arranged the sale of a retail and liquor store property located at 2035 S. Broadway in Denver. The 5,589-square-foot property traded for $4.7 million in an off-market transaction. The names of the seller and buyer were not released. Levi Saxen and Jack Eberwein of The Saxen Team of Pinnacle Real Estate Advisors represented the buyer and seller in the deal.

Cloudland Capital, Blue Hour Housing Receive $5M Loan for Workforce Housing Community in Leadville, Colorado

by Amy Works

LEADVILLE, COLO. — Cloudland Capital and Blue Hour Housing have received $5 million in financing for Silver King Leadville, a workforce housing community in Leadville. William Haass of JLL Capital Market’s Debt Advisory team secured the five-year, fixed-rate loan through a Colorado-based credit union. Located at 2020 N. Poplar St., Silver King offers 56 apartments. Formerly a 66-key hotel, the property was acquired in June 2024 and underwent a comprehensive renovation to convert the asset into a modern workforce housing community. The renovated property now features 47 studios, eight one-bedroom units and one two-bedroom unit, with an average size of 375 square feet. The renovation included adding kitchenettes to all units, installation and improvement of fire and life safety systems, upgrading common areas, building out communal laundry and gym facilities, adding storage lockers and enhancing outdoor spaces. Silver King is master-leased to Climax Molybdenum Co., a subsidiary of Freeport-McMoRan, providing housing for Climax employees and residents of Colorado’s high-country. Six units have been reserved to Lake County, Colo., to allow employees of Lake County access to this workforce housing community.

Trammell Crow Residential, Cigna Receive $75M in Refinancing for Multifamily Community in Denver

by Amy Works

DENVER — Trammell Crow Residential and Cigna have obtained $75 million in refinancing for One Seven at Belleview Station, a multifamily community in Denver. The refinancing will retire the original bank construction loan. Leon McBroom and Mark Erland of JLL Capital Market’s Debt Advisory team arranged the three-year, floating-rate loan through a national life insurance company for the borrowers. Located at 4882 S. Newport St., One Seven at Belleview Station offers 250 one-, two- and three-bedroom units with wood vinyl plank flooring, Bluetooth-enabled entry doors, roller shades, stainless steel appliances, quartz countertops and private balconies. Community amenities include a rooftop pool deck, remote work center, clubroom, wellness center, bike storage, pet spa and theater rooms. The property also offers 7,062 square feet of fully leased retail space.

EDGEWATER, COLO. — CentrePoint Properties has acquired Edgewater Public Market, a 76,000-square-foot retail center located in Edgewater, roughly five miles outside downtown Denver, for an undisclosed price. LCP Development, an affiliate of LCP Management, was the developer and seller. Opened in 2019 within a building formerly occupied by King Soopers, the center comprises a food hall and 17 retail tenants, as well as three additional buildings leased to tenants including Shake Shack, Syrup, Veterinary Emergency Group and Adelita’s Cocina y Cantina.

Sagard Real Estate Acquires Alta Green Mountain Apartment Complex in Lakewood, Colorado for $104.6M

by Amy Works

LAKEWOOD, COLO. — Sagard Real Estate has purchased Alta Green Mountain, a multifamily community located at 13055 W. Mississippi Court in Lakewood, from an undisclosed seller for $104.6 million. Dave Martin and Brian Mooney of Northmarq’s Denver Multifamily Investment Sales team represented the seller in the deal. Built in 2020, Alta Green Mountain offers 260 one-, two- and three-bedroom floor plans with an average unit size of 864 square feet. Apartment amenities include stainless steel kitchen appliances, gray mocha cabinets, washers/dryers, walk-in closets, keyless entries, river white granite countertops, glass tiled backsplashes, garden tubs, balconies and tuck-under garages with driveways available for rent. Some units include mountain views and panoramic views of Denver. Community amenities include a clubhouse, outdoor kitchen and grilling areas, scenic overlook firepit, dog spa, storage units, year-round pool and spa, athletic club with yoga and spin room, an innovation lounge with computer access and individual work rooms, an onsite dog park and run, bike and ski repair shop, and community game room.