PARKER, COLO. — Unique Properties/TCN Worldwide has arranged the purchase of a flex property located at 10120 Twenty Mile Road in Parker. A California-based buyer acquired the asset from a local owner/developer for $4.8 million, or $365 per square foot. Brett MacDougall and Michael DeSantis of Unique Properties/TCN Worldwide represented the buyer in the deal. The approximately 1,315-square-foot building is fully occupied by two long-term tenants on triple-net leases.

Colorado

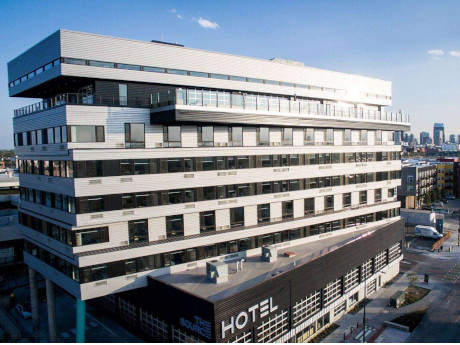

DENVER — Stockdale Capital Partners has acquired The Source, a hotel located in Denver’s River North Arts District, for $61.9 million. The transaction also included a 300-stall parking garage and 17,000-square-foot surface parking lot. The Source features 100 guest rooms, a full-service rooftop restaurant, 5,575 square feet of event space, a fitness center, rooftop pool and business center. Additionally, the hotel offers 44,000 square feet of onsite restaurant and retail space in its Market Hall I & II locations. Stockdale Capital plans to refresh guest rooms, re-imagine the rooftop restaurant, “activate the hotel lobby experience” and create additional revenue drivers for the hotel’s retail space. The name of the seller was not released.

Mesa West Capital Provides $139.9M Loan for Acquisition, Repositioning of Terracina Apartments Near Denver

by Amy Works

BROOMFIELD, COLO. — Mesa West Capital has provided Sares Regis Group with $139.9 million in first mortgage debt for its acquisition and repositioning of Terracina Apartments, located at 13620 Via Varra Road in Broomfield. Built in 2010, the 16.5-acre community features 386 apartments in a mix of one- and two-bedroom apartments spread across four four-story residential buildings. On-site amenities include a pool and hot tub, clubhouse, fitness center, coworking lounge, dog park, pet wash, fire pit and grilling area, and outdoor games area. At the time of sale, the property was 95.1 percent leased. Brian Torp of Jones Lang LaSalle arranged the financing. A portion of the loan proceeds will help fund the borrower’s capital improvement plan that will feature upgrades to unit interiors, as well as the renovation of the community’s common areas. The floating-rate loan features a five-year term.

DENVER, COLO. — New York-based IG Logistics LLC and Meadow Partners have purchased a 26.7-acre industrial storage yard/trailer site in central Denver for $19 million. Located at 409 W. 66th Ave., the vacant property is zoned for outside storage and includes a 10,000-square-foot freestanding industrial building with 6,500 square feet of office space, two drive-thru service bays and 14-foot clear heights. IG Logistics, Imperium Capital’s industrial platform, is an owner-operator of industrial properties that have a large outdoor storage or transportation component. The company specializes in acquiring and developing infill assets in high-barrier-to-entry urban growth markets where demand for logistics real estate is driven by e-commerce. The company’s strategy focuses on last-mile facilities that are mission critical to the supply chain. The buyers have retained Matt Trone and Joey Trinkle of Cushman & Wakefield to lead marketing efforts for the asset. The property can accommodate a single user or multiple.

Unique Properties Brokers $110M Sale of Terra Village Apartments in Edgewater, Colorado

by Amy Works

EDGEWATER, COLO. — Unique Properties/TCN Worldwide and the Unique Apartment Group have arranged the sale of Terra Village Apartments, a multifamily community located at 6201 26th Ave. in Edgewater. California-based Trion Properties acquired the asset for $110 million, or $273,631 per unit. Terra Village features 402 apartments. Recent renovations include new kitchen cabinets, stainless steel appliances, tile backsplashes, updated bathrooms and in-unit washers/dryers. Marc Lippitt, Elliott Polanchych, Will McCauley, Phil Dankner and Kevin Higgins of Unique Properties represented the undisclosed sellers in the deal.

AURORA, COLO. — Marcus & Millichap has negotiated the sale of The Fitz on 14th, an apartment property in Aurora. The community traded for $34.4 million, or $195,455 per unit. The names of the buyer and seller were not released. Constructed in 1973, Fitz on 14th features 176 apartments in a mix of 18 studios and 158 one-bedroom units with open kitchens. Community amenities include a resort-style pool, barbecue/picnic area, playground, dog park, on-site leasing office, laundry facilities and a fully equipped workout room. Jason Hornik and Greg Price of Marcus & Millichap’s Denver office represented the seller and buyer in the transaction.

FEDERAL HEIGHTS, COLO. — Brinkman Real Estate has completed the disposition of Windom Peak Apartments, a multifamily property located at 120 E. Grace Place in Federal Heights. An undisclosed buyer acquired the asset for $24.6 million, or $262,234 per unit. Built in 1964, Windom Peak features 94 units spread across a mix of one-story apartment buildings and two-story townhomes offering one-, two- and three-bedroom floorplans. During Brinkman’s ownership, the company added an energy-efficient boiler, insulation to reduce energy loss on existing systems, and low-flow toilets and fixtures. Jake Young, David Potarf, Dan Woodward and Matt Barnett of Walker & Dunlop represented Brinkman in the deal.

COLORADO SPRINGS, COLO. — CBRE has arranged the sales of two shopping centers in Colorado Springs for a total consideration of $13.8 million. Park Brown, Matthew Henrichs and Brad Lyons of CBRE’s National Retail Partners represented the sellers in each transaction. A Colorado-based private investor acquired the Springs Ranch Shopping Center for $8.3 million, and a San Diego-based 1031 exchange investor purchased Peterson Square for $5.5 million. Located at 6010-6080 N. Carefree Circle, Springs Ranch Shopping Center features 40,331 square feet of multi-tenant retail space. Springs Liquor Outlet anchors the fully leased property. A Denver-based private partnership sold the asset. Located at 6809 Space Village Ave., Peterson Square offers 14,182 square feet of fully occupied retail space. A Denver-based private fund sold the center.

Breakthrough Properties Plans 164,000 SF Life Sciences Redevelopment Campus in Boulder, Colorado

by John Nelson

BOULDER, COLO. — Breakthrough Properties, a developer of life sciences real estate backed by a joint venture of Tishman Speyer and Bellco Capital, has acquired a 9.3-acre, four-building campus in Boulder. The company plans to transform the campus into a 164,000-square-foot office, lab and flex development named Boulder 38 by Breakthrough. Located at the intersection of 38th Street and Arapahoe Avenue, the campus is one mile from Jennie Smith Caruthers Biotechnology Building, a 400,000-square-foot research and technology facility at the University of Colorado Boulder. Research conducted at the university and the surrounding ecosystem has established Boulder as a regional bioscience hub. According to CBRE market report data, the Boulder life sciences market has maintained approximately 1 million square feet of active life science requirements over the past 18 months. “Boulder has succeeded in cultivating a unique ecosystem propelled by leading research and academic institutions, creative residents and premier outdoor recreational amenities,” says Paul DeMartini, senior managing director of Tishman Speyer. “We are excited by this opportunity to create a world-class research campus that will serve as a magnet for life sciences innovation and talent.” The acquisition and redevelopment of Boulder 38 is being capitalized by the Breakthrough Life Science Property …

Dollar General to Build $172M Distribution Facility at HighPoint Elevated Park in Aurora, Colorado

by Amy Works

AURORA, COLO. — Dollar General has acquired a 75-acre land parcel within HighPoint Elevated, an industrial and logistics park located at the southeast corner of East 64th Ave. and E-470 in Aurora, for the development of a Class A distribution facility. The Goodlettsville, Tenn.-based discount retailer plans to invest $172 million into the Aurora facility, which will create around 400 new jobs at full capacity. Dollar General announced the project as part of a three-distribution center expansions in Arkansas, Colorado and Oregon. Hyde Development and Mortenson, the park’s development team, will build the 919,000-square-foot facility. Daniel Close, Todd Witty, Tyler Carner, Jeremy Ballenger and Jessica Osternick of CBRE represented Hyde Development in the land sale. The Dollar General project is the first build-to-suit commissioned at the park, which broke ground last year. Construction for the Dollar General facility is slated to being this summer, with completion scheduled for late 2023. At buildout, Highland Elevated will include up to 5.5 million square feet of industrial and logistics space, as well as retail space. The new Dollar General facility will anchor the east side of the park.