TUCSON, ARIZ. — Schnitzer Properties has broken ground on two industrial developments in Tucson. The $73 million total investment in two Class A industrial spaces will provide workspaces for small and mid-size manufacturers and distributors. The two projects are Corona Commerce Center, totaling 146,963 square feet at 2717 E. Corona Road, and Drexel Commerce Center, offering 184,080 square feet spread across two buildings. Both properties will offer flexible leasing options, with spaces ranging from 6,700 square feet to 184,080 square feet. The development team includes Schnitzer Properties, Sun Corridor and Willmeng Construction.

Western

ENGLEWOOD, COLO. — A joint venture between DPC Cos. and Ogilvie Partners has acquired Englewood CityCenter for an undisclosed price. Brad Lyons of CBRE handled the transaction. Englewood CityCenter offers 220,000 square feet of office, retail and multifamily space. The joint venture is working with the City of Englewood on a master redevelopment plan to transform Englewood CityCenter into a community center with multifamily housing, open space for community gathering and a walkable live/work/shop area with retail, services, restaurants and a hotel within the 12-acre site. At the time of sale, the property was 40 percent leased. Current tenants include Harbor Freight, Ross Dress for Less, Petco, Tokyo Joe’s, Jersey Mike’s Subs and Einstein Bros.

SRS Real Estate, Hanley Investment Group Broker $7.2M Sale of Retail Property in Corning, California

by Amy Works

CORNING, CALIF. — SRS Real Estate Partners and Hanley Investment Group have arranged the sale of a retail property located at 570 Solano St. in Corning, approximately 25 miles from Chico. A Redding, Calif.-based private investor sold the asset to a Napa Valley, Calif.-based private investor for $7.2 million. Sav-Mor Foods occupies the 32,000-square-foot property, which is situated on 2.6 acres. The store is run by North State Grocery, which operates 21 locations in California and Oregon. Alexander Moore of SRS Capital Markets and Lee Csenar of Hanley Investment Group represented the seller in the transaction.

Coastal Holdings Group Buys 11,050 SF Industrial Building in Poway, California for Relocation

by Amy Works

POWAY, CALIF. — Coastal Holdings Group has acquired an industrial building located at 12155 Paine Place in Poway for $4.1 million from Bergo Enterprises. The buyer plans to use the 11,050-square-foot property to accommodate its electrical contracting business. Chris Duncan of Voit Real Estate Services represented the buyer, while Robb Kerr of Intersection Commercial Real Estate represented the seller in the deal. Prior to the acquisition of 12155 Paine Place, Duncan brokered the $3.4 million sale of an 8,049-square-foot industrial building located at 13851 Danielson St. on behalf of Coastal Holdings Group. Escobar Family Real Estate Holdings acquired the asset as an investment property. Travis Jaedtke of Strategic Real Estate Group represented the buyer.

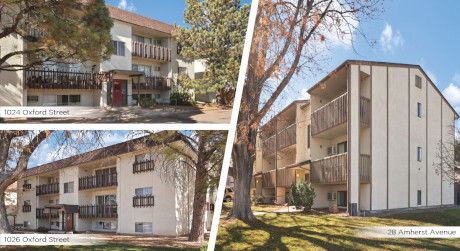

Pinnacle Real Estate Advisors Negotiates Sale of Oxford Pines Apartments in Pueblo, Colorado

by Amy Works

PUEBLO, COLO. — Pinnacle Real Estate Advisors has arranged the sale of Oxford Pines Apartments, located at 1024-1026 Oxford St. and 28 Amherst Ave. in Pueblo. The three-building property offers 35 one- and two-bedroom units, many with private balconies, as well as 23 carports and two garages. Chris Knowlton of Pinnacle Real Estate Advisors represented the undisclosed seller and undisclosed buyer in the deal. The asset traded for $3.1 million, or $90,000 per unit.

— By Amy Ogden, Partner, Industrial, LOGIC Commercial Real Estate — With the presidential election barely in our rearview mirror, many are taking a moment to assess how the outcome might impact (positively or negatively) their operations. On the one hand, this has been a resilient year for Las Vegas’ industrial market, which tracked close to 4.5 million square feet of net absorption. On the other hand, we are beginning to see a slowdown in momentum. The uncertainty of potential changes has left decision-makers hesitant, preferring to avoid any premature moves until after the holiday season. Nevertheless, the market is far from idle. The recent rate cut of 50 basis points, along with expectations of an additional reduction at the upcoming November meeting , has set a quiet hum of activity in motion. Investors and key players are discreetly exploring opportunities, positioning themselves strategically for when the time is right to act. Local industrial vacancy rates have also jump to about 7 percent as an influx of new deliveries come online. Vacancy rates are projected to hit double digits, considering an additional 4 million square feet is expected to deliver by year’s end. This is something we haven’t seen within …

SURPRISE, ARIZ. — SimonCRE has closed on the purchase of the first phase of Asante Trails, a 12.4-acre retail project in Surprise, approximately 35 miles outside Phoenix. SimonCRE has announced a $50 million investment for the acquisition of Asante Trails. According to the Phoenix Business Journal, the seller was a partnership between SimonCRE and Jim Stockwell J. of Clyde Capital LLC, which acquired the land in 2023. The project will be part of a larger 90-acre mixed-use project that will anchor the Asante master-planned community. Phase I of Asante Trails will feature retail tenants including Farmer Boys, Jimmy John’s, Baskin-Robbins, Circle K and Clean Freak Car Wash. Roughly 19,000 square feet is available for lease.

Gantry Secures $27.8M in Acquisition Financing for Multifamily Portfolio in Oakland, California

by Amy Works

OAKLAND, CALIF. — Gantry has secured $27.8 million in financing on behalf of a private real estate investor for the purchase of a portfolio of eight multifamily properties in Oakland. The portfolio includes 225 apartments and three commercial units at one of the properties. Jeff Wilcox and Erinn Cooke of Gantry represented the borrower. The financing was structured as a three-year, variable rate acquisition loan provided by a single institutional debt fund. The instrument included prepayment flexibility and extension options.

WALNUT, CALIF. — CapRock Partners has completed the disposition of West Valley Logistics Center, a LEED-certified industrial warehouse in Walnut. Completed in December 2024, West Valley Logistics offers 270,000 square feet of speculative industrial space situated on 12.5 acres at 4200 Valley Blvd. The property features a clear height of 40 feet, secure dual access with drive-around capabilities, rear loading with 28 dock-high doors, 45 trailer parking stalls, 130 car spots, ample power and 10,000 square feet of two-story office space. Matt Moore, Wes Hunnicut and Michael Torres of Stream Realty represented CapRock Partners, while Mike Hartel and Nick Velasquez of Colliers represented the undisclosed buyer in the deal. The acquisition price was not released.

CARLSBAD, CALIF. — Yunqun LLC has acquired a 21,481-square-foot multi-tenant industrial building located at 5924 Balfour Court in Carlsbad. The Gildred Cos. sold the asset for $6.2 million. Yunqun plans to occupy the vacant 12,105 square feet in the building for its manufacturing business with move-in expected later this year. Chris Baumgart and Steven Field of JLL represented the seller, while Hank Jenkins, Mike Erwin and Tucker Hohenstein of Colliers represented the buyer in the transaction.