ALBUQUERQUE, N.M. — Community Preservation Partners (CPP) has purchased Mountain View II and III, two affordable multifamily properties in Albuquerque, for $22.8 million. CPP plans to renovate the properties, which share a contiguous block, and operate the assets as one development. The seller was not disclosed. Built in 1967 and 1968 respectively, Mountain View II and III are located at 1515 and 1333 Columbia Drive SE, approximately four miles from downtown Albuquerque. In total, Mountain View Apartments offers 241 studio, one-, two- and three-bedroom layouts spread across multiple two-story, garden-style buildings and townhouses. Community amenities include central laundry facilities, off-street parking, a picnic area, playground and on-site management. CPP’s total development investment is approximately $65.8 million, which includes the purchase price and estimated per-unit renovation cost of $95,078. Along with extensive work to repair a burnt building, the total site renovation will bring modernization, ADC compliancy, energy efficiency and improved security to the community. Renovations are scheduled for completion in December 2024. Project partners include New Mexico Mortgage Finance Authority; KeyBank, which secured construction and debt financing through Freddie Mac; and R4, which will provide equity financing.

New Mexico

ALBUQUERQUE, N.M. — Senior Living Investment Brokerage (SLIB) has arranged the sale of two assisted living communities in Albuquerque. The communities were built in 1972 and 1982, with renovations in 2011 and 2015. The properties are 3,176 and 7,880 square feet and are situated on approximately 0.38 and 0.6 acres of land. The seller was a mom-and-pop owner divesting to retire from the industry. The buyer is an owner-operator expanding its presence in the West. This is the buyer’s first acquisition in New Mexico. The price was not disclosed. Vince Viverito and Matthew Alley of SLIB handled the transaction.

— By Robert Gallegos, Senior Vice President, The Mogharebi Group — New Mexico is rapidly becoming an important multifamily market for both investors and developers as the state experiences explosive job and population growth, which is expected to continue on an upward trajectory over the next five to 10 years. While Albuquerque remains the most targeted multifamily market in the state, it is worth noting that the tertiary market of Santa Teresa — near El Paso and the Mexico border — is becoming a hotbed for multifamily investment. Santa Teresa is a key inland port serving as a strategic focal point for intermodal shipments in the Southwestern U.S., with more than 6 million square feet of industrial space in use and nearly 1 million square feet under construction. As more jobs flood into New Mexico, the demand for quality rental housing will continue to far outstrip supply. With a population of more than half a million people and counting, it is no wonder Albuquerque is seeing the bulk of investment activity. The city has drawn an influx of new residents thanks to its diverse economy, relatively affordable cost of living and quality of life. According to Numbeo, one of the largest cost-of-living …

— By Anthony Johnson, AJ Johnson and Chris Fiello, Pegasus Group — New Mexico is no different than the rest of the nation and is not immune to some of the same symptoms that are taxing the national retail market. However, New Mexico retail is also showing signs of resilience as it reshapes itself and finds ways to weather the storms of high interest rates, major brand closures, economic uncertainty and crime. As of now, the big issue is in the theft and resale of retail goods. Indeed, the problem of brazen theft — which is seen in countless cites in the nation — has led New Mexico Gov. Lujan Grisham to announce the revival of the Governor’s Organized Crime Prevention Commission. The hopes are to crackdown on this behavior, which is having a detrimental impact on the bottom line for New Mexico businesses, especially small ones. This onslaught of petty shoplifting to organized sprees of large-scale theft has caused retailers large and small to exit locations. Target, for example, announced in May that it was preparing for a loss of half a billion dollars this year because of rising theft. In 2023, New Mexico saw multiple store closures, including several …

ALBUQUERQUE, N.M. — Westwood Financial has sold Sycamore Plaza, a 37,442-square-foot shopping center in Albuquerque, for an undisclosed price. Petsmart anchors the property, which was fully occupied at the time of sale. Other tenants include Sally Beauty, Einstein Bros. Bagels, Stretch Zone, GNC, Super Cuts and GameStop. CBRE National Retail Partners represented Westwood in the transaction.

Higher-Quality Properties, Downsizing Drive Strong Office Leasing Activity in New Mexico

by Jeff Shaw

— By John Ransom, Senior Vice President and Principal, Colliers — Albuquerque MSA office users continue to closely evaluate real estate decisions post-pandemic. The leasing trend is pivoting toward quality properties with landlords upgrading their building systems, security and amenity offerings. Tenant improvement costs are central to lease negotiations, so matching a tenant with space that requires the least amount of renovations to meet their needs is critical for both the tenant and the landlord to make a deal. In any event, tenants often have to share in the TI costs with upfront capital or amortizing a portion of the construction expense into the rental rate. This leads to longer lease terms and additional lease securitization requirements. Beneficial occupancy and other creative incentives are also being offered by landlords in lieu of additional tenant improvement dollars. Companies looking to downsize are considering a trade up in building/space quality. The upgrade has little impact to overall real estate expense, while improving the working conditions for their employees and ability to recruit in a competitive hiring climate. The office vacancy rate has steadily decreased to about 12 percent from a high of 20 percent five years ago. The bulk of vacancies are …

ALBUQUERQUE, N.M. — Hanley Investment Group Real Estate Advisors has arranged the sale of a 3,331-square-foot, single-tenant retail property in Albuquerque. Raising Cane’s Chicken Fingers occupies the building on a 15-year, triple-net lease. Bill Asher, Jeff Lefko and Jeremy McChesney of Hanley represented the seller and developer, TradeCor LLC, in the transaction, in association with ParaSell Inc. Greg Swedelson and Jon-Eric Greene of SSG Realty Partners represented the buyer, an undisclosed private investor.

— By Will Strong, Executive Vice Chair, Industrial Capital Markets, Cushman & Wakefield — Albuquerque has emerged as a vibrant hub for industrial development, showcasing a thriving economy and a favorable business climate. With its strategic location, robust infrastructure and supportive policies, the city has become an attractive destination for ecommerce and logistics companies seeking growth and expansion. Situated in the heart of the Southwest, Albuquerque enjoys a prime location that serves as a gateway to various markets. It is conveniently connected to major transportation networks, including interstates 25 and 40, making it accessible for shipping goods across the region. The city is served by the Albuquerque International Sunport, facilitating efficientair freight and business travel. The market’s availability of reliable utilities, such as water, electricity and high-speed internet, further strengthens the city’s industrial ecosystem. The Albuquerque industrial market grew more than 300,000 square feet in the past year. Demand has been strong enough to continually outpace deliveries, enabling vacancies to tighten below the historical average, according to CoStar. Vacancies have fallen to just 2.4 percent, well below the national average of 4.5 percent. Albuquerque has a diversified base of industries, led by aerospace, high-tech manufacturing, distribution and logistics, technology and …

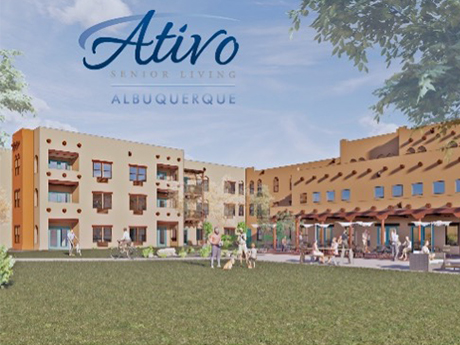

Insight Senior Living Breaks Ground on 144-Unit Ativo of Albuquerque Seniors Housing Community

by Jeff Shaw

ALBUQUERQUE, N.M. — Insight Senior Living has broken ground on Ativo of Albuquerque, a three-story independent living, assisted living and memory care community in Albuquerque. Situated on 6.5 acres, Insight Senior Living will be the operator and Link Senior Development arranged financing. Ativo of Albuquerque will offer 144 apartments. The community is scheduled to open in winter 2024.

ALBUQUERQUE, N.M. — Gantry has arranged $45.5 million in financing for the 572-unit Union 505 Apartments in Albuquerque. The community is located at 801 Locust Place NE. It offers studio, loft, and one- and two-bedroom renovated units in a garden-style format. The complex also features a newly remodeled clubhouse with free Wi-Fi, a fitness facility, outdoor sport court, open space and resort-style pool area. Gantry’s Adam Parker and Chad Metzger secured the loan on behalf of the repeat Gantry borrower. The seven-year, fixed-rate loan was placed with Freddie Mac. It features full-term, interest-only payments. Fannie Mae agreed to underwrite the debt-service-coverage ratio using a 35-year amortization instead of the normal 30-year amortization. The borrower wanted to maximize loan proceeds as they were using the cash to purchase another asset.