SEATTLE — Equity Residential has completed the disposition of Urbana, a seven-story multifamily property in Seattle. Carmel Partners acquired the property. The sales price was nearly $121 million, according to local media reports. Giovanni Napoli, Philip Assouad, Ryan Harmon, Nick Ruggiero and Anthony Palladino of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller and procured the buyer. Brian Eisendrath and Cameron Chalfant of IPA Capital Markets arranged acquisition financing for the buyer. Built in 2014, Urbana offers 289 apartments, two rooftop decks, a resident lounge with theater, a dog run and pet spa, bike storage and a gated parking garage, as well as 29,884 square feet of street-level retail space occupied by Verizon Wireless, Papa John’s, Five Guys and Planet Fitness.

Western

SANTA CLARA, CALIF. — Zscaler has signed a sublease for 301,163 square feet of office space at 4301 and 4401 Great America Parkway in Santa Clara. The company, which provides Zero Trust cybersecurity, will use the facility as its new Silicon Valley global headquarters that is set to open in summer 2026. Mike Saign and Rich Hoyt of Newmark represented Zscaler in the lease negotiations.

LONGMONT AND COLORADO SPRINGS, COLO. — The Garrett Companies is developing two apartment communities in Longmont and Colorado Springs. The combined development value of the two properties is $145 million. Wintrust provided a construction loan for the Longmont property, while National Bank of Indianapolis provided a construction loan for the Colorado Springs asset. Located at 245 Bountiful Ave. in Longmont, the garden-style project will offer 224 one-, two- and three-bedroom apartments, with 12 percent of the units income restricted. The asset will include one four-story and 10 two-story buildings, a resort-style pool and spa with cabanas, a fitness center, TV lounges, pickleball courts and a dog park. Construction for the $90 million project is slated for completion in early 2027. Humphreys & Partners is serving as architect for the development. Situated on the southwest corner of Rio Vista Drive and Barnes Road in Colorado Springs, the garden-style property includes four four-story buildings with a mix of 41 percent one bedrooms, 41 percent two bedrooms and 18 percent three bedrooms. Each of the 163 units will have a full-sized washer/dryer. Community amenities will include a resort-style pool and spa and cabanas, a fitness center, dog park, clubhouse with lounge, billiards and arcade …

PHOENIX — Northmarq has arranged the sale of The Retro on 32nd Street, a garden-style multifamily property in Phoenix. Goodyear, Ariz.-based Belbrook 32 LLC sold the asset to La Jolla, Calif.-based Cane Capital for $8.2 million. Built in 1968 and renovated in 2002, The Retro at 32nd Street offers 62 studio, one- and two-bedroom units. Apartments feature stainless steel appliances, high-speed internet, vinyl plank flooring, oversized closets, open kitchens and ceiling fans. The pet-friendly community includes a swimming pool, leasing office and onsite management, laundry facility, an outdoor grilling space, onsite patrol and gated access. The property is located at 3025 N. 32nd St. Ryan Boyle, Trevor Koskovich, Jesse Hudson and Logan Baca of Northmarq’s Phoenix Multifamily Investment Sales represented the seller in the deal.

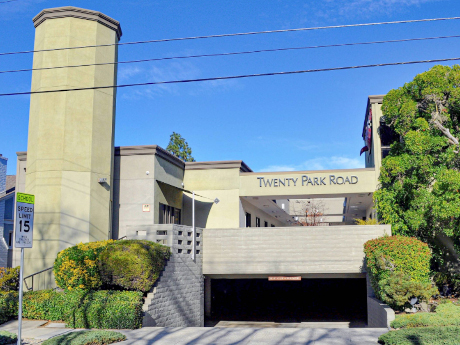

Matthews Real Estate Brokers Sale of 6,815 SF Office Property in Burlingame, California

by Amy Works

BURLINGAME, CALIF. — Matthews Real Estate Investment Services has arranged the sale of The Clock Tower, an office building in Burlingame. Sazze Partners, a venture capital firm from South Korea, acquired the asset for $5.4 million and plans to establish a U.S. office at the site. Located at 20 Park Road, The Clock Tower offers 6,815 square feet of office space. Marko Buljan of Matthews facilitated the transaction.

CHANDLER, ARIZ. — PB Bell and PCCP have completed the sale of Zaterra, an apartment community in Chandler, to an undisclosed buyer for $137.5 million, or $350,765 per unit. Completed in 2023 on 22 acres, Zaterra features 392 apartments with walk-up layouts and garages spread across a two- and three-story garden-style property. Community amenities include two swimming pools with sundecks, a creative suite with a large conference room and individual workspaces, a 24-hour fitness center and yoga lawn. Steve Gebing and Cliff David of Institutional Property Advisors, a division of Marcus & Millichap, represented the sellers and procured the buyer in the deal.

LOS ANGELES — Live Oak Bank has provided a $25 million bridge-to-sale loan to finance a community located near Los Angeles. An entity doing business as Harbert Seniors Housing Fund I LP is the borrower. The financing features a three-year initial term, 36 months of interest-only payments and $2.8 million in potential future earnout proceeds. The property totals 97 units, with independent, assisted living and memory care residences.

Mid-Pen Opens First Phase of Midway Village Affordable Housing Property in Daly City, California

by Amy Works

DALY CITY, CALIF. — MidPen Housing and partners have completed the construction of Midway Village I, which includes 147 affordable housing units in Daly City. MidPen also broke ground on Midway Village II, which will include 113 affordable units and a childcare facility. Midway Village I is reserved for renters earning between 30 and 80 percent of the area median income (AMI). The developer has earmarked 12 of the apartments for young adults aging out of foster care. Local teachers/members of the area’s education workforce will have priority for 27 of the units. When complete in 2027, Midway Village II will feature homes for families earning between 30 and 60 percent of AMI. Twenty-nine of the units will be reserved for individuals with supportive housing needs, provided through the Housing for a Healthy California program. This second phase will also feature a 15,000-square-foot childcare center where Peninsula Family Service will serve 109 children, including children from low-income families in the broader community. These are the first two phases of a four-phase revitalization and expansion effort that will ultimately transform an existing San Mateo County Housing Authority property from 150 outdated units into 555 new apartment homes. Residents of the original …

Stream Realty Partners Secures Entitlements for 100,000 SF Central LA Commerce Center Development

by Amy Works

CUDAHY, CALIF. — Stream Realty Partners has secured project entitlements for Central LA Commerce Center, a Class A light industrial development located at 4900 Cecilia St. in Cudahy, a suburb 11 miles southeast of Los Angeles. The project will transform a functionally obsolete 1950s-era manufacturing building into a LEED-certified light industrial development. The 100,000-square-foot property will feature a clear height of 36 feet, 5,000 square feet of speculative two-story office space, 11 dock-high doors and two drive-in doors. Additionally, the asset will include a fully secured truck court, independent ingress and egress for autos and trucks, and heavy base building power to meet the needs of modern light industrial tenants. Stream’s Industrial Development team for Central LA Commerce Center includes Nick Kreuter, Andrew Warren and Scott Sowanick, who will collaborate with the brokerage team led by Matt Moore and Wes Hunnicutt.

TUCSON, ARIZ. — Providence Property Group has purchased Tropicana Apartments, a multifamily complex in Tucson, from TropicanaApartments LLC for $1.7 million. Located at 3815-3816 E. 3rd St., the 8,650-square-foot asset offers 14 units. Allan Mendelsberg and Joey Martinez of Cushman & Wakefield | PICOR represented both parties in the transaction.