— By Dan Minnaert, Partner and Industrial Specialist, TOK Commercial Real Estate — Industrial leasing activity has slowed year over year in Southern Idaho markets with total transactions down 9 percent. However, all markets saw transactions increase or remain flat from the first quarter to the second quarter. Net absorption has also remained positive in all markets throughout the first half of 2023. Activity is strongest in the Boise MSA with nearly 900,000 square feet of net absorption recording so far this year. Top deals for the year include Ferguson Enterprises leasing 164,600 square feet of new construction in Nampa, and Hensel Phelps Construction leasing 92,900 square feet at 535 Gowen in South Boise. Demand remains strongest for spaces in the 1,000- to 5,000-square-foot range, accounting for 51 percent of deals over the past 12 months. However, absorbed spaces above 15,000 square feet have increased 15 percent year over year. In addition, organic growth is the top driver for leasing activity considering 30 percent of deals over the past year were attributed to tenants opening additional locations or expanding. Additional new industrial tenants are expected to enter Southern Idaho, most notably in the Boise MSA as new projects such …

Idaho

— By Colton Yasinski, Investment Sales Advsor, Capstone Cos. — The multifamily market in Idaho and, specifically, Boise, has experienced an impressive surge over the past five years. This has largely been fueled by the impact of COVID and the attractiveness of Idaho living. The result has been an unprecedented demand for multifamily housing, triggering a development boom that has reshaped the market landscape. In the past year alone, Boise has seen the delivery of 4,000 multifamily units with numerous ongoing construction projects. The city’s rapid population growth and robust housing demand has attracted institutional capital, leading to tighter cap rates similar to larger metropolitan areas. Pioneering developers have recognized the potential in Idaho’s market and entered the scene alongside local development groups. Among them are prominent names like Lincoln Property Company, Alliance Residential Company, Woodside Homes, Morgan Stonehill, American Homes 4 Rent and others shaping the multifamily landscape. However, amidst this growth, market dynamics have started to shift. Over the past year, multifamily sales in Boise have declined by more than 70 percent, accompanied by rising cap rates due to fluctuations in the capital markets. The surge in new units has transitioned the market from favoring landlords to becoming …

Wood Investments Cos. Receives $39.1M Refinancing for Two Shopping Centers in Meridian, Idaho

by Amy Works

MERIDIAN, IDAHO — Wood Investments Cos. has secured refinancing totaling $39.1 million for two shopping centers located in Meridian, roughly 11 miles outside Boise. The first shopping center, Gateway Marketplace, is leased to tenants including a 42,212-square-foot PGA Tour Superstore, Trader Joe’s, Mecca Gym, Land Ocean, Chili’s, Le Peep, Mathnasium and Orange Theory Fitness. Wood acquired the property in 2021. Tim Winton of Keystone Mortgage Corp. arranged a $16.5 million permanent loan through Voya Investment Management for the 135,732-square-foot property. The second shopping center, CentrePoint Marketplace, totals 197,288 square feet and is located across from Gateway Marketplace. Tenants at the property include Kohl’s, Hobby Lobby, Dick’s Sporting Goods, Walgreens, Qdoba Mexican Eats, Panera Bread and Wingers Restaurant & Alehouse. Greg Richardson of Walker & Dunlop arranged the $22.6 million refinancing through RGA ReCap LLC.

POCATELLO, IDAHO — Kidder Matthews has brokered the sale of Pocatello Square, a 138,064-square-foot shopping center in Pocatello, approximately 160 miles north of Salt Lake City. Tenants at the property, which was built in 2006 and fully leased at the time of sale, include Dick’s Sporting Goods, Grocery Outlet, Ross Dress for Less, JOANN Fabric and Crafts and Old Navy. Mike King, Erik Swanson, Darren Tappen, Peter Beauchamp and Nathan Thinnes of Kidder Matthews represented the seller, CWCapital, in the transaction. An undisclosed buyer purchased the center through CWCapital’s online auction platform, RI Marketplace. The price was not disclosed.

CALDWELL, IDAHO — StorageMart, the largest privately-owned self-storage company, has expanded its footprint in Caldwell. The company has added two storage facilities with a combined net rentable space of 131,686 square feet, providing customers with a variety of storage unit sizes and drive-up options. The storage properties provide a range of unit sizes from compact five-foot by five-foot units to 10-foot by 30-foot units. StorageMart continues to grow its presence in Idaho, catering to the increasing demand for self-storage solutions in the area.

BOISE, IDAHO — Capstone Cos. has expanded its brokerage firm with a new regional office in Boise. Colton Yasinski, who has transacted hundreds of units in the Idaho market, including affordable LIHTC product, value-add multifamily and Class A market rate assets, leads the new office. Expanding into Boise reinforces Capstone’s presence in the Western U.S. as the company seeks rapid growth and expansion in the multifamily sector. With the opening of this new office, Capstone continues its nationwide growth with a total of 21 offices and more than $12 billion in sales.

MERIDIAN, IDAHO — Wood Investments Cos. has announced the opening of a 42,212-square-foot PGA Tour Superstore at Gateway Marketplace, a 135,732-square-foot retail center in the Boise suburb of Meridian. The store now leases the former Rosauers grocery store space. Other tenants at the center include Trader Joe’s, Mecca Gym, Land Ocean, Chili’s Grill & Bar, Le Peep, Mathnasium and Orange Theory. Andrea Nilson, LeAnn Hume, Travis Dunn, Julie Kissler and Braydon Torres of Cushman & Wakefield handle leasing at the property. Stuart Thain of Colliers represented the tenant in the leasing negotiations.

Wood Investments Cos. Adds Three Retail Tenants to Canyon Park West in Twin Falls, Idaho

by Jeff Shaw

TWIN FALLS, IDAHO — Wood Investments Cos. has announced the addition of three new tenants to Canyon Park West, a 160,140-square-foot retail center in Twin Falls. Natural Grocers plans to open a 20,000-square-foot store at the property this fall. Additionally, Ashley HomeStore and Carter’s have signed leases totaling 18,000 and 4,084 square feet, respectively, and are now open at the center.

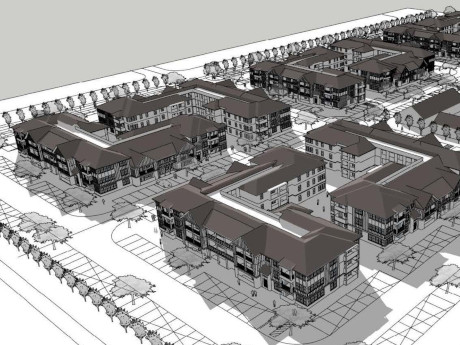

Morgan Stonehill Breaks Ground on 360-Unit Seasons at Meridian Apartments in Metro Boise

by Amy Works

MERIDIAN, IDAHO — Developer Morgan Stonehill, with Los Angeles-based Newman Garrison + Partners as architect, has released plans for Seasons at Meridian, a 360-unit apartment community located at 2700 E. Overland Road in Meridian, a western suburb of Boise. The team broke ground on the development in January. Seasons at Meridian will feature 10 residential buildings arranged around an open-air courtyard space. Each building will offer a mix of studio, one-, two- and three-bedroom units ranging from 488 square feet to 1,328 square feet. The community will offer more than 30,000 square feet of amenity space, including a 10,000-square-foot clubhouse, a pool, park, community garden, fitness facility, bike maintenance room and barbecue areas. Additionally, the project is designed to provide direct pedestrian linkages to the adjacent commercial and retail developments with access to nearby recreational trails, landscaped areas and pocket parks. Completion is slated for second-quarter 2025.

Hawkins Cos. Receives $56M in Construction Financing for Canyon Ridge Apartments in Boise

by Amy Works

BOISE, IDAHO — Hawkins Cos. has obtained $56 million in construction financing for the development of Canyon Ridge, a five-building apartment property in Boise. Sunwest Bank provided the financing. Canyon Ridge will offer 287 apartments, a resort-style outdoor pool, dog park, two playgrounds, a 6,000-square-foot clubhouse, coworking lab, covered barbecue with indoor/outdoor fireplace, fitness center and other common areas. Preleasing is scheduled to begin in spring 2024, with completion slated for May 2025. Dave Karson, Chris Moyer, Paul Roeter and Meredith Donovan of Cushman & Wakefield’s equity, debt and structured finance team represented Boise-based Hawkins Cos. in the transaction.