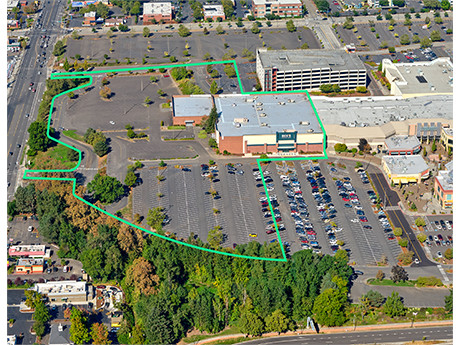

HAPPY VALLEY, ORE. — CBRE has arranged the sale of a 146,888-square-foot property located in Happy Valley, a suburb of Portland. Sears formerly occupied the building, which is physically attached to the adjacent Clackamas Town Center mall, which totals 1.4 million square feet. Dick’s Sporting Goods partially backfilled the property in 2019 and opened in 2020 following the departure of Sears in 2018. The remainder of the building, including two 15,000-square-foot, ground-level spaces and a 64,000-square-foot upper-level space, remains vacant. Dino Christophilis and Daniel TIbeau of CBRE represented the undisclosed seller in the transaction. A Texas-based private investment group acquired the property for an undisclosed price.

Oregon

— By Samuel Hatcher, Field Research Manager, CBRE — Portland’s historically vibrant office market finds itself at a crossroads, striving to regain its footing in the wake of economic headwinds. The city’s unique blend of natural beauty, progressive culture and thriving tech scene has been a magnet for young professionals seeking an exceptional quality of life. However, recent shifting market dynamics have cast a shadow of uncertainty, compelling stakeholders to navigate a path to recovery with adaptability and resilience. Portland’s overall office market vacancy is currently 22 percent across the metro area. Downtown vacancy — which includes the Central Eastside, Northwest Close-in and Lloyd District — is at about 28 percent. Of that vacant space, 3.3 million square feet is Class A. Moreover, sublease availability across the overall office market is up 67 percent year over year and investment remains paused. Capital is waiting on the sidelines due to elevated interest rates and generally tighter financial conditions. Despite these stats, the market is showing some bright spots. The rate at which newly available sublease space is being put on the market has slowed compared to when this narrative was dominating headlines. There’s even a chance of a slight quarter-over-quarter decrease …

PORTLAND, ORE. — Norris & Stevens has arranged the sale of an industrial and office building located at 2316 NE Glisan St. in Portland. Meidi LLC purchased the property from TJR LLC for $1.4 million. Constructed 1953, the 5,140-square-foot industrial and office property features a main level that includes a warehouse/production space and one grade-level overhead door. The second floor features five private offices, a conference room, open work space and a mezzanine storage area. Greg Nesting and Gabe Schnitzer of Portland-based Norris & Stevens represented the seller, while Andrew Galler of Realty Works Group represented the buyer in the transaction.

— By Keegan Clay, Executive Director, Cushman & Wakefield — The Portland metro industrial market is well poised for investment and rent growth into 2024, despite an increase in sublease space coming to market. Portland has experienced many great trends, particularly in the past few years, including year-over-year double-digit rent growth, compressed cap rates, positive net absorption (occupancy growth), strong tenant demand, all-time low vacancy at 2.5 percent and land prices tripling in a short timespan. Such movement has led to increased competition and investment in the Portland region. We have seen an increase in sublease space hitting the market over the past five months to the tune of more than 2 million square feet. The majority of this relinquished space has stemmed from just a few users. Many of these subleases are a result of acquisitions with companies looking to increase efficiencies by eliminating redundancies. Some industrial users have consolidated out of market, including a major home goods business (648,000 square feet), while others have grown their real estate position in Portland. This includes a leading B2B electrical and industrial distribution company (293,000 square feet). Year to date, we have yet to see any of the larger …

BEAVERTON, ORE. — STAG Industrial has purchased Beaverton Industrial Center, a multi-tenant industrial/distribution project in Beaverton. BKM Capital Partners sold the asset for $20.6 million. Situated on 6.4 acres, the 121,426-square-foot property consists of two freestanding distribution buildings located at 5805 and 5807 SW 107th Ave. Originally constructed in the 1960s, the asset was extensively upgraded in 2021. At the time of sale, Beaverton Industrial Center was fully leased. Bryce Aberg, Jeff Chiate, Jeff Cole, Rick Ellison, Mike Adey, Zach Harman and Brad Brandenburg of Cushman & Wakefield’s National Industrial Investment Advisory Group in Southern California represented the seller. Greg Nesting, Aaron Watt and Keegan Clay of Cushman & Wakefield provided local market advisory.

— By Daniel Natsch, Senior Managing Director and Partner, Ethos Commercial Advisors — Portland made it onto the national scene even before the last economic cycle. It’s a charming and relatively inexpensive West Coast market that boasts a great culinary scene, never-ending outdoor activities and its own sense of weirdness. It’s no wonder that Portland’s ticket to the “big time” came by way of population growth throughout the 2010s, spurred by young, highly educated professionals. Alongside that growth came the need for more housing. Institutional capital took note and began targeting Portland for investment. The development boom of the 2010s eventually began to slow. Portland’s multifamily industry took another blow when Inclusionary Zoning legislation was passed. To beat affordable requirements, developers grandfathered as many projects as possible, creating a huge wave of entitled properties. Many of these projects would see their way through permitting, and the pre-inclusionary housing moniker became more valuable to investors. At the time, it appeared that significant in-migration would offset the significant deliveries stacking up in the pipeline. Then came 2020. Downtown Portland became a ghost town as employees stayed home amid the pandemic. It was quiet until large crowds took to the streets to speak …

Marcus & Millichap Negotiates Acquisition of 7,448 SF Retail Property in La Grande, Oregon

by Amy Works

LA GRANDE, ORE. — Marcus & Millichap has brokered the purchase of La Grande Strip Center, a retail asset in La Grande. A private investor acquired the property from an undisclosed seller for $1.6 million. Located at 11621 Island Ave., the 7,448-square-foot La Grande Strip Center was 67 percent occupied at the time of sale. Eric Garske of Marcus & Millichap’s Portland office represented the buyer in the deal.

KeyBank Provides $20.4M in Financing for Salem Manor Affordable Housing Community in Salem, Oregon

by Jeff Shaw

SALEM, ORE. — Hampstead Development Partners has received $20.4 million in financing for the acquisition and renovation of Salem Manor, a 64-unit affordable housing community in Salem. KeyBank Community Development Lending and Investment (CDLI) provided a $4 million construction loan and $6.3 million in Low-Income Housing Tax Credits (LIHTC). KeyBank also arranged $10.1 million in permanent financing through Freddie Mac. John Paul Vachon, Matthew Haas and Hector Zuniga of KeyBank CDLI structured the financing. Salem Manor is subsidized by a Section 8 Housing Assistant Payment contract and is affordable to households earning at or below 60 percent of the area median income. Hampstead plans to conduct a $4 million rehabilitation of the 10-building property. Renovations include updating kitchens and bathrooms, full ADA accessibility upgrades to select units, exterior updates such as new windows and repainting, upgrades to the buildings electrical system and a new fitness center.

PORTLAND, ORE. — Waterton has acquired The Parker, a 177-unit apartment community in Portland. The Parker rises six stories in the Pearl District, one mile north of downtown Portland. The community offers one- and two-bedroom apartments, as well as amenities such as an outdoor courtyard with grilling stations, a fitness center, a dog wash station, bike storage and a community room with a kitchen and business center. Waterton plans to renovate units with new backsplashes, flooring, lighting, plumbing fixtures, cabinets, shades and mirrors.

Marcus & Millichap Negotiates $6M Sale of Mountain View RV & Mini Storage in Madras, Oregon

by Jeff Shaw

MADRAS, ORE. — Marcus & Millichap has arranged the sale of Mountain View RV & Mini Storage in Madras. The original developers sold the 49,675-square-foot self-storage facility to an out-of-state buyer for $6 million. It features 358 self-storage units. The asset was constructed in two phases in 2020 and 2022 at 2086 NW Andrews Drive. The successful sale highlights the ongoing demand and investment opportunities in the self-storage sector, according to Marcus & Millichap. Christopher Secreto and Samuel Olson of Marcus & Millichap’s Seattle office exclusively listed and marketed the property on behalf of the sellers.